ZIX Corporation (NYSE:ZIXI) recommendation

advertisement

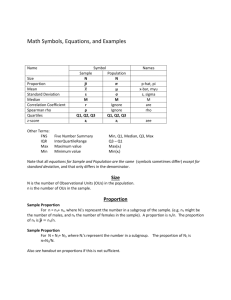

ZIX CORPORATION (NYSE:ZIXI) RECOMMENDATION Analysts: Amey Dargude, Cindy Anggraini, Siwei (Lerrisa) Li, Xuan (Lucy) Liang, Jiaqi (Tommy) Jiang. Current Position: 2000 shares @ $5.68 Recommendation: Hold Industry and Macroeconomic Overview: Zix operates in application software industry. However, the industry is highly fragmented and email encryption service is a very small fragment of the industry. The main macroeconomic conditions that affect Zix’s business are the number of email exchange, number of mobile Internet connection, number of broadband connection and total health expenditure. All conditions above show an increasing trend for the next five years. Company and Business Overview: Zix Corporation (NASDAQ: ZIXI) is headquartered in Dallas, Texas. The company provides services of email encryption, email data loss prevention and bring-your-owndevice (BYOD) solutions majorly to healthcare industry, financial industry, and government. 52% of the company’s revenue in Q3 2015 came from healthcare industry. Zix charges customers per user subscription fee. The company distributes its service through direct sales, telesales, and third parties such as Cisco, Google, Intel and Stmantec. Financial Analysis: Form year 2010 to Q3 2015, Zix’s revenue increased at a declining rate from $33M to $50.3M. The company’s gross margin increased slightly over years, while profit margin decreased due to the continued increase in SG&A expense. Both ROA and ROE were declining. Zix did not issue dividend for the past five years. Zix had no debt outstanding since 2013. By the end of 2014, Zix had U.S. net operating loss carry forward of $254M which will begin to expire in year 2020. Zix realized tax benefit of $1.0M, $1.9M, $11.9M, and $35.5M in year 2013, 2012, 2011, and 2010. Valuation: We projected Zix’s revenue will grow at an average of 16% each year for next five years. We project the expenses will grow proportionally to the revenue, following the historical trend. We don't expect the company will issue debt or more shares in the near future. Since management decision on tax benefit realization is unpredicted. We examined the company’s value both when the company will realize tax benefit and when company will not. Using the discounted rate 9.87%, company’s intrinsic value is $4.39 and $6.52 per share with tax payment and with zero tax payment respectively. We chose Proofpoint and MobileIron, and we used multiples of price/book value and price/sales to calculate the comparable value of Zix, which is $6.98 per share. We weighted more on intrinsic value than comparable value to calculate the price of the company, since Zix has unique business and capital structure in the industry. Recommendation: We recommend holding our current position. We see growth potential in Zix’s revenue. If the company realizes tax benefit, expected value of $6.52 per share will bring us an additional capital gain of around 20%. In addition, we consider Zix as an attractive acquisition target, considering high occurrence of consolidation in the industry, market condition of low interest rate, and Zix’s high deferred tax assets which could possibly be used by the acquirer.