October 15, 2013

advertisement

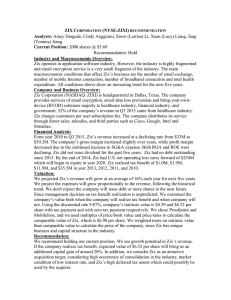

ZIX CORPORATION OCTOBER 15, 2013 Dan Ballantine, Alexander Johansson & Ye Liang Agenda Introduction Holding Information Macroeconomic Outlook Industry Overview Company Overview Financial Analysis Valuation Recommendation Zix Corporation Leading Provider of Email Encryption Designed for Regulatory Compliance and Protecting Sensitive Communication 1 in Every 5 U.S. Bank and Hospital Products & Services: ZixGateway / ZixMail – Sender Service ZixAccess – Receiver Service ZixDirectory World’s Zix Largest Shared Email Encryption Community Research Center Source: MarketLine, Zix 2012 10-K Current Holding April 17, 2012 Acquired 2,000 shares @ $2.89/share Cost basis = $5,780 October 15, 2013 Current holdings 2,000 shares @ $4.85/share Market value = $9,700 Annualized HPR = 41.22% Source: Yahoo Finance Macroeconomic Overview Unemployment Rate US Unemployment Rate 2013 YTD 8.0% 7.8% 7.6% 7.4% 7.2% 7.0% Jan Feb Mar Apr May Jun Jul Aug BYOD Catalyst 4 Out of 5 Employees Use Their Own Devices At Work Sensitive Information Concerns Source: Bureau of Labor Statistics, Ribbit Macroeconomic Overview HIPAA Compliance Health Insurance Portability and Accountability Act Covered entities: health plan, health providers, health care clearinghouses Also applies to business associates of covered entities Requirements: privacy, security, and transaction standards regarding health care patient information Deadline for compliance was September 23, 2013 Continued need for protection as more patient data is stored and transmitted electronically Source: Lorman, American Physical Therapy Association, US HHS Stock Market Source: Google Finance Industry Overview What is Software Industry? Components System Software Operating Systems Network and database management Other Application Software General business productivity and home use application Cross-industry and vertical market applications Other Source: MarketLine Industry Profile Industry Overview United States software market category segmentation: % share, by value, 2011 4% 9% 24% Network and database management General Business productivity & home applications 19% Cross-industry and vertical application 23% 21% Operating System software Other system software Other application software Source: MarketLine Industry Growth United States software market value: $billion, 2007-2011 110 108.7 104.1 105 15% 10% 6.82% 8.37% 100 5% 100.3 99.4 4.73% 95 0% 93.9 -5% 90 -10% -9.80% 85 -15% 2007 2008 2009 $ billion 2010 % Growth Source: MarketLine 2011 Industry Life Cycle Steady growth in sales as product acceptance widens Source: UIUC BADM 449 Industry Forces Analysis Bargaining Power of Suppliers 5 4 3 Rivalry Among Existing Competitors 2 Threat of New entrants 1 0 Threat of Substitute Products or Services Bargaining Power of Buyers Source: MarketLine Industry Forces Analysis Buyer Power: MEDIUM High switching cost, open source substitutes available, large population of customers Supplier Power: MEDIUM Highly differentiated inputs, low threat of forward integration Rivalry Among Existing Competitors: MEDIUM Differentiated products, fast industry growth, many competitors Source: MarketLine Industry Forces Analysis Threat of New Entrants: MEDIUM Low capital intensive, high labor intensive, trusts in certain sub-markets Threat of Substitutes: MEDIUM Cheap or free open source alternatives that update more frequently and quickly, capability