2409.22,92.3-92.35 Page 1 of 20 FOREST SERVICE HANDBOOK Denver, CO

advertisement

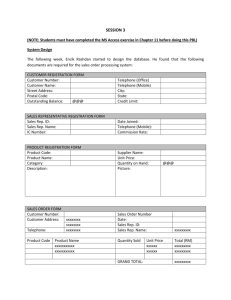

2409.22,92.3-92.35 Page 1 of 20 FOREST SERVICE HANDBOOK Denver, CO FSH 2409.22 - TIMBER APPRAISAL HANDBOOK R2 Amendment No. 2409.22-92-14 Effective July 10, 1992 POSTING NOTICE: Amendments to this title are numbered consecutively. Post by document name. Remove entire document and replace with this amendment. Retain this transmittal as the first page of this document. The last amendment to this Handbook was Amendment 2409.22-92-13 to Chapter 80. Document Name Superseded New (Number of Pages) 92.3-92.35 15 92.3-92.32, R2 Amendment No. 2409.22-91-19, 12/30/91 15 92.33-92.35, R2 Amendment No. 102, 11/5/90 11 Amendments Covered R2 Amendment 2409.22-91-19,12/30/91 R2 Amendment No. 102, 11/5/90 Digest: Updates instructions for completing R2 Forms FS 2400-17 and 2400-17(TEA). Exhibits 2,3,4,5,and 6 are separate electronic documents and need to be printed 16 pitch, portrait style. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 TOM L. THOMPSON Acting Regional Forester 92.3-92.35 Page 2 of 10 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 3 of 10 92.3 - General Instructions for Completing Appraisal Summary Side [(R2-2400-17(TEA)]. An appraisal summary for sales of convertible products must be in only two units of measure: MBF (codes 1,3, or 7); or Cunits (codes 4 or 9). Convertible products must be converted to one of these units and appraised as such to permit the data to be summarized into meaningful summaries by measurement units. (Converting factors must be established and on file in each contract folder when used in a timber sale.) If a sale involves two units of measure, an appraisal summary must be completed for each to avoid mixing appraisal data for the measurement units. Only one appraisal summary will be prepared for each unit of measure, regardless of the number of products involved. For example, if the unit of measure is cunits for both sawlogs and pulpwood, the total or average column will show only total cunits and averages will be weighted from all species/product groups. Subaverages, for example, for sawlogs and pulpwood, will not be shown on the form. SEE CHAPTER 92.35 FOR INSTRUCTIONS TO COMPLETE APPRAISAL SUMMARY SIDE OF FORM R2-240017(TEA). 92.31 - Instructions Pertinent to Standard Rate Appraisal. The instructions for completing the appraisal summary side of Form R2-2400-17(TEA) are shown in Section 92.35. Additional instructions are necessary to complete the appraisal summary side of this form for standard rate appraisals. If the sale contains specified roads or required deposits, refer to Sections 20 and 92.32 in relation to R2-2400-17(TEA). See Exhibit 2 for an example of this standard rate appraisal. 1. General Heading (Card Type 5). See Section 92.35. 2. Species Columns (Card Type 6). Complete only lines 1-7, and 27-37 on a separate appraisal summary side of a R2-2400-17(TEA) for volume with unit code of 3. Line 1, Product and Unit. In addition to the instructions in Section 92.35, sawtimber advertised at standard rates without formal appraisal will be coded 1-3 (sawlogs-MBF). Line 2 through 5. See Section 92.35. Line 6, DBH. See Section 92.35. Line 7, Base Period Price. Enter the Base Period Price from the Current Appraisal Data (Section 51.4) adjusted as directed by FSM 2431.42. Base Period Price is published on a log scale basis. Line 8 through 26. Leave blank. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 4 of 10 Line 27, Predicted Bid. See Section 92.35. Line 28, Competition Factor. In addition to instructions in Section 92.35, sawlog standard rate appraisals shall have a competition factor applied only when removal of material is mandatory and subject to bidding. Material advertised as optional removal or unadvertised sales shall not have an entry in line 28. Line 29, Sale Specified Road Costs. Leave blank. Line 30 through 37. See Section 92.35. 