central banks and the federal reserve system

advertisement

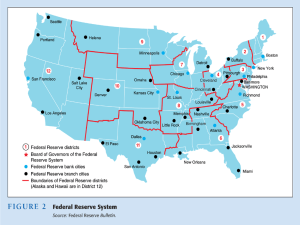

Unit 3 Lecture 1 – EC311 Susanto CENTRAL BANKS AND THE FEDERAL RESERVE SYSTEM The Price Stability Goal • Low and stable inflation • Inflation: – – – – Increase in overall price levels Creates uncertainty and difficulty in planning for the future Lowers economic growth Strains social fabric • Nominal anchor to contain inflation expectations – Ties down price levels within a narrow range to promote price stability • Time-inconsistency problem – Tendency towards pursuing expansionary economic policy to boost the economy This raise inflation expectations Drives wages and prices up [No real output growth] Other Goals of Monetary Policy • High employment – Can’t attain zero unemployment, but the goal is to have the “natural rate of unemployment” only • Economic growth – Related to high employment – Supply side economics: promote growth by encouraging firms to invest and people to save • Stability of financial markets • Interest-rate stability – Fluctuations make it harder for consumers and businesses to plan for the future affect willingness to buy • Foreign exchange market stability – Dollar up too much: American industries less competitive – Dollar down too much: stimulate inflation in the U.S. Should Price Stability be the Primary Goal? • In the long run there is no conflict between the goals • In the short run, it can conflict with the goals of high employment and interest-rate stability • Hierarchical mandate – Price stability goal comes first, the rest are secondary • Dual mandate – Achieve two co-equal objectives: price stability and maximum employment • Price stability should be the primary, long-run goal, while reducing business cycle fluctuation should be the secondary, short-term goal Functions of a central bank 2 sets of functions: A. Macro functions 1. Issue money (Fed issues US notes) 2. Provide lender of last resort function 3. Undertake monetary policy 4. Manage reserves of commercial banks (the banker’s bank function) 5. Advise the federal government and manage the government’s finances Functions of a central bank B. Micro functions 1. Regulate the financial system 2. Supervise certain types of banks 3. Provide check clearing service All central banks have functions listed under A. Some central banks have functions listed under B, some do not. Origins of the Federal Reserve System • Created by the Federal Reserve Act of 1913 – Goal: maintain same sort of decentralized power and system of checks and balances. • In practice: – Division of power between the Board of Governors in Washington and the Federal Reserve Banks in 12 cities. – Division of power between the Federal Government, the banking industry, non-bank business interests. • Consequence: Separate but important roles Structure of the Fed Fed consists of 2 parts: • Regional Feds – split into 12 district banks; each is owned by local commercial banks • Fed HQ in DC – consists of Board of Governors and FOMC, and also comprises research functions. – The largest Federal Reserve Banks in terms of assets are: New York (2nd district), Chicago (7th district), and San Francisco (12th district). – The Federal Reserve Bank of New York is the largest and most important, reflecting the role of New York as the financial center of the US and the world. – The Federal Reserve Bank of Boston is headquarters for the 1st district. Monetary policy Monetary policy tools are: • Reserve requirements: requiring banks to keep a certain % of deposits as reserves least frequently used • Discount rate changes: rate that banks pay for borrowing from the Fed. • Open market operations: buying and selling of government debt to expand or contract money supply most commonly used. Formal Structure of the Fed Board of Governors • Seven members headquartered in Washington, D.C. • Appointed by the president and confirmed by the Senate. • Each serves a 14-year non-renewable term. • Required to come from different districts. • Chairman is chosen from the governors and serves a four-year term. Duties of the Board of Governors • Votes on conduct of open market operations • Sets reserve requirements • Controls the discount rate through “review and determination” process • Sets salaries of president and officers of each Federal Reserve Bank and reviews each bank’s budget • Approves bank mergers and applications for new activities • Specifies the permissible activities of bank holding companies • Supervises the activities of foreign banks operating in the U.S. Chairman of the Board of Governors • Advises the president on economic policy • Testifies in Congress • Speaks for the Federal Reserve System to the media • May represent the U.S. in negotiations with foreign governments on economic matters Federal Reserve Districts Fed district banks • Each Federal Reserve Bank is a legally separate corporation that is owned by the commercial banks in its district. • Quasi-public institution. • Member banks elect six directors for each district; three more are appointed by the Board of Governors – 3 Class A Directors = bankers, elected by member banks. – 3 Class B Directors = other business leaders in industry, commerce, and agriculture, also elected by member banks. – 3 Class C Directors = representatives of the non-bank