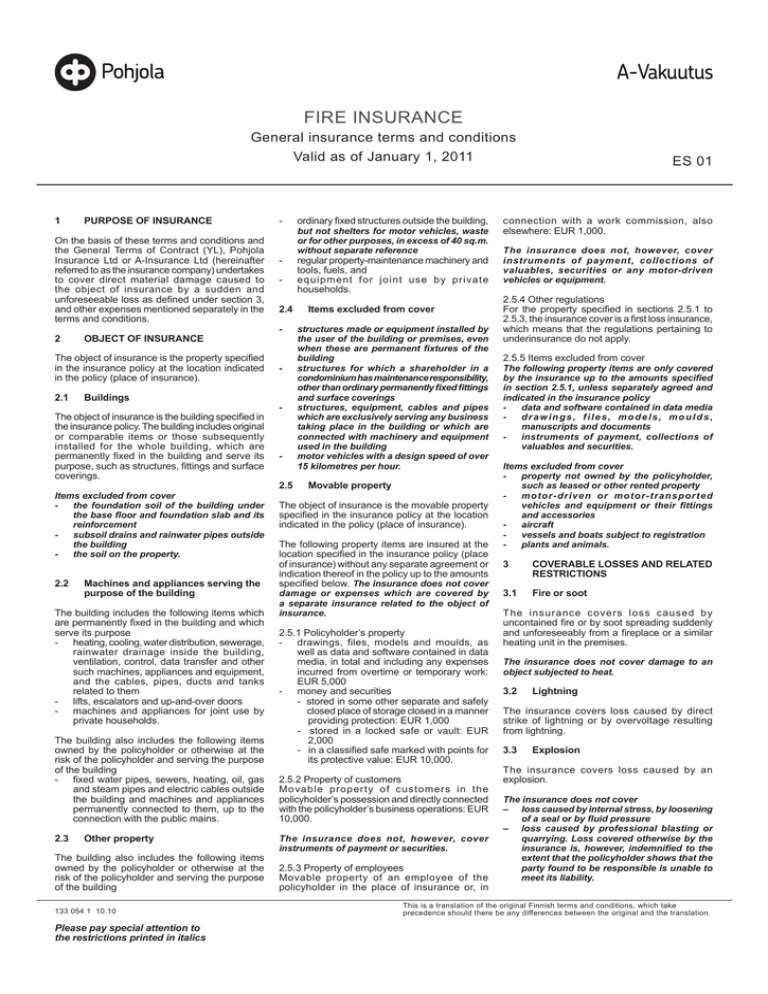

fire insurance

advertisement

FIRE INSURANCE General insurance terms and conditions Valid as of January 1, 2011 1 Purpose of insurance On the basis of these terms and conditions and the General Terms of Contract (YL), Pohjola Insurance Ltd or A-Insurance Ltd (hereinafter referred to as the insurance company) undertakes to cover direct material damage caused to the object of insurance by a sudden and unforeseeable loss as defined under section 3, and other expenses mentioned separately in the terms and conditions. 2 Object of insurance The object of insurance is the property specified in the insurance policy at the location indicated in the policy (place of insurance). 2.1Buildings The object of insurance is the building specified in the insurance policy. The building includes original or comparable items or those subsequently installed for the whole building, which are permanently fixed in the building and serve its purpose, such as structures, fittings and surface coverings. Items excluded from cover - the foundation soil of the building under the base floor and foundation slab and its reinforcement - subsoil drains and rainwater pipes outside the building - the soil on the property. 2.2 Machines and appliances serving the purpose of the building The building includes the following items which are permanently fixed in the building and which serve its purpose - heating, cooling, water distribution, sewerage, rainwater drainage inside the building, ventilation, control, data transfer and other such machines, appliances and equipment, and the cables, pipes, ducts and tanks related to them - lifts, escalators and up-and-over doors - machines and appliances for joint use by private households. The building also includes the following items owned by the policyholder or otherwise at the risk of the policyholder and serving the purpose of the building - fixed water pipes, sewers, heating, oil, gas and steam pipes and electric cables outside the building and machines and appliances permanently connected to them, up to the connection with the public mains. 2.3Other property The building also includes the following items owned by the policyholder or otherwise at the risk of the policyholder and serving the purpose of the building 133 054 1 10.10 Please pay special attention to the restrictions printed in italics - ordinary fixed structures outside the building, - regular property-maintenance machinery and tools, fuels, and equipment for joint use by private households. - but not shelters for motor vehicles, waste or for other purposes, in excess of 40 sq.m. without separate reference 2.4Items excluded from cover - - - - structures made or equipment installed by the user of the building or premises, even when these are permanent fixtures of the building structures for which a shareholder in a condominium has maintenance responsibility, other than ordinary permanently fixed fittings and surface coverings structures, equipment, cables and pipes which are exclusively serving any business taking place in the building or which are connected with machinery and equipment used in the building motor vehicles with a design speed of over 15 kilometres per hour. 2.5 Movable property The object of insurance is the movable property specified in the insurance policy at the location indicated in the policy (place of insurance). The following property items are insured at the location specified in the insurance policy (place of insurance) without any separate agreement or indication thereof in the policy up to the amounts specified below. The insurance does not cover damage or expenses which are covered by a separate insurance related to the object of insurance. 2.5.1 Policyholder’s property - drawings, files, models and moulds, as well as data and software contained in data media, in total and including any expenses incurred from overtime or temporary work: EUR 5,000 - money and securities - stored in some other separate and safely closed place of storage closed in a manner providing protection: EUR 1,000 - stored in a locked safe or vault: EUR 2,000 - in a classified safe marked with points for its protective value: EUR 10,000. 2.5.2 Property of customers Movable property of customers in the policyholder’s possession and directly connected with the policyholder’s business operations: EUR 10,000. The insurance does not, however, cover instruments of payment or securities. 2.5.3 Property of employees Movable property of an employee of the policyholder in the place of insurance or, in ES 01 connection with a work commission, also elsewhere: EUR 1,000. The insurance does not, however, cover instruments of payment, collections of valuables, securities or any motor-driven vehicles or equipment. 2.5.4 Other regulations For the property specified in sections 2.5.1 to 2.5.3, the insurance cover is a first loss insurance, which means that the regulations pertaining to underinsurance do not apply. 