92.32 - Instructions Pertinent to Comparison Appraisal. As presented in Section 20, comparison appraisal may be completed with any appraisal method. Form R2-2400-17(TEA) shall be used on all Comparison With Standard Rate sales. This Form will also be completed in the same manner as Form R2-2400-17(TEA) in Section 92.31 except for a few alterations. See Exhibit 3 for an example of a Comparison With Standard Rate appraisal. Line 17, Sale Road Maintenance. If the sale contains a required road maintenance deposit, enter the cost per unit of measure in parentheses. Leave line 16 Card Type 7 blank. Line 19, Sale Slash Disposal. If the sale contains a required slash deposit, enter the cost per unit of measure in parentheses. Leave line 21 Card Type 7 blank. Line 29, Sale Specified Road Costs. If the sale is totally appraised using Comparison With Standard Rates, the rate entered is the Purchaser Credit Limit from Card Type 5 divided by the volume. The Purchaser Credit Limit is the sum of both ineffective and effective purchaser credit. The rate on line 30 is entered in parentheses. If the sale is composed of a Comparison With Standard Rate appraisal component and another appraisal system component, and contains specified roads, that portion included within the standard rate is determined first and entered as the cost per unit of measure in parentheses on line 29. The product of the specified road cost rate and the volume (line 5) must equal the Purchaser Credit Limit in Card Type 5. The remainder of the Purchaser Credit is transferred into the other appraisal system and is calculated as directed in the related section of the handbook. All of the difference between the Standard Rate and the Base Rate or the total Purchaser Credit divided by total sale volume, whichever is the smaller shall be recorded on line 29. Disregard other cost when calculating purchaser credit. Leave line 30 Card Type 7 blank. At no time will the comparison appraisal carry more Purchaser Credit per like unit of measure than the other appraisal system of which it is a component. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 5 of 10 92.33 - Instructions Pertinent to Empirical Appraisal. Completion of Form FS-2400-17 for empirical appraisal is similar to that of residual value appraisal (Section 92.34). The primary difference is that the costs and values for empirical appraisal are derived through construction, whereas residual value appraisal is based upon zone cost collection. A composite of both appraisal methods may appear in the same appraisal. An example of this is where selling values and most costs will be based upon cost collected figures as used in residual value, but the logging costs need to be constructed since the sale contains skyline logging. In mixed sales such as this, refer to the section of this Handbook which deals with that appraisal method. For purposes of this section a pure empirical appraisal will be considered. 1. General Heading (Card Type 5). See Section 92.35. 2. Species Columns (Card Type 6). Line 1 through 5. See Section 92.35. Line 6, Selling Value L.S. Enter the constructed value of primary lumber selling value per unit of measure. Line 7 and 8. Leave blank. Line 9, Chips and Byproducts. Enter the constructed value of byproduct selling value per unit of measure. Line 10, Selling Value L.S. Enter the total selling value, the sum of line 6 and line 9. Line 11 through 29, (Logging Costs). Enter the constructed cost per unit of measure for logging operations. Contractual items such as temporary roads should be equal to the total costs divided by the volume to carry the costs to arrive at the unit cost. Line 30, Specified Road Costs. See Section 92.35. Line 31, Total Logging Cost L.S. Enter sum of lines 29 and 30. Line 32, MFG Cost L.T. Enter the constructed primary lumber manufacturing cost per unit of measure. Line 33, Chips and Byproducts. Enter the constructed byproduct manufacturing cost per unit of measure. Line 34, MFG Cost L.S. Enter the total manufacturing cost, line 32 plus line 33. Line 35 through 46. SELF EXPLANATORY. 