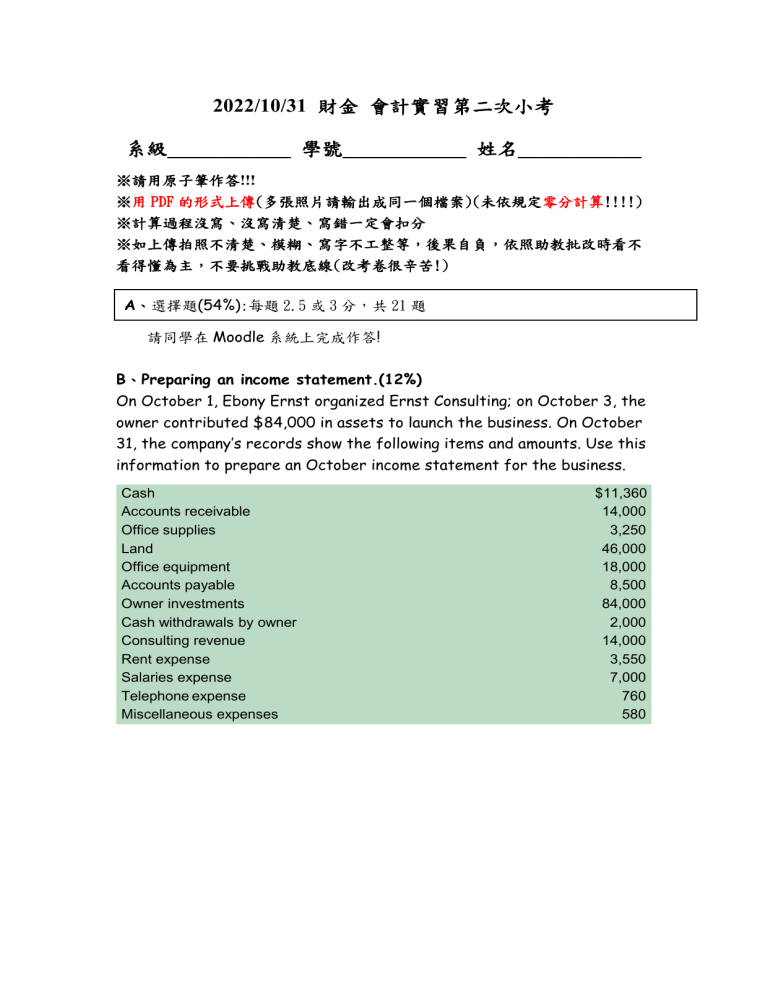

2022/10/31 財金 會計實習第二次小考 系級____________ 學號____________ 姓名____________ ※請用原子筆作答!!! ※用 PDF 的形式上傳(多張照片請輸出成同一個檔案)(未依規定零分計算!!!!) ※計算過程沒寫、沒寫清楚、寫錯一定會扣分 ※如上傳拍照不清楚、模糊、寫字不工整等,後果自負,依照助教批改時看不 看得懂為主,不要挑戰助教底線(改考卷很辛苦!) A、選擇題(54%):每題 2.5 或 3 分,共 21 題 請同學在 Moodle 系統上完成作答! B、Preparing an income statement.(12%) On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $84,000 in assets to launch the business. On October 31, the company’s records show the following items and amounts. Use this information to prepare an October income statement for the business. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Owner investments Cash withdrawals by owner Consulting revenue Rent expense Salaries expense Telephone expense Miscellaneous expenses $11,360 14,000 3,250 46,000 18,000 8,500 84,000 2,000 14,000 3,550 7,000 760 580 C、Preparing and posting journal entries.(18%) Denzel Brooks opened a web consulting business called Venture Consultants and completed the following transactions in March. Mar.1 Brooks invested $150,000 cash along with $22,000 in office equipment in the company. 2 The company prepaid $6,000 cash for six months’ rent for an office. 3 The company made credit purchases of office equipment for $3,000 and office supplies for $1,200. Payment is due within 10 days. 6 The company completed services for a client and immediately received $4,000 cash. 9 The company completed a $7,500 project for a client, who must pay within 30 days. 12 The company paid $4,200 cash to settle the account payable created on March 3. 19 The company paid $5,000 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $5,000. 22 The company received $3,000 cash as partial payment for the work completed on March 9. 25 credit. 29 30 credit. 31 The company completed work for another client for $3,820 on Brooks withdrew $5,100 cash from the company for personal use. The company purchased $600 of additional office supplies on The company paid $700 cash for this month’s utility bill. Required 1. Prepare general journal entries to record these transactions(題目沒 給的,多寫多錯) D、Preparing adjusting and subsequent journal entries (16%) Arnez Company’s annual accounting period ends on December 31, 2019. The following information concerns the adjusting entries to be recorded as of that date. Entries can draw from the following partial chart of accounts: Cash; Rent Receivable; Office Supplies; Prepaid Insurance; Building; Accumulated Depreciation—Building; Salaries Payable; Unearned Rent; Rent Earned; Salaries Expense; Office Supplies Expense; Insurance Expense; and Depreciation Expense—Building. a. The Supplies account started the year with a $4,000 balance. During 2019, the company purchased supplies for $13,400, which was added to the Supplies account. The inventory of supplies available at December 31, 2019, totaled $2,554. b. An analysis of the company’s insurance policies provided the following facts. The total premium for each policy was paid in full (for all months) at the purchase date, and the Prepaid Insurance account was debited for the full cost. (Year-end adjusting entries for Prepaid Insurance were properly recorded in all prior years.) Policy A B C Date of Purchase April 1, 2017 April 1, 2018 August 1, 2019 Months of Coverage 12 36 12 Cost $14,400 12,960 2,400 c. The company has 15 employees, who earn a total of $1,960 in salaries each working day. They are paid each Monday for their work in the fiveday workweek ending on the previous Friday. Assume that December 31, 2019, is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year’s Day is a paid holiday, they will be paid salaries for five full days on Monday, January 6, 2020. d. The company purchased a building on January 1, 2019. It cost $960,000 and is expected to have a $45,000 residual value at the end of its predicted 60-year life. e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,000 per month, starting on November 1, 2019. The rent was paid on time on November 1, and the amount received was credited to the Rent Earned account. However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who has promised to pay both December and January rent in full on January 15. The tenant has agreed not to fall behind again. f. On November 1, the company rented space to another tenant for $2,800 per month. The tenant paid five months’ rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account. Required(此題務必注意計算過程!!!!!) 1. Use the information to prepare adjusting entries as of December 31, 2019. 2. Prepare journal entries to record the first subsequent cash transaction in 2020 for parts c and e. 3. 加分題 寫出 a. Supplies account 的 T 字帳