Building on IT - kennedyonline.us

advertisement

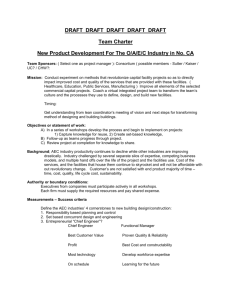

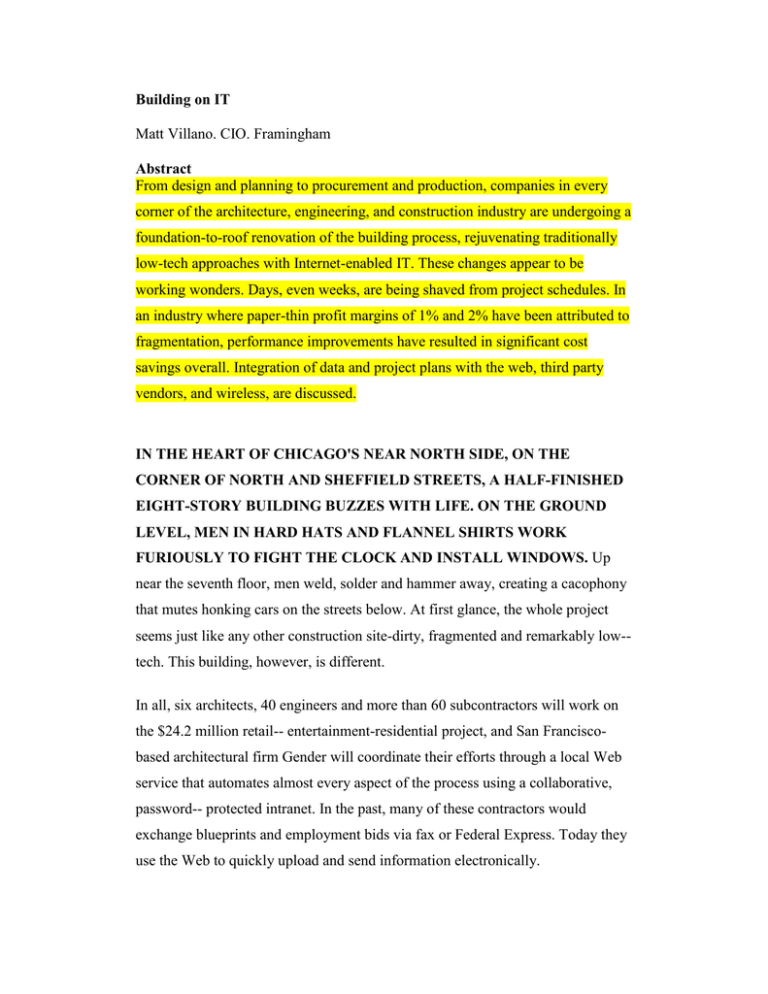

Building on IT Matt Villano. CIO. Framingham Abstract From design and planning to procurement and production, companies in every corner of the architecture, engineering, and construction industry are undergoing a foundation-to-roof renovation of the building process, rejuvenating traditionally low-tech approaches with Internet-enabled IT. These changes appear to be working wonders. Days, even weeks, are being shaved from project schedules. In an industry where paper-thin profit margins of 1% and 2% have been attributed to fragmentation, performance improvements have resulted in significant cost savings overall. Integration of data and project plans with the web, third party vendors, and wireless, are discussed. IN THE HEART OF CHICAGO'S NEAR NORTH SIDE, ON THE CORNER OF NORTH AND SHEFFIELD STREETS, A HALF-FINISHED EIGHT-STORY BUILDING BUZZES WITH LIFE. ON THE GROUND LEVEL, MEN IN HARD HATS AND FLANNEL SHIRTS WORK FURIOUSLY TO FIGHT THE CLOCK AND INSTALL WINDOWS. Up near the seventh floor, men weld, solder and hammer away, creating a cacophony that mutes honking cars on the streets below. At first glance, the whole project seems just like any other construction site-dirty, fragmented and remarkably low-tech. This building, however, is different. In all, six architects, 40 engineers and more than 60 subcontractors will work on the $24.2 million retail-- entertainment-residential project, and San Franciscobased architectural firm Gender will coordinate their efforts through a local Web service that automates almost every aspect of the process using a collaborative, password-- protected intranet. In the past, many of these contractors would exchange blueprints and employment bids via fax or Federal Express. Today they use the Web to quickly upload and send information electronically. What's more, says Gensler's Chicago office CIO Randall Dolph, while subcontractors used to spend hours on the phone with suppliers ordering from catalogs, now they can connect to suppliers and order online. "This technology enables us to triple or quadruple the speed with which we can pull off a project," he says. "It's like we've been waiting for this kind of improvement all our professional lives." Dolph discusses this new connective technology the same way a proud father talks about his child. For the first time, superfast Web connectivity is available to the midsize and small players, like Gensler, and not just the big guys like Bechtel ($15.1 billion in revenue), the Houston-based global engineering and construction giant that has managed projects such as the $20 billion construction of Jubail Industrial City in Saudi Arabia. From design and planning to procurement and production, companies in every corner of the architecture, engineering and construction (AEC) industry are undergoing a foundation-to-roof renovation of the building process, rejuvenating traditionally low-tech approaches with Internetenabled IT. At a handful of the biggest companies, CIOs have incorporated new, proprietary Web applications to reengineer the way they use data from the beginning. Smaller companies without big IT budgets have opted for outsourcing, relying on a number of new subscription-based Web tools to revolutionize cooperation and collaboration in virtual space. These changes appear to be working wonders. Days, even weeks, are being shaved from project schedules. In an industry where paper-thin profit margins of 1 percent and 2 percent have been attributed to fragmentation, performance improvements have resulted in significant cost savings overall. Down the road, XML and wireless technology may pad margins even more. For now, Kent Allen, research director at Aberdeen Group, an IT think tank in Palo Alto, Calif., says industry bigwigs are simply enjoying the results of their current technological forays. "Think about it: With all that dirt and grime, with all those musclemen hammering away or firing up the blow-- torch, the construction industry has been low-tech since day one," he says. "It's amazing to think about how far a little technology in this space can go." On the GROUND FLOOR As Allen implies, companies in the $1 trillion AEC industry have become what you'd call high-tech only in the past five years. Despite how information-intensive these industries are, slim margins historically have made it difficult for AEC executives to justify IT expenditures. The exception was the introduction of computer-aided design (CAD) software, used by architects and designers to create blueprints and drawings. More than a decade later, well after CIOs in the manufacturing, aerospace and automotive industries honed enterprise solutions that leverage backend data with front-end functionality, the AEC industry realized it wanted systems that could integrate data and project plans with the Web. Basic? Yes. Long overdue for the AEC industry? Absolutely. Today, some of the industry leaders have implemented such applications, addressing every aspect of the engineering, procurement and construction (EPC) life cycle. For instance, Bechtel is working on a number of Web-oriented upgrades in the area of procurement. Under the guidance of Director of Procurement Jack Futcher and CIO Hank Leingang, the company recently developed a password-protected intranet portal where project managers can submit up to five times the number of employment and materials bids they could before. Dubbed the BPS, for Bechtel Procurement System, this application generates purchase orders in which project managers can solicit participating subcontractors to submit bids. BPS is just one of the online tools that Futcher says he hopes will slash Bechtel's $3 million annual FedEx bill. At Pasadena, Calif.