Transfer Tax - Ingrid Sumarroca

Real Estate

Legal Services

Ingrid Sumarroca

Lawyer

Balmes, 297, 3th floor

+34 93 209 55 63 - + 34 657 769 812

Barcelona, 26 November 2014

Spain Real Estate

Market Issues

• Spain’s housing market is now recovering, amidst gradually improving economic conditions. Spanish house prices dropped 3.03% during the year to end-Q2 2014, (-3.12% inflation-adjusted), the lowest annual decline since Q2 2008.

• During the latest quarter, Spanish house prices increased slightly by

0.15% (-0.78% inflation-adjusted) in Q2 2014. Residential property transactions surged 48% in Q1 2014 from a year earlier, according to the Instituto Nacional de Estadistica (INE).

2

Barcelona Real Estate

Legal & Political Issues

• Legal Issues:

• Reasonably hospitable climate for foreign investment. Lawmakers strive to facilitate investment to the country (i.e., Residence for buyers of properties valued 500,000 € at least, SOCIMI, residential renting).

• Foreign investment up to 100% of equity is permitted.

• Capital movements are completely liberalized.

• Political Issues:

• Spain has been successful in making the transition from dictatorship (up to

1978) to democracy.

• Prime Minister, Mr Mariano Rajoy, has recently proposed that Barcelona had the same political attributions as Madrid has.

• Barcelona Council, whose financial situation is far better than Catalonian

Government, endeavours private iniciative through the Barcelona Activa platform.

3

2014 SPANISH TAX REVIEW

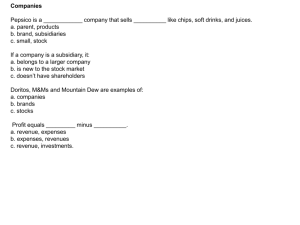

A. Companies

B. Individuals

C. Other direct taxes

D. Turnover taxes

4

A. Companies

Resident companies

Corporate tax rates • 30%

• 25% for SMEs (annual profits over EUR

300,000)

•

20% for micro-enterprises (annual profits up to

EUR 300,000)

• surcharge from 0.01% to 0.75% may apply

Tax base

Capital gains

Unilateral double taxation relief worldwide yes, part of business income exemption and ordinary foreign tax credit

5

A. Companies

Non-resident companies

Corporate tax rates

Capital gains on sale of shares in resident companies

Final withholding tax rates

Branch profits

Dividends

•

25.75% generally;

• rates depend on type of Spanish-source income

21% (exempt if derived by residents of the

EU)

• for tax years 2012-2014:

•

21% (effective rate 44.7%);

• otherwise, 19% (effective rate 43.3%);

•

0% (PEs of EU resident companies except

Cyprus)

21%;

0% for qualifying EU companies (5% participation for 1 year required) (EU Parent Subsidiary

Directive)

6

Interest

Royalties

Fees (technical)

Fees (management)

21%;

0% for associated EU companies (EU

Interest and Royalties Directive);

0% on bank deposits and government bonds

24.75%;

0% for associated EU companies (EU

Interest and Royalties Directive)

24.75% (exempt for associated EU companies)

24.75% (exempt for associated EU companies)

7

3. Specific issues

Participation relief

Group treatment

Incentives

Anti-avoidance inbound dividends: yes outbound dividends: yes yes investment/reinvestment credits and deductions;

R&D and technological innovation credits; personnel costs credits; environmental tax credit; holding companies (ETVEs) - participation exemption; tonnage tax regime; special regions regimes; newly created companies; film industry general rule; transfer pricing; limitation on interest deduction;

CFC

8

B. Individuals

1. Resident individuals

Income tax rates

Capital gains

Unilateral double taxation relief general income: progressive - top rate 45% (over EUR

175,000.20); surcharge - top rate 7% (over EUR

300,000); savings income: progressive - top rate 27% (over EUR

24,000) part of savings income if assets are held for more than 1 year; subject to progressive income tax rates if assets are held for less than 1 year yes

9

2. Non-resident individuals

Income tax rates

Capital gains on sale of shares in resident companies rates depend on type of Spanish-source income; business and employment income: 24.75%

21% (specific exemptions for shares transferred on stock exchange and there is a tax treaty or if derived by certain EU residents)

24.75% Final withholding tax rates

Employment income

Dividends

Interest

Royalties

Fees (technical)

Fees (directors)

21%;

0% if less than EUR 1,500 or derived by EU or treaty-country residents)

21%;

0% if paid to residents of EU Member States

(except Cyprus), on bank deposits, public bonds, securities issued in Spain by certain international organizations)

24.75%

24.75%

24.75%

10

C. Other direct taxes

Net wealth tax

Inheritance and gift taxes yes (for 2011 to 2014) yes

D. Other indirect taxes

VAT/GST (standard)

VAT/GST (reduced)

VAT/GST (increased)

Other

21%

0%, 4%, 10% no no

11

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Key features under Law 11/2009 amended by Law 16/2012

• Public listed companies (information issues).

