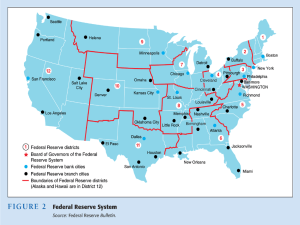

Federal Reserve System

advertisement

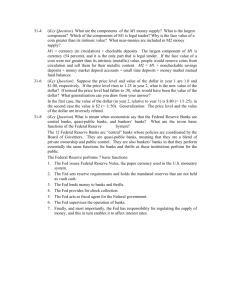

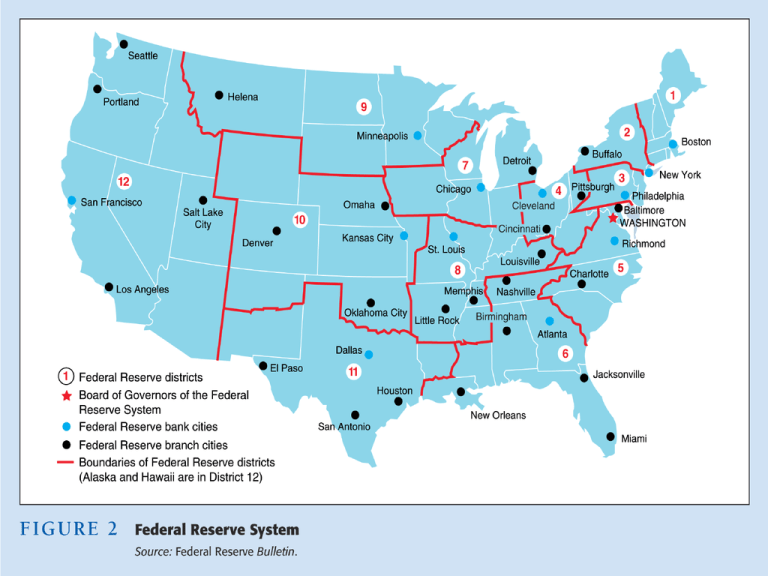

Federal Reserve System • Americans long resisted a central bank Fear of centralized power Distrust of moneyed interests • First U.S. experiments with a central bank • terminated in 1811 and in 1836 • Without lender of last resort … Nationwide bank panics on a regular basis Panic of 1907 … JP Morgan to the rescue? a central bank needed • Federal Reserve Act of 1913 Elaborate system of checks and balances Decentralized District banks: Quasi-public institutions owned by private member commercial banks in the district Goals of Central Banks •Price stability •High employment •Steady growth •Financial market stability •Stable interest rates •Stable exchange rate } dual mandate of Fed Price stability has long-run precedence, consistent with high employment Time – Inconsistency Problem: temptation to go beyond stated target •Hype the economy/lose credibility •Worker and firm altered expectations and responses undo policy intent “Rules not discretion” But… Governor Mishkin’s pragmatism Bagehot’s rule: Lend and lend freely Keynes: In the long-run we’re all dead …small events at times have large consequences. A liquidity crisis in a fractional reserve banking system is precisely the kind of event that can trigger – and often has triggered – a chain reaction. And economic collapse often has the character of a cumulative process. Let it go beyond a certain point, and it will tend for a time to gain strength from its own development as its effects spread and return to intensify the process of collapse. Because no great strength would be required to hold back the rock that starts a landslide, it does not follow that the landslide will not be of major proportions. Friedman and Schwartz A Monetary History of the United States The Functions of a Modern Central Bank The Government's Bank: – Manages government transactions. – Controls availability of money and credit. The Banker’s Bank: Lender of last resort in crises Operates clearing system for payments. Oversees financial intermediaries - ensure their soundness. - ensure public confidence interbank Functions of Federal Reserve District Banks • Clear checks • Issue new currency/withdraw damaged currency • Make discount loans to banks in district • Evaluate mergers/expansions of bank activities • Liaison between business community and the Fed • Examine bank holding companies and state-chartered member banks • Collect data on local business conditions • Research Money, Banking and the Financial System FRBNY’s special roles • Bond and currency open market operations • Supervise bank holding companies in NY district • Member of Bank for International Settlements Board of Governors • Seven members headquartered in D.C. • Appointed by president/confirmed by Senate 14-year non-renewable term Chairman serves 4-year renewable term Chairman speaks for Fed/“Runs the Show” • Set reserve requirements • Control the discount rate • Direct open market operations • Approve bank mergers • Regulate bank holding companies/foreign banks in the US Federal Open Market Committee(FOMC) • Meets eight times a year … more often if needed Reports on domestic and currency open market operations “Green book” forecast “Blue book” forecasts … responses to alternative policies • 12 Voting members: 7 Fed Governors; president of FRBNY; and presidents of 4 other district banks in rotation • BoG Chairman chairs FOMC • End of meeting announcements: Directive to the trading desk at FRBNY Balance of risks statement How Independent is the Fed? • Instrument independent • Goal independent … undemocratic? Political pressure would impart inflationary bias to monetary policy Political business cycle? Could facilitate Treasury financing of large budget deficits— accommodation • Independent revenue • Structured by Congress/accountable to Congress • Presidential influence Influence on Congress Appoints members Appoints chairman Time to reform? Today (2003), the key issues behind recent financial scandals are the complex instruments used to skirt legal rules; the rogue employees that managers and shareholders cannot monitor; and the incentives for managers to engage in financial malfeasance, given the deregulated markets. The antiquated system of financial regulation, developed in the 1930s and designed to prevent another market crash after 1929, no longer fits modern markets. Efforts to deregulate pockets of the markets, at the urging of financial lobbyists, have created an admixture of strict rules governing some dealings and no rules governing others. As a result, the markets are now like Swiss cheese, with the holes -the unregulated pieces -- getting bigger every year… … Whether stock markets are going up or down, they are not nearly as efficient as a generation of economists had taught corporate and government leaders. In recent years (1998…), the markets have withstood losses … largely because …investors … and regulators have remained composed…Unfortunately, as banks pass credit risks along to insurance firms and industrial companies, these other companies become de facto banks, and the rules and oversight that have kept banks safe for decades do not cover these firms. If investors ever come to understand the hidden risks within these non-bank firms, they might very well panik. Frank Partnoy, Infectious Greed, 2003 European Central Bank • Patterned after the Federal Reserve • Central banks from each country play similar role as Fed district banks Monetary operations are not centralized ECB does not supervise and regulate financial institutions More independent than Fed • Maastricht Treaty would have to be revised to change ECB charge But less goal independent than Fed Price Stability Rules