The Conduct of Monetary Policy

advertisement

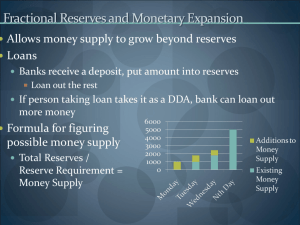

The Conduct of Monetary Policy The specific “nuts and bolts” of monetary policy, from beginning (policy tools) to end (key macroeconomic variables such as the price level and real GDP). How Monetary Policy is Done -- A Diagram Policy Tools Operating Target Intermediate Target Final Targets Important Terms Policy Tools -- The Federal Reserve’s policy instruments, usually open market operations (OMOs). Final Targets -- Overall goal variables for the economy, such as real GDP (Y) or the price level (P). Intermediate Targets Intermediate Targets -- Variables which are known to have a direct effect on final targets. Possible Candidates – an interest rate (short-term and long-term), M1, M2, other money supply measures. Operating Targets Operating Targets -- Variables which are known to have a direct effect on intermediate targets. Possible Candidates -- the Federal Funds rate (iFF), Reserves (R), the Monetary Base (H), the Nonborrowed Base (HNON), Nonborrowed Reserves (RNON). Criteria for Choosing Intermediate Targets Measurability -- The variable must be accurately measured and available on a frequent basis. Controllability -- The Fed should be able to hit the target with reasonable accuracy on a consistent basis. Predictive Accuracy -- Given the value of the intermediate target, the Fed should be able to predict with reasonable accuracy the final targets. The Money Supply -- not great at controllability, stronger on predictive accuracy. Criteria for Choosing Operating Targets Same as choosing intermediate targets. Controllability more important. Predictive ability -- applies to intermediate target. The Current Conduct of US Monetary Policy Policy Tools Operating Target Intermediate Target Final Targets Since 1988: OMOs iFF M2 Y, P Setting Monetary Policy -Expansionary The FOMC lowers the target Federal Funds Rate. To achieve this target, the Open Market Manager buys bonds, supplying more reserves to the system. The Fed does this until the new equilibrium iFF equals its newly set target rate. Setting Monetary Policy -Contractionary The FOMC raises the target Federal Funds Rate. To achieve the FOMC’s new target, the Open Market Manager sells bonds, thereby removing reserves from the system. The Fed does this until the equilibrium iFF equals its target. Maintaining Monetary Policy (Increased Loan Demand) Income (Y) or Loan Demand increases. This change increases the Demand for Reserves, shifting the curve rightward, and threatening to increase the equilibrium iFF. The Open Market Manager increases the Supply of Reserves until the equilibrium iFF equals its mandated target rate. The Procyclical Money Supply Outcome of Federal Funds rate targeting, due to policy maintenance. Money supply misses its target in the direction of the business cycle (e.g. too much during inflation). Potentially destabilizing on economy, money supply miss aggravates the existing macro problem. Monetary Policy -- Current Issues and Developments M1 is becoming obsolete -- sweep programs. Less reliance on money supply for short-term policy, used for longer-term growth targets instead. Greater reliance on iFF as an operating target. Has it in fact become the intermediate target? More Developments The end of stand-alone investment banks? (merging with banks or converting into banks) The restructuring of Fannie Mae and Freddie Mac Another look at mortgages and mortgage securitization Developments -- Banking Getting out of the mortgage foreclosure problem and stabilizing the banking system. Harsher bank regulations coming down (as with FIRREA)? More global cooperation and coordination of banking and financial market regulations? Continuous Financial innovation -- a given.