• Corporate purpose: a) Leased urban assets b) Stake in share capital of other SOCIMI or other foreign analogue vehicle o similar REIT.

• Requirements:

• Share capital: ≥ 5,000,000 € (monetary or non monetary contributions).

• ≥ 80% of its assets must be leasable urban properties or shares of other REIT.

• ≥ 80% of its earnings must come from lease or dividends distributed by any subsidiary REIT.

• Property assets may be leased for a minimum 3 year term (Spanish Tax

Authorities will analyse the overall degree of compliance).

• To take into account:

• SOCIMI must not comply with all the abovementioned requirements if the listed company is not the SOCIMI itself but its parent company.

• When opting for the special tax regime, some of the requirements may be met within the following 2 years.

12

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Tax Regime under Law 11/2009 amended by Law 16/2012

•

Corporate tax rate: 0%

• Provided that the shareholders owning at least 5% of the SOCIMI are taxed on the dividends received at a minimum rate of 10% (the most favorable

scenario).

• Where investors do not meet the above requirement, the SOCIMI will be taxed at 19% on the portion of the distributed profit corresponding to those investors (the least favoreable scenario).

•

Non-Resident Investors:

•

With permanent establishment in Spain:

•

They will include the dividend in their Income Tax base without entitlement to double taxation relief.

•

Without permanent establishment in Spain:

•

They will be subject to a withholding tax of 19% unless an exemption

(parent-subsidiary) or reduced tax treaty rate (*) is applicable.

(*) As set forth by Article 10 of the “Convention between the Kingdom of Spain and the State of Israel for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital”:

1.

Dividends paid by a company which is a resident of a Contracting State to a resident of the other Contracting State may be taxed in that other State.

2.

However, such dividends may also be taxed in the Contracting State of which the company paying the dividends is a resident and according to the laws of that State, but if the beneficial owner of the dividends is a resident of the other Contracting

State, the tax so charged shall not exceed 10 per cent of the gross amount of the dividends. (…)

13

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Tax Regime

•

Transfer Tax: 5%

• 95% reduction on the Transfer Tax triggered on the acquisition of real estate assets if they are residential properties to be leased or land for the promotion of residential properties to be leased, to the extent that the holding period requirement of 3 year is met.

14

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Alternative Market (MAB)

• The listing requirement can be fulfilled within the MAB, which has more flexible regulation and less regulatory requirements.

• Alongside other segments (SICAVS, Venture Capital Companies and

Growth Companies), there is an specific MAB segment for SOCIMI regulated under Circular of the MAB 2/2013.

• Requirements:

• Registered advisor.

• Liquidity agreement (the liquidity provider could be an investment services company or a credit institution).

• Valuation report drafted by an independent expert under international valuation standards.

• Minimum free float required, ≤ 5% of share capital. These shareholders must hold a number of shares representing the lesser of the following amounts:

• 2,000,000 € (estimated market value); or

• 25% of the shares issued by the company.

15

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Application & Procedure for Admission to Trading

• Application (“information document for inclusion on the MAB”):

• Real estate assets: description, depreciation periods, situation and condition, policy for investment and replacement, potential costs due to a change in the lessee.

• Finance:

• International Financial Reporting Standards (IFRS); or

• General Accepted Accounting Principles used in the United States (US GAAP).

• Corporate & Management.

• Procedure:

• It takes between 2-4 months.

• Issuers of their shareholders will not be obliged to conduct an offering for the sale or subscription of shares prior to their inclusion on the MAB in order to comply with the minimum free float requirement.

• Once listed, core shareholders & key executives are obliged to maintain the shares during the first year following their listing.

16

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Disclosure & Transparency requirements

Principles:

1. Sufficient information: investors may have available information to enable them to make trading decisions.

2. Simplicity: MAB is a more flexible market than any other regulated market.

Information Basis Content

Financial

Material

Half-yearly & Yearly • Key financial data related to the first 6 months each year.

• Audited anual financial statements.

• Calling for shareholder’s meeting.

• Changes in the management body.

• Corporate transactions.

• Bylaw amendments (Specific content for the Company bylaws, see next slide).

• Etc.

