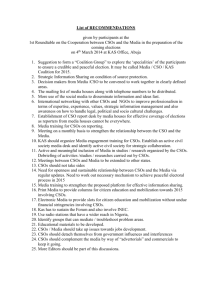

Legal framework affecting the establishment, operation and

advertisement

Overall on Legal Framework for Civil Society Organizations Presentation to PPWG Workshop By Nguyen Thi Bich Diep VNAH Hanoi, 5-2007 Purposes and Approaches Purposes Introduce the Legal Framework for Civil Society Organizations in general and in Vietnam Share internal and international experiences in improving this Legal Framework Approaches Broadly and generally Civil Society Organizations focused I. Civil Society Organizations (CSOs) in Vietnam Common charateristics: Non-state and non-market; and Voluntary; and Self management; and Self finance; and Not-for-profit CSOs in Vietnam Membership (known as association/ society) Mass organizations*; Associations, Unions, Federations, etc; Các hiệp hội nghề nghiệp* Community based organizations Non-membership (known as fund/foundation/NFP corporation) Non-membership organizations: research institutions, scientific institutions, centres working on development, education, training, poverty reduction, ect*; Social funds, charity funds, development funds; Not for profit companies/ corporations* Not sure 1. Religious organizations*; 2. Informal groups*; 3. International NGOs* II. Improvement of the legal framework shall enhance participation and contribution of CSOs in the socio-economic development 1. Increasing roles Economic impact Active workforce: all countries: 4.4%, Netherlands In Vietnam: no exact statistic is known (14.4%), US (9.8%), France (7.6%), In some transitioning countries: Czech Rep : 2% (74,000 employees); Hungary: 1.1% (~ 62,000 full time employees) Social impact Increasingly engage in health, culture, education, recreation, research, consultancy and comment on policies, social services, community development, and other activities relating to evaluation and monitoring, etc. Enhance participation and contribution of CSOs in the socio-economic development Scarce Government Resources Help fill the gaps and assure that missing public goods are provided where there is lack of government resource or failure of market Delivering public goods and services more efficiently, thanks to: Fact of volunteerism Competition Access to real needs Enhance participation and contribution of CSOs in the socio-economic development 2. Ensure the transparency and accountability For those CSOs with tax incentives or exemption/ deduction For those for public benefit CSOs who receive public support, government fund or donations As a legal base for certifying both CSOs and State’s transparent and fair management exercises Current legal framework for CSOs in Vietnam 1. Policies and directions by the Party and the State to encourage the growth of CSOs 2. Laws/bylaws that directly regulate the rights, establishment and operation of CSOs The Constitution (Art. 69) The Decree-law No 102/SL-L (1957) on Regulations on the Rights to Set Up Associations The Civil Code 1995, revised 2005 Laws on distinguished mass organizations (*) Decree No. 177/1999/ND-CP on Social Funds and Charity Funds Decree No. 88/2003/ND-CP on Associations Decree 35/1992/HDBT on management of scientific and technological activities Others III. Current legal framework for CSOs in Vietnam 3. Laws/bylaws closely related to Taxes Social services, public services Finance, funding, aids, donations, ODA Assurance of people participation Decentralization, grass-root democracy Examining, investigating, filing petition Others Currently, Vietnam is in the process of drafting the Law on Associations (upgraded from Decree 88/2003 on Associations) and reviewing relevant legal documents. Legal framework (con’t) Comparatively comprehensive in terms of number of laws/bylaws for distinguished CSOs Legal base for CSOs to engage in various activities (i.e. Art.22 Decree 88/ 2003 on Associations) … To provide consultation and comments on matters of concerns, and to contribute opinions on legal documents To propose and coordinate with concerned agencies and/or organizations on matters of concerned To raise funds and receive lawful financial supports of domestic and foreign sources Join international and regional organizations and activities … Certain types of taxes exemption and deduction available (subject to procedures) Legal framework (con’t) Issues for further improvement Complex Need be more comprehensive Not clear mechanism of state management Not sufficient mechanism for effective evaluation and monitoring Not sufficient tax incentives and supporting mechanism for sustainable finance Not sufficient dialogues and linkage among broad CSOs and Government and the Private sector IV. Khảo sát các tiêu chí xây dựng khung pháp lý tốt cho các tổ chức XHDS Purposes of a good legal framework Compromise rights, benefit and responsibilities, duties of relevant stakeholders Create a legal base to create a