16-1 CHAPTER 16 COST ALLOCATION: JOINT PRODUCTS AND

advertisement

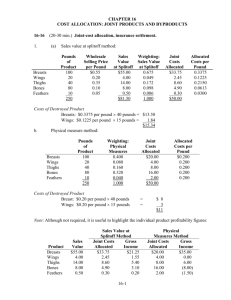

CHAPTER 16 COST ALLOCATION: JOINT PRODUCTS AND BYPRODUCTS 16-1 Exhibit 16-1 presents many examples of joint products from four different general industries. These include: Industry Separable Products at the Splitoff Point Food Processing: • Lamb • Lamb cuts, tripe, hides, bones, fat • Turkey • Breasts, wings, thighs, poultry meal Extractive: • Petroleum • Crude oil, natural gas 16-2 A joint cost is a cost of a production process that yields multiple products simultaneously. A separable cost is a cost incurred beyond the splitoff point that is assignable to each of the specific products identified at the splitoff point. 16-3 The distinction between a joint product and a byproduct is based on relative sales value. A joint product is a product from a joint production process (a process that yields two or more products) that has a relatively high total sales value. A byproduct is a product that has a relatively low total sales value compared to the total sales value of the joint (or main) products. Products can change from byproducts to joint products when their total sales values increase. 16-4 A product is any output that has a positive sales value (or an output that enables a company to avoid incurring costs). In some joint-cost settings, outputs can occur that do not have a positive sales value. The offshore processing of hydrocarbons yields water that is recycled back into the ocean as well as yielding oil and gas. The processing of mineral ore to yield gold and silver also yields dirt as an output, which is recycled back into the ground. 16-5 The chapter lists the following six reasons for allocating joint costs: 1. Computation of inventoriable costs and cost of goods sold for financial accounting purposes and reports for income tax authorities. 2. Computation of inventoriable costs and cost of goods sold for internal reporting purposes and division profitability analysis. 3. Cost reimbursement under contracts when only a portion of a business's products or services is sold or delivered under cost-plus contracts. 4. Insurance settlement computations for damage claims made on the basis of cost information of joint products or byproducts. The insurance company and the insured must agree on the value of the loss. 5. Rate regulation when one or more of the jointly-produced products or services are subject to price regulation. 6. Litigation in which costs of joint products are key inputs. 16-6 The joint production process yields individual products that are either sold this period or held as inventory to be sold in subsequent periods. Hence, the joint costs need to be allocated between total production rather than just those sold this period. 16-1 16-7 This situation can occur when a production process yields separable outputs at the splitoff point that do not have selling prices available until further processing. The result is that selling prices are not available at the splitoff point to use the sales value at splitoff method. Examples include processing in integrated pulp and paper companies and in petro-chemical operations. 16-8 Both methods use market selling-price data in allocating joint costs, but they differ in which sales-price data they use. The sales value at splitoff method allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point of the total production of these products during the accounting period. The net realizable value method allocates joint costs to joint products on the basis of the relative net realizable value (the final sales value minus the separable costs of production and marketing) of the total production of the joint products during the accounting period. 16-9 Limitations of the physical measure method of joint-cost allocation include: a. The physical weights used for allocating joint costs may have no relationship to the revenue-producing power of the individual products. b. The joint products may not have a common physical denominator––for example, one may be a liquid while another a solid with no readily available conversion factor. 16-10 The NRV method can be simplified by assuming (a) a standard set of post-splitoff point processing steps, and (b) a standard set of selling prices. The use of (a) and (b) achieves the same benefits that the use of standard costs does in costing systems. 16-11 The constant gross-margin percentage NRV method takes account of the post-splitoff point “profit” contribution earned on individual products, as well as joint costs, when making cost assignments to joint products. In contrast, the sales value at splitoff point and the NRV methods allocate only the joint costs to the individual products. 16-12 No. Any method used to allocate joint costs to individual products that is applicable to the problem of joint product-cost allocation should not be used for management decisions regarding whether a product should be sold or processed further. When a product is an inherent result of a joint process, the decision to process further should not be influenced by either the size of the total joint costs or by the portion of the joint costs assigned to particular products. Joint costs are irrelevant for these decisions. The only relevant items for these decisions are the incremental revenue and the incremental costs beyond the splitoff point. 16-13 No. The only relevant items are incremental revenues and incremental costs when making decisions about selling products at the splitoff point or processing them further. Separable costs are not always identical to incremental costs. Separable costs are costs incurred beyond the splitoff point that are assignable to individual products. Some separable costs may not be incremental costs in a specific setting (e.g., allocated manufacturing overhead for postsplitoff processing that includes depreciation). 16-14 Two methods to account for byproducts are: a. Production method—recognizes byproducts in the financial statements at the time production is completed. b. Sales method—delays recognition of byproducts until the time of sale. 16-2 16-15 The sales byproduct method enables a manager to time the sale of byproducts to affect reported operating income. A manager who was below the targeted operating income could adopt a “fire-sale” approach to selling byproducts so that the reported operating income exceeds the target. This illustrates one dysfunctional aspect of the sales method for byproducts. 16-3 16-16 (20–30 min.) Joint-cost allocation, insurance settlement. 