3. Sale Total or Average (Card Type 7). See Section 92.35. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 6 of 10 92.34 - Instructions Pertinent to Residual Value Appraisal. Transaction Evidence procedures and FORM R2-240017(TEA) is the only approved method and FORM for both zones in this REGION for new sales. 92.35 - Instructions Pertinent to Transaction Evidence Appraisal R2-2400-17(TEA). An appraisal summary for sales of convertible products must be in only one of two units of measure: MBF (codes 1,3, or 7); or CUNITS (codes 4 or 9). Convertible products must be converted to one of these units and appraised as such to permit the data to be summarized into meaningful summaries by measurement units. Converting factors must be established and on file in each contract folder when used in a timber sale. If a sale involves two units of measure, an appraisal summary must be completed for each to avoid mixing appraisal data for measurement units. Only one appraisal summary will be prepared for each unit of measure, regardless of the number of products involved. For example, if the unit of measure is cunits for both sawlogs and pulpwood, the total or average column will show only total cunits and averages will be weighted from all species/product groups. Subaverages, for example, for sawlogs and pulpwood, will not be shown on the form. See EXHIBIT 4 and 5 for examples of Transaction Evidence appraisals for sawlogs and POL respectively. 1. General Heading (Card Type 5). Sale Name. Enter name of sale. Summary Checked By. Enter name of person who checked the form for completeness and accuracy and the date checked. It must be someone other than the person who prepared the summary initially. Specified Road Construction. Enter to the nearest one-tenth of a mile the amount of specified road to be constructed. A mileage of five miles will be entered as 50 (decimal implied). Reconstruction. Enter to the nearest one-tenth of a mile the amount of existing specified road to be reconstructed. A mileage of five miles will be entered as 50 (decimal implied). Purchaser Credit Limit. Enter to the nearest whole dollar the amount of purchaser credit to be allowed. Purchaser credit limit is equal to specified road cost estimate (based on local wage rates excluding Davis-Bacon adjustment) less amount of cash or material contributions at time of advertisement. Product. Enter the code of the product being appraised. Appraised to. Enter location(s) to which appraised. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 7 of 10 Haul Miles. Enter to the nearest mile the combined truck and rail one-way haul distance to the appraisal point for each product being appraised. If more than one appraisal point is used, enter the weighted average haul miles. Temporary Road Construction. Enter to the nearest one-tenth of a mile the amount of temporary road to be constructed and closed. A mileage of 5 and two tenths will be recorded as 52. (decimal implied) Temporary Road Cost. Enter to the nearest whole dollar the total estimated cost of the planned temporary road construction. This amount will be for the distance listed in temporary road construction. Note: Where there are two units of measure, hence two appraisal summaries and type 5 cards, the miles of road construction and costs, including purchaser credit limit, may be either pro-rated to the two measurement units or all shown on one form and the other left blank. Do not enter total miles and costs on both forms. Basic Data Period. Enter the period indicated in the Current Appraisal Data (Section 51.4, or 61.4 for sawlogs and Section 71.4 for POL). An entry