Interest Rate Risk - Utah's Credit Unions

advertisement

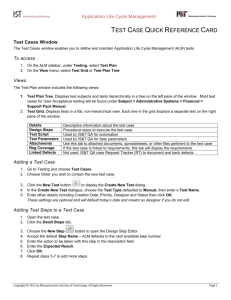

Pierre Cardenas Senior Consultant CU Lending Advice President Innovators of Change LET’S TAKE A LOOK AT WHAT IS HAPPENING IN THE INDUSTRY FIRST CREDIT UNIONS LANDSCAPE Trend line: 2003 2010 2011 2012 No. of U.S. Credit Unions: 9,750 7491 7236 7163 Consumer Member-Owners: 84.3M 92.6M 93.1M 93.7M Assets: 1.04T 628B 923B 974B Loans: 582.3B 387B 581B 582.2B Membership grew 8.3M in 7 year span (‘03 – ’10) approx. 1.1 Mil per year. End of 2010 – 1st Qtr 2012 also at 1.1M -2,587 less credit unions in the US, -73 less in the last year MOBILE TECHNOLOGY IS QUICKLY BEING ADOPTED BY CONSUMERS Tracking consumer behavior over time provides a picture of how they may act in the future WWW.BAI.ORG/RESEARCH 10 “ALM IS THE PROCESS OF EVALUATING BALANCE SHEET RISK AND MAKING PRUDENT DECISIONS, WHICH ENABLES A CREDIT UNION TO REMAIN FINANCIALLY VIABLE AS ECONOMIC CONDITIONS CHANGE. A SOUND ALM PROCESS INTEGRATES STRATEGIC, PROFITABILITY, AND NET WORTH PLANNING WITH RISK MANAGEMENT.” NCUA REGULATORY GUIDELINES AND BEST PRACTICES FOR ALM NCUA has spelled out best practices on ALM integration in Letters to Credit Unions as well as its Examiner’s Guide. In its January 2013 Letter to Credit Unions, NCUA stated that examiners will be focusing on assessing capacity by specifically looking at a CU’s “ability to mitigate interest rate and liquidity risk, especially where there are high levels of long-term assets funded by shortterm, less stable funds. This evaluation will include how [the] credit union has modeled its earnings, capital, and liquidity performance under stressed scenarios.” The NCUA has also emphasized ALM by issuing additional mandates on Interest Rate Risk management NCUA ASSESSES THE ADEQUACY OF A FICU’S ALM SYSTEM AS PART OF ITS CAMEL MODEL. Capital Adequacy, Asset Quality, Management, Earnings, and Liquidity/Asset-Liability Management. In its January 2013 Letter to Credit Unions, NCUA stated that examiners will be focusing on assessing capacity by specifically looking at a CU’s “ability to mitigate interest rate and liquidity risk, especially where there are high levels of long-term assets funded by short-term, less stable funds. The NCUA has also emphasized ALM by issuing additional mandates on IRR (Interest Rat Risk) management. Citing the “increasing exposure to IRR due to changes in the balance sheet composition and increased uncertainty in the financial markets” as its primary motives, the NCUA has begun requiring some FICU’s (approximately 45% -- those having more than $50 million and those having between $10 million and $50 million whose Supervisory Interest Rate Risk Threshold Ratio (SIRRT ratio) is greater than one, will need to have a written IRR Management policy. ALM PROCESS: 5 STEPS TO CONSIDER 1. Create a set of written policies and procedures 2. Apply NCUA guidelines, which are specific to IRR policies, to ALM policy 3. Establish a set of measurements for ALM analysis 4. Recommend establishing an “ALCO” committee 5. Evaluate the ALM program STEP 1 – CREATE A SET OF WRITTEN POLICIES AND PROCEDURES The board of directors is ultimately responsible for the establishment of a CU’s ALM objectives, policies, risk tolerance limits, stress testing, internal controls and regular monitoring procedures. Interest Rate Risk (IRR) is a major focus. §703.30 What are the responsibilities of my (a federal credit union’s) board of directors? The board of directors must establish a written investment policy that is consistent with the Act, and other applicable laws and regulations. The investment policy must address the following: (a) The purpose and objectives of your investment activities. 