Ownership

Side-agreements

Half-yearly • Number of shareholders

• List of shareholders (≥ 5%)

I.e., terminantion of shareholder’s agreements affecting the transfer of shares or shareholders’ voting rights.

Besides being disclosed to the market, the abovementioned information must be posted on the website which the company will have to have available.

17

Spanish REIT- SOCIMI (Sociedades Anónimas Cotizadas en el Mercado Inmobiliario)

Specific content for SOCIMI bylaws

Provisions to include in SOCIMI bylaws:

• Obligation for shareholders to notify the Company of the acquisition or sale of shares where it causes their ownership interest to reach, go above, or fall bellow, 5% of the capital stock and successive multiples of 5%; the same obligation applies at a lower 1% to directors and senior managers.

• Obligations for shareholders to notify the issuing Company of the signing, extension or termination of any agreements that restrict the transferability of shares or affect the right to vote.

• Obligation for the issuing company, if it resolves to stop trading on the MAB without the unanimous vote of the shareholders, to offer the shareholders who did not vote in favour, to acquire their shares at a justified price in accordance with the criteria set out in the legislation on tender offers.

• Obligation for any shareholder who receives a purchase offer from another shareholder or from a third party, which implies that the transferee is going to own a controlling interest (above 50%), not to be able to transfer their interest unless the potential transferee makes an offer to all the shareholders to buy their shares on the same terms.

18

Individual Income Tax

Investment

Transfer Tax

INCOME

Return

Rent Income

Extraordinary Income

EXPENSES

Managemnt

Management fee

RESULT

EBITDA – Operating Margin

% Corporate Income Tax

Individual Income Tax

BENEFIT AFTER TAXES

SOCIMI Comparison

Private

Company

Limited

5,000,000 €

8 %

4,600,000 €

12%

552,000 €

1%

50,000 €

502,000 €

30 %

351,400 €

26.46%

Individual

5,000,000 €

8%

4,600,000 €

12%

552,000 €

552,000 €

0%

52%

264,960 €

69.04%

SICAV

5,000,000 €

0%

5,000,000 €

12%

600,000 €

3%

150,000 €

450,000 €

1%

445,500 €

0.54%

(*) Transfer Tax for SOCIMI is 0.35%. It results from 5% (95% reduction) • 7%.

Transfer Tax for Private Company Limited and Individuals is 8%. It results from 7% (Transfer Tax) + 1%.

SOCIMI

5,000,000 €

0,35% (*)

4,982,500

12%

597,900€

3%

150.000 €

447,900 €

0%

447,900 €

19

Dividends Taxation for Individuals

DIVIDENDS DISTRIBUTED

Dividends Withholding (21%)

Shareholding ≥ 5%

Shareholding ≤ 5%

Less than 1.500 € (0%)

1.500,01- 7.500 € (21%)

7.500,01 € - 25.500 € (25%)

More than 25.500,01 € (27%)

Less than 6.000 € (21%)

6.000,01 € - 24.000 € (25%)

More than 24.000,01 €

RESULT

SOCIMI Comparison

Private

Company

Limited

351,400 €

73,794 €

-

1,500 €

1,260 €

4,500 €

87,993 €

19,959 €

31.04%

Individual

264,960 €

55,642 €

-

1,500 €

1,260 €

4,500 €

64,654.20 €

14,772.60 €

77.04%

SICAV

445,000 €

93,555 €

-

1,260 €

4,500 €

113,805 €

26,010 €

0.55%

SOCIMI

447,900 €

94,059 €

19% (*)

1,260 €

4,500 €

114,453 €

26,154 €

(*) SOCIMI’s dividends are taxed at 19%. At any other cases, they will be taxed up to 27% within ranges.

20

REAL ESTATE LEGAL SERVICES

Property selection

Corporate Formation

Day-to-Day Legal: handling rentals, and any other issues.

Barcelona Corporate Address

Tax optimization

Contact to Barcelona Local Council

Bureaucracy issues intermediation

Rehab control

21

INGRID SUMARROCA

Practice Areas

Finance & Restructurings

Mergers & Acquisitions

Commercial law

Experience

Deloitte Touche Tohmatsu - Uría Menéndez

Education

Law Degree (UAB, 2007)

Administration and Management Degree (UAB, 2007)

Corporate Finance & Law Master (ESADE, 2012)

Languages

SP - CAT- EN

Professional Associations

Barcelona Bar Association (N. 32482)

International Bar Association (N. 1043778)

Contact: ish@sumarrocalegal.com

+34 93 209 55 63 / +34 657 769 812

297, Balmes

08006 Barcelona

22

Thanks

@ YOUR DISPOSAL

23