shall be made for all sales whether escalated or flat rate. Adjusted to. Enter the period to which the average bids were adjusted from the Current Appraisal Data (Section 51.4,or 61.4 for sawlogs and Section 71.4 for POL). It applies to flat rate sales as well as stumpage rate adjustment sales. Will be the period represented by the base indices (line 37) if the contract has quarterly escalation. Enter "Standard Rates" for standard rate appraisals which are not based upon Section 51.4,61.4,or 71.4 Index Operation. Standard rate appraisals based upon Section 51.4,61.4 or 71.4 Index Operation, shall reflect the period to which selling values were adjusted in Section 51.4,61.4 or 71.4. 2. Species Columns (Card Type 6). Do not use any of the columns for developing interim averages. Lines 1, 3, 5, 7, 15, and 26 must have entries for species/products. Line 1, Product and Unit. This will be a product code entry, to be followed by unit of measure code, such as 1-7 for sawtimber to be measured in MBF(Transaction Evidence) or 3-9 for POL to be measured in 100nd cubic feet. If more than one product is to be measured in a common unit (for example, sawlogs and POL measured in cunits), group species by product, in ascending order of product codes. For example, list all species coded 1-9, then list all species coded 3-9. Convertible Products Sawlogs Product Code 1 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 8 of 10 Pulpwood (Includes all Aspen) 2 Other convertible products (POL) (Poles, Pilings, Posts, Mine props) 3 Cull logs or substandard material 4 Optional code (Fuelwood) 5 Nonconvertible Products Pine distillate wood 6 Christmas tree 7 Naval Stores 8 Other (specify) 9 Unit of Measure (Appraisal Type) Unit Code MBF (other than TEA) 1 Cord (other than TEA) 2 MBF (older dead which is not included with green material) 3 C cu. ft. (CCF or Cunits)(other than TEA) 4 Each nonconvertible products only, such as Christmas trees 5 Ton (Distillate wood) 6 MBF (Transaction Evidence) 7 Cord (not used in R2) 8 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 C. cu. ft. (Transaction Evidence) 92.3-92.35 Page 9 of 10 9 When measurement unit code 3 is used, the computer will exclude the volume from its averaging of appraisal elements for the Summary of Reports of Timber Sale, Report numbers 5 and 6. Only one Report of Timber Sale side of a R2-2400-17(TEA) should be completed for each sale. (See Exhibit 1). Fuelwood shall be coded 5-4 (fuelwood-C.Cu.Ft.) Line 2, Species Initials. Use species initial as commonly used in local practice. All species of true fir shall be coded as true fir (025) rather than the exact species code of individual fir species. Provide for minor amounts of a species known to exist in the general area, but which did not show up in the cruise or other presale preparation, by adding "&O" to the species of comparable value. Line 3, Species Code. Use species code for each price group (species/product) which is to appear in the contract. Within each product, list species in ascending order of species codes, e.g. 1-1, 2-1, 3-1 across the columns. When minor species are combined, use the same as for initials on line 2. These should agree with those listed on report of timber sale. A given species code may be used only once for any combination of product and unit of measure. