Joint Products and Byproducts

advertisement

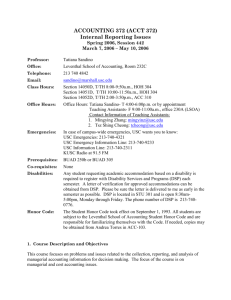

Cost Allocation: Joint Products and Byproducts Cost Accounting Horngreen, Datar, Foster Joint Cost Terminology Joint Costs: costs of a single production process that yields multiple products simultaneously Splitoff Point: the place in a joint production process where two or more products become separately identifiable Separable Costs: all costs incurred beyond the splitoff point that are assignable to each of the now-identifiable specific products Cost Accounting Horngreen, Datar, Foster Joint Cost Terminology Categories of Joint Process Outputs: 1. Outputs with a positive sales value 2. Outputs with a zero sales value Product: any output with a positive sales value, or an output that enables a firm to avoid incurring costs • Value can be high or low Cost Accounting Horngreen, Datar, Foster Joint Cost Terminology Joint Products: outputs of a joint production process that yields two or more products with a high sales value compared to the sales values of any other outputs Main Product: output of a joint production process that yields one product with a high sales value compared to the sales values of the other outputs Byproducts: outputs of a joint production process that have low sales values compared to the sales values of the other outputs Cost Accounting Horngreen, Datar, Foster Joint Process Flowchart Steam: An Output with Zero Sales Value Joint Product #1 Single Production Process Joint Product #2 Byproduct Cost Accounting Horngreen, Datar, Foster Reasons for Allocating Joint Costs Required for GAAP and taxation purposes Cost values may be used for evaluation purposes Cost-based contracting Insurance settlements Required by regulators Litigation Cost Accounting Horngreen, Datar, Foster Joint Cost Allocation Methods Physical Measures • allocate using tangible attributes of the products, such as pounds, gallons, barrels, etc. Market-Based • allocate using market-derived data (dollars): 1. Sales value at splitoff 2. Net Realizable Value (NRV) 3. Constant Gross-Margin percentage NRV Cost Accounting Horngreen, Datar, Foster Physical-Measure Method Allocates joint costs to joint products on the basis of the relative weight, volume, or other physical measure at the splitoff point of total production of the products Example: two products arise out of one joint process costing $500 Joint Product % Joint Costs Gallons of Total Volume Costs Allocated Cream 25 25% $ 500 $ 125 Skim-milk 75 75% 500 375 Total 100 100% $ 500 Cost Accounting Horngreen, Datar, Foster Sales Value at Splitoff Method Uses the sales value of the entire production of the accounting period to calculate allocation percentage Ignores inventories Cream Final Sales Value of Production Cream: 25 gals@ $50/gal Skim-milk: 75 gals@ $10/gal Total Skim-milk $1,250 $ 750 $ 2,000 Allocation Based on % of Total Sales (rounded) 62.5% 37.5% Joint Costs ($500) Allocated: Joint Cost X Allocation % 321.5 187.5 Cost Accounting Total Horngreen, Datar, Foster Net Realizable Value Method Applicable if products are further processed after the splitoff point Allocates joint costs to joint products on the basis of relative NRV of total production of the joint products NRV = Final Sales Value – Separable Costs Implicit Assumption: • All profit margin is attributable to the joint process • Non to the separable cost • Not always appropriate as profit is typically attributable to all phases of production Cost Accounting Horngreen, Datar, Foster NRV Example Cream Skim-milk Final Sales Value of Production Cream: 25 gals@ $50/gal Skim-milk: 75 gals@ $10/gal Total Total $ 1,250 $ 750 $ 2,000 Less: Separable Costs $ 900 $ 200 $ 1,100 NRV $ 350 $ 550 $ 900 NRV Weighting: Product NRV ÷ Total NRV 39% 61% Joint Costs 500 500 $ 194 $ 305 Joint Costs Allocated NRV Weighting X Joint Costs Cost Accounting Horngreen, Datar, Foster Constant Gross Margin Allocates joint costs to joint products in a way that the overall gross-margin percentage is identical for the individual products Joint Costs are calculated as a residual amount Implicit assumption: Joint products are a single product with a single aggregate gross–margin percentage Single ratio of cost to sales value is very unlikely to be observed in multi product firms Cost Accounting Horngreen, Datar, Foster Constant Gross Margin NRV Method Example Cream Skim-milk Total Final Sales Value of Production Cream: 25 gals@ $50/gal Skim-milk: 75 gals@ $10/gal Total $ 1,250 $ 750 $ 2,000 Less: Separable Costs $ 1,100 NRV $ 900 Joint Costs $ 500 Gross Profit $ 400 Gross Profit % of Sales Value 20,0% Cream Skim-milk Sales Values $ 1,250 $ 750 Total $ 2,000 Less Gross Margin @ 20% $ 250 $ 150 $ 400 Total Product Costs $ 1,000 $ 600 $ 1,600 Less Separable Costs $ 900 $ 200 $ 1,100 Joint Costs Allocated Cost Accounting $ 100 $ 400 Horngreen, Datar, Foster $ 500 Method Selection If selling price at splitoff is available, use the Sales Value at Splitoff Method If selling price at splitoff is not available, use the NRV Method If simplicity is the primary consideration, Physical-Measures Method or the Constant Gross-Margin Method could be used Physical-Measures Method might be used if costs are to be determined for pricing decision (avoid circulars) Despite this, some firms choose not to allocate joint costs at all Cost Accounting Horngreen, Datar, Foster Relevant Costs I: Sell-or-Process Further Decisions In Sell-or-Process Further decisions, joint costs are irrelevant. Joint Costs are sunk Joint products have been produced, and a prospective decision must be made: to sell immediately or process further and sell later Separable Costs need to be evaluated for relevance individually Process-further is worthwhile if additional revenues exceed additional costs Cost Accounting Horngreen, Datar, Foster Relevant Costs II: Performance evaluation and pricing Performance evaluation: • Conflicts of interest might arise with regard to decision making on further processing • Manager is evaluated based on e.g. profit • Extensive allocation of fixed costs due to further process decision might render a generally favorable decision unfavorable from the managers perspective Pricing • Each way of allocating costs from joint production process is highly subjective • Should not be used for pricing decisions • Moreover: Cost allocation might be based on prices Cost Accounting Horngreen, Datar, Foster Byproducts Outputs of a joint production process that have low sales values compare to the sales values of the other outputs Two methods for accounting for byproducts: Production Method • recognizes byproduct inventory as it is created, and sales and costs at the time of sale Sales Method • recognizes no byproduct inventory, and recognizes only sales at the time of sales: byproduct costs are not tracked separately Cost Accounting Horngreen, Datar, Foster Accounting for Byproducts Assume a firm produces a main product and a byproduct in a joint production process Both products are not processed further after splitoff point Production costs for the whole process are $1,000 Main product sells for $ 50, byproduct for $ 1 Main product Byproduct Beginning Inventory 0 0 Cost Accounting Production 100 5 Sales 80 4 Horngreen, Datar, Foster Ending Inventory 20 1 Profit and Loss Account Production versus Sales Method Production Method Revenues: Main Product Byproduct Total revenues Costs of goods sold : Total manufacturing costs Deduct byproduct revenue Net manufacturing cost Deduct main product inventory Cost of goods sold Gross margin: Gross margin percentage Inventoriable Costs (end of period) Main product Byproduct Cost Accounting Sales Method 4,000 4,000 4,000 4 4,004 1,000 -5 995 199 796 3,204 0.801 1,000 199 1 Horngreen, Datar, Foster 1,000 200 800 3,204 0.8002 200 Sales Method versus Production Method Production method • Recognizes byproduct in inventory in the period of production • Production costs equal to revenue from sales are allocated to byproduct • Firm makes zero profit from byproduct Sales Method • Does not recognize the byproduct in inventory in production period • No production costs are allocated to byproduct • Profit from byproduct= Sales from byproduct Cost Accounting Horngreen, Datar, Foster True or False All products yielded from joint product processing have some positive value to the firm. Joint processing costs are always relevant for pricing decisions of the final product. Cost Accounting Horngreen, Datar, Foster Pick your Choice Oily Slime buys Emils, which is produced until two products can be separated, Ems and Ils. The cost of processing Emils to the splitoff point is $50,000. When the products can be identified, the following information is available: Ems Ils Production 20,000 units 25,000 units Sales Value at Splitoff $5 $6 If the firm uses the Sales value at splitoff method, how much of the joint processing cost should be allocated to Ems? • $20,000 • $25,000 • $30,000 • $50,000 Cost Accounting Horngreen, Datar, Foster