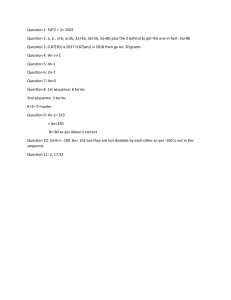

Return on a short sale

advertisement

Investment Analysis and Portfolio Management Lecture 2a Gareth Myles Return on a short sale The calculation of the return for a short sales raises some questions Considering this issue gives an insight into the meaning of “return” Assume an investor sells short 100 stock at a price of £1 each A year later the short sale is reversed when the stock are trading at £0.50 What is the return? Return on a short sale It is clear the investment has been successful The investor received £100 at the time of the short sale The borrowed stock were replaced for £50 The investor has gained £50 So the return must be positive? Return on a short sale It was claimed that the formula would always work Return = (Final value – Initial value)/Initial value For the short sale: Initial value = -100 Final value = -50 Return on a short sale These values give Return = (-50 – (-100))/(-100) = - 0.5 The calculated return is negative How does this fit with the fact that the trade has lead to a profit? The explanation lies with the meaning of a return Return on a short sale Consider placing £100 in a bank account for 1 year at an interest rate of 10% Then 100 (1.1) = 110 Equivalently Return = (110 – 100)/100 = 0.1 The return is the interest rate More generally the return, r, solves Initial (1 + r) = Final Return on a short sale Apply this logic to the example of a short sale -100 (1 + r) = -50 Solving gives r = -0.5 Interpretation: if I have an overdraft of £100 what interest rate will reduce this to an overdraft of £50 in one year? So a negative return on negative quantities is good Return on a short sale And remember the calculation of portfolio return This is composed of the sum of terms Xiri For a short sale Xi is negative If ri is also negative then Xiri is positive