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 10 of 10 Use code 001 for merchantable dead, regardless of species initials on line 2. Some of the more commonly used species initials and codes are as follows: Species Name Species Initials Species Code Dead DD 001 Other softwoods OSFW 001 Other hardwoods OHDW 004 Combined softwoods CSFW 007 Combined hardwoods CHDW 008 White fir WF 1/ 025 (015) Grand fir GF 1/ 025 (015) Subalpine fir AF 1/ 025 (019) True firs 1/ TF 1/ 025 Corkbark fir (True fir) CF 1/ 025 White spruce WS 090 Engelmann spruce ES 093 Lodgepole pine LP 108 White pine WP 119 Ponderosa pine PP 122 Front Range and <12" PP P 122 Douglas-fir DF 204 Aspen A 740 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 Oak 92.3-92.35 Page 11 of 10 OK 800 1/ Code for all species of fir. Line 4, Percent by Species. Enter percent of volume by species rounded to nearest 1/100 percent, e.g. 86.44. The total of percent by species must equal 100 percent. Line 5, Volume. Enter volume by species to the nearest whole unit of measure in accordance with section 91. Do not use decimals. Line 6, DBH. Enter the weighted average sale "quadratic mean" DBH by volume from the CRUISE PRINTOUT in Card Type 7. Do not include volumes subject to agreement. Line 7, Base Period Price. Enter the Base Period Price from the Current Appraisal Data (Section 51.4 or 61.4 for sawlogs and Section 71.4 for POL). Base Period Price is published on a log scale basis. Do not adjust. Do not average except in Card Type 7. Line 8 through 15, (Average Logging Costs). Enter the average costs per unit of measure for the associated logging costs from the Current Appraisal Data (Section 51.4 or 61.4 for sawlogs and Section 71.4 for POL). These are the logging costs within the base period average sale. Line 16 through 26, (Sale Logging Costs). Enter the cost per unit of measure for logging operations. See Chapter 50,60 and Chapter 71 for determining these values for sawlogs and POL respectively. Contractual items such as temporary roads should be equal to the total costs divided by the volume to carry the costs to arrive at the unit cost. Line 27, Predicted Bid. Enter sum of lines 7 and 15 minus line 26. Line 28, Competition Factor. Enter the cost per unit of measure for the competition factor calculated per instructions in Chapter 50 or 60 for sawlogs and Section 71 for POL. Line 29, Sale Specified Road Costs. Purchaser Credit Limit from Card Type 5 divided by the volume to carry Specified Road Costs equals the per unit cost to be entered on line 29. Line 30, Indicated Net Stumpage. Enter the result of line 27 minus line 28 and line 29. Some species rates may be less than base rates, or may be negative. Make no adjustment at this point. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 12 of 10 Line 31, Indicated Advertised Rate. Enter the result of line 30 plus line 29. Also enter the indicated tract value in the total column line space. In timber property sales, add timber property value unit rates developed from line 30 to arrive at indicated advertised rates. Line 32, Base Rates. For each species enter the Regionally prescribed minimum rate plus any adjustment needed to cover costs of regeneration. Refer to Chapter 80. Timber property value must be protected against usage by K-V and purchaser credit. Therefore, add timber property value to arrive at base rates, not to exceed Indicated Advertised rate. Line 33, Adjustments to Base Rates. If any rates on line 31 are below base, line 33 provides for entry of positive adjustments required to bring them up to base as shown on the following page. Calculate total deficit = deficit species volume 1,200 MBF X deficit adjustment per unit = total deficit X $0.88/MBF = $1,056.00 Calculate per unit adjustment to other species groups total deficit amount /(divided) by total positive species volume $1,056.00 / 3,800 MBF (3,000 + 500) = $0.28/MBF negative adjustment The indicated advertised rates for the positive species are reduced by the adjustment to no less than base rates, and the negative species is increased to base rate. The total value of the sale as a whole remains the same. If there is insufficient value to adjust the total deficit, all species will be adjusted to no less than base rates. See EXHIBIT 6. Line 34, Advertised Rates. These are the rates at which the timber is to be advertised. Transfer these rates to the bid Form FS-2400-14 or FS 2400-42a. Add rates developed from line 31 plus