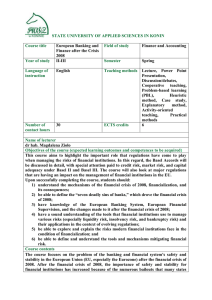

Core Principles for Effective Banking Supervision

advertisement

Presentation to the Portfolio Committee on Finance Annual Report 2006 Bank Supervision Department Cape Town 7 August 2007 Mr Errol Kruger Registrar of Banks Agenda Introduction Developments/activities in banking supervision Developments related to banking legislation Salient information on the South African banking sector Trends in South African banks 2 Introduction The Bank Supervision Department executes the functions assigned to the Registrar of Banks under the Banks Act, 1990 and its mission is: To promote the soundness of the banking system through the effective and efficient application of international regulatory and supervisory standards. 3 Developments/activities in banking supervision 4 Outline Core Principles for Effective Banking Supervision Development of bank directors New Capital Accord (Basel II) Compliance with anti-money laundering legislation International supervisory interaction Proliferation of credit in South Africa Combating illegal deposit taking Training of Department’s staff Other 5 Core Principles for Effective Banking Supervision 6 Description of the Core Principles for Effective Banking Supervision The Core Principles comprise twenty-five fundamental requirements, covering various components and aspects of a bank supervisory system, that need to be complied with for a banking supervisor to operate effectively and for banks to operate in a safe and sound manner. 7 Background to Core Principles Core Principles originally published in 1997 Core Principles Methodology - published in 1999 allows for uniform assessment Developed by the Basel Committee on Banking Supervision at request of G7 Finance Ministers Developed in close cooperation with supervisors across the world IMF and World Bank monitors implementation of Core Principles 8 Uniqueness of the Core Principles The first comprehensive document dealing with banking supervision Resulted in the establishment of first non-G10 Basel Committee working group, i.e. the Core Principles Liaison Group (renamed December 2006 as International Liaison Group - ILG) – Originally tasked to discuss and oversee the application of Core Principles – Developed into a high-level forum for the Basel Committee liaison with senior non-G10 supervisors, the IMF and World Bank • South Africa active member of ILG 9 Objectives of the Core Principles Provision of sufficient powers, independence and resources to supervisory authorities Provision of a roadmap for a sound supervisory framework Strengthening legal framework Establishment of appropriate checks and balances Establishment of good governance practices 10 Myths of the Core Principles The Core Principles do not: provide an instant “magic potion” for countries with inexperienced supervisors or weak supervisory regimes repair economic/financial mismanagement change (reduce) the responsibilities of the supervisory authority guarantee that no bank will fail 11 Revision of the Core Principles Significant developments in banking and bank regulation since 1997, inter alia: – Enhanced risk management – Corporate governance issues – Anti-money laundering and terrorist financing concerns Lessons from the IMF/World Bank FSAPs – more precision required on certain issues However, the objective was to update and not to “change the goalposts” 12 Revision of the Core Principles (cont.) Establishment of the Basel Core Principles Reference Group BCP Reference Group consisted of members from Basel Committee and International Liaison Group – South Africa participated Revised Core Principles published in October 2006 13 Compliance with revised Core Principles Bank Supervision Department performed a Core Principles self-assessment in 2006 Objectives of self-assessment – Benchmark South African banking system against revised Core Principles – Conduct comprehensive gap analysis – Develop action plans to eliminate identified shortcomings Project commenced first half 2006 - prior to finalisation of revised Core Principles, further changes therefore closely monitored and considered 14 Compliance with revised Core Principles (cont.) Project team established to co-ordinate and steer assessments Conservative approach, every compliance grading supported by one or more of: – Banks Act, 1990 – Regulations relating to Banks – Supervisory process Culminated in workshop attended by all staff Project team continues to meet to assess implementation of action plans 15 Development of bank directors 16 Individual banks’ induction and training programmes Department continued to focus on banks’ corporate governance processes in 2006 Department analysed banks’ induction and training programmes – diverged significantly Banks’ operations are unique, however bank directors should be exposed to homogenous development programmes 17 Director development