1-Coverpage

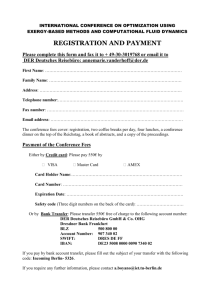

advertisement

Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Accounting by Small and Medium-sized Entities (SMEs) - German Case Study Kati Beiersdorf Accounting Standards Committee of Germany Vienna, 15 March 2006 -1- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Agenda A. Development and Characteristics of National GAAP B. Accounting by SMEs in Germany C. Future Developments -2- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® A.1 German Accounting Legislation 1861 First Uniform Accounting Regulation independent of legal form or size of entities (AGHGB) 1870 1892 • Accounting Laws differentiating between legal forms, e.g. corporations, partnerships (e.g. AktG, GmbHG) • Link between financial and tax accounting regulated by law 1897 For all companies: „German Accepted Accounting Principles“, obligation to publish financial accounts depending on legal form (HGB) 19311965 Continuing differentiation: accounting regulations for corporations; in addition: differentiation between sizes (Aktienrechts(not)verordnung, AktG) Focus of accounting regulation: corporations = differentiation by legal form 1969 New level: Accounting regulations mandatory for all legal forms, but dependent on size (PublG) = differentiation by legal form and size -3- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® A.1 German Accounting Legislation 1985 • Implementation of 4th, 7th and 8th European Directives (BiRiLiG) and • Restructuring of German Accounting Legislation from fragmentation by laws specific to legal forms to generally accepted principles for all entities • First time: broad accounting regulations for all companies within the German Commercial Code (Third Book of HGB) First Level: Differentiation by Legal Form Part one: all merchants Part two: supplementary rules for corporations Part three: cooperatives Second Level: Differentiation by Size • Corporations and commercial partnerships (part two): small, medium-sized, large • Other companies must comply with PublG when certain size criteria are met -4- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® A.1 German Accounting Legislation 1998 Option for capital market oriented companies to prepare their consolidated financial statements in accordance with internationally accepted accounting standards (US GAAP, IFRS) (KapAEG) = additional differentiation by capital market orientation and form of financial statement (single or consolidated) 2004 Implementation of EU-Directive, IFRS-Regulation (BilReG) current • • • • Modernisation of German Accounting Legislation Globalisation and Internationalisation drive further Developments Importance of Information Several Criteria for Differentiation between different GAAP -5- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Group Accounts Individual Accounts LISTED Companies IFRS MANDATORY since 2005 Member State Option NON-LISTED Companies A.2 IFRS Regulation – Member State Options Member State Option Member State Option -6- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® A.3 Member State Options – Germany NON-LISTED Companies LISTED Companies Group Accounts Individual Accounts IFRS: Prohibited IFRS MANDATORY since 2005 Obligation Effective from 2007 for Listed debt instruments and users of US GAAP German GAAP Accounts Still Mandatory Large Companies may file IFRS financial statements with the Federal Gazette IFRS: Prohibited IFRS: Option German GAAP Accounts Still Mandatory -7- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® A.4 Characteristics of German Accounting Legislation Objective / Purpose Single Financial Statements: • determine distributable profits • tax purposes • information, stewardship Consolidated Financial Statements: • provide Information Investor oriented Creditor oriented Focus German Accepted Accounting Principles Prudence: Imparity Principle Realisation Principle • historical cost convention • no recognition of unrealised gains Anticipation of Losses • recognition of expected or unrealised losses required • principle of lower of cost or market value (writedowns) -8- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Agenda A. Development and Characteristics of National GAAP B. Accounting by SMEs in Germany C. Future Developments -9- © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® B.1 „Mittelstand“ – Relevance of SMEs in Germany 2003: 3.38 mil SMEs with about 20 mil employees SMEs in % of all enterprises subject to VAT turnover of SMEs in % of all turnovers subject to VAT 99,7 41,2 SME-Definition by IfM: • number of employees < 500 • annual turnover < 50 mil € • 70 % sole proprietorships • 15,4 % private limited companies • 12,6 % partnerships • 2 % other legal forms Source: IfM Bonn (2004), SMEs in Germany Facts and Figures 2004, page 5 - 12. - 10 - © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® B.2 Accounting Options for SMEs Accounting for SMEs National GAAP IFRS Remarks: • integration in international market majority of SMEs (e.g. 1/6 of profits in SMEs with applies National GAAP annual turnover of 25 – 50 mil € from international transactions) Advantages • well known standards • education for companies, auditors, tax and accounting with long tradition advisors in two systems • prudence principle necessary Disadvantages • demand for SMEs to apply IFRS because of consolidation by • no acceptance parent companies, demand by internationally banks, international creditors or • lack of information international capital markets - 11 - larger, international and capital market-oriented companies exercise option Advantages • internationally accepted • informative presentation of financial position Disadvantages • at present two financial statements required • debt/equity problem © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® B.3 Differential Financial Reporting under German GAAP Criteria for Differentiation all merchants corporations and commercial partnerships other… (1) Legal Form (2) Size Total Assets Annual Turnover Employees Small < 4.015 mil € < 8.03 mil € < 50 Medium-sized < 16.06 mil € < 32.12 mil € < 250 Levels of Differentiation (1) Accounting (2) Auditing (3) Publication - 12 - (4) Enforcement © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® B.4 Differential Financial Reporting under German GAAP (1) Accounting: Examples Legal Form components of financial statements All Merchants Supplementary Regulation for Corporations PLUS notes, management report balance sheet, income statements supplementary regulation for consolidated financial statements PLUS statement of changes in shareholders‘ equity, cash flow statement and (optional) segment reporting write-downs based on prudent business no such write-downs recognition and judgement measurement less options: e.g. if write-downs no longer apply lower carrying measurement options amount cannot be retained (2) Auditing Size of Entity Large Medium-sized Small audit of annual report required required exempted - 13 - © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® B.4 Differential Financial Reporting under German GAAP (3) Publication Requirements Size of Entity Large Medium-sized Small preparing f/s within 3 months 3 months 6 months file f/s with commercial register within 12 months 12 months 12 months balance sheet yes yes, shorter version yes, shorter version profit/loss yes yes no notes full simplified significant simplifications management report yes yes no publication in federal gazette yes no no Listed Securities No Listed Securities yes no (4) Enforcement examined by financial reporting enforcement panel - 14 - © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Agenda A. Development and Characteristics of National GAAP B. Accounting by SMEs in Germany C. Future Developments - 15 - © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® C. Future Developments Accounting for SMEs Decisive Factors in Germany • German GAAP is creditor oriented • Tax link • IASB-Project: IFRS for SMEs Current Developments: • Modernisation of German Accounting Legislation • Discussion of alternative systems of determining the distributable profit • Discussion to separate tax and accounting legislation • Increasing demand for accounting according to IFRS in SMEs • High costs of different accounting systems SME-Project: • Consideration of SME-specific aspect • Accounting simplifications - 16 - Future ? Uniform accounting regulation in accordance with IFRS (IFRS and IFRS for SMEs) © Kati Beiersdorf, ASC of Germany / 15 March 2006 Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® ® Deutsches Rechnungslegungs Standards Committee e. V. Accounting Standards Committee of Germany ® Zimmerstraße 30 10969 Berlin Tel. +49 (0)30 20 64 12 0 Fax +49 (0)30 20 64 12 15 www.drsc.de beiersdorf@drsc.de info@drsc.de - 17 - © Kati Beiersdorf, ASC of Germany / 15 March 2006