line 33 adjustments to arrive at advertised rates. Also enter the total tract value in the total column/line space. Line 35, Indicated Stat. Net Rates. Enter result of line 34 minus the sum of line 29 and timber property value if any. Line 34-(line 29 + TPV). Line 36, Appraised Net Rates. Adjust line 35 to not less than base rates (line 32) using the line 33 procedure. Line 37, Base Indecies. Enter for escalation sales only. This is the base index corresponding to the appropriate base period to which the base period average bid is adjusted from the Current Appraisal Data (Section 51.4, 61.4 and 71.4). R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 13 of 10 Skid Distance. Enter the average skid distance for the sale in feet. 3. Sale Total or Average (Card Type 7). The weighted averages in this column equal the sum of species volume multiplied by the species line rates, divided by the total volume. For example: Line 5. Volume 26. Total Sale Cost Total or ES&O 2400 26.19 AF Average 1600 30.27 T 4000 A 27.82 [(2400 X 26.19) + (1600 X 30.27)]/4000 = 27.82 Line 6 and 15 through 25. Show averages on all lines except subtotals (lines 18 and 21). Line 26. The weighted average total must equal the actual total of the weighted averages in lines 16 through 24. If there is a variation due to rounding, it is permissible to change the individual weighted averages by one penny, to achieve an arithmetically correct total. The arithmetic instructions on the form shall be followed. Line 31 must equal line 30 plus line 29; line 34 must equal line 31 plus line 33. Totals on lines 31 and 34 will equal the sum of each species volume multiplied by the species rate, not the total volume times the weighted average. R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 14 of 20 EXHIBIT 2 APPRAISAL SUMMARY R2-2400-17 (TEA) (4/23/92) Sale Name: Sample - Standard Spec. Rd Const. (Miles) 0 Summary Checked By: XXX CARD TYPE 5 Reconst. (Miles) Product: Appraised To: Haul Miles 2 5 1 : Millsite Basic Data Period Temp. Rd. Const. (Miles) 3rd Q CY 87 - 1st Q CY 88 Date: XXX 0 Purch. Cr. Limit 0 $ 0 Temp. Rd. Cost $ 0 Adj. to (Appr. Base period) 4th Q 1987 CARD TYPE 7 CARD TYPE 6 1. Product/Unit Un of Meas. 1-3 3 ES&O TOT OR AVE 3. Species code 093 XXXXXXXXX 4. % By Species 100.00 2. Species 5. Volume 6. DBH 7. Base period price L.S. 20 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 40.80 T 100.00% T 20 A A 11.3 40.80 8. Ave. Haul 9. Ave. Road Maintenance 10. SUBTOTAL, Ave. Transportation 11. Ave. Slash Disposal 12. Ave. Erosion Control 13. SUBTOTAL, Ave. Environ. Protect 14. Ave. Temporary Roads 15. TOTAL AVERAGES (10+13+14) A 16. Sale Haul A 17. Sale Road Maintenance A 18. SUBTOTAL, Sale Transportation 19. Sale Slash Disposal A 20. Sale Erosion Control A 21. SUBTOTAL, Sale Environ. Protect 22. Sale Temporary Roads A 23. Loggind cost Adj. A 24. Skid Distance Adj. A 25. Unusual Adjustments A 26. TOTAL SALE COSTS (18+21+22+23+24+25) A 27. Predicted bid (7+15-26) 28. Competition Factor 29. Sale Specified Road Costs (A10) 40.80 A 40.80 5.63 A 5.63 A R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 30. Indicated Net Stumpage (27-28-29) 92.3-92.35 Page 15 of 20 35.17 A XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 31. Indicated Advertised Rate (30+29) 32. Base Rates 35.17 T 703.40 35.17 6.00 33. Adjustments to Base Rates A 35.17 A 6.00 A XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T 703.40 34. Advertised Rates (31+33) 35.17 A 35.17 35. Indicated stat net rates (34-29) 35.17 A 35.17 36. Appraised net rates * 35.17 A 35.17 37. Base indices N/A Skid Distance 600 ft. Net Sale Average Bd. Ft./Cu.Ft. Ration 4.9434 * Adjusted if needed to not less than base rate (line 32), using line 33 procedure. Note: Lines 30, 31, 34-36 include planned SAB collections as authorized by 46 Stat. 527; 16 U.S.C. 576. Average Net Vol./Acre MBF or CCF. EXHIBIT 3 