programme for banking sector Department communicated divergence of induction and training programmes to The Banking Association South Africa – No bank-specific development programme available Banking Association requested University of Pretoria to develop director development programme Development programme consists: – Introductory course – Governance-level risk management course – Leadership forum – focus on “real-life” experience 18 Director development programme for banking sector (cont.) Development programme satisfies needs of new and experienced directors Comprehensive programme – provides solid foundation for new directors entering banking sector Banks Act Circular 9/2006 – Banks’ chairpersons encouraged to utilise programme – Development programme supplementary to individual banks’ internal programmes 19 New Capital Accord (Basel II) 20 Introduction Efficient management of capital essential for stability of individual banks and banking system Capital management – part of overall risk management framework Basel II – Basel Committee’s revised guidance on regulatory capital Basel II to be implemented by all South African banks on 1 January 2008 21 Accord Implementation Forum Accord Implementation Forum (AIF) – body established to pursue sound and robust implementation of Basel II – South African Reserve Bank, all commercial banks, National Treasury, South African Institute of Chartered Accountants and Banking Association AIF stakeholders intensified efforts during 2006 Department engaged actively with AIF working group chairpersons following November 2006 issuing of draft 3 of the proposed Regulations – Conclude high-priority issues to be incorporated in draft 4 of Regulations 22 Overview of Basel II approaches Basel I did not allow for different approaches Basel II offers menu of approaches, particularly for credit risk and operational risk Advanced approaches are subject to approval from the Department – Applications to be processed during 2007 23 Overview of Basel II approaches – Credit risk 24 Overview of Basel II approaches – Operational risk 25 Conclusion Significant progress made with Basel II project Supervisors worldwide face many challenges in ensuring effective and appropriate implementation for their respective countries Chairman of Basel Committee – Supervisors have utilised supervisory tools in the past which fortunately will still be relevant for Basel II implementation, such as sound judgement 26 Compliance with Financial Intelligence Centre Act, 1990 Department performed review to verify compliance with requirements of Financial Intelligence Centre Act (FICA) – Largest 5 banks reviewed in 2005 – Similar review of remaining local banks and selected branches of foreign banks in 2006 All banks have made good progress in implementing anti-money laundering and counterterrorist financing measures Role of internal audit function proposed to be extended to include FICA requirements 27 International supervisory interaction Meetings held with supervisors in Argentina, Mauritius and Namibia Department attended seminar hosted by Indonesian supervisory authorities Department maintained participation in Basel Committee working groups and Financial Stability Institute training initiatives Department participated in IMF and World Bank events 28 Proliferation of credit in South Africa Public exposed to new names linked to banking services Confusing, banking names linked to retail outlets, cellular phone service providers and others Form – joint ventures or divisions of banks not stand-alone initiatives Uncertainty as regards origin and soundness of above initiatives Supervisory viewpoint – Department ensures prudent risk-management of above joint ventures or bank divisions 29 Combating illegal deposit taking Department responsible for regulation and supervision of registered banks Department not responsible for registering or supervising investment schemes However, Banks Act – powers to control activities of unregistered persons conducting banking business Approximately 40 unregistered businesses or investment schemes investigated by Department in 2006 30 Training of Department’s staff IMF meeting on Financial Soundness Indicators in Brazil Financial Stability Institute’s (FSI) International Banking Supervision seminar in Switzerland and subscription to FSI Connect – web-based training Seminars of national supervisory authorities in the United Kingdom and United States Ongoing Basel II training Department hosted and presented Intermediate course in risk-based supervision, attended by SADC countries 31 Other supervisory developments in 2006 Department attended International Conference of Banking Supervisors in Mexico International Monetary Fund conducted Article IV consultation Market-risk and liquidity risk management in South African banks Joint Forum’s working stream on the supervision of financial