File

advertisement

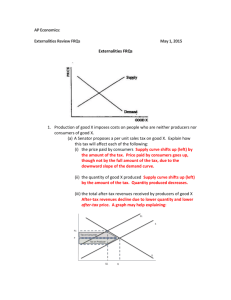

Market Failure and the Role of Government Capitalism Review 2 Characteristics of Capitalism 1. Private property 2. Freedom of choice 3. Self-interest 4. Competition 5. Prices, not bureaucrats, guide decisions 6. Limited Government 3 Heritage Foundation’s 2014 Index of Economic Freedom 4 Bottom 10 5 Freedom creates wealth! 6 North Korea South Korea 7 Does the free market always work perfectly? Can economic efficiency ever be improved by government intervention? 8 Market Failure A situation in which the free market fails to satisfy society’s needs and wants efficiently 9 Types of Market Failures 1. Public Goods 2. Externalities 3. Monopolies 4. Income Inequality 10 Public Goods Video: Free Market Fire Department 11 Market Failure #1: PUBLIC GOODS Why is the free market bad at providing public goods? Free Riders! People who benefit from something without paying for it 13 Free Rider Good Citizen 14 The Free Rider Problem Examples: 1. People who download music illegally 2. People who watch a street performer and don’t pay 3. Teenagers that live at home and don’t have a job 15 Does anyone free ride off you? •Canadian Military Spending: 1% of GDP •US Military Spending: 4.4% of GDP Why doesn’t Canada spend more on defense? 16 17 What’s Wrong With Free Riders? Free Riding Less Less revenue potential profit Less incentive to Firms produce less than the produce socially optimal quantity Possible solutions: 1. Punish free-riders 2. Have government provide the good 18 Trimester Grades •I’m willing to give everyone an A if you guys give me $500 •Everyone in the class will get an A - even those who don’t contribute anything •Who’s willing to pay? 19 Public Goods Defined 20 Definition True public goods meet two criteria: 1. Non-excludable •Impossible to exclude people from enjoying its benefits (even if they don’t pay). Example: National Defense 2. Non-rival •One person’s consumption doesn’t affect anyone else’s •Example: A Fireworks Show 21 Identify which of the following are TRUE public goods (have non-exclusion and non-rival consumption): 1. Hamburgers 2. Satellite TV 3. The Grand Canyon 4. A house 5. Street lights 6. Highways 22 National defense is an example of a public good because A) it requires tax revenues to fund any production (B) one person’s use of it will decrease another person’s ability to use it (C) it is nonexcludable and nonrival (D) the private market typically produces the socially efficient level of output (E) the public is protected from invasion National defense is an example of a public good because A) it requires tax revenues to fund any production (B) one person’s use of it will decrease another person’s ability to use it (C) it is nonexcludable and nonrival (D) the private market typically produces the socially efficient level of output (E) the public is protected from invasion Could the federal government… 1.Stop most illegal immigration? 2.Make sure everyone in the US has a job? 3.Build a research station on Mars? It probably could! Then why doesn’t it? The costs outweigh the benefits 26 How should the government decide how much of a public good to produce? Weigh the Costs and Benefits! 27 In Theory… A good’s Marginal Social Benefit curve is equal to its demand curve (based on individuals’ willingness to pay for it) A good’s Marginal Social Cost curve is its marginal cost curve plus any externalities Video: Dam Tragedy Demand for a New Park Marginal willingness to pay higher taxes # of Parks 1 2 3 4 5 Adam is Jill is willing to willing to pay pay $4 $3 $2 $1 $0 $5 $4 $3 $2 $1 Society’s Assume: Marginal Demand 1. There areCost only (MSB) two people in $9 society. $5 2. $7 Each $5 additional park $5 costs $5 $5 $3 $5 How many parks $1should$5 be made? Demand for a New Park Marginal willingness to pay (higher taxes) # of Parks 1 2 3 4 5 Adam is Jill is Society’s Marginal willing to willing to Demand Cost pay pay (MSB) $4 $3 $2 $1 $0 $5 $4 $3 $2 $1 $9 $7 $5 $3 $1 $5 $5 $5 $5 $5 Demand for a New Park Marginal willingness to pay higher taxes # of Parks 1 2 3 4 5 Adam is Jill is Society’s Marginal willing to willing to