1. (a) Sales value at splitoff method: Breasts Wings Thighs Bones Feathers Pounds of Product 100 20 40 80 10 250 Wholesale Selling Price per Pound $0.55 0.20 0.35 0.10 0.05 Sales Value at Splitoff $55 4 14 8 0.5 $81.5 Weighting: Sales Value at Splitoff 0.675 0.049 0.172 0.098 0.006 1.000 Joint Costs Allocated $ 33.75 2.45 8.60 4.90 0.30 $50.00 Allocated Costs per Pound 0.3375 0.1225 0.2150 0.0613 0.0300 Costs of Destroyed Product Breasts: $0.3375 per pound × 40 pounds = $13.50 Wings: $0.1225 per pound × 15 pounds = 1.84 $15.34 (b) Physical measure method: Breasts Wings Thighs Bones Feathers Pounds of Product 100 20 40 80 10 250 Weighting: Physical Measures 0.400 0.080 0.160 0.320 0.040 1.000 Costs of Destroyed Product Breast: $0.20 per pound × 40 pounds Wings: $0.20 per pound × 15 pounds Joint Costs Allocated $ 20.00 4.00 8.00 16.00 2.00 $50.00 = = Allocated Costs per Pound $0.200 0.200 0.200 0.200 0.200 $ 8 3 $11 Note: Although not required, it is useful to highlight the individual product profitability figures: Product Breasts Wings Thighs Bones Feathers Sales Value $55 4 14 8 0.5 Sales Value at Splitoff Method Joint Costs Gross Allocated Income $33.75 $21.25 2.45 1.55 8.60 5.40 4.90 3.10 0.30 0.20 16-4 Physical Measures Method Joint Costs Gross Allocated Income $20.00 $35.00 4.00 0.00 8.00 6.00 16.00 (8.00) 2.00 (1.50) 2. The sales-value at splitoff method captures the benefits-received criterion of cost allocation and is the preferred method. The costs of processing a chicken are allocated to products in proportion to the ability to contribute revenue. Quality Chicken’s decision to process chicken is heavily influenced by the revenues from breasts and thighs. The bones provide relatively few benefits to Quality Chicken despite their high physical volume. The physical measures method shows profits on breasts and thighs and losses on bones and feathers. Given that Quality Chicken has to jointly process all the chicken products, it is non-intuitive to single out individual products that are being processed simultaneously as making losses while the overall operations make a profit. Quality Chicken is processing chicken mainly for breasts and thighs and not for wings, bones, and feathers, while the physical measure method allocates a disproportionate amount of costs to wings, bones and feathers. 16-5 16-17 (10 min.) Joint products and byproducts (continuation of 16-16). 1. Ending inventory: Breasts 12 Wings 5 Thighs 7 Bones 6 Feathers 3 × × × × × $0.3375 0.1225 0.2150 0.0613 0.0300 = $4.0500 = 0.6125 = 1.5050 = 0.3678 = 0.0900 $6.6253 2. Joint products Breasts Thighs Byproducts Wings Bones Feathers Net Realizable Values of byproducts: Wings $ 4 Bones 8 Feathers 0.5 $12.5 Joint costs to be allocated: Joint costs – Net Realizable Values of byproducts $50 – $12.5 = $37.5 Breast Thighs Pounds of Product Wholesale Selling Price per Pound Sales Value at Splitoff Weighting: Sales Value at Splitoff Joint Costs Allocated Allocated Costs Per Pound 100 40 $0.55 0.35 $55 14 $69 55/69 14/69 $29.89 7.61 $37.50 $0.2989 0.1903 Ending inventory: Breasts 12 × $0.2989 Thighs 7 × 0.1903 3. $3.5868 1.3321 $4.9189 Treating all products as joint products does not require judgments as to whether a product is a joint product or a byproduct. Joint costs are allocated in a consistent manner to all products for the purpose of costing and inventory valuation. In contrast, the approach in requirement 2 lowers the joint cost by the amount of byproduct net realizable values and results in inventory values being shown for only two of the five products, the ones (perhaps arbitrarily) designated as being joint products. 16-6 16-18 (10 min.) Net realizable value method. A diagram of the situation is in Solution Exhibit 16-18. Final sales value of total production, 12,500 × $50; 6,250 × $25 Deduct separable costs Net realizable value at splitoff point Weighting, $250,000; $62,500 ÷ $312,500 Joint costs allocated, 0.8; 0.2 × $325,000 Corn Syrup Corn Starch $625,000 375,000 $250,000 0.8 $260,000 $156,250 93,750 $ 62,500 0.2 $ 65,000 Total $781,250 468,750 $312,500 $325,000 SOLUTION EXHIBIT 16-18 (all numbers are in thousands) Joint Costs Separable Costs Processing $375,000 Corn Syrup: 12,500 cases at $50 per case Processing $93,750 Corn Starch: 6,250 cases at $25 per case Processing $325,000 Splitoff Point 16-7 16-19 (40 min.) Alternative joint-cost-allocation methods, further-process decision. A diagram of the situation is in Solution Exhibit 16-19. 1. Methanol Physical measure of total production (gallons) 3,000 Weighting, 3,000; 9,000 ÷ 12,000 0.25 Joint costs allocated, 0.25; 0.75 × $150,000 $ 37,500 2. 3. Turpentine Total 9,000 0.75 $ 112,500 12,000 Methanol Turpentine $150,000 Total Final sales value of total production, 3,000 × $22.00; 9,000 × $15.00 Deduct separable costs, 3,000 × $4.00; 9,000 × $3.00 Net realizable value at splitoff point $ 66,000 $135,000 $201,000 12,000 $ 54,000 27,000 $ 108,000 39,000 $162,000 Weighting, $54,000; $108,000 ÷ $162,000 Joint costs allocated, 1/3; 2/3 × $150,000 1/3 $ 50,000 2/3 $100,000 $150,000 Methanol $66,000 Turpentine $135,000 Total $201,000 37,500 12,000 49,500 $16,500 112,500 27,000 139,500 $ (4,500) 150,000 39,000 189,000 $ 12,000 Methanol $66,000 Turpentine $135,000 Total $201,000 50,000 12,000 62,000 $ 4,000 100,000 27,000 127,000 $ 8,000 150,000 39,000 189,000 $ 12,000 a. Physical-measure (gallons) method: Revenues Cost of goods sold: Joint costs Separable costs Total cost of goods sold Gross margin b. Estimated net realizable value method: Revenues Cost of goods sold: Joint costs Separable costs Total cost of goods sold Gross margin 16-8 4. Alcohol Bev. Final sales value of total production, 3,000 × $65.00; 9,000 × $15.00 $195,000 Deduct separable costs, (3,000 × $14.00) + (0.20 × $195,000); 9,000 × $3.00 81,000 Net realizable value at splitoff point $ 114,000 Weighting, $114,000; $108,000 ÷ $222,000 0.51 Joint costs allocated, 0.51; 0.49 × $150,000 $ 76,500 Turpentine $135,000 $330,000 27,000 $ 108,000 0.49 $ 73,500 108,000 $222,000 An incremental approach demonstrates that the company should use the new process: Incremental revenue, ($65.00 – $22.00) × 3,000 Incremental costs: Added processing, $10.00 × 3,000 Taxes, (0.20 × $65.00) × 3,000 Incremental operating income from further processing Proof: Total sales of both products Joint costs Separable costs Cost of goods sold New gross margin Old gross margin Difference in gross margin 16-9 $ 129,000 $30,000 39,000 Total (69,000) $ 60,000 $330,000 150,000 108,000 258,000 72,000 12,000 $ 60,000 $150,000 SOLUTION EXHIBIT 16-19 Joint Costs Separable Costs 3,000 gallons Processing $4 per gallon Methanol: 3,000 gallons at $22 per gallon 9,000 gallons Processing $3 per gallon Turpentine: 9,000 gallons at $15 per gallon Processing $150,000 for 12,000 gallons Splitoff Point 16-10 16-20 (40 min.) Alternative methods of joint-cost allocation, ending inventories. Total production for the year was: X Y Z Sold 120 340 475 Ending Inventories 180 60 25 Total Production 300 400 500 A diagram of the situation is in Solution Exhibit 16-20. 1. a. Net realizable value (NRV) method: X Final sales value of total production, 300 × $1,500; 400 × $1,000; 500 × $700 Deduct separable costs Net realizable value at splitoff point Weighting, $450; $400; $150 ÷ $1,000 Joint costs allocated, 0.45, 0.40, 0.15 × $400,000 Y Z Total $450,000 –– $450,000 $400,000 –– $400,000 $350,000 200,000 $150,000 $1,200,000 200,000 $1,000,000 0.45 0.40 0.15 $180,000 $160,000 $ 60,000 X 180 300 60% Y 60 400 15% $ 400,000 Ending Inventory Percentages: Ending inventory Total production Ending inventory percentage Z 25 500 5% Income Statement X Revenues, 120 × $1,500; 340 × $1,000; 475 × $700 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 60%; 15%; 5% of production costs Cost of goods sold Gross margin Gross-margin percentage Y Z Total $180,000 $340,000 $332,500 $852,500 180,000 –– 180,000 160,000 –– 160,000 60,000 200,000 260,000 400,000 200,000 600,000 108,000 72,000 $108,000 24,000 136,000 $204,000 13,000 247,000 $ 85,500 145,000 455,000 $397,500 60% 60% 25.71% 16-11 b. Constant gross-margin percentage NRV method: Step 1: Final sales value of prodn., (300 × $1,500) + (400 × $1,000) + (500 × $700) Deduct joint and separable costs, $400,000 + $200,000 Gross margin Gross-margin percentage, $600,000 ÷ $1,200,000 $1,200,000 600,000 $ 600,000 50% Step 2: X Final sales value of total production, 300 × $1,500; 400 × $1,000; 500 × $700 Deduct gross margin, using overall gross-margin percentage of sales, 50% Total production costs Step 3: Deduct separable costs Joint costs allocated Y Z Total $450,000 $400,000 $350,000 $1,200,000 225,000 225,000 200,000 200,000 175,000 175,000 600,000 600,000 — $225,000 — $200,000 200,000 200,000 $(25,000) $ 400,000 The negative joint-cost allocation to Product Z illustrates one “unusual” feature of the constant gross-margin percentage NRV method: some products may receive negative cost allocations so that all individual products have the same gross-margin percentage. Income Statement Revenues, 120 × $1,500; 340 × $1,000; 475 × $700 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 60%; 15%; 5% of production costs Cost of goods sold Gross margin Gross-margin percentage X Y Z Total $180,000 $340,000 $332,500 $852,500 225,000 225,000 200,000 200,000 (25,000) 200,000 175,000 400,000 200,000 600,000 135,000 90,000 $ 90,000 50% 30,000 170,000 $170,000 50% 8,750 166,250 $166,250 50% 173,750 426,250 $426,250 50% 16-12 Summary a. NRV method: Inventories on balance sheet Cost of goods sold on income statement b. Y Z Total $108,000 72,000 $ 24,000 136,000 $ 13,000 247,000 $145,000 455,000 $600,000 $135,000 90,000 $ 30,000 170,000 $ 8,750 166,250 $173,750 426,250 $600,000 Constant gross-margin percentage NRV method Inventories on balance sheet Cost of goods sold on income statement 2. X Gross-margin percentages: X 60% 50% NRV method Constant gross-margin percentage NRV Y 60% 50% Z 25.71% 50.00% SOLUTION EXHIBIT 16-20 Joint Costs Separable Costs Product X: 300 tons at $1,500 per ton Joint Processing Costs $400,000 Product Y: 400 tons at $1,000 per ton Processing $200,000 Splitoff Point 16-13 Product Z: 500 tons at $700 per ton 16-21 (30 min.) Joint-cost allocation, process further. Joint Costs = $2,100 ICR8 (Non-Saleable) Processing $170 Crude Oil 200 bbls × $15 / bbl = $3,000 ING4 (Non-Saleable) Processing $100 NGL 100 bbls × $7 / bbl = $700 XGE3 (Non-Saleable) Processing $200 Gas 700 eqvt bbls × $1.10 / eqvt bbl = $770 Splitoff Point 1a. Physical Measure Method 1. Physical measure of total prodn. 2. Weighting (200; 100; 700 ÷ 1,000) 3. Joint costs allocated (Weights × $2,100) 1b. 1. 2. 3. 4. 5. Crude Oil 200 0.20 $420 NGL 100 0.10 $210 Crude Oil $3,000 170 $2,830 0.7075 $1,485.75 NGL $700 100 $600 0.1500 $315.00 Gas 700 0.70 $1,470 Total 1,000 1.00 $2,100 NRV Method Final sales value of total production Deduct separable costs NRV at splitoff Weighting (2,830; 600; 570 ÷ 4,000) Joint costs allocated (Weights × $2,100) 16-14 Gas $770 200 $ 570 0.1425 $299.25 Total $4,470 470 $4,000 $2,100 2. The operating-income amounts for each product using each method is: (a) Physical Measure Method Revenues Cost of goods sold Joint costs Separable costs Total cost of goods sold Gross margin (b) Crude Oil $3,000 NGL $700 Gas $770 Total $4,470 420 170 590 $2,410 210 100 310 $390 1,470 200 1,670 $ (900) 2,100 470 2,570 $1,900 Crude Oil $3,000.00 NGL $700.00 Gas $770.00 Total $4,470.00 1,485.75 170.00 1,655.75 $1,344.25 315.00 100.00 415.00 $285.00 299.25 200.00 499.25 $ 270.75 2,100.00 470.00 2,570.00 $1,900.00 NRV Method Revenues Cost of goods sold Joint costs Separable costs Total cost of goods sold Gross margin 3. Neither method should be used for product emphasis decisions. It is inappropriate to use joint-cost-allocated data to make decisions regarding dropping individual products, or pushing individual products, as they are joint by definition. Product-emphasis decisions should be made based on relevant revenues and relevant costs. Each method can lead to product emphasis decisions that do not lead to maximization of operating income. 4. Since crude oil is the only product subject to taxation, it is clearly in Plumpton’s best interest to use the NRV method since it leads to a lower profit for crude oil and, consequently, a smaller tax burden. A letter to the taxation authorities could stress the conceptual superiority of the NRV method. Chapter 16 argues that, using a benefitsreceived cost allocation criterion, market-based joint cost allocation methods are preferable to physical-measure methods. A meaningful common denominator (revenues) is available when the sales value at splitoff point method or NRV method is used. The physical-measures method requires nonhomogeneous products (liquids and gases) to be converted to a common denominator. 16-15 16-22 (30 min.) Joint-cost allocation, sales value, physical measure, NRV methods. 1a. PANEL A: Allocation of Joint Costs using Sales Value at Splitoff Method Sales value of total production at splitoff point (10,000 tons × $10 per ton; 20,000 × $15 per ton) Weighting ($100,000; $300,000 ÷ $400,000) Joint costs allocated (0.25; 0.75 × $240,000) PANEL B: Product-Line Income Statement for June 2009 Revenues (12,000 tons × $18 per ton; 24,000 × $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage Special B/ Beef Ramen Special S/ Shrimp Ramen $100,000 0.25 $60,000 $300,000 0.75 $180,000 Special B Special S $216,000 60,000 48,000 $108,000 50% $600,000 180,000 168,000 $252,000 42% $816,000 240,000 216,000 $360,000 44% Special B/ Beef Ramen 10,000 33% $80,000 Special S/ Shrimp Ramen 20,000 67% $160,000 Total 30,000 $240,000 Special B Special S Total Total $400,000 $240,000 Total 1b. PANEL A: Allocation of Joint Costs using Physical-Measure Method Physical measure of total production (tons) Weighting (10,000 tons; 20,000 tons ÷ 30,000 tons) Joint costs allocated (0.33; 0.67 × $240,000) PANEL B: Product-Line Income Statement for June 2009 Revenues (12,000 tons × $18 per ton; 24,000 × $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage $216,000 80,000 48,000 $ 88,000 41% $600,000 160,000 168,000 $272,000 45% $816,000 240,000 216,000 $360,000 44% 1c. PANEL A: Allocation of Joint Costs using Net Realizable Value Method Final sales value of total production during accounting period (12,000 tons × $18 per ton; 24,000 tons × $25 per ton) Deduct separable costs Net realizable value at splitoff point Weighting ($168,000; $432,000 ÷ $600,000) Joint costs allocated (0.28; 0.72 × $240,000) PANEL B: Product-Line Income Statement for June 2009 Revenues (12,000 tons × $18 per ton; 24,000 tons × $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage 16-16 Special B Special S Total $216,000 48,000 $168,000 28% $67,200 $600,000 168,000 $432,000 72% $172,800 $816,000 216,000 $600,000 Special B $216,000 67,200 48,000 $100,800 46.7% Special S $600,000 172,800 168,000 $ 259,200 43.2% Total $816,000 240,000 216,000 $ 360,000 44.1% $240,000 2. Sherrie Dong probably performed the analysis shown below to arrive at the net loss of $2,228 from marketing the stock: PANEL A: Allocation of Joint Costs using Sales Value at Splitoff Sales value of total production at splitoff point (10,000 tons × $10 per ton; 20,000 × $15 per ton; 4,000 × $5 per ton) Weighting ($100,000; $300,000; $20,000 ÷ $420,000) Joint costs allocated (0.238095; 0.714286; 0.047619 × $240,000) PANEL B: Product-Line Income Statement for June 2009 Revenues (12,000 tons × $18 per ton; 24,000 × $25 per ton; 4,000 × $5 per ton) Separable processing costs Joint costs allocated (from Panel A) Gross margin Deduct marketing costs Operating income Special B/ Beef Ramen Special S/ Shrimp Ramen Stock $100,000 $300,000 $20,000 $420,000 23.8095% 71.4286% 4.7619% 100% $57,143 $171,429 $11,428 $240,000 Special S Stock Total $600,000 168,000 171,429 260,571 $20,000 0 11,428 8,572 10,800 ($2,228) $836,000 216,000 240,000 380,000 10,800 $ 369,200 Special B $216,000 48,000 57,143 110,857 Total In this (misleading) analysis, the $240,000 of joint costs are re-allocated between Special B, Special S, and the stock. Irrespective of the method of allocation, this analysis is wrong. Joint costs are always irrelevant in a process-further decision. Only incremental costs and revenues past the splitoff point are relevant. In this case, the correct analysis is much simpler: the incremental revenues from selling the stock are $20,000, and the incremental costs are the marketing costs of $10,800. So, Instant Foods should sell the stock—this will increase its operating income by $9,200 ($20,000 – $10,800). 