principal–agent theory

advertisement

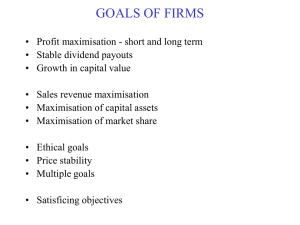

CHAPTER 10. Managerial objectives and the firm • Principal-Agent theory. • Managerial theories. • Behavioural theories. Learning outcomes This chapter will help you to: • • • • • Analyse the different objectives firms may choose when deciding on their production and pricing decisions. Appreciate the meaning and significance of principal–agent theory and its relationship to business objectives and corporate governance. Recognise the nature of different managerial theories of the firm, namely sales revenue maximisation, utility maximisation and corporate growth maximisation models. Distinguish between managerial and behavioural theories of the firm and the contrast between maximising and satisficing strategies Understand the importance of business ethics within the framework of managerial decisions in today’s business environment. Challenging the traditional assumptions The traditional approach is based on two key assumptions: • • Decisions are made under conditions of perfect knowledge. The objective of the firm is to maximise profits. There are five main reasons which can be offered as justification for abandoning these two assumptions.These relate to the following: • • • • • The growth in oligopoly. The growth of managerial capitalism. Difficulties surrounding profit maximisation in practice. The organisational complexity of firms. Recognition that real life decisions are often made in the face of imperfect or incomplete information. In summary, therefore, the traditional theory of profit maximisation featured in previous chapters may be criticised because: • • • • • It may not be readily applicable to oligopoly markets. It takes inadequate account of the need to gather and utilise information. It is no longer appropriate in today’s environment,where managerial capitalism has taken over from entrepreneurial capitalism and where control of businesses has become divorced from their ownership in many industries. Pricing policies in practice may bear little obvious resemblance to those suggested by the MR =MC principle. The complexity of organisational structures today calls into question some of the basic assumptions of the traditional theory and draws attention to the process of decision-making. Principal-agent theory Figure 10.1 The principal-agent relationship: private v public sector Figure 10.2 Impact of inefficiency on average cost Managerial theories • Sales revenue maximisation. • Managerial utility maximisation. • Corporate growth maximisation. Sales revenue maximisation • • • • • • High and expanding sales revenues help to attract external finance to the firm 僕larger firms generally find it easier to raise capital, while financial institutions may be less willing to deal with a firm suffering from declining sales. High sales assist the distribution and retailing of products 睦 resulting in economies from selling in bulk. Consumers may view a firm with falling sales in a less favourable light 釦this may deter consumers from buying and reduce sales even further. The distributive trade may be less co-operative,for example in extending credit lines, when a firm’s sales are declining. Falling sales may result in reductions in staffing levels, including managerial staff, as costs are cut. Last,but not least,managers’ salaries may depend on a fast growth of sales revenues 卜managers are often rewarded for expanding the business. Figure 10.3 Sales revenue maximisation Managerial utility maximisation Williamson’s model suggests that managers’ self-interest focuses on the achievement of goals in four particular areas, namely: • • • • High salaries Staff under their control Discretionary investment expendtirue Fringe benefits U =f (S ,Id ,M ) Corporate growth maximisation The valuation ratio for any company is its current share price multiplied by the number of its issued shares divided by the net book value (assets less liabilities) of the company. Figure 10.4 The corporate growth maximisation model Behavioural theories • Production . A goal that output must lie within a certain satisfactory range. • Sales .A goal that there must be a satisfactory level of sales however defined. • Market share .A goal indicating a satisfactory size of market share as a measure of comparative success as well as of the growth of the firm. • Profit . Still an important goal,but one amongst a number rather than necessarily the goal of overriding importance. In these circumstances,the objectives of the firm are eventually determined by factors such as the following: • Bargaining between groups and the relationship between groups within the firm. • The power and influence of different groups within the firm. • The method by which objectives are formulated within the organisation. • How groups and,therefore,the ’firm’ react to experiences and make adjustments . 10.13 Business ethics Firms now recognise the importance of issues such as: • • • The public’s growing interest and concern about environmental challenges ,involving pollution, the use of non-renewable resources,energy efficiency,etc.leading to the so-called ‘greening of business’. The rights of workers and human rights in general, the development of fair pay,equal opportunities,health and safety at work,etc. Ethical marketing involving limitations on the selling of products such as tobacco and alcohol that may damage public health and general well-being. Key learning points • • • The traditional theory of the firm, based on the assumptions of perfect knowledge and profit-maximising behaviour, may not be readily applicable, given the complexity of markets and organisational structures today. Principal -gent theory recognises the growth in managerial capitalism and the complexity of modern organisational structures based on a growing separation between the owners of the firm (the principals) and the firm’s senior management or directors (the agents). This theory leads to a focus on corporate governance arrangements. Baumol concludes that management which attempt to maximise sales revenue will tend to produce at a higher output level,set lower prices and invest more heavily in measures that boost demand than management which attempt to maximise profits. Key learning points • • • Williamson ‘s managerial utility maximisation model argues that managers seek to maximise their own self-interest based on the achievement of goals such as high salaries,authority over staffing, discretionary investment expenditure decisions and fringe benefits. Marris’s corporate growth maximisation model suggests that management seek to maximise the growth of the firm subject to an optimal dividend-to-profit retention ratio, in order to safeguard the firm from a hostile takeover bid. The satisficing explanation of managerial behaviour is associated with behaviouralist theory and argues that there is no single objective of the firm; instead, there are multiple goals.These emerge from the potential for conflict amongst interest groups within the firm, such that the aim will be to achieve a satisfactory performance for each of the goals without necessarily any single, maximisation objective. Key learning points • Business ethics is concerned with the social responsibility of management towards the firm’s major stakeholders, the environment and society in general. There is a growing belief that ethical and ‘green’ business are linked to improved business performance over time because of increased public concern for human rights and the world environment. Business ethics extends to treating all stakeholders ‘fairly’; hence the growing emphasis on health and safety issues,’good 蜘working practices and the like in business decision-making.