Demand Cost pay pay (MSB) $4 $3 $2 $1 $0 $5 $4 $3 $2 $1 $9 $7 $5 $3 $1 $5 $5 $5 $5 $5 Supply and Demand for Public Parks The Demand is the equal to the marginal benefit to society Price $9 7 5 3 1 D=MSB 0 1 2 3 4 Quantity of Parks 5 Supply and Demand for Public Parks 1. What if the government made 1 park? 2. What if the government made 4 parks? Price $9 7 MSB = MSC S=MSC 5 The supply is the public good’s marginal cost to society 3 1 0 1 2 3 D=MSB 4 Quantity of Parks 5 What is an externality? A side effect of an economic action that is felt by an unrelated third party 34 Externalities Consumers and firms sometimes fail to consider the external costs and benefits of their actions – i.e. how their actions will affect other people As a result, the free market may fail to produce the “socially optimal” quantity of some goods Negative Externalities 36 Negative Externalities (aka: Spillover Costs) Costs resulting from an economic action that are felt by an unrelated third party 37 Example: Whistle Tips 38 Example 2 Zoram Pharmaceutical Co. pollutes the air when it manufactures Spazoprolam, a new drug that helps you dance better Zoram only considers its INTERNAL costs (ignores the social cost of pollution) If Zoram had to pay all costs, it would produce less Market for Spazoprolam The marginal private cost doesn’t include the costs to society P Supply = Marginal Private Cost D=MSB QFree Market Q 40 Market for Spazoprolam What will MC/Supply look like when EXTERNAL cost are factored in?Supply = P Marginal Social Cost Supply = Marginal Private Cost D=MSB QOptimal QFree Market Q 41 Market for Spazoprolam At QFM the MSC is greater than the MSB. Too much is being produced P S =MSC S=MPC Overallocation D=MSB QOptimal QFree Market Q 42 Market for Spazoprolam What should the government do to fix a negative externality? P S =MSC S=MPC Solution: Tax the amount of the externality (Per Unit Tax) D=MSB QOptimal QFree Market Q 43 Market for Spazoprolam What should the government do to fix a negative externality? P S =MSC =MPC MSB = MSC S=MPC Solution: Tax the amount of the externality (Per Unit Tax) D=MSB QOptimal QFree Market Q 44 Positive Externalities 45 Positive Externalities (aka: Spillover Benefits) Benefits from an economic action that are enjoyed by an unrelated third party. (E.g.: Vaccines, Education, Home Renovation) 46 Example: A mom decides to get the MMR vaccine for her child • Mom only looks at the INTERNAL benefits (the reduced risk of her own daughter getting sick) • If parents considered the social benefits (the reduced likelihood that her daughter will spread diseases to other children), demand would be greater Market for MMR vaccine The marginal private benefit doesn’t include the additional benefits to society. P S = MSC QFree Market D=Marginal Private QBenefit 48 Market for MMR vaccine What will the MB/D look like when P EXTERNAL benefits are factor in? S = MSC QFM QOptimal D=Marginal Social Benefit D=Marginal Private QBenefit 49 Market for MMR vaccine If the market produces QFM why is it a market failure? P S = MSC D=Marginal Social Benefit D=MSB QFM QOptimal Q 50 Market for MMR vaccine P At QFM the MSC is less than the MSB. Too little is being produced S = MSC Underallocation QFM QOptimal D=Marginal Social Benefit Q 51 Market for MMR vaccine What should the government do to fix a negative externality? P Subsidize the amount of the externality (Per Unit Subsidy) S = MSC D=MSB =MPB D=MPB QFM QOptimal Q 52 Seating Chart! 53 “I’m writing you a prescription for pecan pie” The Tragedy of the Commons a.k.a. The Common Pool Problem Why are public bathrooms so nasty? • No one who uses them has an incentive to keep them clean! • This problem – called the “Tragedy of the Commons” or the “Common Pool Problem,” applies to any nonexcludable good • e.g. The air, the oceans, rivers, etc. What can be done about this? Market Failure #3 Monopolies 57 Monopoly Socially UnregulatedOptimal P $9 8 7 6 MC Fair Return 5 4 3 2 ATC D MR 1 2 3 4 5 6 7 8 9 10 Q 58 Government in Action: Antitrust Laws Legislative Executive Judicial 59 Anti-Trust Laws Laws designed to break up monopolies and promote competition. •Prompted