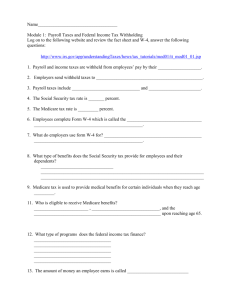

Payroll PPT

advertisement

Payroll Where’s My Money??? Ingram, S. Ingram, S. Time Card/Time Sheet • Used to keep a record of the total hours worked by an employee paid on a time basis. Ingram, S. Gross Pay • Equals the number of hours worked times the given hourly rate. • The total amount • Janet Parsons is paid earned before any $5.40 an hour. Find her payroll deductions are gross pay for a week in made. which she worked 40 • It is the amount on hours. which the employee’s • Gross pay = 40 X $5.40 = taxes are based. $216.00 Ingram, S. Net Pay • Equals the gross pay minus all deductions. • Janet Parsons’ gross pay is $216.00. She must pay $23.76 in Federal Income • Equals the amount to Tax, $15.12 in State Income be paid to the Tax, $13.40 in FICA-Social employees after all Security, and $3.14 in required and FICA-Medicare. Find her authorized deductions net pay for this week. have been subtracted • Net pay = $216.00 - $23.76 from the gross pay. - $15.12 - $13.40 - $3.14 = $160.58 Ingram, S. Federal Income Taxes • Used to provide for national programs such as defense, community development, and law enforcement. • These taxes are paid by the employee and matched by the employer. • The amount withheld depends on the number of allowances on the Form W-4 (2011). Ingram, S. State Income Taxes • Used to provide for state programs such as community development and law enforcement. • These taxes are also paid by the employee and matched by the employer. • Again, the amount withheld depends on the number of allowances on the MO W-4. Ingram, S. FICA-Social Security • Provides for a system of old age, survivors, and disability insurance. • The employee tax rate for Social Security is 6.2% (amount withheld). For the year 2003, the wage base is $87,000.00. Ingram, S. FICA-Medicare • Provides for a system of health insurance. • The employee tax rate for Medicare is 1.45% (amount withheld). There is no wage base limit for Medicare tax; all covered wages are subject to Medicare tax. Ingram, S. • The purpose of this form is to document that each new employee (both citizen and noncitizen) hired after Nov. 6, 1986, is authorized to work in the United States. Provides Employment employees hired and working in the U.S. Eligibility Verification. • All must complete Form I-9 • The following items are part of the list of acceptable documents: I-9 Form • LIST A 1. U.S. Passport 2. Permanent Resident Card or Alien Registration Receipt Card 3. Foreign passport that contains a temporary I-551 stamp LIST B 1. Driver’s License 2. ID card issued by federal, state or local government agencies 3. School ID card w/ photograph 4. Voter’s registration card 5. U.S. Military Card LIST C 1. Social Security Card 2. Birth Certificate 3. Native American Tribal Document 4. U.S. Citizen ID Card