16-17 16-23 (20 min.) Joint cost allocation: sell immediately or process further. 1. a. Sales value at splitoff method: Sales value of total production at splitoff, 600lbs × $1.20; 120 gallons × $4.80 Weighting, $720; $576 ÷ $1,296 Joint costs allocated, 0.556; 0.444 × $600 b. Cookies/ Soymeal $720 Soyola/ Soy Oil $576 0.556 0.444 Total $1,296 $334 $266 $600 Cookies Soyola Total $1,728 360 $1,368 0.74 $720 240 $480 0.26 $2,448 600 $1,848 $444 $156 $600 Net realizable value method: Final sales value of total production, 720lbs × $2.40; 480qts × $1.50 Deduct separable costs Net realizable value Weighting, $1,368; $480 ÷ $1,848 Joint costs allocated, 0.74; 0.26 × $600 2. Sell at Splitoff – Revenue Process Further - NRV Profit (Loss) from Processing Further Cookies/Soy Meal $720a $1,368 c $648 Soyola/Soy Oil $576 b $480 d ($96) a 600 lbs × $1.20 = $720 120 gal × $4.80 = $576 c 720 lbs × $2.40 – $360 = $1,368 d 480 qts × $1.50 – $240 = $480 b ISP should process the soy meal into cookies because it increases profit by $648 (1,368-720). However, they should sell the soy oil as is, without processing it into the form of Soyola, because profit will be $96 (576-480) higher if they do. Since the total joint cost is the same under both allocation methods, it is not a relevant cost to the decision to sell at splitoff or process further. 16-18 16-24 (30 min.) Accounting for a main product and a byproduct. Production Method 1. Revenues Main product Byproduct Total revenues Cost of goods sold Total manufacturing costs Deduct value of byproduct production Net manufacturing costs Deduct main product inventory Cost of goods sold Gross margin 32,000 × $20.00 8,000 × $5.00 c (8,000/40,000) × $440,000 = $88,000 a b 2. a Main Product Byproduct d e Sales Method $640,000a — 640,000 $640,000 28,000d 668,000 480,000 40,000b 440,000 88,000c 352,000 $ 288,000 480,000 0 480,000 96,000e 384,000 $ 284,000 5,600 × $5.00 (8,000/40,000) × $480,000 = $96,000 Production Method $88,000 12,000a Sales Method $96,000 0 Ending inventory shown at unrealized selling price. BI + Production – Sales = EI 0 + 8,000 – 5,600 = 2,400 pounds Ending inventory = 2,400 pounds × $5 per pound = $12,000 16-19 16-25 (35–45 min.) Joint costs and byproducts. 1. Computing byproduct deduction to joint costs: Revenues from C, 40,000 × $3 Deduct: Gross margin, 10% of revenues Marketing costs, 25% of revenues Peanut Butter Department separable costs Net realizable value (less gross margin) of C $120,000 Joint costs Deduct byproduct contribution Net joint costs to be allocated $320,000 58,000 $262,000 16-20 12,000 30,000 20,000 $58,000 Quantity A 20,000 B 120,000 Totals A B Totals Deduct Net Unit Final Separable Sales Sales Processing Price Value Cost $10 $ 200,000 $40,000 2 240,000 –– $440,000 $40,000 Joint Costs Allocation $104,800 157,200 $262,000 Add Separable Processing Costs $40,000 –– $40,000 Realizable Value at Splitoff $ 160,000 240,000 $400,000 Total Costs $144,800 157,200 $302,000 Weighting 40% 60% Units 20,000 120,000 140,000 Allocation of $262,000 Joint Costs $104,800 157,200 $262,000 Unit Cost $7.24 1.31 Unit cost for C: $1.45 ($58,000 ÷ 40,000) + $0.50 ($20,000 ÷ 40,000) = $1.95, or $3.00 – $0.30 (10% × $3) – $0.75 (25% × $3) = $1.95. 2. If all three products are treated as joint products: Quantity A 20,000 B 120,000 C 40,000 Totals A B C Totals Unit Final Sales Sales Price Value $10 $ 200,000 2 240,000 3 120,000 $560,000 Joint Costs Allocation $108,936 163,404 47,660 $320,000 Deduct Separable Processing Cost $40,000 50,000 $90,000 Add Separable Processing Costs $40,000 –– 20,000 $60,000 Net Realizable Value at Splitoff $ 160,000 240,000 70,000 $470,000 Total Costs $148,936 163,404 67,660 $380,000 Weighting 160/470 240/470 70/470 Units 20,000 120,000 40,000 180,000 Allocation of $320,000 Joint Costs $108,936 163,404 47,660 $320,000 Unit Cost $7.45 1.36 1.69 Call the attention of students to the different unit “costs” resulting from the two assumptions about the relative importance of Product C. The point is that costs of individual products depend heavily on which assumptions are made and which accounting methods and techniques are used. 16-21 16-26 (25 min.) Accounting for a byproduct. 1. Byproduct recognized at time of production: Joint Cost = $1,500 Joint cost to be charged to main product = Joint Cost – NRV of Byproduct = $1,500 – (50 lbs. × $1.20) = $1,440 $1440 Inventoriable cost of main product = 400 containers = $3.60 per container Inventoriable cost of byproduct = NRV = $1.20 per pound Gross Margin Calculation under Production Method Revenues Main product: Water (600/2 containers × $8) Byproduct: Sea Salt Cost of goods sold Main product: Water (300 containers × $3.60) $2,400 0 $2,400 _____ $1,080 Gross margin Gross-margin percentage ($1,320 ÷ $2,400) $1,320 55.00% Inventoriable costs (end of period): Main product: Water (100 containers × $3.60) = $360 Byproduct: Sea Salt (10 pounds × $1.20) = $12 2. Byproduct recognized at time of sale: Joint cost to be charged to main product = Total Joint Cost = $1,500 $1500 Inventoriable cost of main product = 400 containers = $3.75 per container Inventoriable cost of byproduct = $0 16-22 Gross Margin Calculation under Sales Method Revenues Main product: Water (600/2 containers × $8) Byproduct: Sea Salt (40 pounds × $1.20) Cost of goods sold Main product: Water (300 containers × $3.75) $2,400 48 $2,448 _____ $1,125 Gross margin Gross-margin percentage ($1,323 ÷ $2,448) $1,323 54.04% Inventoriable costs (end of period): Main product: Water (100 containers × $3.75) = $375 Byproduct: Sea Salt (10 pounds × $0) = $0 3. The production method recognizes the byproduct cost as inventory in the period it is produced. This method sets the cost of the byproduct inventory equal to its net realizable value. When the byproduct is sold, inventory is reduced without being expensed through the income statement. The sales method associates all of the production cost with the main product. Under this method, the byproduct has no inventoriable cost and is recognized only when it is sold. 16-23 16-27 (40 min.) Alternative methods of joint-cost allocation, product-mix decisions. A diagram of the situation is in Solution Exhibit 16-27. 