issue with the alternatives Conclusion: Moderately attractive industry Source: MarketLine Company Overview Products and Services: New to the Family in 2013 ZixONE; byod Source: Zix Corporation Website Company Overview Strategy: Differentiation Highly specialized in data protection Software-as-a-Service (SaaS) Revenue method: Annual service subscription fee Pricing is fixed per sender each year 75% of deals are 3-yr contracts with an average of 2.5 years Cash generally collected annually upfront Retention of 90%+ of revenue Source: ZixCorp Investor Relations Company Overview Source: Zix Corporation Investor Relations Product Life Cycle Steady growth in sales as product acceptance widens: •Demand increases as business related online communication expanding •Products reach out to wider range of audience Source: UIUC BADM 449 Business Risk Analysis Changing regulations on internet privacy Main customers subject to political factors Rapidly growing technologies bring uncertainty Dependent on strong human capital Existing and potential big players End user preference Hacker population brings challenges SWOT Analysis Strengths Weaknesses - - No long-term debt Strong cash position Growing product base Subscription business model - Operating losses in past 5 years Forced to exit business segments in the past few years Opportunities Threats - Healthcare compliance (HIPAA) - Increased emphasis on security of data and communication - BYOD trend in the workplace - Big data trends - NSA security threats - Increased hacker issues - Rapid technological change Management Outlook Optimistic about subscription business model coupled with over $60 million backlog Enthusiastic about September release of ZixOne to address the BYOD segment Concerns over increased SG&A expenses in 2013 due to increased sales force Recognized increased competition from companies such as McAfee and Cisco Systems Source: Zix Corporation Q2 Earnings Call Recent Financial Information Source: Zix 2012 10-K, Zix 2010 10-K Recent Financial Information Source: Zix 2012 10-K, Zix 2010 10-K Current Stock Information Metric Value Current Stock Price $4.85 Trailing P/E 36.62 Forward P/E 20.70 Market Cap ($ millions) $297.00 Source: Capital IQ, Yahoo Finance Financial Analysis Current Ratio Quick Ratio Cash Ratio Operating Profit Margin Net Margin ROA ROE (Book Value) Debt/Assets Debt/Equity Interest Coverage Liquidity Ratios 2008 2009 0.83 0.82 0.77 0.76 0.74 0.72 2010 1.54 1.42 1.34 2011 1.29 1.13 1.10 2012 1.32 1.16 1.11 Profitability Ratios 2008 2009 -21.42% -14.88% -19.41% -14.47% -28.03% -22.68% 683.67% 269.44% 2010 15.56% 125.45% 95.80% 184.78% 2011 27.73% 59.13% 31.24% 43.11% 2012 20.63% 25.38% 13.72% 18.49% Solvency Ratios 2008 2009 0.92 0.89 NM NM NM NM 2010 0.25 0.36 233.91 2011 0.23 0.30 1,511.00 2012 0.22 0.30 8,943.00 Financial Analysis A/R Turnover Days Sales Outstanding A/P Turnover Days Payable Outstanding Fixed Asset Turnover Total Asset Turnover Tax Burden Interest Burden Operating Profit Margin Asset Turnover Leverage ROE Activity Ratios 2008 2009 35.15 49.60 10.38 7.36 26.51 12.24 13.77 29.81 12.37 14.02 1.44 1.57 2010 31.43 11.61 7.52 48.53 15.22 0.76 2011 37.25 9.80 13.17 27.71 17.19 0.53 2012 51.89 7.03 16.97 21.51 18.80 0.54 DuPont Analysis 2008 2009 100.78% 101.53% 89.91% 95.77% -21.42% -14.88% 144.39% 156.76% (24.39) (11.88) 683.67% 269.44% 2010 794.67% 101.44% 15.56% 76.36% 1.93 184.78% 2011 211.48% 100.83% 27.73% 52.83% 1.38 