Zix Corporation November 20, 2014 Efe Faydali, Fan Fei,

advertisement

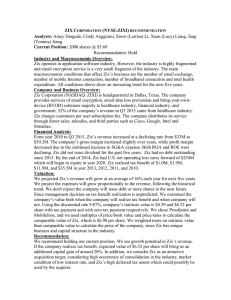

Zix Corporation November 20, 2014 Agenda 1. 2. 3. 4. 5. 6. 7. 8. Introduction Macroeconomic Review Relevant Stock Market Prospects Company Review Financial Analysis Financial Projection Application of Valuation Methodologies Recommendation Position • Purchased 2000 shares @ $2.89/share on April 17, 2012 • Basic cost: $5,780 • Current: 2000 shares @ $3.25/share on November 19, 2014 • Market value: $6,500 • Holding period : 19 months • Gain: 12.46% • Annualized return: 7.82% Source: Yahoo Finance Company Review A Leader in Email Data Protection • Founded in 1998 as an email encryption company • Nearly 192 employees in the US and Canada • Committed to innovative, easy-to-use email encryption • Expanded into data loss prevention (DLP) with email-specific solution • Innovator in the bring-your-own-device (BYOD) market Source: Zix Corporation Investor Relations, page 2 Revenue Origination Source: Zix Corporation Investor Relations, page 30 Macroeconomic Outlook BYOD - “Bring your own device” • Strong trend & Growing fast • 81% of Employees use at least one personal device for business use in 2012. • The United States, currently the largest BYOD market with 71 million BYOD devices, will have 108 million by 2016, or a 52% growing rate. • Security risk • 90% of users disabled auto-lock for tablets and 75% of users disabled auto-lock smartphones • 71% of businesses that permitted BYOD had NO specific security or support policies Sources: akuity, 2012; Cisco, 2013; ITIC, 2012 Macroeconomic Outlook Regulatory drivers • The Health Insurance Portability and Accountability Act (HIPAA) • Health Information Technology for Economic and Clinical Health Act (the “HITECH Act”) • Gramm-Leach-Bliley Act (“GLBA”) • State specific email encryption law Source:U.S. Department of Health & Human Services Industry Analysis U.S. Software Market Value Forecast Source: Marketline Industry Porter’s 5 Forces • Bargaining Power of Suppliers: NA • Bargaining Power of Buyers: Moderate to high • Rivalry: High • Threat of Substitutes: Low • Threat of New Entrants: High Management’s Strategy • Be a leader and innovator in email data security • Maintain Ease of Use • Launch new products to establish the reputation in email data security • Expand customer reach through a network of resellers and other distribution partners Source: Zix 2013 Annual Report, page 3 Company Products Email Encryption Services • Enables the secure exchange of email including sensitive information • Allows an enterprise to use policy-driven rules • Software-as-a-Service (“SaaS”) solution • Customers pay an annual service subscription fee Technology -ZixDirectory -Best Method of Delivery -ZixData Center -ZixResearch Center ZixGateway ZixMail Senders ZixGateway ZixAccess ZixPort ZixDirect Receivers Source: Zix 2013 10-K, page 3 Easy-of-Use How Zix Different From Other Solutions Source: Zix Corporation Investor Presentation, page 9-10 New-launched Products Email Data Loss Prevention – ZixDLP March 29, 2013 • Providing a straightforward DLP approach with a focus strictly on email • Addresses business’s greatest source of data risk • Decreases the complexity and cost • Reduces deployment timelines from month to hours • Easy-to-use for both employees and administrators Source: Zix 2013 10-K, page 3 New-launched Products BYOD – ZixOne September 3, 2013 • Enables Android or IOS mobile devices to view remotely-stored corporate email and to interact with that data • Never allows emails to be stored on the device, where it might be subjected to exposure from theft or loss of the device • Not requires employees to relinquish device control or personal privacy to their employer Source: Zix 2013 10-K, page 3 Why ZixOne MDM – Mobile Device Management • Require individual users to permit their employer access to and control over personally-owned smartphones and tablet computers • Create user concerns about loss of control and privacy of their devices ZixOne – Delivering a view of corporate email on mobile devices in the cloud only Source: Zix Corporation Investor Relations, page 22-24 SWOT Analysis • Strengths • • • • Easy-of-use • Software-as-a-Service (“SaaS”) A more effective BYOD solution • protecting business data High defer tax credit • • Weaknesses • • • Opportunities Cisco ending IronPort Encryption Appliance Increased demand on