1. a. Computation of joint-cost allocation proportions: Sales Value of Total Production at Splitoff A $ 62,500 B 37,500 C 62,500 D 87,500 $250,000 Weighting 625/2500 = 0.25 375/2500 = 0.15 625/2500 = 0.25 875/2500 = 0.35 1.00 Allocation of $125,000 Joint Costs $ 31,250 18,750 31,250 43,750 $125,000 Weighting 3750/6250 = 0.60 1250/6250 = 0.20 625/6250 = 0.10 625/6250 = 0.10 1.00 Allocation of $125,000 Joint Costs $ 75,000 25,000 12,500 12,500 $125,000 b. A B C D Physical Measure of Total Production 375,000 gallons 125,000 gallons 62,500 gallons 62,500 gallons 625,000 gallons c. Final Sales Value of Total Separable Production Costs Super A $375,000 $250,000 Super B 125,000 100,000 C 52,500 – Super D 150,000 112,500 Net Realizable Value at Splitoff $125,000 25,000 62,500 37,500 $250,000 16-24 Weighting 1250/2500 = 0.50 250/2500 = 0.10 625/2500 = 0.25 375/2500 = 0.15 1.00 Allocation of $125,000 Joint Costs $ 62,500 12,500 31,250 18,750 $125,000 Computation of gross-margin percentages: a. Sales value at splitoff method: Super A Super B $375,000 $125,000 31,250 18,750 250,000 100,000 281,250 118,750 $ 93,750 $ 6,250 25% 5% Revenues Joint costs Separable costs Total cost of goods sold Gross margin Gross-margin percentage b. Super D $150,000 43,750 112,500 156,250 $ (6,250) (4.17%) Total $712,500 125,000 462,500 587,500 $125,000 17.54% Physical-measure method: Revenues Joint costs Separable costs Total cost of goods sold Gross margin Gross-margin percentage c. C $62,500 31,250 0 31,250 $31,250 50% Super A Super B $375,000 $125,000 75,000 25,000 250,000 100,000 325,000 125,000 $ 50,000 $ 0 0% 13.33% C $62,500 12,500 0 12,500 $50,000 80% Super D $150,000 12,500 112,500 125,000 $ 25,000 16.67% Total $712,500 125,000 462,500 587,500 $125,000 17.54% Net realizable value method: Revenues Joint costs Separable costs Total cost of goods sold Gross margin Gross-margin percentage Super A $375,000 62,500 250,000 312,500 $ 62,500 Super B $125,000 12,500 100,000 112,500 $ 12,500 C $62,500 31,250 0 31,250 $31,250 Super D Total $150,000 $712,500 18,750 125,000 112,500 462,500 131,250 587,500 $ 18,750 $125,000 16.67% 10% 50% 12.5% Super B C Super D Summary of gross-margin percentages: Joint-Cost Allocation Method Super A Sales value at splitoff 25.00% 5% 50% (4.17)% Physical measure 13.33% 0% 80% 16.67% Net realizable value 16.67% 10% 50% 12.50% 16-25 17.54% 2. Further Processing of A into Super A: Incremental revenue, $375,000 – $62,500 Incremental costs Incremental operating income from further processing $312,500 250,000 $ 62,500 Further processing of B into Super B: Incremental revenue, $125,000 – $37,500 Incremental costs Incremental operating loss from further processing $ 87,500 100,000 $ (12,500) Further Processing of D into Super D: Incremental revenue, $150,000 – $87,500 Incremental costs Incremental operating loss from further processing $ 62,500 112,500 $ (50,000) Operating income can be increased by $62,500 if both B and D are sold at their splitoff point rather than processed further into Super B and Super D. SOLUTION EXHIBIT 16-27 Revenues at Splitoff and Separable Costs Joint Costs A, 375,000 gallons Revenue = $62,500 B, 125,000 gallons Revenue = $37,500 Processing $125,000 Processing $250,000 Super A $375,000 Processing $100,000 Super B $125,000 Processing $112,500 Super D $150,000 C, 62,500 gallons Revenue = $62,500 D, 62,500 gallons Revenue = $87,500 Splitoff Point 16-26 16-28 (40–60 min.) Comparison of alternative joint-cost allocation methods, furtherprocessing decision, chocolate products. Joint Costs $30,000 Separable Costs ChocolatePowder Liquor Base Cocoa Beans Processing $12,750 Chocolate Powder Processing Milk-Chocolate Liquor Base Processing $26,250 Milk Chocolate SPLITOFF POINT 1a. Sales value at splitoff method: Sales value of total production at splitoff, 600 × $21; 900 × $26 Weighting, $12,600; $23,400 ÷ $36,000 Joint costs allocated, 0.35; 0.65 × $30,000 ChocolatePowder/ Liquor Base MilkChocolate/ Liquor Base $12,600 0.35 $23,400 0.65 $36,000 $10,500 $19,500 $30,000 600 gallons 900 gallons 1,500 gallons 0.40 0.60 $12,000 $18,000 Total 1b. Physical-measure method: Physical measure of total production (15,000 ÷ 1,500) × 60; 90 Weighting, 600; 900 ÷ 1,500 Joint costs allocated, 0.40; 0.60 × $30,000 16-27 $30,000 1c. Net realizable value method: Final sales value of total production, 6,000 × $4; 10,200 × $5 Deduct separable costs Net realizable value at splitoff point Weighting, $11,250; $24,750 ÷ $36,000 Joint costs allocated, 0.3125; 0.6875 × $30,000 d. ChocolatePowder MilkChocolate $24,000 12,750 $11,250 0.3125 $51,000 26,250 $ 24,750 0.6875 $75,000 39,000 $36,000 $9,375 $20,625 $30,000 Total Constant gross-margin percentage NRV method: Step 1: Final sales value of total production, (6,000 × $4) + (10,200 × $5) Deduct joint and separable costs, ($30,000 + $12,750 + $26,250) Gross margin Gross-margin percentage ($6,000 ÷ $75,000) $75,000 69,000 $ 6,000 8% Step 2: Final sales value of total production, 6,000 × $4; 10,200 × $5 Deduct gross margin, using overall gross-margin percentage of sales (8%) Total production costs ChocolatePowder MilkChocolate Total $24,000 $51,000 $75,000 1,920 22,080 4,080 46,920 6,000 69,000 12,750 $9,330 26,250 $ 20,670 39,000 $30,000 Step 3: Deduct separable costs Joint costs allocated 16-28 2. a. b. c. Revenues Joint costs Separable costs Total cost of goods sold Gross margin ChocolatePowder $24,000 10,500 12,750 23,250 $ 750 MilkChocolate $51,000 19,500 26,250 45,750 $ 5,250 Total $75,000 30,000 39,000 69,000 $ 6,000 Gross-margin percentage 3.125% 10.294% 8% Revenues Joint costs Separable costs Total cost of goods sold Gross margin $24,000 12,000 12,750 24,750 $ (750) $51,000 18,000 26,250 44,250 $ 6,750 $75,000 30,000 39,000 69,000 $ 6,000 Gross-margin percentage (3.125)% 13.235% 8% Revenues Joint costs Separable costs Total cost of goods sold Gross margin $24,000 9,375 12,750 22,125 $ 1,875 $51,000 20,625 26,250 46,875 $ 4,125 $75,000 30,000 39,000 69,000 $ 6,000 Gross-margin percentage d. 7.812% Revenues Joint costs Separable costs Total cost of goods sold Gross margin $24,000 9,330 12,750 22,080 $ 1,920 Gross-margin percentage 8% 16-29 8.088% 8% $51,000 20,670 26,250 46,920 $ 4,080 $75,000 30,000 39,000 69,000 $ 6,000 8% 8% 3. Further processing of chocolate-powder liquor base into chocolate powder: Incremental revenue, $24,000 – $12,600 Incremental costs Incremental operating income from further processing $ 11,400 12,750 $ (1,350) Further processing of milk-chocolate liquor base into milk chocolate: Incremental revenue, $51,000 – $23,400 Incremental costs Incremental operating income from further processing $ 27,600 26,250 $ 1,350 Chocolate Factory could increase operating income by $1,350 (to $7,350) if chocolate-powder liquor base is sold at the splitoff point and if milk-chocolate liquor base is further processed into milk chocolate. 16-30 16-29 (30 min.) Joint-cost allocation, process further or sell. A diagram of the situation is in Solution Exhibit 16-29. 1. a. Sales value at splitoff method. Monthly Unit Output Studs (Building) Decorative Pieces Posts Totals Selling Price Per Unit Sales Value of Total Prodn. at Splitoff 90,000 $ 8 $ 720,000 46.1539% $ 553,847 6,000 24,000 60 20 360,000 480,000 $1,560,000 23.0769 30.7692 100.0000% 276,923 369,230 $1,200,000 Physical Measure of Total Prodn. 90,000 6,000 24,000 120,000 Weighting 75.00% 5.00 20.00 100.00% Joint Costs Allocated $ 900,000 60,000 240,000 $1,200,000 Net Realizable Value at Splitoff Weighting Joint Costs Allocated Weighting Joint Costs Allocated b. Physical measure at splitoff method. Studs (Building) Decorative Pieces Posts Totals c. Net realizable value method. Monthly Units of Total Prodn. Studs (Building) Decorative Pieces Posts Totals a b 90,000 5,400 24,000 a Fully Processed Selling Price per Unit $ 8 $ 720,000 100 20 430,000 480,000 $1,630,000 b 6,000 monthly units of output – 10% normal spoilage = 5,400 good units. 