-based Parsons Corp., a private, global engineering and construction company that recently renovated Ronald Reagan Washington (D.C.) National Airport, CIO John Thomas is dabbling in other areas. Last October, after years of handling project controls manually, Thomas launched P-Works, a Web-enabled project control system that can access scheduling and financial project information from anywhere in the world. Thomas followed this with a $4 million commitment to DMCS, an offline document and material control system upgraded into a Web-enabled platform where engineers and managers track the progress of a job by ensuring that materials are ordered and tracked on time for the least amount of cost. According to Thomas, this system will upload new information several times a day, and he expects it to save Parsons one year on a two-year project. Similar proprietary efforts are underway at other privately owned construction industry giants such as Fluor Daniel and Black & Veatch. But this new game is not just for the big guys. Local governments and midsize and small AEC companies are deploying homegrown Internet applications. In Silicon Valley, civic officials from eight cities recently launched a website so that contractors can apply online for building permits (see "Permit Hermits," Page 150). Late last year, $1.3 billion Knoxville, Tenn.-- based homebuilder Clayton Homes unveiled a $300,000 extranet that Director of IS Kevin Banker says will link retail stores with back-end office software to give service representatives a legitimate sense of when customers can expect their manufactured homes. "Our new system should make everything operate more smoothly," says Banker, who adds that by switching communications online as opposed to offline as they'd been doing in the past, Clayton should save an additional $2 million to $3 million each year. Second Floor: THIRD-PARTY VENDOR SERVICES Banker's colleagues elsewhere in the industry also see IT as a panacea but can't afford to engineer applications of their own. Instead, like Dolph, the CIO at Gender, these executives have turned to vendors to provide the technology they need. For a monthly fee, they can tap in to services ranging from procurement to recruitment, and project management to all-out document sharing and collaboration. According to Ray Levitt, director of the Center for Integrated Facility Engineering at Stanford University in Palo Alto, Calif., vendors work well and are perfect for those AEC companies that decide software development is not a core competency. San Francisco-based Buzzsaw.com, the 2-year-old company that helped Gensler, offers customers a shared space where project managers can exchange documents with engineers and architects, bid for subcontractor services, and even track scheduling and performance. Citadon, also based in San Francisco, is the 4-yearold byproduct of the merger of dotcom companies Bidcom and Cephren, and has similar offerings to Buzzsaw.com. Such technology enables customers to manage communication among the hundreds and thousands of individuals involved on a particular project. Phil Go, CIO at Barton Malow, a construction management and architectural firm in Southfield, Mich., agrees, saying that without signing on to use the Citadon service last year, managing the development of the $325 million future home of the New England Patriots and New England Revolution sports teams in Massachusetts would have been exorbitantly expensive. "We're here in Michigan, and we've got to coordinate hundreds of [subcontractors] 1,000 miles away-can you imagine how much we would have spent on overnight mail?" he asks. Other vendors cater to the AEC market too, offering targeted services to more narrowly defined niches. TradePower, a company based in Linthicum Heights, Md., offers materials management and procurement functions to contractors in the electrical and electrical engineering fields. Redwood City, Calif.