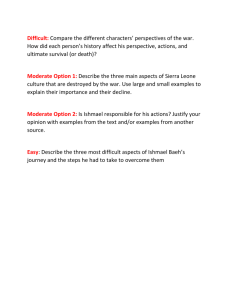

The Commercialisation of Agriculture in Sierra Leone: Options for

advertisement