Cash

advertisement

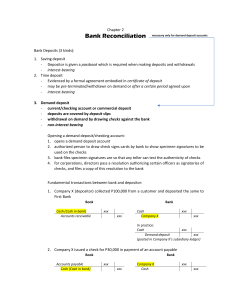

Cash Group #4 Bajacan, Karla Mae Carlos, Juan Paolo Castro, Patrick Lu, Enrico Rafael What is Cash? • Layman’s point of view “cash” simply means money. – Money is the standard medium of exchange in business transaction. • Immediately available for use • Cash includes: coins, bills, currencies, checks, money orders, bank drafts and deposits. • Cash is not a legal tender. - Legal tender medium of payment that can be used extinguish a debt, or meet a financial obligation. Categories of Cash 1. Cash on Hand – undeposited cash collection – Examples: Bank drafts, money orders and traveler’s checks 2. Cash in Bank − Includes demand deposits 3. Cash Fund − Segregated for current use Petty cash fund Tax fund Payroll fund Dividend fund Change fund Interest fund Special Cases 1. Deposits - closed bank - time deposits 2. 3. 4. 5. Foreign Currencies Post-dated Checks Stale Checks Outstanding Checks What is Cash Equivalents? Short-term highly liquid investments Acquired 3 months before maturity Debt instrument Example: Three month BSP treasury bill Internal Control - All policies and procedures used to protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies. 1. Segregate Custodianship and Recording Functions 2. Voucher System 3. Issue official receipt 4. Place cash in bank 5. Bank Reconciliation Petty Cash Fund - Petty Cash is money set aside to pay small expenses which cannot be paid conveniently by means of check. Methods of Handling Petty Cash Fund a.Imprest Fund System b.Fluctuating Fund System Bank Reconciliation – A statement prepare by an enterprise which brings into agreement the cash per book and cash balance per bank. • Bank statement – bank report on the depositor’s beginning and ending cash balance, and a listing of its changes, for a period. Reconciling items: •Book Reconciling items 1. Credit Memos Notes receivables collected by bank Proceeds of bank loan granted to depositor Matured time deposit transferred by bank to the account of the depositor 2. Debit Memos No sufficient Fund Technically Defective Check Bank Services Charges Reduction of Loan • Bank Reconciling Items: 1. Deposit in Transit collections already recorded by the depositor as cash receipts but not yet reflected on the bank statement. 2. Outstanding Checks checks already recorded by the depositor as cash disbursement but not yet reflected on the bank statement. Errors Book Errors a. Understatement of cash receipts b. Overstatement of cash receipts c. Understatement of cash disbursement d. Overstatement of cash disbursement Bank Errors a. b. c. d. Understatement of bank credit Overstatement of bank credit Understatement of bank debit Overstatement of bank debit