APPRAISAL SUMMARY R2-2400-17 (TEA) (4/23/92) Sale Name: Sample - Standard Spec. Rd Const. (Miles) 2 Product: Appraised To: Haul Miles 2 5 1 : Millsite Basic Data Period Summary Checked By: XXX CARD TYPE 5 Reconst. (Miles) Temp. Rd. Const. (Miles) 3rd Q CY 87 - 1st Q CY 88 Date: XXX 0 Purch. Cr. Limit 0 $ 1 2 0 0 Temp. Rd. Cost $ Adj. to (Appr. Base period) 0 4th Q 1987 CARD TYPE 7 CARD TYPE 6 1. Product/Unit Un of Meas. 1-3 3 ES&O TOT OR AVE 3. Species code 093 XXXXXXXXX 4. % By Species 100.00 2. Species 5. Volume 6. DBH 7. Base period price L.S. 8. Ave. Haul 9. Ave. Road Maintenance 10. SUBTOTAL, Ave. Transportation 11. Ave. Slash Disposal 12. Ave. Erosion Control 13. SUBTOTAL, Ave. Environ. Protect 14. Ave. Temporary Roads 20 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 40.80 T 100.00% T 20 A A 11.3 40.80 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 16 of 20 15. TOTAL AVERAGES (10+13+14) A 16. Sale Haul A 17. Sale Road Maintenance (0.50) A (0.50) 18. SUBTOTAL, Sale Transportation 19. Sale Slash Disposal A 20. Sale Erosion Control A 21. SUBTOTAL, Sale Environ. Protect 22. Sale Temporary Roads A 23. Loggind cost Adj. A 24. Skid Distance Adj. A 25. Unusual Adjustments A 26. TOTAL SALE COSTS (18+21+22+23+24+25) A 27. Predicted bid (7+15-26) 40.30 A 40.30 5.63 A 5.63 29. Sale Specified Road Costs (A10) (3.00) A (3.00) 30. Indicated Net Stumpage (27-28-29) 31.67 A 31.67 28. Competition Factor XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 31. Indicated Advertised Rate (30+29) 32. Base Rates T 693.40 34.67 6.00 33. Adjustments to Base Rates A 34.67 A 6.00 A XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T 693.40 34. Advertised Rates (31+33) 34.67 A 34.67 35. Indicated stat net rates (34-29) 31.67 A 31.67 36. Appraised net rates * 31.67 A 31.67 37. Base indices N/A Skid Distance 600 ft. Net Sale Average Bd. Ft./Cu.Ft. Ration 4.9434 * Adjusted if needed to not less than base rate (line 32), using line 33 procedure. Note: Lines 30, 31, 34-36 include planned SAB collections as authorized by 46 Stat. 527; 16 U.S.C. 576. Average Net Vol./Acre MBF or CCF. EXHIBIT 4 APPRAISAL SUMMARY R2-2400-17 (TEA) (4/23/92) Sale Name: Sample - Standard Spec. Rd Const. (Miles) 6 4 Product: Appraised To: Haul Miles 2 5 1 : Millsite Basic Data Period Summary Checked By: XXX CARD TYPE 5 Reconst. (Miles) 3 Temp. Rd. Const. (Miles) 3rd Q CY 87 - 1st Q CY 88 Date: XXX 1 Purch. Cr. Limit 1 $ 1 5 Temp. Rd. Cost $ Adj. to (Appr. Base period) 6 0 4 5 6 5 0 9 4th Q 1987 CARD TYPE 7 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 17 of 20 CARD TYPE 6 1. Product/Unit 2. Species Un of Meas. 1-7 1-7 7 ES&O AF TOT OR AVE 3. Species code 093 025 4. % By Species 60.00 40.00 T 100.00% 2400 1600 T 5. Volume 6. DBH 7. Base period price L.S. 8. Ave. Haul 9. Ave. Road Maintenance XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 40.80 40.80 33.83 XXXXXXXXX 4000 A 12.1 A 40.80 33.83 4.84 4.84 38.67 38.67 11. Ave. Slash Disposal 4.00 4.00 12. Ave. Erosion Control 0.24 0.24 13. SUBTOTAL, Ave. Environ. Protect 4.24 4.24 14. Ave. Temporary Roads 1.83 1.83 15. TOTAL AVERAGES (10+13+14) 44.74 44.74 A 44.74 16. Sale Haul 14.89 14.89 A 14.89 A 3.66 10. SUBTOTAL, Ave. Transportation 17. Sale Road Maintenance 3.66 3.66 18.55 18.55 19. Sale Slash Disposal 4.03 4.03 A 4.03 20. Sale Erosion Control 0.69 0.69 A 0.69 21. SUBTOTAL, Sale Environ. Protect 4.72 4.72 22. Sale Temporary Roads 1.63 1.63 A 1.63 23. Loggind cost Adj. 1.29 1.29 A 1.29 18. SUBTOTAL, Sale Transportation 24. Skid Distance Adj. A 25. Unusual Adjustments 4.08 A 1.63 26. TOTAL SALE COSTS (18+21+22+23+24+25) 26.19 30.27 A 27.82 27. Predicted bid (7+15-26) 59.35 55.27 A 57.72 5.63 5.63 A 5.63 39.01 39.01 A 39.01 14.71 10.63 A 13.08 28. Competition Factor 29. Sale Specified Road Costs (A10) 30. Indicated Net Stumpage (27-28-29) XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T208,352.00 