The Competitive Marketplace

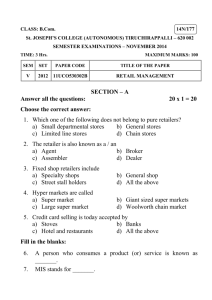

advertisement

Chapter 4 Evaluating the Competition in Retailing Models of Retail Competition The competitive marketplace Market structure The demand side of retailing Nonprice decisions Competitive actions Suppliers as partners and competitors The Competitive Marketplace Retailers compete for target customers on five major fronts: The price for benefits offered Service level Product selection Location or access Customer experience LO 1 Market Structure Economists use four different economic terms to describe the competitive environment in the retailing industry: Pure Competition – is rare in retailing and occurs when a market has homogeneous products and many buyers and sellers, all having perfect knowledge of the market, and ease of entry for both buyers and sellers. Pure Monopoly – occurs when there is only one seller for a product or service. Monopolistic Competition – occurs when the products offered are different, yet viewed as substitutable for each other and the sellers recognize that they compete with sellers of these different products. Oligopolistic Competition – occurs when relatively few sellers, or many small firms who follow the lead of a few larger firms, offer essentially homogeneous products and any action by one seller is expected to be noticed and reacted to by the other sellers. LO 1 Market Structure Monopolistic competition Retailers in monopolistic competition attempt to differentiate themselves with the products or services they offer. Oligopolistic competition Oligopolies are likely to end up selling at a similar price since everybody knows what others are doing. In rare cases, retailing is characterized as oligopolistic competition. Oligopolistic competition is more common at a local level, especially in smaller communities. Outshopping - Occurs when a household travels outside their community of residence or uses the Internet to shop in another community. LO 1 The Demand Side of Retailing In a monopolistically competitive market, the retailer will be confronted with a negatively sloping demand curve. caused by ―the law of diminishing returns LO 1 Nonprice Decisions Price is the easiest variable for competitors to copy. Ways of using nonprice variables to achieve a protected niche: Store positioning - Identifying a well-defined market segment using demographic or lifestyle variables and appealing to this segment with a clearly differentiated approach. Offering private-label merchandise that has unique features or offers better value than do competitors. Providing additional benefits for the customer. Mastering stockkeeping with its basic merchandise assortment. LO 1 Competitive Actions Overstored - Condition in a community where the number of stores in relation to households is so large that to engage in retailing is usually unprofitable or marginally profitable. Understored - Condition in a community where the number of stores in relation to households is relatively low so that engaging in retailing is an attractive economic endeavor. Competition is most intense in overstored markets because many retailers are achieving an inadequate return on investment LO 1 Suppliers as Partners and Competitors Suppliers as competitors – Suppliers compete for gross margins throughout the supply chain. The retailer must develop a loyal group of patrons that encourages the supplier to accommodate the needs of its retail partner. Suppliers as customers– Suppliers can be a critical competitive advantage to retailers when they provide a unique product or promotion. LO 1 Types of Competition Intratype competition - two or more retailers of the same type compete directly with each other for the same households. The most common type of retail competition. Intertype competition - two or more retailers of a different type compete directly by attempting to sell the same merchandise lines to the same households. Divertive competition - retailers intercept or divert customers from competing retailers. Can be either in the form of intertype or intratype . Most retailers operate very close to their breakeven point. Break-even point - Total revenues equal total expenses and the retailer is making neither a profit nor a loss. LO 2 Exhibit 4.6 - Retail Institutions in Their Various Stages of the Retail Life Cycle LO 3 The Retail Life Cycle Introduction - Begins with an aggressive, bold entrepreneur who is willing and able to develop a different approach to retailing of certain products. During this stage profits are low, despite increasing sales levels. Growth - Sales and profits explode. New retailers enter the market and begin to copy the idea. Late in this stage, both market share and profitability approach their maximum levels. Maturity - Market share stabilizes and profits decline due to: shift in type of establishment overexpansion competition Decline - A major loss of market share will occur, profits will fall, and the once-promising idea will no longer be needed in the marketplace. LO 3 Future Changes in Retail Competition Nonstore retailing (e-tailing, direct selling, catalog sales) New retailing formats Heightened global competition Integration of technology Increasing use of private labels LO 4 New Retailing Formats Off-price retailers - Sell products at a discount but do not carry certain brands on a continuous basis. They carry those brands they can buy from manufacturers at closeout or deep one-time discount prices. Primary examples of off-price retailers—factory outlets and warehouse clubs. Supercenter - A cavernous combination of supermarket and discount department store carrying more than 80,000 to 100,000 SKUs that allows for one-stop shopping. Recycled merchandise retailers - Establishments that sell used and reconditioned products; examples include pawn and thrift shops, auction houses, flea markets, and eBay. Liquidators - These firms purchase the inventory of the existing retailer and run its ‘‘going-out-of-business’’ sale. Rentals, another form of retailing, has been popular for a limited number of items for decades LO 4 Heightened Global Competition Increasing rate of change Greater diversity Creation of new retail formats LO 4 Integration of Technology Technological innovations can be grouped under three main areas: Supply chain management using new initiatives such as direct store delivery (DSD) and collaborative planning, forecasting, and replenishment (CPFR) systems. Customer management Customer satisfaction LO 4 Increasing use of Private Labels Develop a partnership with well-known celebrities, noted experts, and institutional authorities. Develop a partnership with traditionally higher-end suppliers to bring an exclusive variation on their highly regarded brand name to the market. Reintroduce products that have strong name recognition but that have fallen from the retail scene. Brand an entire department or business; not just a product line. LO 4