2.5.5 Items excluded from cover The following property items are only covered by the insurance up to the amounts specified in section 2.5.1, unless separately agreed and indicated in the insurance policy - data and software contained in data media - d r a w i n g s , f i l e s , m o d e l s , m o u l d s , manuscripts and documents - instruments of payment, collections of valuables and securities. Items excluded from cover - property not owned by the policyholder, such as leased or other rented property - motor-driven or motor-transported vehicles and equipment or their fittings and accessories - aircraft - vessels and boats subject to registration - plants and animals. 3 Coverable losses and related restrictions 3.1 Fire or soot The insurance covers loss caused by uncontained fire or by soot spreading suddenly and unforeseeably from a fireplace or a similar heating unit in the premises. The insurance does not cover damage to an object subjected to heat. 3.2 Lightning The insurance covers loss caused by direct strike of lightning or by overvoltage resulting from lightning. 3.3 Explosion The insurance covers loss caused by an explosion. The insurance does not cover – loss caused by internal stress, by loosening of a seal or by fluid pressure – loss caused by professional blasting or quarrying. Loss covered otherwise by the insurance is, however, indemnified to the extent that the policyholder shows that the party found to be responsible is unable to meet its liability. This is a translation of the original Finnish terms and conditions, which take precedence should there be any differences between the original and the translation. – damage to a combustion engine caused by an explosion in the engine, nor – damage to a closed, pressure-resistant container, equipment, pipe or tank in which there has been gas or steam, unless the reason for the breakage was exceptional overpressure arising suddenly and unforeseeably. 3.4 Triggering of extinguishing equipment The insurance covers loss caused when extinguishing equipment is triggered suddenly and unforeseeably. The precondition is that the equipment complies with the rules of the Federation of Finnish Insurance Companies. 4 Ensuing losses The insurance also covers loss caused by subject to indemnification in sections 3.1 to 3.3 and 3.4 - property being stolen, disappearing or being damaged, as a result of the circumstances of a coverable loss, in connection with a loss otherwise subject to indemnification, and - cold or heat, rain or other similar reason if the loss was a direct consequence of a coverable loss. 5 Safety regulations 6 Indemnities The policyholder shall comply with the safety regulations indicated in the insurance policy and below (see the General Terms of Contract, section 6.1). The indemnity is calculated in accordance with the indemnification regulations (ES AK) and with the following regulations applied to this insurance. 5.1 The safety regulations indicated in the policy must be followed when engaged in work involving the use of fire (hot work). 6.1 Deductible for hot work Hot work refers to work where sparks occur or where a gas flame, other open fire or a hot air blower is used. 5.2 System and application software and data must be copied at least once a day so that, in addition to the original, there are two copies on an electronic data storage medium. The backup copy must be kept in a fireproof safety file intended for data media. The safety file must not be located in the same fire compartment as the other copies, or it must be placed in a data medium cabinet of at least class S60 DIS. If a loss caused by uncontained fire (fire loss) and covered under this insurance is caused by hot work (see section 5.1), the policyholder’s deductible is ten times that recorded in the insurance policy, though not more than EUR 20,000 or a higher deductible specified in the insurance policy. 6.2 Deductible for fire damage caused to fire-safe waste shelters and underground waste containers No deductible is subtracted if a fire-safe waste shelter or underground waste container has restricted the extent of the damage. 5.3 Locations protected by fire extinguishing equipment or automatic fire detection equipment must have a written maintenance programme drawn up for them in compliance with official regulations for these systems. The fire extinguishing equipment and fire detection equipment must be functional and properly checked or serviced. Pohjola Insurance Ltd, Lapinmäentie 1, FI-00013 Pohjola Domicile: Helsinki, main field of operations: insurance business The company has been entered in the Finnish Trade Register, business ID 1458359-3 A-Insurance Ltd, Lapinmäentie 1, FI-00350 Helsinki Domicile: Helsinki, main field of operations: insurance business The company has been entered in the Finnish Trade Register, business ID 1715947-2

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)