1ST STEP – HAVE A SET OF WRITTEN POLICIES AND PROCEDURES • Comprehensive policies and procedures should govern all aspects of the IRR management process. Such policies and procedures should ensure the IRR implications of new strategies • They should also document and provide for controls over permissible hedging strategies and hedging instruments. Institutions should ensure the assessment of IRR is appropriately incorporated in firm-wide risk management efforts so that the interrelationships between IRR and other risks are understood. • IRR tolerances articulated in an institution’s policies should be explicit and address the potential impact of changing interest rates on earnings and capital from a short-term and a long-term perspective • Well-managed institutions generally specify IRR tolerances in the context of scenarios of potential changes in market interest rates and a target or range for performance metrics SAMPLE POLICY CHARACTERISTICS OF INVESTMENTS Instead of using statements that address the maturity or weighted average life limits, the relation of a coupon to a cap or floor or other characteristics addressing interest rate risk, a credit union could choose instead to specify directly its risk limits by including statements such as the following: “investments must have a duration of less than 3 years and a convexity of no less than minus 0.5; investments must be estimated to have a price change of no more than 10 percent for a 300 basis point instantaneous, parallel shift in the yield curve.” • fixed rate investments issued by the US Treasury, the Federal Home Loan Mortgage Corporation (FHLMC), and the Federal National Mortgage Association (FNMA); • fixed rate federally insured deposits of 1 year or less; • securities with fixed rate coupons and maturities of 3 years or less; • variable rate securities with maturities less than 7 years indexed to Constant Maturity Treasury (CMT) yields of 1 year or less, adjusting at least annually, that have a coupon that is not a multiple of the index, and a lifetime cap at the time of purchase that is at least 300 basis points above the current coupon on the investment; • mortgage-backed securities issued or guaranteed by GNMA, FNMA or FHLMC having a weighted average life of 3 years or less. SETTING RISK LIMITS FOR INVESTMENTS IN RELATION TO YOUR NET CAPITAL & EARNINGS Maximum Allowable Reduction in Net Income From The Investment Portfolio Yield Curve Changes Maximum Allowable Investment Portfolio Market Loss to Net Capital +/- 100 bps a% x% +/- 200 bps b% y% +/- 300 bps c% z% a section of the ALM policy must still include the investment policy requirements which limit the amount of risk the credit union can take in its investment portfolio. STEP 2 – APPLY NCUA GUIDELINES TO ALM POLICY IRR management is a central element of an ALM program because Interest Rate Risk (IRR) on earnings and capital), liquidity risk and credit risk are the three primary risks facing a credit union. Other Risks included in the ALM Management are : • Concentration Risk – Having too much reliance in any one category or too much growth in only one. For example, - 30 year Real Estate Loans excessive; Money Markets & 9 mo. CDs - One member with over 10% of loans outstanding verses capital • Strategic Risk – Name change, expanding membership beyond sponsored employee group, changing charter or closing branches in favor of technology branches • Reputation Risk – News paper article announcing CU security breach 3 PRIMARY RISKS FACING CREDIT UNIONS 1. INTEREST RATE RISK, 2. LIQUIDITY RISK, 3. CREDIT RISK 1. IRR - INTEREST RATE RISK • Interest Rate Risk - Refers to the vulnerability of a credit union’s financial condition to adverse movements in market interest rates. Negative affects to a credit union’s earnings, net worth, and its net economic value, which is the difference between the market value of assets and the market value of liabilities. • Changes in interest rates influence a credit union’s earnings by altering interest- sensitive income and expenses (e.g., loan income and share dividends). • Changes in interest rates also affect the economic value of a credit union’s assets and liabilities because the present value of future cash flows and, in some cases, the cash flows themselves may change when interest rates change. • IRR takes several forms: Repricing risk, yield curve risk, spread risk, basis risk, and options risk. 1. The board of directors or a committee thereof shall review the savings association's interest-raterisk exposure and management of that risk. 2. The board of directors shall formerly adopt a policy for the management of interest-rate risk. 3. The management shall periodically report to the board of directors regarding implementation of the policy for interest-rate-risk management and shall make that information available upon request. 