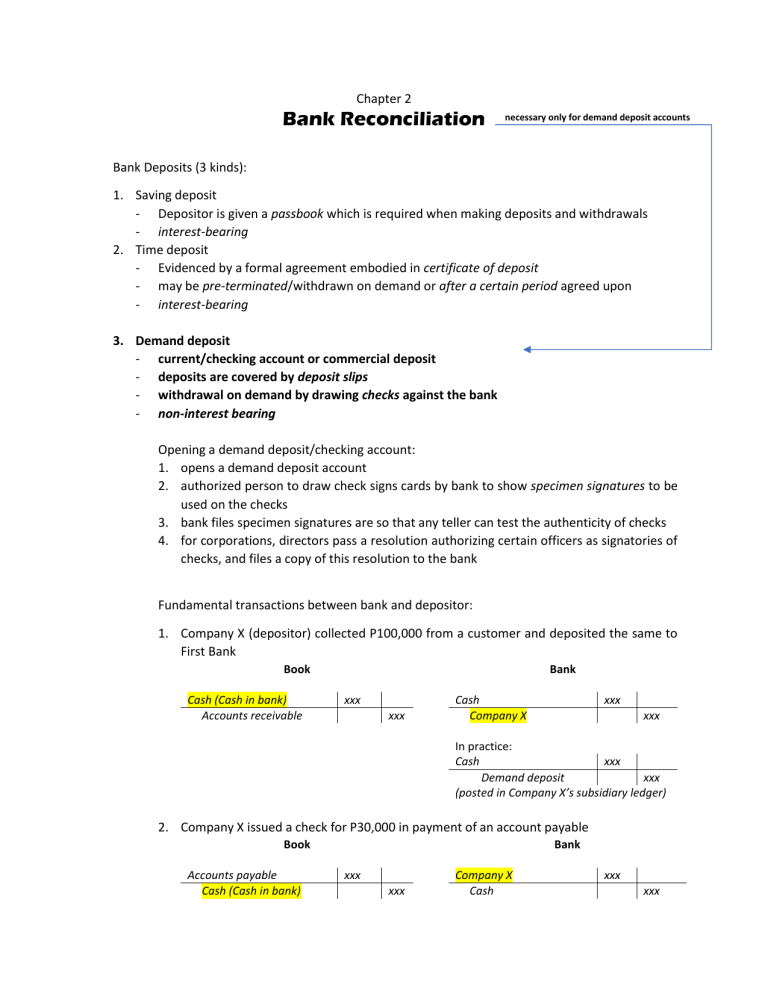

Chapter 2 Bank Reconciliation necessary only for demand deposit accounts Bank Deposits (3 kinds): 1. Saving deposit - Depositor is given a passbook which is required when making deposits and withdrawals - interest-bearing 2. Time deposit - Evidenced by a formal agreement embodied in certificate of deposit - may be pre-terminated/withdrawn on demand or after a certain period agreed upon - interest-bearing 3. Demand deposit - current/checking account or commercial deposit - deposits are covered by deposit slips - withdrawal on demand by drawing checks against the bank - non-interest bearing Opening a demand deposit/checking account: 1. opens a demand deposit account 2. authorized person to draw check signs cards by bank to show specimen signatures to be used on the checks 3. bank files specimen signatures are so that any teller can test the authenticity of checks 4. for corporations, directors pass a resolution authorizing certain officers as signatories of checks, and files a copy of this resolution to the bank Fundamental transactions between bank and depositor: 1. Company X (depositor) collected P100,000 from a customer and deposited the same to First Bank Book Cash (Cash in bank) Accounts receivable Bank xxx xxx Cash Company X xxx xxx In practice: Cash xxx Demand deposit xxx (posted in Company X’s subsidiary ledger) 2. Company X issued a check for P30,000 in payment of an account payable Book Accounts payable Cash (Cash in bank) Bank xxx xxx Company X Cash xxx xxx When balances are extracted, both the depositor’s book and the bank’s book has a cash balance of P70,000. The two accounts have equal balances because they are reciprocal accounts. When one account is debited, the other account is credited, or vice-versa. Thus, the two should have equal balances as long as no errors are committed, and the same information are recorded on both. BUT… very frequently, there are items on the depositor’s book which do not appear on the bank records as of the same date, and less frequently, there are items on the bank records which do not appear on the depositor’s book. It is in this light that preparing bank reconciliation becomes necessary. Bank Reconciliation - a statement which brings into agreement the cash balance per book and the cash balance per bank usually prepared monthly because it is only at the end of the month that the bank provides the depositor with the bank statement together with debit and credit memoranda and canceled checks which are issued checks that are actually paid by the bank A bank statement is a monthly report of the bank to the depositor, which is an exact copy of the depositor’s ledger in the records of the bank containing the ff: a. beginning cash balance per bank b. deposits made and acknowledged by the bank c. checks drawn and paid by the bank d. daily cash balance per bank during the month Reconciling Items Book Bank a. Credit memos a. Deposits in transit b. Debit memos b. Outstanding checks c. Errors c. Errors Book reconciling items a. Credit Memos (+) - items not representing deposits credited by the bank to the account to the depositor but not yet recorded by the depositor as cash receipts - increases bank balance, but has no effect yet on book balance examples: a. notes receivable collected by the bank b. proceeds of bank loan c. matured time deposits transferred to current account b. Debit Memos (-) - Items not representing checks paid by bank which are charged or debited by the bank to the depositor’s account but not yet recorded by the depositor as cash disbursements - decreases the bank balance, but has no effect yet on the book balance examples: a. NSF or no sufficient fund checks - checks deposited but returned by the bank due to insufficiency f fund b. technically defective checks c. bank service charges d. reduction of loan – amount deducted as payment for matured loan Errors - there’s no definite rule whether to add or deduct should be analyzed for proper treatment reconciling items of the party who committed them; thus, they can be book or bank reconciling items Bank reconciling items a. Deposits in transit (+) - collections already recorded by the depositor, but not yet reflected on the bank statement - increases book balance, but has no effect yet on the bank balance examples: a. collections already forwarded to the bank but missed the bank statement b. undeposited collections / cash on hand awaiting delivery to the bank for deposit b. Outstanding checks (-) - checks already recorded by the depositor as cash disbursements but not yet reflected on the bank statement - decreases book balance, but has no effect yet on the bank balance examples: a. checks drawn and given to payee but not yet presented b. certified checks or checks stamped “accepted” or “certified” by the bank, indicating sufficiency of fund. This should be deducted from total outstanding checks (if included therein) Forms of bank reconciliation 1. Adjusted balance 2. Book to bank method method - book balance and bank - book balance is balance are brought to a correct adjusted to equal the cash balance that must appear bank balance on the balance sheet - preferred over the other two 3. Bank to book method - bank balance is adjusted to equal the book balance