24-Central Banks

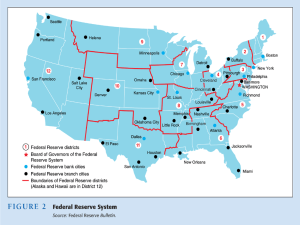

advertisement

14 – Central Banks Cecchetti Chapter 15 Early History of the Fed Federal Reserve Act: 1914 Created as a bureau of the Treasury and the Secretary of Treasury was required to serve as an ex officio Chairman of the Federal Reserve Board. Act signed by President Wilson Central Banks Primary reason central banks exist: print currency and control monetary policy Free markets cannot do this: adverse selection Banker’s Bank Provide loans during times of financial stress Manage the payments system Regulate commercial banks How does the Fed Work? When the Fed wishes to increase the money supply (shift AD curve to right) When the Fed wishes to decrease the money supply (shift AD curve to left) Buys U.S. bonds from commercial banks Sells U.S. bonds from commercial banks Together these are called “open market operations” Money Supply and Interest Rates When the money supply increases, interest rates drop inflation pressure increases When the money supply decreases, interest rates increase Inflation pressure decreases Central Bank Objectives Low stable inflation High Stable Real Growth Stability of the financial system Interest Rate Stability Effective Central Banks Independence from political pressure Decision making by committee Control over own budgets Policies must be irreversible Risk of putting one person in charge can be high Accountability and Transparency Establish a system of goals Publicly report progress Independent Central Banks Do independent central banks just keep the money supply too low (line A)? P Do central banks run by political leaders do a better job keeping the economy Running at full capacity (line B)? B A Aggregate Output, Y Independent Central Banks Empirical Evidence: B There is no difference in unemployment rates across countries with independent central banks (line A) and without Independent central banks (line B). P A Countries without independent central banks Just have higher inflation. Aggregate Output, Y Banking Act of 1935 Federal Reserve reorganized Board of Governors shall be composed of seven members, appointed by President Among these is appointed a Chairman and Vice Chairman First Chairman: Mariner S. Eccles A principal sponsor of the act Was serving as an assistant to the Secretary of the Treasury and a Governor of the Federal Reserve Board Mariner S. Eccles Fed Chairman 1936 – 1948 Fed Governor 1948-1951 Federal Reserve Eccles Building Eccles and Fed independence 1947: Inflation at 14% 1948: Inflation at 8% Treasury wanted to keep rates low Facilitate war debt funding Fed (Eccles) wanted to contain inflation Congress supported Eccles Truman declines to reappoint Eccles in 1948 Eccles and Fed Independence Thomas McCabe Chairman 1948-1951 1951: Same argument between Treasury and Fed emerged Truman calls FOMC to Whitehouse Snyder, Secretary of Treasury, announces that rates will be kept at 2.5% Eccles and Fed Independence Eccles releases confidential minutes of White House meeting to public Asks Truman to resolve the conflict Truman had William McChesney Martin, a Treasury Official, negotiate. Eccles and Fed Independence Martin made the Chair of the Fed in 1951. Accord of 1951 was signed making clear that the Fed was independent of the Treasury. Federal Reserve System Central Government Agencies Board of Governors 12 regional banks FOMC Private Banks Advisory Committees Federal Reserve Regional Banks Board of Governors Seven Governors Chairman and Vice Chairman Appointed by President Confirmed by Senate Serve 14 –year terms Terms staggered with a term beginning once every two years Appointed by president from among the seven Four year terms No two governors can serve from the same district Board of Governors Duties Analyzes financial and economic conditions Administers consumer credit protection laws Supervises and regulates the regional Reserve Banks, including budgets and salaries Sets the reserve requirement Approves bank merger applications Regulates and supervises the banking system Collects and publishes data Regional Banks Federally charted banks and private, nonprofit organizations owned by commercial banks Managed in part by Board of Directors Nine members Some chosen by private banks Others chosen by Board of Governors Managed in part by a president Appointed for a five-year term by banks board of directors with approval from Board of Governors Regional Banks As the bank for U.S. government Issue new currency and destroy old currency Maintain U.S treasury bank account/borrowings As the banker’s bank Hold deposits (reserves) which pay zero interest Operate payments network (checks, debit cards, . . .) Make discount loans Supervise and regulate financial institutions Collect data Federal Reserve Bank of New York Point of contact with financial markets Open market operations Treasury securities are auctioned Federal Open Market Committee Has twelve voting members Seven governors President of FRB New York Four Reserve Bank Presidents Serve one-year terms President of FRB Chicago and Cleveland vote every other year Other nine presidents vote one out of every three years Federal Funds Rate Federal Funds Rate Rate at which banks borrow from each other overnight Determined by supply and demand When there are excess reserves, FF rate is low When there is low supply of reserves, FF rate is high Discount Rate Rate at which banks can borrow money from Fed at discount window. Set by regional banks’ boards of directors Set automatically at a premium above the Federal Funds rate. FOMC Targets Federal Funds Rate If prices are “sticky” than they influence the “real rate” Real = Nominal – Inflation Policy decision directs staff at FRB New York to engage in open market operations Federal Open Market Committee Beige Book Green Book Published two weeks before meeting Anecdotal information about economic conditions Only document released to public before meeting Distributed Thursday before meeting Board Staff’s economic forecast for next few years Blue Book Distributed Saturday before meeting Discussion of current markets and policy options Power Within the FOMC Governors make up a majority Green and Blue books prepared by Fed staff Before formal vote, chair makes recommendation followed by others saying “yes” or “no” All bank presidents participate Chair votes first Board controls Regional Bank budgets and salaries To impact policy, governors and bank presidents must generate support through statements in meeting and in public. Assessment of Fed Structure Independence Control own budget Decisions can’t be over-turned Terms are long Structure can only be changed by congressional legislation Decision by committee Assessment of Fed Structure Accountability and transparency Load of information on web sites Immediately after meeting: announcement of policy decision and explanatory statement Minutes published about two weeks later After 5-years: word-for-word transcript, Blue and Green Books Twice yearly “Monetary Report to Congress” (see next slide) Is it the right information? No press conference Blackout period 5-year delay for transcript, Green and Blue Books Inflation Targets? Press Release 11/14/2007 The Federal Open Market Committee (FOMC) announced on Wednesday that, as part of its ongoing commitment to improve the accountability and public understanding of monetary policy making, it will increase the frequency and expand the content of the economic projections that are made by Federal Reserve Board members and Reserve Bank presidents and released to the public. Press Release 11/14/2007 The FOMC will compile and release projections four times each year rather than twice a year. The projection horizon will be extended to three years, from two. FOMC meeting participants will now provide projections for inflation real gross domestic product growth, the unemployment rate core inflation.