by growth of Standard Oil and Carnegie Steel Why are monopolies a Market Failure? •They are neither productively nor allocatively efficient 60 WHAT DOES THE GOVERNMENT DO? Legislative Branch •Passed Sherman Act of 1890“Every person who shall monopolize …or conspire to monopolize…shall be deemed guilty of a felony.” Executive Branch •Federal Trade Commission must approve all corporate mergers. •Justice Department prosecutes anti-competitive firms Judicial Branch •Federal Courts adjudicate antitrust complaints 61 Market Failure #4 Wealth Inequality 62 Wealth Inequality • In 2014, the mean household income in the U.S. was $72,641 • In 2014, the median household income was $51,939 How can this be? 63 The Lorenz Curve and Gini Coefficient 64 Measuring Income The process: Distribution • Divide households into quintiles based on income • If perfect equality, 20% of families should earn 20% of income, 40% should earn 40%...etc. • Compare actual distribution (Lorenz Curve) to perfect distribution – ratio is the Gini Coefficient 65 Measuring Income Distribution Example: Group #1 (Poorest 20%) • Total of $5Bn (5% of total income) Group #2 • Total of $10Bn (10% of total income) Group #3 • Total of $15Bn (15% of total income) Group #4 • Total of $25Bn (25% of total income) Group #5 (Richest 20%) • Total of $45Bn (45% of total income) 66 The Lorenz Curve Percent of Income 100 80 Perfect Equality 60 40 20 0 20 40 60 80 Percent of Families 100 67 The Lorenz Curve Percent of Income 100 Lorenz Curve (actual distribution) 80 Perfect Equality 60 55 40 30 20 15 5 0 20 40 60 80 Percent of Families 100 68 The Lorenz Curve Percent of Income 100 Lorenz Curve (actual distribution) 80 Perfect Equality 60 55 40 The size of the banana shows the degree of income inequality. 30 20 15 5 0 20 40 60 80 Percent of Families 100 69 The Lorenz Curve 100 Percent of Income After Redistribution 80 Perfect Equality 60 55 40 The banana gets smaller when the government redistributes income 30 20 15 5 0 20 40 60 80 Percent of Families 100 70 The Lorenz Curve Percent of Income 100 80 Perfect Equality 60 A 55 40 Gini Coefficient = A/(A+B) B 30 20 15 5 0 20 40 60 80 Percent of Families 100 71 Government Policy to Reduce Inequality Transfer Payments (AKA “welfare”) and Taxes 72 Welfare provides a safety net for citizens (retirement, unemployment, workers comp, health care, etc.) What are some possible downsides? Where does the government get the money for welfare? 73 Taxes 74 What are Taxes? Taxes – mandatory payments to the government Two purposes: 1. Pay for government operations • Public goods: highways, national defense, police, the court system • Other programs: welfare, social security 2. Change economic behavior E.g. Excise tax on tobacco raises revenue AND discourages cigarette production 75 Three Types of Taxes 1. Progressive Taxes – higher income earners pay a higher percentage Ex: Current Federal Income Tax system 2. Proportional (Flat) Taxes – everyone pays the same percentage of income 3. Regressive Taxes – lower income earners pay a higher percentage Ex: Head tax, sales tax 76 Three Types of Taxes What kind of taxes are these? (Think % of Income) 1. Toll road tax ($5 per use) 2. State income tax where richer citizens pay higher % 3. $.45 tax per pack of cigarettes 4. Medicare tax of 1.45 % on every $ earned 5. 5.6% Arizona sales tax 77 Federal Income Tax Equal Tax of $350 per week (Regressive Tax) Income Amount of Tax % Amount to live on • $200 $350 175% -$150) • $350 $350 100% $0 • $500 $350 70% $150 • $1,000 $350 35% $650 • $5,000 $350 7% $4,650 Tax tax of 20% per week (Proportional Tax) Income Amount of Tax Amount to live on • $200 $40 $160 • $350 $70 $280 • $500 $100 $400 • $1,000 $200 $800 • $5,000 $1,000 $4,000 78 Federal Income Tax This is our current system. Is it fair? The final graph to learn for microeconomics… The Laffer Curve Illustrates the relationship between tax rate and tax revenue 80 The Laffer Curve % Tax Rate If government raises tax rates, revenue will increase…to a point. If the tax rate becomes too high, tax revenue will eventually fall. Why? Tax Revenue 81 GREAT NEWS… WE’RE DONE WITH MICRO! 82