neither analysis

advertisement

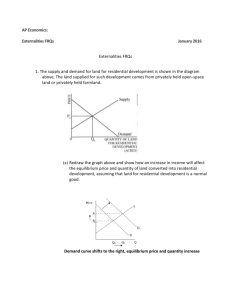

AP Economics: Externalities Review FRQs May 1, 2015 Externalities FRQs 1. Production of good X imposes costs on people who are neither producers nor consumers of good X. (a) A Senator proposes a per unit sales tax on good X. Explain how this tax will affect each of the following: (i) the price paid by consumers Supply curve shifts up (left) by the amount of the tax. Price paid by consumers goes up, though not by the full amount of the tax, due to the downward slope of the demand curve. (ii) the quantity of good X produced Supply curve shifts up (left) by the amount of the tax. Quantity produced decreases. (iii) the total after-tax revenues received by producers of good X After-tax revenues decline due to lower quantity and lower after-tax price. A graph may help explaining: (b) Explain how imposing this tax might result in greater economic efficiency than would be achieved in an unregulated competitive market. Tax will move supply curve to the left, making equilibrium closer to where MSC=MSB. 2. The graph below shows the price (P0) and quantity (Q0) at which there is an efficient allocation of resources. However, in some cases the market fails to allocate resources efficiently. (a) Assume the chemical industry is polluting the air. (i) Using marginal benefit and marginal cost analysis, explain how the chemical industry is misallocating resources. Air pollution imposes a cost on society not borne by the industry. MSC > MPC, so MSC > MSB and the industry will overallocate resources. (ii) Identify one policy or action the government could take to correct this market failure. 1) Impose a per unit tax on the industry, or 2) limit quantity produced, 3) impose a price ceiling that effectively limits quantity produced or 4) limit production by requiring permits, or 5) initiate liability lawsuits (b) Assume it is difficult to exclude nonpayers from enjoying the benefits of national defense. (i) Using marginal benefit and marginal cost analysis, explain how the private market will fail to produce the efficient level of national defense. MSB > MSC, but the private market will produce at the intersection of MPC and MPB, a lower quantity. (ii) Identify one policy or action the government could take to correct this market failure. Subsidize producers or government produces public product 3. Assume that product X is produced in a perfectly competitive industry and product X yields costs to individuals who are neither consumers nor producers of product X. (a) Using one correctly labeled graph, show the industry output and price under each of the following conditions: (i) the industry ignores the externality Correct labels; show MPC curve and higher MSC curve; MSB demand curve; equilibrium at intersection of MPC and MSB curves (ii) the industry produces the socially optimal level of output Correct labels; show MPC curve and shift to higher MSC curve; downward sloping MSB demand curve; increase in price and decrease in quantity (b) Assume the market is producing the level of output you identified in (i). Identify one policy the government might use to achieve the level of output you identified in (i). 1) Impose a per unit tax on the industry, or 2) limit quantity produced, 3) impose a price ceiling that effectively limits quantity produced or 4) limit production by requiring permits, or 5) initiate liability lawsuits