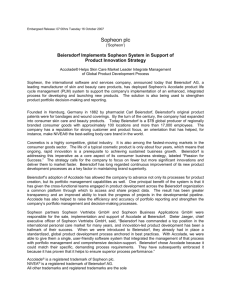

Managing Political Risk in Global Business: Beiersdorf 1914-1990 Working Paper

advertisement