Partnership Financial Statement Format: Example & Template

advertisement

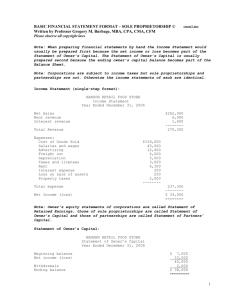

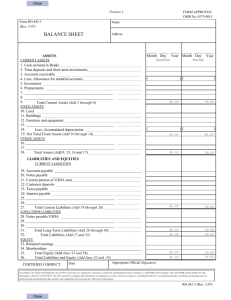

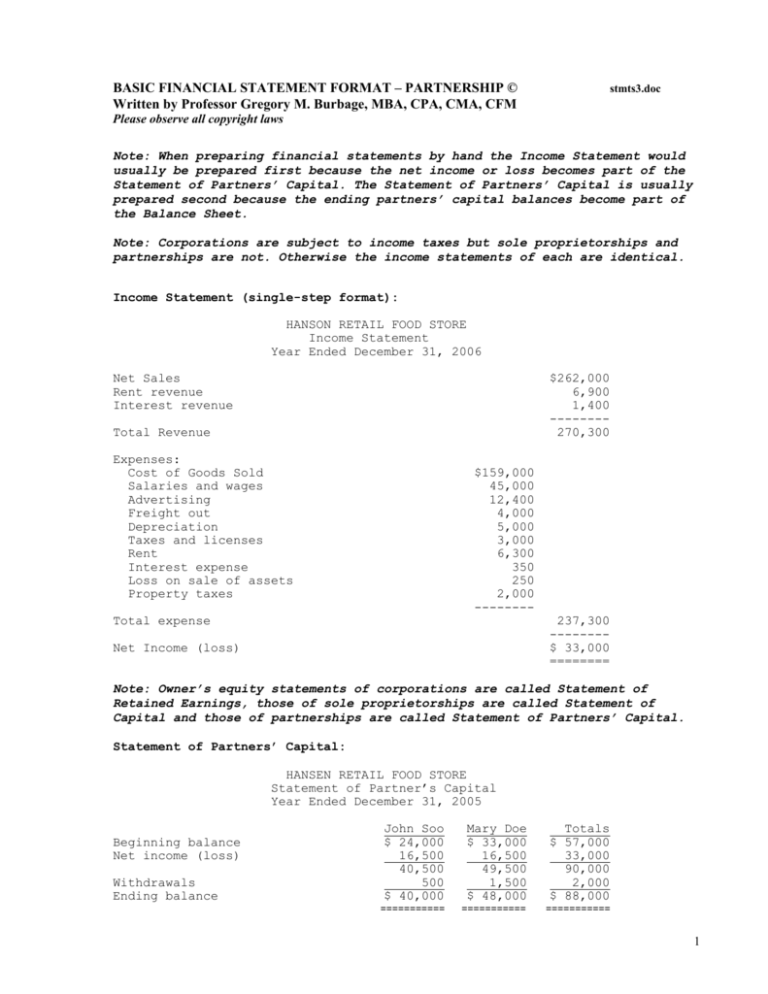

BASIC FINANCIAL STATEMENT FORMAT – PARTNERSHIP © Written by Professor Gregory M. Burbage, MBA, CPA, CMA, CFM stmts3.doc Please observe all copyright laws Note: When preparing financial statements by hand the Income Statement would usually be prepared first because the net income or loss becomes part of the Statement of Partners’ Capital. The Statement of Partners’ Capital is usually prepared second because the ending partners’ capital balances become part of the Balance Sheet. Note: Corporations are subject to income taxes but sole proprietorships and partnerships are not. Otherwise the income statements of each are identical. Income Statement (single-step format): HANSON RETAIL FOOD STORE Income Statement Year Ended December 31, 2006 Net Sales Rent revenue Interest revenue $262,000 6,900 1,400 -------270,300 Total Revenue Expenses: Cost of Goods Sold Salaries and wages Advertising Freight out Depreciation Taxes and licenses Rent Interest expense Loss on sale of assets Property taxes $159,000 45,000 12,400 4,000 5,000 3,000 6,300 350 250 2,000 -------- Total expense 237,300 -------$ 33,000 ======== Net Income (loss) Note: Owner’s equity statements of corporations are called Statement of Retained Earnings, those of sole proprietorships are called Statement of Capital and those of partnerships are called Statement of Partners’ Capital. Statement of Partners’ Capital: HANSEN RETAIL FOOD STORE Statement of Partner’s Capital Year Ended December 31, 2005 Beginning balance Net income (loss) Withdrawals Ending balance John Soo $ 24,000 16,500 40,500 500 $ 40,000 Mary Doe $ 33,000 16,500 49,500 1,500 $ 48,000 Totals $ 57,000 33,000 90,000 2,000 $ 88,000 =========== =========== =========== 1 Note: Balance Sheets of corporations have a Shareholders’ Equity section whereas sole proprietorships have an Owner’s Capital section and partnerships have a Partners’ Capital section. Otherwise the Balance Sheets would be identical. Balance Sheet: HANSEN RETAIL FOOD STORE Balance Sheet December 31, 2006 ASSETS Current Assets: Cash Short-term investments/marketable securities Accounts receivable, net Inventory Prepaid rent Office supplies on hand Total current assets Long-Lived Assets: Long-term investments Land Building Machinery & equipment Less accumulated depreciation Patents $ 3,000 6,000 5,000 10,000 2,000 1,000 27,000 $ 10,000 35,000 86,000 50,000 ( 23,000) 4,000 162,000 $189,000 ======== Total long-lived assets Total Assets LIABILITIES Current Liabilities: Accounts payable Notes payable Interest payable Wages payable Total current liabilities $ Long-Term Liabilities: Mortgage payable Bonds payable Total long-term liabilities Total Liabilities 4,200 15,000 1,000 800 21,000 $ 30,000 50,000 80,000 101,000 PARTNERS’ CAPITAL John Soo, Capital Mary Doe, Captial Total Partners’ Capital Total Liabilities and Owner’s Equity 40,000 48,000 88,000 $189,000 ======== 2