The Multiplier Effect

advertisement

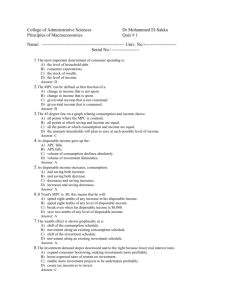

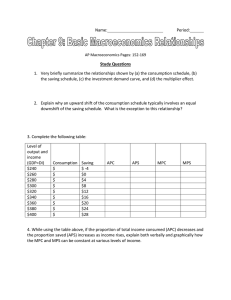

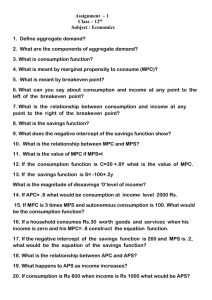

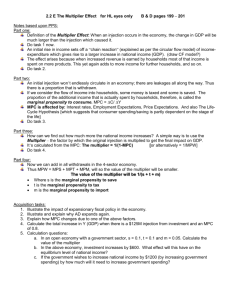

The relationships between Income and Saving and Income and Consumption Consumption is the largest component of AD What determines a person’s level of consumption? What is DI? The proportion of income that a person spends is called the average propensity to consume (APC) Equal to C/DI To spend or to save? Consumers after tax income- DI Consumers can choose to spend or save their DI The APC may be less than 1 It may be equal to 1 for students and teachers Student earns $100, student spends $100: 100/100=1 The proportion of income a consumer saves is called average propensity to save (APS) Equal to S/DI To spend or to save? Consumers have only two options: spend or save C + S = DI Therefore the APC + APS = 1 The proportion of income spent plus the proportion of income saved equals the total income. Consumers do not invest; businesses invest. Investment is buildings, equipment, things used for production. When consumers buys stocks, or mutual funds, it’s a form of saving; important distinction. The term investment is used differently in other places. Back to marginal analysis… Marginal always means change or additional. MPC MPS What’s the difference between APC / APS and the MPC / MPS? MPC The additional spending that results when a consumer receives additional disposable income. If a consumer receives an additional $1 and they spend half of it, their MPC is 0.5 The MPS is the additional saving that results when a consumer receives additional disposable income. If a consumer receives an additional dollar of disposable income and saves half of it, their MPS is 0.5 Because the DI = S + C, MPC + MPS = 1 The additional spending from the additional dollar plus the additional saving from the additional dollar must equal the additional dollar. MPC, MPS MPC = C/ DI MPS = S/ DI MPC + MPS = 1 The Multiplier Assume the government spends an additional $100 on office supplies ( G increases by $100) That becomes the income for the office supply store owner. What does the store owner do with the additional income? She consumes part of it and saves part of it! How much does she consume? It depends on the MPC. Assume MPC is 0.8. The store owner spends $80 and saves $20. What happens to the $80 she spends? The Multiplier It becomes income for someone else. Assume she spends it on groceries. The spending becomes income for the grocery store owner. What does he do with it? He spends some he saves some. Thus we have multiple rounds of spending. The Multiplier $100 $20.00 $80.00 $16.00 $64.00 $12.50 $51.20 The Multiplier How long will this process continue? Until there is no more income to pass on to the next round. What is the total amount of spending created by the initial change in government spending of $100? It will equal $100+ 80+ 64 + 51.20… The initial spending increase of $100 has multiplied! We could continue to calculate the increase in spending through each round, but there is an easier way. The Multiplier What determined the spending passed on in each round? The MPC What would happen if the MPC were larger? More would be passed on. What would happen if the MPC were smaller? Less would be passed on. The Multiplier Remember the circular flow model? Savings is a leakage from the circular flow model. The size of the final change in spending depends on the MPC. The spending multiplier = 1/(1-MPC) OR 1/MPS The Multiplier Any initial change in spending will be multiplied C , I , G , Xn A change in taxes will affect spending because it affects DI. This is called the Tax Muliplier The Tax Multiplier Tax multiplier is slightly different for 2 reasons: First: The tax multiplier is negative because an increase in taxes decreases DI and spending (and vice versa). The effect of taxes is inverse so the multiplier has a negative sign. Second: A change in taxes must change DI before it changes spending. This is different from a change in C, I, G, or Xn that immediately affects spending. A $1 change in taxes will only change spending by $1 x MPC. The Tax Multiplier If the MPC is 0.80 and consumers get a $1 reduction in taxes, they will only increase spending by $0.80. Consumers get a $1 reduction in taxes, they will only increase spending by $0.80. These two differences mean the tax multiplier is equal to : MPC/ (1-MPC). The Tax Multiplier Tax multiplier differences: 1) T 2) DI T C DI T C = MPC x Tax Multiplier = -MPC/(1-MPC) OR: - MPC / MPS DI DI C