Ch05 Additional

advertisement

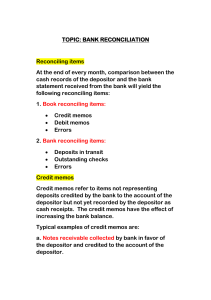

Extra Lecture Note Bank Reconciliation Statement RECONCILIATION OF BANK BALANCES Schedule explaining any differences between the bank’s and the company’s records of cash. Reconciling Items: 1. Deposits in transit. 2. Outstanding checks. 3. Bank charges Time Lags 4. Bank credits. 5. Bank or depositor errors. LO 10 Reconciling items • Deposit in Transit • Outstanding checks End-of-month deposits of cash recorded on the depositor’s book in one month are received and recorded by the bank in the following month. Checks written by the depositor are recorded when written but may not be recorded by (may not “clear”) the bank till the next month. Reconciling items • Bank charges • Not Sufficient Fund (NSF) Charges recorded by the bank against the depositor’s balance for such items as bank services, printing checks, Not-sufficient funds (NSF) checks, and safedeposit box rentals. The depositor may not be aware of these charges until the receipt of bank statement. NSF checks. The bank may have rejected some of your deposited checks, because the person or business issuing the checks did not have sufficient funds in their account(s) to remit to your bank. These are known as NSF (not sufficient funds) checks. Reconciling items • Bank Credits Collection or deposits by the bank for the benefit of the depositor that may be unknown to the depositor until receipt of bank statement. Example are note collection for the depositor and interest earned on interest-bearing checking accounts. • Bank or Depositor Errors. Errors on either the part of the bank or the part of the depositor cause the bank balance disagree with depositor’s book balance. Reconciling items • Direct debit payments • Standing order payments This is an instruction by the business to the bank to make direct payments for amount owing to certain suppliers) This is an instruction by the business to the bank to make certain fixed amount of payment every month, such as insurance, rental, loan repayment installment. Reconciling items • Credit transfer Which amount paid by customers directly through bank transfer. RECONCILIATION OF BANK BALANCES ILLUSTRATION 7A-1 Bank Reconciliation Form and Content LO 3 Control Features: Use of a Bank Reconciliation Procedures + Deposit in Transit + Notes collected by bank - - NSF (bounced) checks - Check printing or other service charges Outstanding Checks +/- Bank Errors +/- Company Errors CORRECT BALANCE CORRECT BALANCE LO 3 Prepare a bank reconciliation.