-based BuildPoint, with a database of more than 30,000 contractors, offers similar platforms for contractors and small engineering companies in the commercial construction sector. In New York City, architectturned-technophile Jim Lockwood, president of a company called Design Build Partners, is going after a different kind of marketplace: His product helps clients find human resources for projects that require extra hands. For all their power in connecting people, though, the one thing these services lack is bandwidth. If a project entails particularly large CAD files, the online options are severely limited. Most CAD files range in size from 30MB to 100MB, and none of these vendors offer the bandwidth necessary to share files that are larger than that. Some companies, such as Citadon and Trade-- Power, have developed the capacity to take snapshots of large files and display them in a much smaller, read-only format. This, however, only postpones the problem. As Stanford's Levitt explains, even if project managers upload read-only copies of a blueprint for approval, contractors and subcontractors accustomed to working off an original that can be altered will still need to download the full file eventually. Third Floor: WIRELESS Vendors may be forced to find solutions to the bandwidth issue sooner rather than later. As PDAs and other wireless devices proliferate, and as the capacity for cellular phones to access the Internet improves, more and more contractors and subcontractors will rely on these devices to download blueprints, specifications and other data directly to the job site. Some AEC companies have embraced wireless like a new friend. At D.R. Horton, a $3.7 billion homebuilder based in Arlington, Texas, CIO Felix Vasquez launched a pilot program where project managers can use PDAs to interface directly with suppliers and order materials such as lumber and sheetrock for a job. At a test site in southeast Florida, this feature worked like a charm, enabling managers to complete a new housing development more than one week ahead of schedule-and Horton did not have to install any new technology to make it work. At Lennar Corp., a $3.1 million residential homebuilding company in Miami, CIO John Nygard says project managers use BlackBerry pagers to facilitate e-mail communication with suppliers and accomplish similar time-saving results. Larger companies with international operations are piping wireless technologies through satellites to bring data to job sites in Africa, the Middle East and South America. At Bechtel, CIO Leingang says these wireless satellite hookups solve the problems his field managers have experienced connecting to the network through local telecommunications facilities. At Fluor Signature Services, a business unit of Aliso Viejo, Calif.-based Fluor Corp., Vice President and CIO J.B. King adds that on remote jobs in the United Arab Emerites and Colombia, outsourcing satellite wireless technologies has been the only way to enable architects and engineers to deliver data to project managers in the field. "Our people need access in the middle of the jungle of South America just like they would in downtown Houston," says King. Top Floor: THE VIEW Going forward, the AEC industry is focusing its attention on the technologies it thinks will dominate the future-virtual simulation and 4-D CAD, or CAD with the added dimension of time, as in real-time scheduling capabilities. Experts say virtual simulation of building plans could become reality and indicate that a handful of companies are already using it today. At the Houston-based architectural firm Archimage, architecture and computer imagery combine to create 3-D, fly-through blueprints and plans of attack for projects of every size. At Vite, a Mountain View, Calif.-based software development and consulting company founded by Levitt, managers most recently applied similar fly-- through and simulation technologies to orchestrate a high profile cleanup of the Chernobyl nuclear power plant last year. "Think of this as a flight simulator for trying a number of different approaches to an architectural or engineering problem," Levitt says. "With simulations like this, you don't need to resolve yourself to one approach so soon." Most of the advancements in this area come from Martin Fischer, who, as associate professor of civil and environmental engineering at Stanford University, has developed a methodology for modeling schedules as well as the projects themselves. Fischer has tested this technology frequently over the past year, but most recently, he worked with Disney on its new California Adventure theme park, opened Feb. 8. Just as the collaborative environments of Citadon and Buzzsaw.com enable participants to integrate documents from various sources, Fischer sees a new, XML-based industrywide platform that enables everyone from architects to contractors to integrate applications, and links every program in the entire EPC cycle. At AutoDesk, a $900 million software design company based in San Rafael, Calif., Vice President Phil Bernstein envisions the same Holy Grail. From his office in Manchester, N.H., Bernstein playfully touts an "intergalactic scripting device" that will someday accommodate all of the different back-end platforms within the industry. Until that day, though, the fragmented AEC industry will remain fragmented. "How do you handle it if your sheet metal contractor can't use anything but a drawing, or if the pricing system your HVAC guy uses isn't compatible with yours?" asks Bernstein. "These are cool problems, and they're ones we can't solve without IT." Sidebar See how the Web was used to CUT THE COSTS OF BUILDING the Venetian Resort Hotel.