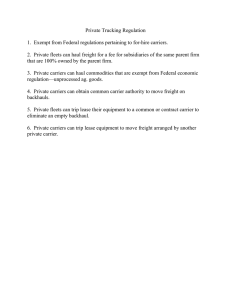

State Department of Insurance

The Framework of Insurance

Regulation

Rex Bagwell

Business Development Manager

Insurance Productivity Services

Kurt Jackson

EVP of Sales

GhostDraft v

Rex Bagwell

• Business Development Lead with

Salient Commercial Solutions

• Worked directly in the insurance industry for 9 years as an agent, a district manager and now with Salient years

• Former Director IASA Board and on several other national committees

Kurt Jackson

• Proven and accomplished sales leader with over 20 years of experience in the technology sector

• EVP of Sales and Marketing at

• IASA volunteer and committee member

Key takeaways

Insurance Regulation

101

• Protecting the policyholder

The impact of regulations on carriers v and rate of change

How do regulations affect your ability to sell

• Do your homework

• Based on what you are selling

Agenda

• The Purpose of Insurance Regulation

• Key Regulators

• The Structure of Insurance Regulation

• Key Legislation

• Regulations and Carrier Concerns v

• Vendor Opportunities

• Case Studies

The Purpose of Insurance Regulation

Protect the insured (policyholder):

• State departments of insurance are accessible and interests of the policyholder.

• State regulation works to protect insured and ensure promises made by insurers are kept.

Other Insurance Regulation Assurances

• Availability and Equal Treatment to All Entitled Persons

• Fair Competition

• Insurer’s Solvency through Monitoring of Assets

• Availability of Insurance v

Key Regulators

State Department of Insurance

• Establish and oversee state insurance departments

• Regularly review and revise state insurance laws

• Approve regulatory budgets

• Have impact on market entry of new carriers v

• Audit insurance companies

National Association of Insurance Commissioners (NAIC)

• Advisory body and service provider for state insurance departments to:

• Pool scarce resources

• Discuss issues of common concern

• Align their oversight of the industry

The Structure of Insurance Regulation

Company

Licensing

Consumer

Services

Producer

Licensing v

Market

Regulation

Product

Regulation

Financial

Regulation

Regulatory Measures

• Guaranty Funds

• Yellow Book

• Oversight

• Statistical Reporting v

State Revenue from Regulation

• In 2000 states collected more than $10.4 billion in revenues from insurance sources:

$880 million (8.4%) went to regulate the business of insurance

Remaining $9.6 billion went to state general funds for other purposes

Effectively paying a premium tax v

Insurance for Those Who Can’t Get

Insurance

• Assigned Risk Pool

• FAIR Plans

• Workers Compensation Funds

• Windstorm / Hail Pools & Beach Plans

• Healthcare v

*Associations for each

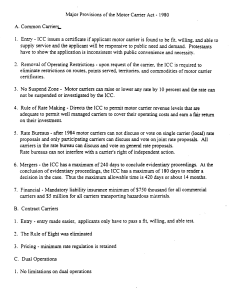

Key Legislation

1945 ‐ McCarren‐Ferguson Act

1996 – Health Insurance Portability and Accountability Act (HIPAA)

2002 – Sarbanes‐Oxley Act (affects publicly held carriers)

2010 - Affordable Healthcare Act

Regulations and Carrier Concerns

• Licensing

• Product Ratings

• Financial Stability

• Market Conduct Exams

• Insurer Complaints v

• Relationships with Commissioners

Liberty Mutual Insurance TV Commercial –

New Car Replacement and Accident Forgiveness

Implications of Regulations on Carriers

Why do companies pull out of states?

• Florida Insurance Market

Understanding of prospects markets they serve and the regulatory climate

PA Commissioner interested in holding board accountable v

Often new regulations are delayed six months before rollout

Vendor Opportunities

• Understand carrier ability to use your product or service

• Forms regulation management

• Address carrier concerns with regulations

• Keep up with changing regulations

• Reduce risk and increase regulatory accuracy

• Understand regulations to get credibility with executives

Case Studies

• Producer Lifecycle Management

Licensing and compliance, ensure authorization to sell

• Customer Communication Management

Less customer complaints through effective communications

Forms Compliance v

• Statistical Reporting

• Product Development / Compliance

Future of Regulations

Federal Government moving into regulations?

v

Regulation Resources:

• Insurance Journal: http://www.insurancejournal.com/news/national/2015/01/08/353430.htm

• NAIC: http://www.naic.org/documents/consumer_state_reg_brief.pdf

Key Takeaways

Insurance Regulation

101

• Protecting the policyholder

The impact of regulations on carriers and rate of change

How do regulations affect your ability to sell

• Do your homework

• Based on what you are selling

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)