2. LIQUIDITY RISK Liquidity is a financial institution’s capacity to meet its cash and collateral obligations without incurring unacceptable losses. Adequate liquidity is dependent upon the institution’s ability to efficiently meet both expected and unexpected cash flows and collateral needs without adversely affecting either daily operations or the financial condition of the institution. Liquidity risk is the risk to an institution’s financial condition or safety and soundness arising from its inability (whether real or perceived) to meet its contractual obligations. The primary role of liquidity-risk management is to: (1) prospectively assess the need for funds to meet obligations (2) ensure the availability of cash or collateral to fulfill those needs at the appropriate time by coordinating the various sources of funds available to the institution under normal and stressed conditions. 3. CREDIT RISK • Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. • For most banks, loans are the largest and most obvious source of credit risk. • However, there are other sources of credit risk both on and off the balance sheet. • Off-balance sheet items include letters of credit unfunded loan commitments, and lines of credit. • Other products, activities, and services that expose a bank to credit risk are credit derivatives, foreign exchange, and cash management services. STEP 3 – ESTABLISH A SET OF MEASUREMENTS YOU WILL USE FOR ALM ANALYSIS Measurements need to look at the effects of internal decisions as well as external conditions on a variety of performance measures. • • • ALM includes the analysis of the impact and likelihood of risk events on the past, present and future According to NCUA guidelines, an adequate ALM model should look at the impact of a what-if scenario in a time frame of at least two years (preferable 5 years) in the future. • Tests of IRR risk exposure should include changes in rates of +/- 300 to 400 points Scenario analysis should test the impact on certain ratios, including, but not limited to: • Loan to Share Ratio Cost of Funds impact • Long Term Ratio Net Monthly Income • Return on Average Assets (ROA) Net Interest Margin • Net Worth to Assets Ratio Capital impact Other ALM measurements include: NEV (Net Economic Value) EVE (Economic Value of Equity) Gap Analysis Earnings Simulation Stress Testing Mix Analysis Comparing against past, present & future ALM models require a set of assumptions that require documentation . ESTABLISH A SET OF MEASUREMENTS FOR ALM ANALYSIS INTERNAL DECISIONS EXTERNAL CONDITIONS IMPACT ON Scenario Analysis: • Loan to Share ratio • Long Term ratio • Return on Average Assets (ROA) • Net Worth to Assets ratio • Cost of Funds impact • Net Monthly Income • Net Interest margin • Capital impact Other ALM Measures: • NEV (Net Economic Value) • EVE (Economic Value of Equity) • Gap Analysis • Earnings Simulation • Stress Testing • Mix Analysis • Comparing past, present & future 4. RECOMMENDED ESTABLISHING AN ASSET LIABILITY COMMITTEE (ALCO) Asset Liability Committee (ALCO) – a committee made up of senior managers who are responsible for overseeing the implementation, evaluation and monitoring of the ALM program • Allows for diverse brainstorming on changes to the underlying assumptions which should occur regularly and changes should also be documented • This group should integrate use of the system into every decision they make and be able to show the expectations and anticipated results forecasted • This committee also serves as an education process in developing other employees on the ALM framework and emphasize its use and importance on a daily basis Board members must monitor manager’s adherence to and use of ALM and hold them accountable for deficiencies. 