Review Guide Unit IV - Lincoln Park High School

advertisement

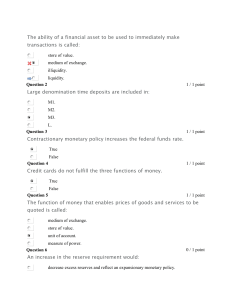

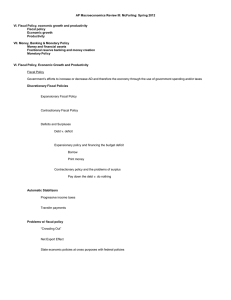

AP Macro - Unit IV - Review Guide 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) 21) 22) 23) 24) 25) 26) 27) 28) 29) 30) 31) 32) List the 3 functions of money Medium of Exchange, (Unit of Account or Standard Value),Store of Value M1 definition of money includes M2 definition of money includes The paper money used in the United States is issued by the Largest component of M1 is What is the Money Supply backed by? The equilibrium rate of interest in the money market is determined by the intersection of the: Draw and label a T-Account or Balance sheet… use a sample from the book a. List common assets that a commercial bank has b. List common liabilities that a commercial bank has What is currently one of the biggest deterrents to bank panics in the U.S? How do banks (Monetize) create money? The U.S’s modern day banking system is based on what type of system What is the difference between; actual, required, and excess reserves? What happens to the required reserves of a bank when a check is drawn and cleared against it? Formula of the simple deposit expansion multiplier? What is the formula to find the maximum amount of new demand deposit money that can be created by the banking system? Limitations on the expansion multiplier theory with bank excess reserves? Who is in charge of Monetary Policy in the United States? What is the Federal Funds Rate? What is the discount rate? How is the real interest rate determined? What similarities do vault cash and reserve accounts have? The term neutrality of money refers to the situation where – increases in the money supply eventually result in no change in real output How does expansionary monetary policy affect interest rates in the short term? How does contractionary monetary policy affect interest rates in the short term? List the 3 tools of monetary policy List how the 3 tools can be used for expansionary purposes. List how the 3 tools can be used for contractionary purposes. Graph money market, investment demand, and AS/AD showing cause and effect relations for tight or contractionary Graph money market, investment demand, and AS/AD showing cause and effect relations for easy or expansionary monetary policy If the economy were experiencing a recession what would be a proper monetary policy? If the Federal Reserve authorities were attempting to reduce demand pull inflation, what would be the proper monetary policy?