Money and Banking

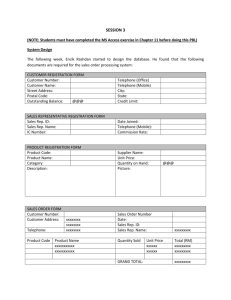

advertisement

Bell Ringer: We’re going to begin talking money. Do you know which presidents (or other people) are listed on the following currency/coin? Write what you know and we’ll review the correct answers. $1--? $100? $2--? 1¢? $5--? 5¢? Today: --Chapters 12&13 TEST—How did you $10? 10¢? do? What’s your current Bus. Econ $20? 25¢? grade? What can you still turn in?? $50? --LNE Winners of SMG??!!?? --Functions & Characteristics of Money Click a Team ID to access that team's portfolio. # of Teams Requested Class Name Advisor Bus Econ Pd 2 Bus Econ Pd 4 Team IDs Rankings Total Equity Password ~ NE_40_T292215 xxxxxxxxx 5 NE_40_ZZ230 NE_40_ZZ231 NE_40_ZZ232 NE_40_ZZ234 NE_40_ZZ235 160 204 172 177 219 $100,327.71 $99,766.95 $100,200.48 $100,173.72 $98,907.26 xxxxxxxxx xxxxxxxxx xxxxxxxxx xxxxxxxxx xxxxxxxxx 6 NE_40_ZZ236 NE_40_ZZ237 NE_40_ZZ238 NE_40_ZZ239 NE_40_ZZ240 NE_40_ZZ241 166 251 85 192 154 225 $100,236.71 $96,425.73 $102,626.76 $100,007.99 $100,386.17 $98,766.44 xxxxxxxxx xxxxxxxxx xxxxxxxxx xxxxxxxxx xxxxxxxxx xxxxxxxxx Bryant Anthony Nate SMG Grades—on Grade Report Would you like additional points? See my web site . . . Amanda Elise Talon SMG Grades—on Grade Report Would you like additional points? See my web site . . . Chapter 14 The basis is voluntary exchange Bills, coins, checks Historically – shells, gold, or sheep Native Americans used wampum – beads wampum made from shells People in the Fiji Islands used whales’ teeth Money: anything customarily used as a medium of exchange, a unit of accounting, and a store of value Medium of exchange: use of money for exchange for goods or services Barter: exchange of goods and services for other goods and services This tactic would be used if money didn’t exist Requires a double coincidence of wants ▪ Each party must want exactly what the other has Unit of accounting: use of money as a yardstick for comparing the values of goods and services in relation to one another Each nation uses a basic unit to measure the value of goods, just as it uses a foot or meter to measure distance Units by nation United States: Dollar Japan: Yen – 0.01 US Dollar Europe: Euro – 1.36 US Dollar Brazil: Real – 0.45 US Dollar India: Rupee – 0.016 US Dollar Russia: Ruble – 0.031 US Dollar Australia: Dollar – 0.94 US Dollar A single unit of accounting also allows people to keep accurate financial records Debts owed Income saved Salaries Many more Store of value: use of money to store purchasing power for later use People usually receive their money income once, twice, or four times a month, but spend it at all points during a pay period Storing your income in the form of cash or in a checking account keeps the value for when you want to use it at a later time Anything that people are willing to accept in exchange for goods can serve as money Historic examples include the following: Cattle Salt Animal hides Gems Tobacco (first page of notes should be completed) Chapter 14 Vocab After completing the notes, you should be able to complete at least four or five of these ▪ DO NOT TURN IN—KEEP IN YOUR FOLDER UNTIIL WE FINISH IT Guided Reading 14-1 Feel free to use your textbook If you finish it, turn it in. It is NOT due, tho. ▪ It’s due on TEST DAY Bell Ringer: More trivia about money and how long it lasts: “Guess” the number of years the following notes remain in circulation before they are no longer able to use. ▪ For Example: the $1 bill lasts 5.8 years ▪ What about?? ▪ The $5? The $10? The $20? The $50? The $100? (turn in bell ringer form) ▪ TRADE WITH CUBA NEWSPAPER ARTICLE ▪ Nebraska Unemployment Rate. . . Commodity Money: a medium of exchange such as cattle or gems that has value as a commodity or good aside from its value as money Representative Money: Money that is backed by an item of value, such as gold or silver Fiat Money: money that has value because a government fiat, or order, has established it as acceptable for payment of debts ▪ “Fiat”—latin word for “it shall be”—based on faith Legal Tender: money that by law must be accepted for payment of public and private debts What Gives a Dollar Bill its Value? What is Bitcoin? Watch this 3 minute video to get an overview How many Bitcoins can you purchase today with 1 US dollar? (Bitcoin exchange rate) Section 2 During the early colonial period of American history, England did not permit the new colonies to print money or mint coins Bartering became common To help pay for the Revolutionary War, the Continental Congress issued bills of credit, called Continentals, that could be used to pay debts. So many of these were issued that they became worthless and many places wouldn’t accept them The Constitution, ratified in 1788, gave Congress the power to mint coins. In 1792, Congress passed the Coinage Act, which established the dollar as the basic unit of currency for the nation. Our nation’s new leaders were torn between a national banking system and a state-chartered banking system. Today we have both Why do we choose one bank over another? Different banks offer different services to entice customers. Overdraft checking: checking account that allows a customer to write a check for more money than exists in his or her account Electronic Funds Transfer (EFT): system of transferring funds from one bank account directly to another without any paper money changing hands Automated Teller Machines (ATM): unit that allows consumers to do their banking without the help of a teller With EFT, comes the chance of identity theft. Since everything is stored in a computer, if someone knew how to get around the security, your information and money could be stolen! The Electronic Funds Transfer Act of 1978 describes the rights and responsibilities of participants in EFT systems. EFT customers are responsible for $50 in losses when someone steals or illegally uses their ATM cards, if they report the cards missing within 2 days. If they wait longer, they could be held responsible for up to $500! Section 3 Many people use the term “money” to refer only to “cash” but there are many different forms of money Checking account: account in which deposited funds can be withdrawn at any time by writing a check Bell Ringer (new form) Explain in 2-3 sentences what fiat money is. Today: Chapter 14, Section 3 What are the types of money? The difference between M1 and M2? The difference between debit/credit cards? Checkable deposits: funds deposited in a bank that can be withdrawn at any time by presenting a check Does your employer pay you using a debit card? Thrift institutions: mutual savings banks, Savings and Loans, and credit unions that offer many of the same services as commercial banks Credit cards are technically not “money.” They defer payments rather than complete transactions that ultimately involve the use of money. Debit card: device used to make cashless purchases; money is electronically withdrawn from the consumer’s checkable account and transferred directly to the store’s bank account Usually within 72 hours Debit cards vs. Credits Cards short video (8 min) Near moneys: assets such as savings accounts that can be turned into money relatively easily and without the risk of loss of value M1: narrowest definition of the money supply; consists of moneys that can be spent immediately and against which checks can be written M2: broader definition of the money supply; includes all of M1, plus such near moneys as savings deposits, small-denomination time deposits, money market deposit accounts, and retail money market mutual fund balances Fed information on M1&M2 Bell Ringer: Without just rewriting the definitions, please state the difference of M1 and M2 in discussing money supply. Use at least 2 sentences. Today: Money supply chart Chapter 14 Vocab/Guided Reading Debit cards vs. Credits Cards short video (8 min) Take Away Questions from video SMG time in lab????