5,400 good units × $100 = $540,000 – Further processing costs of $110,000 = $430,000 16-31 44.1718% $ 530,061 26.3804 29.4478 100.0000% 316,565 353,374 $1,200,000 2. Presented below is an analysis for Sundown Sawmill, Inc., comparing the processing of decorative pieces further versus selling the rough-cut product immediately at splitoff: Monthly unit output Less: Normal further processing shrinkage Units available for sale Final sales value (5,400 units × $100 per unit) Less: Sales value at splitoff Incremental revenue Less: Further processing costs Additional contribution from further processing 3. Units 6,000 600 5,400 Dollars $540,000 360,000 180,000 110,000 $ 70,000 Assuming Sundown Sawmill, Inc., announces that in six months it will sell the rough-cut product at splitoff due to increasing competitive pressure, behavior that may be demonstrated by the skilled labor in the planing and sizing process include the following: • • • lower quality, reduced motivation and morale, and job insecurity, leading to nonproductive employee time looking for jobs elsewhere. Management actions that could improve this behavior include the following: • • • Improve communication by giving the workers a more comprehensive explanation as to the reason for the change so they can better understand the situation and bring out a plan for future operation of the rest of the plant. The company can offer incentive bonuses to maintain quality and production and align rewards with goals. The company could provide job relocation and internal job transfers. 16-32 SOLUTION EXHIBIT 16-29 Joint Costs $1,200,000 Separable Costs Studs $8 per unit Raw Decorative Pieces $60 per unit Processing Processing $110,000 Posts $20 per unit Splitoff Point 16-33 Decorative Pieces $100 per unit 16-30 (40 min.) Joint-cost allocation. 1. Joint Costs $20,000 Separable Costs Butter Processing $.5 per pound Spreadable Butter Milk Processing For P. 16-31 Buttermilk Buttermilk Processing $.25 per pint SPLITOFF POINT a. Physical-measure method: Physical measure of total production (10,000 lbs × 2; 20,000 qts × 4) Weighting, 20,000; 80,000 ÷ 100,000 Joint costs allocated, 0.20; 0.80 × $20,000 Butter Buttermilk Total 20,000 cups 80,000 cups 100,000 cups 0.20 0.80 $4,000 $16,000 $20,000 b. Sales value at splitoff method: Sales value of total production at splitoff, 10,000 × $2; 20,000 × $1.5 Weighting, $20,000; $30,000 ÷ $50,000 Joint costs allocated, 0.40; 0.60 × $20,000 16-34 Butter $20,000 Buttermilk $30,000 0.40 0.60 $8,000 $12,000 Total $50,000 $20,000 c. Net realizable value method: Butter Final sales value of total production, 20,000 × $2.5; 20,000 × $1.5 Deduct separable costs Net realizable value Weighting, $45,000; $30,000 ÷ $75,000 Joint costs allocated, 0.60; 0.40 × $20,000 d. Buttermilk Total $50,000 5,000 $45,000 0.60 $30,000 -0- . $ 30,000 0.40 $80,000 5,000 $75,000 $12,000 $8,000 $20,000 Constant gross-margin percentage NRV method: Step 1: Final sales value of total production, Deduct joint and separable costs, ($20,000 + $5,000) Gross margin Gross-margin percentage ($55,000 ÷ $80,000) $80,000 25,000 $ 55,000 68.75% Step 2: Final sales value of total production (see 1c.) Deduct gross margin, using overall gross-margin percentage of sales (68.75%) Total production costs Butter Buttermilk Total $50,000 $30,000 $80,000 34,375 15,625 20,625 9,375 55,000 25,000 5,000 $10,625 -0- . $ 9,375 5,000 $20,000 Step 3: Deduct separable costs Joint costs allocated 2. Advantages and disadvantages: - Physical-Measure Advantage: Low information needs. Only knowledge of joint cost and physical distribution is needed. Disadvantage: Allocation is unrelated to the revenue-generating ability of products. 16-35 - Sales Value at Splitoff Advantage: Considers market value of products as basis for allocating joint cost. Relative sales value serves as a proxy for relative benefit received by each product from the joint cost. Disadvantage: Uses selling price at the time of splitoff even if product is not sold by the firm in that form. Selling price may not exist for product at splitoff. - Net Realizable Value Advantages: Allocates joint costs using ultimate net value of each product; applicable when the option to process further exists Disadvantages: High information needs; Makes assumptions about expected outcomes of future processing decisions - Constant Gross-Margin percentage method Advantage: Since it is necessary to produce all joint products, they all look equally profitable. Disadvantages: High information needs. All products are not necessarily equally profitable; method may lead to negative cost allocations so that unprofitable products are subsidized by profitable ones. 3. When selling prices for all products exist at splitoff, the sales value at split off method is the preferred technique. It is a relatively simple technique that depends on a common basis for cost allocation – revenues. It is better than the physical method because it considers the relative market values of the products generated by the joint cost when seeking to allocate it (which is a surrogate for the benefits received by each product from the joint cost). Further, the sales value at splitoff method has advantages over the NRV method and the constant gross margin percentage method because it does not penalize managers by charging more for developing profitable products using the output at splitoff, and it requires no assumptions about future processing activities and selling prices. 16-36 16-31 (10 min.) Further processing decision (continuation of 16-30). 1.and 2. The decision about which combination of products to produce is not affected by the method of joint cost allocation. For both the sales value at splitoff and physical measure methods, the relevant comparisons are as shown below: Sell at Splitoff – Revenue Process Further - NRV Profit (Loss) from Processing Further Butter $20,000 a $45,000 c $25,000 Buttermilk $30,000 b $32,000 d $2,000 a 10,000 lbs × $2 = $20,000 20,000 qts × $1.5 = $30,000 c 20,000 tubs × $2.5 – 10,000lbs × $.5 = $45,000 d 40,000 pints × $1 – 40,000 pints × $.2 = $32,000 b To maximize profits, Elsie should process butter further into spreadable butter. However, Elsie should also sell the buttermilk in the pint containers. The extra cost to convert to pint containers ($0.2 per pint × 2 pints per quart = $0.40 per quart) does not exceed the increase in selling price ($1 per pint × 2 pints per quart = $2 per quart - $1.50 original price = $0.50 per quart) and leads to a gain of $2,000. 3. The decision to sell a product at split off or to process it further should have nothing to do with the allocation method chosen. For each product, you need to compare the revenue from selling the product at split off to the NRV from processing the product further. Other things being equal, management should choose the higher alternative. The total joint cost is the same regardless of the alternative chosen and is therefore irrelevant to the decision. 16-37 16-32 (20 min.) Joint-cost allocation with a byproduct. 