home_depot - Homework Market

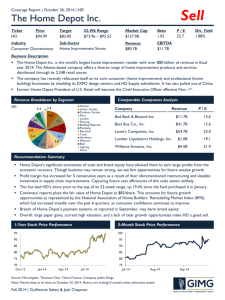

advertisement

Running head: HOME DEPOT FINANCIAL ANALYSIS Home Depot Financial Analysis Name: Course: Professor: Institution: Date: 1 Running head: HOME DEPOT FINANCIAL ANALYSIS Financial Analysis - Home Depot Company Overview Based on the record sales in the fiscal year ended February 1, 2015, Home Depot Inc. is the largest home improvement company that offers a wide range of services and sells a variety of materials. The main objectives of the company is to provide its customers with a unique customer experience, have a product authority and good capital allocation and an efficiency in productivity. The company has been able to achieve these objectives through introduction of mobile services used mainly by the stores departments, improvements on the company websites and mobile sites and efficiency in the supply chain operations. Home Depot has three customer groups, which is the customers who own homes and do their own installations when they purchase products. What the company does is to answer their questions about installations and how to handle the projects. Another group of customers are those home owners who purchase materials and have their projects handled by 3rd parties and finally the professional customers. The associates are trained to provide quality and unique customer service and those who show exemplary performance are rewarded. Home Depot opened six new stores in Mexico during the fiscal year ended February 1st. This included one relocation and it also opened one new store in Canada. It had 2,269 stores operating at the end of 2014, 10 % under lease and the rest owned by Home Depot and 162 warehouses and distribution centers located in different provinces. (Home Depot 2014 Annual Report, 2015). The mission of Home Depot can be summarized as follows: It strives to provide exceptional services with a wide range of products at competitive prices. Its main values are providing outstanding experience to its customers, ensuring its employees are satisfied, participating in 2 Running head: HOME DEPOT FINANCIAL ANALYSIS corporate social responsibilities, generating shareholders’ worth, promoting an entrepreneurial spirit and building strong relationships. Due to improving U.S. economy and recovery of the U.S. housing market, the fiscal year 2014 was a successful year for Home Depot with record sales made. The sales revenue grew from 78,812 million to 83,176 million. The diluted earnings per share increased from 3.76 to 4.71 dollars per share. The Company’s performance depends on several factors like the construction of homes, upgrading of homes whose prevailing economic conditions and ever changing nature of these markets affect the performance of Home Depot. Ratio Analysis 1st January 2015 Ratio Current Assets Current ratio =Current Liabilities Quick ratio 15302 1St January 2014 15279 = 11269 = 10749 =1.3579 = 1.42 =1.4 =1.4 = 15302−11079 11269 = 15279−11057 10749 Current Assets−Inventories = Current Liabilities = 0.37474 = 0.3927 = 0.4 = 0.4 3 Running head: HOME DEPOT FINANCIAL ANALYSIS Sales Revenue Inventory Turnover = Total asset turnover = Debt ratio = Inventory Sales Revenues Total Assets Total liabilities Total assets Gross profits Gross margin profit = Sales revenues Net profit margin = = Sales revenues Net Profit Return on Investment =Total Assets = 11079 78812 10749 = 7.5075 = 7.3320 =7.5 =7.3 = 83176 = 39946 78812 40518 = 1.344 = 1.344 =1.3 =1.3 = 30624 = 39946 27996 40518 =0.7666×100 =0.69095×100 = 76.66% = 69.1% = 28954 = 83176 27390 78812 = 0.3481 =0.3475 =0.3481 ×100 = 0.3475 ×100 = 34.8% =34.8% = Net profit after interest and taxes 83176 6345 = 83176 5385 78812 = 0.07628×100 =0.06833×100 =7.6% = 6.8% = 6345 = 39946 =0.1588×100 4 5385 40518 =0.1329×100 Running head: HOME DEPOT FINANCIAL ANALYSIS = 15.88% Return on Equity = 6345 = 13.3% = 9322 5385 12522 Net Income = Shareholders′ 𝑒𝑞𝑢𝑖𝑡𝑦 =0.68064×100 =0.4300×100 = 68.1% = 43% Financial ratios are useful in checking if the performance of a company is up to speed with the required or targeted performance, checking how the company fairs in relation to competition and finally getting to understand the processes or activities that management needs to act upon. Home depot is very keen on how it handles stocks and also ensuring its prices are competitive. It is therefore keen on its level of cash flows. The company’s current ratio is 1.4 meaning the current assets can meet current liabilities. The amount however is lower than 2.4 indicating that the company is channeling its cash inflows towards some specific projects for instance there is a huge investment in capital expenditure. However the way the company earns its income is in such a way that it receives cash every day and therefore able to meet its short term liabilities as they fall due. A quick ratio which subtracts inventories from the current assets figure is 0.4 which shows that the company is unable to meet its short term liabilities with its most liquid assets. This is a red flag especially because it is recurrent over the years. The inventory turnover ratio of 7.5 is appealing which means that the company is making high sales and keeping an eye on its stocks not to increase to unmanageable levels. Most of the stocks available are sold. The company’s financial strength is reducing greatly and its debt ratio has increased from 69.1% to 5 Running head: HOME DEPOT FINANCIAL ANALYSIS 76.6%. The company issued more notes during the fiscal year. Profit margins as a percentage of sales have shown an improvement over the years. This indicates the company is operating efficiently and there is efficient management of the affairs of business. Return on assets ratio shows the income that is generated by a company’s investment in debt and also equity while return on equity indicates the income generated as a result of investment on shareholders’ equity. The return on investments has been increasing investments and the return on equity shows the increasing profitability of the company. Trend Analysis Trend analysis compares how revenues and expenses change from one financial year to another. The financial report indicates a tremendous increase in sales revenue, coupled with slight increases in operating costs, which resulted in an overall increase in the profitability of the company. The increased profitability also led to an increase in earnings per share during the financial periods under review. Despite the increased profitability and increased earnings per share, the company did not greatly vary the dividends they paid. (2014 Annual Report, 2015). With the low quick ratio otherwise known as the acid test ratio being low, the company aims at improving its liquidity position as seen in the balance sheet balances of the report. The company has also been faced with an increase in debt due to increase in the issue of notes. The organization has reduced its stock repurchase as shown in the cash flow statement in page 36. The cash flow also shows there was an increase in borrowing of both the short-term and the long term debt which could have been used to invest in the capital expenditure. 6 Running head: HOME DEPOT FINANCIAL ANALYSIS Vertical Analysis The improvement in the U.S economy has contributed to the increase in performance at Home Depot. In the letter to the shareholders, the management mention that the made record sales in the fiscal year and achieved the highest net earnings. The company is targeting a payout ratio of 50 percent of net earnings and any excess cash will be issued to shareholders in form of shares. In 2014, Home Depot repurchased a total of 80 million shares of their outstanding stock and in February 2015 they announced a new $18 billion share repurchase program. This resulted to an increase in dividend by 26% to $0.59 per share quarterly and an annual dividend of $ 2.36 per share. The good economic condition has favored the performance of the organization. 7 Running head: HOME DEPOT FINANCIAL ANALYSIS Reference Home Depot 2014 Annual Report. (2015). Retrieved on 20th September 2015 from: http://media.corporateir.net/media_files/IROL/63/63646/2015%20Annual%20Report_Ho me%20Depot.pdf 8