31. Indicated Advertised Rate (30+29) 32. Base Rates 53.72 49.64 A 52.09 6.00 6.00 A 6.00 33. Adjustments to Base Rates A XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T208,352.00 34. Advertised Rates (31+33) 53.72 49.64 A 52.09 35. Indicated stat net rates (34-29) 14.71 10.63 A 13.08 36. Appraised net rates * 14.71 10.63 A 13.08 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 37. Base indices Skid Distance 92.3-92.35 Page 18 of 20 214.85 600 ft. 214.85 Net Sale Average Bd. Ft./Cu.Ft. Ration 4.9438 * Adjusted if needed to not less than base rate (line 32), using line 33 procedure. Note: Lines 30, 31, 34-36 include planned SAB collections as authorized by 46 Stat. 527; 16 U.S.C. 576. Average Net Vol./Acre MBF or CCF. EXHIBIT 5 APPRAISAL SUMMARY R2-2400-17 (TEA) (4/23/92) Sale Name: Sample - Standard Spec. Rd Const. (Miles) 3 Product: Appraised To: Haul Miles 4 7 3 : Olathe, CO Basic Data Period Summary Checked By: XXX CARD TYPE 5 Reconst. (Miles) Date: XXX 0 Purch. Cr. Limit 0 $ 4 4 3 7 Temp. Rd. Cost $ 4 4 1 1 Temp. Rd. Const. (Miles) 5 4th Q CY 89 - 3rd Q CY 90 Adj. to (Appr. Base period) Sept. 1990 CARD TYPE 7 CARD TYPE 6 1. Product/Unit 2. Species Un of Meas. 3-4 4 ES&O TOT OR AVE 3. Species code 740 XXXXXXXXX 4. % By Species 100.00 5. Volume 6. DBH 7. Base period price L.S. 2770 T 100.00% T 2770 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX A 7.47 A 7.47 8. Ave. Haul 9. Ave. Road Maintenance 1.34 10. SUBTOTAL, Ave. Transportation 1.34 11. Ave. Slash Disposal 0.11 12. Ave. Erosion Control 13. SUBTOTAL, Ave. Environ. Protect 0.11 14. Ave. Temporary Roads 1.67 15. TOTAL AVERAGES (10+13+14) 3.12 16. Sale Haul -1.59 1/ 17. Sale Road Maintenance 1.76 18. SUBTOTAL, Sale Transportation 0.17 19. Sale Slash Disposal 0.74 20. Sale Erosion Control 3.12 A -1.59 1/ A 1.76 A 0.74 A 21. SUBTOTAL, Sale Environ. Protect 0.74 22. Sale Temporary Roads 1.59 23. Loggind cost Adj. A A A 1.59 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 19 of 20 24. Skid Distance Adj. A 25. Unusual Adjustments A 26. TOTAL SALE COSTS (18+21+22+23+24+25) 2.50 A 2.50 27. Predicted bid (7+15-26) 8.09 A 8.09 28. Competition Factor 5.63 A 5.63 29. Sale Specified Road Costs (A10) 1.60 A 1.60 30. Indicated Net Stumpage (27-28-29) 6.49 A 6.49 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX 31. Indicated Advertised Rate (30+29) 8.09 32. Base Rates 2.40 33. Adjustments to Base Rates T22,409.30 A 8.09 A 2.40 A XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T22,409.30 34. Advertised Rates (31+33) 8.09 A 8.09 35. Indicated stat net rates (34-29) 6.49 A 6.49 36. Appraised net rates * 6.49 A 6.49 37. Base indices Skid Distance 600 ft. Net Sale Average Bd. Ft./Cu.Ft. Ration 4.9434 * Adjusted if needed to not less than base rate (line 32), using line 33 procedure. Note: Lines 30, 31, 34-36 include planned SAB collections as authorized by 46 Stat. 527; 16 U.S.C. 576. Average Net Vol./Acre MBF or CCF. EXHIBIT 6 APPRAISAL SUMMARY R2-2400-17 (TEA) (4/23/92) CARD TYPE 7 CARD TYPE 6 1. Product/Unit 2. Species Un of Meas. 1-7 1-7 1-7 ES&O PP DF TOT OR AVE 3. Species code 093 122 204 XXXXXXXXX 4. % By Species 66.00 24.00 10.00 5. Volume 3,300 1,200 500 T 29. Sale Specified Road Costs (A10) 30. Indicated Net Stumpage (27-28-29) T 100.00% 5,000 8.93 8.93 8.93 A 8.93 14.48 -1.81 11.00 A 10.22 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T 95,762.00 31. Indicated Advertised Rate (30+29) 32. Base Rates 33. Adjustments to Base Rates 23.41 6.00 -0.28 7.12 19.93 A 19.15 6.48 8.00 6.00 A +0.88 -0.28 A 0 R2 AMENDMENT 2409.22-92-14 EFFECTIVE 07/10/92 92.3-92.35 Page 20 of 20 XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX XXXXXXXXX T 95,762.00 34. Advertised Rates (31+33) 23.13 8.00 19.65 A 19.15 35. Indicated stat net rates (34-29) 14.20 -0.93 10.72 A 10.22 A 10.22 36. Appraised net rates * 37. Base indices 11.38 8.00 198.60 298.56 7.90 214.00 --A -1.59 1/