5. EVALUATE THE ALM PROGRAM An independent review of an institution’s ALM program should take place on a regular basis. • Deficiencies should be identified, models-including the reasonableness and comprehensive inclusion of all underlying assumptions and results – should be back-tested for validity and recommendations should be made for corrective actions. • If an outside vendor is used to provide ALM – related services and technology, they should provide documentation of their system’s validity. The increasing interest rate risk that comes with many credit unions borrowing short to lend long, the NCUA has refocused its attention on asset-liability management functions. Agency issued rules requiring complex credit unions to develop a written IRR management policy and process as part of their ALM responsibilities. The NCUA said such policies will be considered in determining the insurability of credit unions. The bottom line is your credit union’s ALM policy needs to lessen the possibility of unforeseen future losses caused by changes in interest rates. It’s both a regulatory mandate and strategic management tool. AS YOU REVIEW YOUR ALM PROCESSES AND WORK TO MANAGE IRR, KEEP THE FOLLOWING POINTS IN MIND 1. Management controls very little in our business. Outside forces command much of what goes on in the financial world–members, who drive loan demand and influence liquidity; the economy and Federal Reserve, which influence interest rates; competition, which has less reliance on net interest margins. Be realistic in what you can do. 2. When measuring IRR, data integrity is critical. The data that inform your decisions must be accurate and reliable, and your analyses can only be as good as the tools used to compile the information. 3. ALM is not a budget. Changes are allowed and often necessary. While tracking trends is vital, no one can accurately predict where rates will be in the future. Management and the committee need to be prepared to make adjustments for cyclical and market changes, as well as for issues that arise within the credit union. 4. While no amount of preparation can predict the future, having your credit union prepared for multiple scenarios puts your asset-liability committee and management team in a better position to succeed. Validation of Practices An ALM expert can examine current processes to verify if they are Balance-sheet stability An outside viewpoint can determine how to guard against volatility while isolating risks where possible. Management and committee members can learn how to spot movements or tendencies in the balance sheet A SUGGESTED MODEL FOR RISK MANAGEMENT Reference: Sant, Raymond R. and R. W. Schroeder, “Credit Unions and Capital Adequacy: Managing Growth and Risk." International Journal of Business and Social Research, 2012, Vol.2, No. 6. (http://thejournalofbusiness.org/index.php/site/issue/view/14 LET’S TAKE A LOOK AND SEE WHAT WE CAN SEE! CREDIT UNION BUSINESS MODEL: 2002 VS. 2012 DATA AS OF DECEMBER 31, 2012 © CALLAHAN & ASSOCIATES, INC. 2002 2012 Change Interest Income 5.94% 3.66% -2.28% + Interest Expense 2.30% 0.73% -1.57% Net Interest margin 3.64% 2.94% -0.70% + Non-Interest Income 1.06% 1.47% 0.41% - Loss Provisions 0.35% 0.36% 0.01% - Operating Expenses 3.28% 3.19% -0.09% 1.07% 0.86% -0.21% ROA CU ASSETS 2012 $100,000,000.00 Annual Net Income $860,000.00 Mo. Net Income $71,666.67 LET’S DO OUR OWN SCENARIO’S 2002 2012 Change Interest Income 5.94% 3.66% -2.28% + Interest Expense 2.30% 0.73% -1.57% Net Interest margin 3.64% 2.94% -0.70% + Non-Interest Income 1.06% 1.47% 0.41% - Loss Provisions 0.35% 0.36% 0.01% - Operating Expenses 3.28% 3.19% -0.09% 1.07% 0.86% -0.21% ROA CU ASSETS 2012 $100,000,000.00 Annual Net Income $860,000.00 Mo. Net Income $71,666.67 INTEREST INCOME INTEREST EARNED FROM LENDING DEPOSITS INTERESTED EARNED FROM INVESTMENTS • New Autos * Mutual Funds • Used Autos * Money Market Mutual Funds • Indirect Auto Loans * Money Market • Unsecured 1st * Agency Debt • Mortgages * ABS – Asset backed securities > 1 yr • 2nd Lien Mortgages * AAA – rated securities with 9 mo. duration • Home Equity Loans • Visa • Business Loans INTEREST EXPENSE • Student Loans * All Deposit products you pay interest on • Participations ANY QUESTIONS? PIERRE CARDENAS Senior Consultant & President of IOC pierre@culendingadvice.com 512-619-0545