conglomerates Implementation of the Auditing Profession Act, 2005 32 Developments related to banking legislation 33 Introduction Department continued to ensure legal framework remains relevant and current Department reviews banking legislation – Banks Act, 1990 – Mutual Banks Act, 1993 – Regulations to above Acts Incorporation of guidelines of Basel Committee and other international standard-setters, inter alia: – Basel II – Core Principles for Effective Supervision 34 Banks Act, 1990 Banks Amendment Bill through a thorough consultation process in 2006 – Accord Implementation Forum – Standing Committee approval – Ministerial approval During 2007 Bill approved by Cabinet and Portfolio Committee on Finance 35 Regulations relating to Banks Drafting of proposed Regulations managed via AIF structure Draft 3 of proposed Regulations submitted to Minister of Finance in August 2006 for initial review Revised draft discussed at Standing Committee meeting in first half 2007, subsequently revised and issued for public comment in first half 2007 Final draft to be tabled at August 2007 Standing Committee meeting for approval Following above approval, to be submitted to Minister of Finance for consideration and ultimate approval 36 Salient information on the banking sector May 2007 37 Salient information on the banking sector – May 2007 The banking system consists of: – Registered banks – Mutual banks – Local branches of foreign banks – Foreign banks with approved local representative offices 20 2 14 43 38 Salient information on the banking sector* Dec 2005 Dec 2006 May 2007 Total assets (R billions) 1 677,5 2 075,1 2 221,5 Loans and advances (R billions) 1 338,3 1 721,9 1 880,9 Funding related liabilities to the public (R billions) 1 358,9 1 694,1 1 825,4 Non-bank funding (R billions) 1 101,5 1 353,2 1 471,5 133,3 164,9 181,0 Capital adequacy ratio (%) 12,7 12,3 12,4 Return on equity – smoothed (%) 15,2 18,3 18,8 Return on assets – smoothed (%) 1,2 1,4 1,4 Efficiency ratio – smoothed (%) 66,3 58,9 57,2 Non-performing loans (R billions) 20,1 18,8 22,0 Non-performing loans as % of loans and advances 1,5 1,1 1,2 Specific provisions as % of non-performing loans 59,4 54,4 47,3 Capital and reserves (R billions) * Excludes representative offices 39 Distribution of total banking sector assets (R billions) Market Share % May 2007 Dec 2005 Dec 2006 May 2007 5 Largest banks 1 502,6 1 862,3 1 992,9 89,7 Standard Bank 436,3 530,6 564,4 25,4 Absa 358,6 446,4 483,3 21,8 FirstRand 307,3 388,2 414,9 18,7 Nedbank 303,2 379,3 399,5 18,0 Investec 97,1 117,8 130,9 5,9 175,0 212,8 228,6 10,3 1 677,5 2 075,1 2 221,5 100 Other Total Banks 40 Trends in South African banks December 2006 41 Balance-sheet structure 42 Aggregate balance sheet – R2 075,1 billion 43 Composition of liabilities – R2 075,1 billion 44 Composition of non-bank deposits – R1 353,2 billion 45 Composition of non-bank deposits according to maturity – R1 353,2 billion 46 Composition of total assets – R2 075,1 billion 47 Total loans and advances – R1 735,8 billion 48 Composition of loans and advances – R1 735,8 billion 49 Capital adequacy 50 Capital-adequacy ratio – 12,3 per cent 51 Distribution of banks in terms of capital adequacy 52 Qualifying capital and reserves – R153,3 billion 53 Risk profile of on and off-balance-sheet items 54 Profitability 55 Composition of the income statement 56 Interest margin – 3,4 per cent 57 Growth in staff expenses, number of employees and number of branches 58 Efficiency ratio of the banking sector – 58,9 per cent 59 Efficiency of banking institutions according to asset value 60 Profitability (12-month smoothed average) 61 Liquidity risk 62 Statutory liquid assets (actual versus required) – R96,3 billion vs R86,6 billion 63 Deposits from banks’ ten largest depositors - R389,4 billion (as percentage of total funding – R1 694,1 billion) 64 Anticipated maturity of short-term funding – R384,8 billion (as percentage of total funding – R1 694,1 billion) 65 Derivative contracts 66 Turnover in derivative contracts – R2 618,2 billion 67 Total unexpired derivative contracts – R9 272,2 billion 68 Credit risk 69 Total banking-sector overdues – R18,8 billion 70 Net overdues (R8,5 billion) as percentage of net qualifying capital and reserves (R153,3 billion) 71 Composition of overdues – R18,8 billion (as percentage of loans and advances – R1 735,8 billion) 72 Analysis of overdues – R18,8 billion 73 Coverage ratio (specific provisions and security as percentage of gross overdues) 74 Large exposures (granted – R511 billion and utilised – R266 billion) percentage of net qualifying capital and reserves – R153,3 billion 75 Asset performance 76 Currency risk 77 Maximum effective net open foreigncurrency position as percentage of net qualifying capital and reserves 78 Position in foreign-currency instruments US$14,9 billion vs –US$14,6 billion 79 Thank you for your attention 80