supportive, easy and transparent environment for CSOs to effectively develop and best contribute Promote stable and sustainable social and economic development Results of a good legal framework Protect Fundamental Freedoms when registration and operation Integrity and Good Governance Financial Sustainability Accountability and Transparency Create linkage between CSOs and the State sector, the private sector and the others 1. Protecting Fundamental Freedoms when registration and operation Registration CSOs should be allowed to come into existence and not be required to obtain legal personality in order to engage in lawful activities Registration should be relatively quick, easy, and inexpensive Registration agency/ies should be fair, clearly directed and adequately staffed with competent professionals Right to file a petition should be available Activities (not limited to) Be permitted to engage in activities for the benefit of their members and in public benefit or “charitable” activities Be certificated with Public Benefit Status in order to obtain more preferences Conduct research, discussion, consultation and comments on matters of concerns, and policies and programs of the State Be expose to mass media for and state media to inform their own activities * Those activities should be in accordance with laws and bylaws or morality or customs, and shall satisfy required procedures or conditions if any. 2. Integrity and Good Governance Mandatory Provisions for Governing Documents Strengthen monitoring and evaluation, and supervision Avoid any actual or potential conflict between their personal or business interests and the interests of the CSOs Make clear and prohibit distribution of profits Encourage voluntary Self-Regulation upon operation and management Encourage formation of umbrella organizations or network to adopt and enforce principles of voluntary self-regulation. 3. Financial Sustainability Fund raising: through legally acceptable and culturally appropriate fundraising activities Requirement: registration with a state organ or an independent supervisory organ, which will issue permits, badges, and other identification materials to the fund raisers, set standards for public solicitation activities, provide information to the public, and sanction inappropriate conduct Lawful economic, business, or commercial activities Requirement: Within the area of operation; no distribution of profits, certificated if required; possible tax durable Tax deduction and exemption, organizations, donors and donations specially for public benefit Special treatment for donation and investment in public benefit areas Foreign funding and aids: registered CSOs are allowed to Encouragement of volunteers receive cash or in-kind donations or transfers from aid agencies of another country 4. Accountability and Transparency Reporting Report to the licensing and/or management agency/ies: at least annually on its general finance and operation Report to tax and audit organs * All reports required of CSOs should be as simple to complete and as uniform among state organs as is possible, with appropriate provisions to protect the legitimate privacy interests (if any) Disclosure or Availability of Information to the Public required for significant activities or assets or with substantial public support Audit by authorized agencies or donors Subject to sanction when there is violation As equal to any legal person or subject as in the Civil code, and for violations of laws/ bylaws peculiar to CSOs 5. Improvement of Partnership Provide for regular or irregular, formal or informal exchanging and cooperating mechanism Encourage cooperation of Government – CSOs, CSOs – CSOs, and CSOs – Private sector Encourage Government funded programs and projects implemented by CSOs through signing a contract or granting V. Making a good legal framework for CSOs This is a long lasting, continuing and repeating process that needs lots of efforts and contribution of relevant stakeholders Revise, draft and newly promulgate laws/ bylaws, at the same time make cross-sectoral changes where appropriate and relevant. Combine a series of research, assessment, implementation, capacity for implementation, monitoring, evaluation and propose for changes when necessary Making a good legal framework for CSOs During the process of drafting, promulgating, implementing, and reviewing the legal framework for CSOs: Raise concerns and encourage participation by cross-sector and different stakeholders Create a strong partnership among state agencies and institutions and public including businesses, domestic and international supporters, independent experts and researchers, and especially CSOs – the resources, the beneficiaries, the implementers, at the same time, the monitors Thank you very much! Nguyen Thi Bich Diep, LL.M. t.Lawyer diepnguyen@vnah-hev.org