43.11% 2012 121.53% 101.24% 20.63% 54.06% 1.35 18.49% Comparable Companies Company Tucows Inc. Axway Software S.A. Fortinet Inc. Trend Micro Inc. Proofpoint, Inc. USA Technologies Inc. Zix Corporation Ticker (Exchange) Market Cap ($millions) TCX (AMEX) $105.44 AXW (ENXTPA) $594.36 FTNT (NASDAQ) $3,446.84 4704 (TSE) $5,029.95 PFPT (NASDAQ) $1,039.23 USAT (NASDAQ) $53.17 ZIXI (NASDAQ) $291.49 Source: Capital IQ Stock Performance Source: Yahoo Finance Comparable Company Analysis Target Company Zix Corporation Ticker Symbol (Exchange) ZIXI (NASDAQ) Comparable Companies Tucows Inc. Axway Software S.A. Fortinet Inc. Trend Micro Inc. Proofpoint, Inc. USA Technologies Inc. TCX (AMEX) AXW (ENXTPA) FTNT (NASDAQ) 4704 (TSE) PFPT (NASDAQ) USAT (NASDAQ) Comparable Statistics High Median Low Mean Price/Book Forward Forward Value TEV/Sales TEV/EBITDA Forward P/E 4.62x 5.14x 16.35x 20.70 4.75x 1.84x 6.07x 4.00x 27.50x 2.61x 0.78x 1.75x 4.60x 3.32x 6.71x 1.18x 10.47x 10.97x 20.97x 12.79x NM 6.42x 15.00 18.54 37.20 23.82 NM 25.00 27.50x 4.37x 1.84x 7.79x 6.71x 2.54x 0.78x 2.62x 20.97x 10.97x 6.42x 13.80x 37.20 23.82 15.00 23.64 Source: Capital IQ Comparable Company Analysis Multiple Price/Book Value Forward TEV/Sales Forward TEV/EBITDA Forward P/E Multiple Price/Book Value Forward TEV/Sales Forward TEV/EBITDA Forward P/E ZIX Implied Stock Price Low $ $ $ $ 1.89 0.29 1.35 3.45 Implied ZIX Share Price Median High $ 4.50 $ 28.32 $ 1.79 $ 5.35 $ 2.57 $ 5.25 $ 5.48 $ 8.56 Weight 25% 25% 25% 25% Mean $ $ $ $ Implied ZIX Stock Price $ 8.03 $ 1.86 $ 3.33 $ 5.44 $ 4.66 Source: Capital IQ 8.03 1.86 3.33 5.44 Discount Rate CAPM Risk-Free Rate Market Risk Premium 5-Year Beta 2.64% 6.00% 0.41 CAPM Cost of Equity 5.12% Annual Realized Returns Year 1 2 3 4 5 Actual 2.23% 112.57% -36.25% 16.94% 67.59% Total Realized Return 171.51% Arithmetic Annual Return Geometric Annual Return 32.62% 22.11% Source: Yahoo Finance Discount Rate Weighted Average Cost of Capital Share Price $ 4.76 Shares Outstanding (thousands) 61,240.00 Market Value of Equity $ 291,502.40 Debt - Percent Equity Weight Percent Debt Weight 100.00% 0.00% Cost of Debt Cost of Equity CAPM Cost of Equity ZIX Realized Return Cost of Equity 5.12% 22.11% 13.62% Tax Rate WACC 38.0% 13.62% 50.00% 50.00% Cost of Equity Weightings DCF Analysis Zix Corporation Discounted Cash Flow Analysis ($ thousands) Net Income Depreciation Capital Expenditures Changes in Net Working Capital Less Increases in A/R Less Increases in Inventories Plus Increases in A/P Free Cash Flow Present Value Discount Rate 2013E 12,615 1,430 (1,500) 2014E 14,794 1,472 (1,525) 2015E 18,002 1,504 (1,550) 2016E 21,460 1,532 (1,575) 2017E 25,309 1,558 (1,600) (130) 247 12,662 11,145 (107) 227 14,860 11,512 (115) 278 18,119 12,354 (46) 340 21,710 13,029 (121) 361 25,507 13,473 Terminal Value 247,484 130,725 13.62% Calculation of Implied Share Price Implied Enterprise Value Less Debt Plus Cash Implied Market Cap $192,238 $ $22,988 $215,226 Implied Share Price $ 3.51 Terminal Value Terminal Growth Rate 3.00% Decision Drivers Strengths Strong cash position and improving balance sheet Well positioned in health care segment Additional BYOD segment growth opportunities Concerns Strong recent stock performance Internet and data privacy threats Operating losses in the past Recommendation Valuation Summary Current Stock Price: $4.85/share Comparable Companies Valuation: $4.66/share DCF Valuation: $3.51/share Recommendation: HOLD Questions?