security of data and communication Strong trend of BYOD • Threats Limited resources • Forced to exit business segments in the past few years • • • Industry consolidation (M&A, strategic alliance) Rapid technology changes The reliability and sustainability of data center The relationships with third-party distributors Financial Analysis – Ratio Liquidity Ratios 2010A 2011A 2012A 2013A Current Ratio 1.54 1.29 1.32 1.56 Quick Ratio 1.54 1.29 1.32 1.56 Cash to Total Asset 37% 27% 28% 30% Profitability Ratios 2010A 2011A Revenue Growth Rate 25.22% 15.36% Gross Margin 80.44% 81.10% Operating Margin 15.79% 27.96% ROA 7.81% 13.75% ROE (With Tax Benefit) 86.8% 39.0% ROE (Without Tax Benefit) 11.1% 18.5% 2012A 13.66% 82.45% 20.88% 10.93% 18.0% 14.8% 2013A 11.03% 84.18% 19.62% 10.42% 15.8% 14.3% Financial Analysis – Ratio Greenblatt 2010A 2011A 2012A 2013A 43% 137% 99% 63% 3% 5% 6% 4% EBIT/Tangible Assets EBIT/EV DuPont Analysis Tax Burden Interest Burden Operating Profit Margin Asset Turnover Leverage TA/ TE 2010A 2011A 2012A 2013A 7.80 2.11 1.22 1.11 1.01 1.01 1.01 1.01 16% 28% 21% 19% 0.49 0.49 0.52 0.53 1.43 1.34 1.35 1.37 ROE 86.8% 39.0% 18.0% 15.8% ROE (Without Tax Benefit) 11.1% 18.5% 14.8% 14.3% Technical Analysis Weighted Cost of Capital Beta Beta from Yahoo 3yr Beta 2yr Beta 1yr Beta Adj Beta CAPM Risk Free Rate Market Premium CAPM 1.15 1.15 1.12 1.63 1.20 2.40% 6% 9% Return to Owner 2 Year (Annualized) 8% 1 Year -28% Half Year (Annualized) -8% Adj ZIXI Return to Owner 9% Graham Growth Rate Trailing P/E 24.85 Graham Implied g% 8.18% Capital Structure Equity $198,702 100.0% Total Financing $198,702 100% Discount Rate ZIXI Return to Owner Graham Implied g% CAPM Adj Cost of Equity Cost of Equity WACC Risk Premium Discount Rate 9% 33% 8.18% 33% 9% 33% 8.7% 8.7% 100.0% 8.7% 3.5% 12.2% Financial Projection Income Statement Historical Figures Revenues % growth Cost of revenues % of Sales Gross margin % margin R&D % of Sales SG&A % of Sales Operating income % margin Interest expense % of Sales Income before income taxes % margin Income tax benefit % of EBT Income from operations % margin 2009A 2010A 26,407 33,066 25% 4,576 6,468 17% 20% 21,831 26,598 82.7% 80.4% 3,619 5,089 14% 15% 15,927 16,363 60.31% 49.49% 2,285 5,146 9% 16% -21 -22 -0.08% -0.07% 2,478 5,220 9% 16% -67 35,500 -0.3% 107.4% 2,411 40,720 9% 123% 2011A 38,145 15% 7,211 19% 30,934 81.1% 5,229 14% 15,128 39.66% 10,577 28% -7 -0.02% 10,665 28% 11,889 31.2% 22,554 59% 2012A 43,356 14% 7,609 18% 35,747 82.4% 7,419 17% 19,385 44.71% 8,943 21% -1 0.00% 9,054 21% 1,949 4.5% 11,003 25% 2013A 48,138 11% 7,614 16% 40,524 84.2% 9,563 20% 21,646 44.97% 9,315 19% 0 0.00% 9,447 20% 1,006 2.1% 10,453 22% Forecasted Figures 2014E 49,727 3.3% 7,956 16.0% 41,770 84.0% 9,945 20.0% 22,377 45.0% 9,584 19.3% 0 0.0% 9,584 19% 0 0.0% 9,584 19% 2015E 56,191 13.0% 8,991 16.0% 47,200 84.0% 7,867 14.0% 25,286 45.0% 14,202 25.3% 0 0.0% 14,202 25% 0 0.0% 14,202 25% 2016E 62,372 11.0% 9,980 16.0% 52,392 84.0% 8,732 14.0% 28,067 45.0% 15,764 25.3% 0 0.0% 15,764 25% 0 0.0% 15,764 25% 2017E 69,233 11.0% 11,077 16.0% 58,156 84.0% 11,770 17.0% 29,078 42.0% 17,498 25.3% 0 0.0% 17,498 25% 0 0.0% 17,498 25% 2018E 75,464 9.0% 12,074 16.0% 63,390 84.0% 12,829 17.0% 31,695 42.0% 19,073 25.3% 0 0.0% 19,073 25% 0 0.0% 19,073 25% DCF Analysis Net earnings pre tax Depreciation and amortization Capital expenditures Change NWC FCF PV FCF Implied Equity Value Current Share Outstanding Implied share price 2014 9,584 1,510 (1,641) (134) 9,588 8,543 $186,448 57,610.4 $3.24 2015 14,202 1,555 (1,690) (3,516) 17,583 13,961 2016 15,764 1,602 (1,741) (2,586) 18,212 12,885 2017 17,498 1,650 (1,793) (2,871) 20,226 12,751 Post 2023 2018 2019-2023 with Tax 19,073 1,699 (1,847) (2,607) 21,533 426,494 323,708 12,096 97,485 28,726 Discount rate Terminal Value Growth Rate 12.23% 2.50% Implied Price Terminal Growth Rate DCF : $3.24 Current Stock Price : 3.25 3.24 11.23% 1.75% $3.41 2.00% $3.48 2.25% $3.55 2.50% $3.62 2.75% $3.70 3.00% $3.79 Discount Rate 11.73% 12.23% 12.73% $3.23 $3.07 $2.92 $3.29 $3.12 $2.97 $3.35 $3.18 $3.02 $3.42 $3.24 $3.07 $3.49 $3.30 $3.12 $3.56 $3.36 $3.18 13.23% $2.79 $2.83 $2.87 $2.92 $2.97 $3.02 Key Factors Pro • • • • • Easy-of-Use BYOD trend ZixOne uniqueness Google partnership Cisco IronPort Encryption Appliance Con • Industry rivalry high • First year order decreasing • Weak quarter expectation • No specific industry alignment Recommendation HOLD