1. Sales value at splitoff method: Byproduct recognized at time of production method Joint cost to be charged to joint products = Joint Cost – NRV of Byproduct = $10,000 – 1000 tons × 20% × 0.25 vats × $60 = $10,000 – 50 vats × $60 = $ 7,000 Sales value of coal at splitoff, 1,000 tons × .4 × $100; 1,000 tons × .4 × $60 Weighting, $40,000; $24,000 ÷ $64,000 Joint costs allocated, 0.625; 0.375 × $7,000 Gross Margin (Sales Revenue-Allocated Cost) 2. Grade A Coal $40,000 Grade B Coal $24,000 Total 0.625 0.375 $4,375 $2,625 $ 7,000 $35,625 $21,375 $57,000 $64,000 Sales value at splitoff method: Byproduct recognized at time of sale method Joint cost to be charged to joint products = Total Joint Cost = $10,000 Sales value of coal splitoff, 1,000 tons × .4 × $100; 1,000 tons × .4 × $60 Weighting, $40,000; $24,000 ÷ $64,000 Joint costs allocated, 0.625; 0.375 × $10,000 Gross Margin (Sales Revenue-Allocated Cost) Grade A Coal $40,000 Grade B Coal $24,000 Total 0.625 0.375 $6,250 $3,750 $10,000 $33,750 $20,250 $54,000 $64,000 Since the entire production is sold during the period, the overall gross margin is the same under the production and sales methods. In particular, under the sales method, the $3,000 received from the sale of the coal tar is added to the overall revenues, so that Cumberland’s overall gross margin is $57,000, as in the production method. 3. The production method of accounting for the byproduct is only appropriate if Cumberland is positive they can sell the byproduct and positive of the selling price. Moreover, Cumberland should view the byproduct’s contribution to the firm as material enough to find it worthwhile to record and track any inventory that may arise. The sales method is appropriate if either the disposition of the byproduct is unsure or the selling price is unknown, or if the amounts involved are so negligible as to make it economically infeasible for Cumberland to keep track of byproduct inventories. 16-38 16-33 (15 min.) 1. Byproduct journal entries (continuation of 16-32). Byproduct – production method journal entries i) At time of production: Work in process inventory Accounts Payable, etc. 10,000 10,000 For byproduct: Finished Goods Inv – Coal tar Work in process inventory 3,000 For Joint Products Finished Goods Inv – Grade A Finished Goods Inv – Grade B Work in process inventory 4,375 2,625 3,000 7,000 ii) At time of sale: For byproduct Cash or A/R 3,000 Finished Goods Inv – Coal Tar 3,000 For Joint Products Cash or A/R Sales Revenue – Grade A Sales Revenue – Grade B 64,000 40,000 24,000 Cost of goods sold - Grade A 4,375 Cost of goods sold - Grade B 2,625 Finished Goods Inv – Grade A 4,375 Finished Goods Inv – Grade B 2,625 2. Byproduct – sales method journal entries i) At time of production: Work in process inventory Accounts Payable, etc. 10,000 10,000 For byproduct: No entry For Joint Products Finished Goods Inv – Grade A Finished Goods Inv – Grade B Work in process inventory 16-39 6,250 3,750 10,000 ii) At time of sale For byproduct Cash or A/R Sales Revenue – Coal Tar For Joint Products Cash or A/R Sales Revenue – Grade A Sales Revenue – Grade B 3,000 3,000 64,000 40,000 24,000 Cost of goods sold - Grade A 6,250 Cost of goods sold - Grade B 3,750 Finished Goods Inv – Grade A 6,250 Finished Goods Inv – Grade B 3,750 16-40 16-34 (40 min.) Process further or sell, byproduct. 1. The analysis shown below indicates that it would be more profitable for Newcastle Mining Company to continue to sell bulk raw coal without further processing. This analysis ignores any value related to coal fines. It also assumes that the costs of loading and shipping the bulk raw coal on river barges will be the same whether Newcastle sells the bulk raw coal directly or processes it further. Incremental sales revenues: Sales revenue after further processing (9,400,000a tons × $36) Sales revenue from bulk raw coal (10,000,000 tons × $27) Incremental sales revenue $338,400,000 270,000,000 68,400,000 Incremental costs: Direct labor Supervisory personnel Heavy equipment costs ($25,000 × 12 months) Sizing and cleaning (10,000,000 tons × $3.50) Outbound rail freight (9,400,000 tons ÷ 60 tons) × $240 per car Incremental costs Incremental gain (loss) 800,000 200,000 300,000 35,000,000 37,600,000 73,900,000 $(5,500,000) a 10,000,000 tons × (1– 0.06) 2. The cost of producing the raw coal is irrelevant to the decision to process further or not. As we see from requirement 1, the cost of producing raw coal does not enter any of the calculations related to either the incremental revenues or the incremental costs of further processing. The answer would the same as in requirement 1: do not process further. 3. The analysis shown below indicates that the potential revenue from the coal fines byproduct would result in additional revenue, ranging between $4,950,000 and $9,900,000, depending on the market price of the fines. Coal fines = = = 75% of 6% of raw bulk tonnage 0.75 × (10,000,000 × .06) 450,000 tons Potential incremental income from preparing and selling the coal fines: Incremental income per ton (Market price – Incremental costs) Incremental income ($11; $22 × 450,000) Minimum $11 ($15 – $4) Maximum $22 ($24 – $2) $4,950,000 $9,900,000 16-41 The incremental loss from sizing and cleaning the raw coal is $5,500,000, as calculated in requirement 1. Analysis indicates that relative to selling bulk raw coal, the effect of further processing and selling coal fines is only slightly negative at the minimum incremental gain ($4,950,000 – $5,500,000 = – $550,000) and very beneficial at the maximum incremental gain ($9,900,000 – $5,500,000 = $4,400,000). NMC will benefit from further processing and selling the coal fines as long as its incremental income per ton of coal fines is at least $12.22 ($5,500,000 ÷ 450,000 tons). Hence, further processing is preferred. Note that other than the financial implications, some factors that should be considered in evaluating a sell-or-process-further decision include: • Stability of the current customer market for raw coal and how it compares to the market for sized and cleaned coal. • Storage space needed for the coal fines until they are sold and the handling costs of coal fines. • Reliability of cost (e.g., rail freight rates) and revenue estimates, and the risk of depending on these estimates. • Timing of the revenue stream from coal fines and impact on the need for liquidity. • Possible environmental problems, i.e., dumping of waste and smoke from unprocessed coal. 16-42 16-35 (30 min.) Accounting for a byproduct. Note: This solution is based off of the problem update listed on the errata sheet in the front matter of this solution manual. 1. Byproduct recognized at time of production: Joint Cost = ($240 × 40) + $8,000 = $17,600 Joint cost charged to main product = Joint Cost – NRV of Byproduct = $17,600 – (4 × 40 scarves × $20) = $17,600 – (160 scarves × $20) = $14,400 Inventoriable cost of main product = $14,400 / 720 = $20.00 per blouse Inventoriable cost of byproduct = NRV = $20 per scarf Gross Margin Calculation under Production Method Revenues Main product: Blouses (600 blouses × $72) Byproduct: Scarves Cost of goods sold Main product: Blouses (600 blouses × $20.00) $43,200 0 $43,200 _______ $12,000 Gross margin Gross-margin percentage ($31,200 ÷ $43,200) $31,200 72.22% Inventoriable costs (end of period): Main product: Blouses (120 blouses × $20.00) = $2,400 Byproduct: Scarves (30 scarves × $20) = $600 2. Byproduct recognized at time of sale: Joint cost to be charged to main product = Total Joint Cost = $17,600 Inventoriable cost of main product = $17,600 / 720 = $24.44 per blouse Inventoriable cost of byproduct = $0 16-43 Gross Margin Calculation under Sales Method Revenues Main product: Blouses (600 blouses × $72) Byproduct: Scarves (130 scarves × $20) Cost of goods sold Main product: Blouses (600 blouses × $24.44) $43,200 2,600 $45,800 _______ $14,667 Gross margin Gross-margin percentage ($31,133 ÷ $45,800) $31,133 67.98% Inventoriable costs (end of period): Main product: Blouses (120 blouses × $24.44) = $2,933 Byproduct: Scarves (30 scarves × $0) = $0 3. (a) Byproduct – production method journal entries i) At time of