public, appointed by the Board of Governors. Functions of the Federal Reserve District Banks • • • • • • • • • Clear checks Issue new currency Withdraw damaged currency from circulation Administer and make discount loans to banks in their districts Evaluate proposed mergers and applications for banks to expand their activities Act as liaisons to the business community Examine bank holding companies and state-chartered member banks Collect data on local business conditions Use staffs of professional economists to research topics related to the conduct of monetary policy Federal Reserve District Banks and Monetary Policy • Directors “establish” the discount rate – The directors of each bank recommend a setting for the discount rate, which is then approved by the Board of Governors. • Decide which banks can obtain discount loans • Directors select one commercial banker from each district to serve on the Federal Advisory Council which consults with the Board of Governors and provides information to help conduct monetary policy • Five of the 12 bank presidents have a vote in the Federal Open Market Committee (FOMC) – The New York Fed runs the Open Market Desk, where open market operations are conducted at the request of the FOMC Member commercial banks • All national banks are required to be members – Commercial banks chartered by states are not required but may choose to be members • Before 1980, only member banks were required to hold reserves as vault cash or deposits at Fed Banks. – These reserves do not pay interest. Many states allowed nonmember banks to hold reserves in the form of interest-earning securities. As a result, many state banks chose not to become members and, as interest rates rose during the 1970s, many state banks who were members decided to leave the Federal Reserve System. • Depository Institutions Deregulation and Monetary Control Act of 1980 subjected all banks to the same reserve requirements as member banks and gave all banks access to Federal Reserve facilities. Informal Structure of the Fed Monetary policy in practice • Monetary policy effectively determined by the FOMC at its meetings every 6 weeks (or sooner) • They determine Open market operations and usually determine the level of the discount rate too • Chairman of the Fed also testifies to Congress and the Senate on a regular basis • Chairman advises the U.S. President on economic policy • Fed is not completely independent of government – can be influenced by the White House to a degree. Federal Open Market Committee • The Federal Open Market Committee (FOMC) meets eight times per year. • The FOMC consists of: – All 7 members of the Board of Governors. – The president of the New York Fed and four other Reserve Bank presidents. • The seven Reserve Bank non-voting presidents are not on the FOMC, but they still attend the meetings and participate in the discussions. – The Governors as a group have 7 of the 12 votes–and hence a majority of the votes on FOMC FOMC’s roles • The FOMC’s principal role is to make decisions regarding the conduct of open market operations. • Thus, the FOMC controls the monetary base, and thereby exerts the most powerful influence on the money supply as a whole. • Within the Federal Reserve System, the FOMC plays the most important role in formulating monetary policy. • Three key documents are prepared before each FOMC meeting: – Green Book = Contains forecasts for the US economy – Blue Book = Contains an outline of different monetary policy options – Beige Book = Contains a description of economic activity within each of the 12 Federal Reserve districts. • Only the beige book is released to the public. How Independent is the Fed? • Instrument and goal independence. • Independent revenue. • Fed’s structure is written by Congress, and is subject to change at any time. • Presidential influence: – Influence on Congress – Appoints members – Appoints chairman although terms are not concurrent Central Bank Independence Factors making Fed independent 1. Members of Board have long terms 2. Fed is financially independent: This is most important – only Fed can run the printing presses and it gives government its profits at the end of the year. Factors making Fed dependent 1. Congress can amend Fed legislation 2. President appoints Chairmen and Board members and can influence legislation Overall: Fed is relatively independent compared with other central banks around the world. Explaining Central Bank behavior Theory of bureaucratic behavior: bureaucracy’s objective is to maximize its political influence and its member’s welfare 1. Is an example of principal-agent problem: principals are the voters, agents are the bureaucracies 2. Bureaucracy often acts in own interest – not in the country’s Implications for Central Banks: 1. Act to preserve independence 2. Try to avoid controversy: often plays games 3. Seek additional power over banks Independence: the case for and against Should Fed be Independent? Case For: 1. Independent Fed likely has longer-run objectives, politicians don't: evidence is better policy outcomes 2. Avoids political business cycle 3. Less likely deficits will be inflationary Case Against: 1. Fed may not be accountable to public 2. Hinders coordination of monetary and fiscal policy 3. Fed has often performed badly – e.g. Great Depression