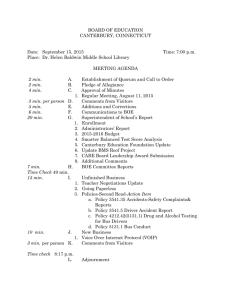

the embark_presentation_pamphlet_mark_iv .DOC

advertisement

embark oil & gas ltd. embark oil & gas ltd. (embark) is an incorporated Canadian entity targeting the unique opportunities present in today’s challenging Oil and Gas Sector. With oil prices down from their record 2014 values and the low Canadian dollar in tow, we believe that these conditions are conducive for Investors to realize significant returns within our company’s life cycle. OUR ACQUISITION PLAN In 2015, there has been very little positive movement in the price of oil. More and more companies who have budgeted on high revenue expectations in 2014 are finding it difficult to survive with their actual cash-flows. It is our vision to capitalize on the properties pertaining to these distressed owners, and build a new corporation designed to function within the economics and politics of the current recession. Management’s plan is to acquire multiple oil weighted assets (~70/30 oil), with low decline profiles, in manageable iterations of approximately 250 BOE (barrels of oil equivalent)/day. embark’s intent is to establish a base acquisition portfolio of approximately 1,000 BOE/day, giving embark a gross monthly cash-flow in excess of $1.5MM CDN using today’s under-valued price of oil (WTI of $40 USD/BOE). WHERE WE ARE LOOKING Given the economic climate in Western Canada’s Energy Sector, these properties will not be difficult to find (i.e. – properties of a distressed producing company, or a company’s non-core assets, or from a company’s orphaned well list, etc.). embark will not restrict themselves to one producing area and is prepared to manage multiple areas across Western Canada to achieve their base production volumes. In evaluating candidate assets in multiple strike areas however, management will maintain a sensitivity to their geography based on the following criteria: saturation of industry service providers in the immediate area that are conducive to lowering the unit price of production (Operational Expense or OPEX) well established infrastructure with highways, access roads, pipelines, facilities, natural gas co-ops, and power grids high industry activity in the area with further neighboring assets that have future acquisition potential LIMITED DISTRIBUTION TO QUALIFIED RECIPIENTS ONLY. THIS DOCUMENT IS SUBJECT TO RETURN UPON NOTICE. DUPLICATION WITHOUT THE EXPRESSED WRITTEN CONSENT OF THE COMPANY IS STRICTLY PROHIBITED. embark oil & gas ltd. LIMITED DISTRIBUTION TO QUALIFIED RECIPIENTS ONLY. THIS DOCUMENT IS SUBJECT TO RETURN UPON NOTICE. DUPLICATION WITHOUT THE EXPRESSED WRITTEN CONSENT OF THE COMPANY IS STRICTLY PROHIBITED. embark oil & gas ltd. WHAT WE ARE LOOKING FOR In regards to building the corporate production portfolio, Reservoir/Exploitation Engineering will quantify optimization potentials and will only green-light those that possess a minimum incremental potential of 25% further capacity. It is management’s intentions to visit the following methods to obtain these optimized volumes (but are not restricted to): mechanical down-hole stimulation up-hole and/or down-hole tubing recompletion enhanced oil recovery (EOR) techniques like gas lift technology, and/or waterflood injection; chemical injection, etc. This business plan will seek corporate production levels of 1,250 BOE/day once optimization plans have concluded. The 1,000 BOE/day of production from initial acquisition efforts is expected to generate the cash flow needed to fund the optimization work and further organic growth. In addition, it will also fund exploration/drilling activity after stable cash flow has been achieved. It is management’s intention to then add the incremental production from drilling and exploration to the finished production portfolio, which is a target of 2,000 to 2,500 BOE/day over the life of the corporation. CONTACT US • embark oil & gas ltd. is seeking accredited investors for involvement at the ground floor of this project • the Detailed Business Plan along with Key Management’s Profiles will be made available upon request THE FUTURE It is our goal to build a first class junior oil company characterized by sustainable growth with emphasis on preserving the environment……a corporation powered by a ‘green’ sail. 306, 1228 Kensington Road N.W. Calgary, Alberta CANADA T2N 3P7 www.embarkog.com Gil Francisco, President & CEO – 403.863.1296 Anton Huynh, COO – 403.542.0027 LIMITED DISTRIBUTION TO QUALIFIED RECIPIENTS ONLY. THIS DOCUMENT IS SUBJECT TO RETURN UPON NOTICE. DUPLICATION WITHOUT THE EXPRESSED WRITTEN CONSENT OF THE COMPANY IS STRICTLY PROHIBITED.