production: Work in process inventory Accounts payable, etc. 17,600 17,600 For byproduct: Finished Goods Inv – Scarves Work in process inventory 3,200 For main product Finished Goods Inv – Blouses Work in process inventory 14,400 3,200 14,400 ii) At time of sale: For byproduct Cash or A/R 2,600 Finished Goods Inv – Scarves 2,600 For main product Cash or A/R Sales Revenue – Blouses 43,200 43,200 Cost of goods sold - Blouses 12,000 Finished Goods Inv – Blouses 12,000 16-44 (b) Byproduct – sales method journal entries i) At time of production: Work in process inventory Accounts payable, etc. 17,600 17,600 For byproduct: No entry For Joint Product Finished Goods Inv – Blouses Work in process inventory ii) At time of sale: For byproduct Cash or A/R Sales Revenue – Scarves For Joint Product Cash or A/R Sales Revenue – Blouses 17,600 17,600 2,600 2,600 43,200 43,200 Cost of goods sold - Blouses 14,667 Finished Goods Inv – Blouses 14,667 16-45 Collaborative Learning Problem 16-36 (60 min.) Joint Cost Allocation 1. (a) The Net Realizable Value Method allocates joint costs on the basis of the relative net realizable value (final sales value minus the separable costs of production and marketing). Joint costs would be allocated as follows: Final sales value of total production Deduct separable costs Net realizable value at splitoff point Weighting ($23,500; $7,500 ÷ $31,000) Joint costs allocated (0.7581; 0.2419 × $24,000) Total production costs ($18,194 + $1,500; $5,806 + $1,000) Production costs per unit ($19,694; $6,806 ÷ 500 units) (b) Deluxe Module $25,000 1,500 $23,500 0.7581 $18,194 Standard Module $ 8,500 1,000 $ 7,500 0.2419 $ 5,806 $19,694 $ 6,806 $ 39.39 $ 13.61 Total $33,500 2,500 $31,000 $24,000 $26,500 The constant gross-margin percentage NRV method allocates joint costs in such a way that the overall gross-margin percentage is identical for all individual products as follows: Step 1 Final sales value of total production: (Deluxe, $25,000; Standard, $8,500) Deduct joint and separable costs (Joint, $24,000 + Separable Deluxe, $1,500 + Separable Standard, $1,000) Gross margin Gross-margin percentage ($7,000 ÷ $33,500) $33,500 26,500 $ 7,000 20.8955% Step 2 Final sales value of total production Deduct gross margin using overall gross margin percentage (20.8955%) Total production costs Deluxe Module $25,000 Standard Module $8,500 Total $33,500 5,224 19,776 1,776 6,724 7,000 26,500 1,500 $18,276 1,000 $5,724 2,500 $24,000 $ 39.55 $13.45 Step 3 Deduct separable costs Joint costs allocated Production costs per unit ($19,776; $6,724 ÷ 500 units) 16-46 (c) The physical measure method allocates joint costs on the basis of the relative proportions of total production at the splitoff point, using a common physical measure such as the number of bits produced for each type of module. Allocation on the basis of the number of bits produced for each type of module follows: Physical measure of total production (bits) Weighting (500,000; 250,000 ÷ 750,000) Joint costs allocated (0.6667; 0.3333 × $24,000) Total production costs ($16,000 + $1,500; $8,000 + $1,000) Production costs per unit ($17,500; $9,000 ÷ 500 units) Deluxe Module/ Chips Standard Module/ Chips 500,000 0.6667 $16,000 250,000 0.3333 $ 8,000 $24,000 $17,500 $ 9,000 $26,500 $ 35.00 $18.00 Total 750,000 Each of the methods for allocating joint costs has weaknesses. Because the costs are joint in nature, managers cannot use the cause-and-effect criterion in making this choice. Managers cannot be sure what causes the joint costs attributable to individual products. The net realizable value (NRV) method (or sales value at splitoff method) is widely used when selling price data are available. The NRV method provides a meaningful common denominator to compute the weighting factors. It allocates costs on the ability-to-pay principle. It is probably preferred to the constant gross-margin percentage method which also uses sales values to allocate costs to products. That’s because the constant gross-margin percentage method makes the further tenuous assumption that all products have the same ratio of cost to sales value. The physical measure method bears little relationship to the revenue-producing power of the individual products. Several physical measures could be used such as the number of chips and the number of good bits. In each case, the physical measure only relates to one aspect of the chip that contributes to its value. The value of the module as determined by the marketplace is a function of multiple physical features. Another key question is whether the physical measure chosen portrays the amount of joint resources used by each product. It is possible that the resources required by each type of module depend on the number of good bits produced during chip manufacturing. But this cause-and-effect relationship is hard to establish. MMC should use the NRV method. But the choice of method should have no effect on their current control and measurement systems. 16-47 2. The correct approach in deciding whether to process further and make DRAM modules from the standard modules is to compare the incremental revenue with the incremental costs: Incremental revenue from making DRAMs ($26 × 400) – ($17 × 500) Incremental costs of DRAMs, further processing Incremental operating income from converting standard modules into DRAMs $1,900 1,600 $ 300 A total income computation of each alternative follows: Alternative 1: Sell Deluxe and Standard Total revenues ($25,000 + $8,500) $33,500 Total costs 26,500 Operating income $ 7,000 Alternative 2: Sell Deluxe and DRAM Difference ($25,000 + $10,400) $35,400 ($26,500 + $1,600) 28,100 $ 7,300 $1,900 1,600 $ 300 It is profitable to extend processing and to incur additional costs on the standard module to convert it into a DRAM module as long as the incremental revenue exceeds incremental costs. The amount of joint costs incurred up to splitoff ($24,000)––and how these joint costs are allocated to each of the products––are irrelevant to the decision of whether to process further and make DRAMS. That’s because the joint costs of $24,000 remain the same whether or not further processing is done on the standard modules. Joint-cost allocations using the physical measure method (on the basis of the number of bits) may mislead MMC, if MMC uses unit-cost data to guide the choice between selling standard modules versus selling DRAM modules. In requirement 2, allocating joint costs on the basis of the number of good bits yielded a cost of $16,000 for the Deluxe modules and $8,000 for the Standard modules. A product-line income statement for the alternatives of selling Deluxe modules and DRAM modules would appear as follows: Deluxe Module Revenues Cost of goods sold Joint costs allocated Separable costs Total cost of goods sold Gross margin DRAM Module $25,000 $10,400 16,000 1,500 17,500 $ 7,500 8,000 2,600* 10,600 $ (200) *Separable costs of $1,000 to manufacture the Standard module and further separable costs of $1,600 to manufacture the DRAM module. 16-48 This product-line income statement would erroneously imply that MMC would suffer a loss by selling DRAMs, and as a result, it would suggest that MMC should not process further to make and sell DRAMs. This occurs because of the way the joint costs are allocated to the two products. As mentioned earlier, the joint-cost allocation is irrelevant to the decision. On the basis of the incremental revenues and incremental costs, MMC should process the Standard modules into DRAM modules. 16-49