Chapter 13

advertisement

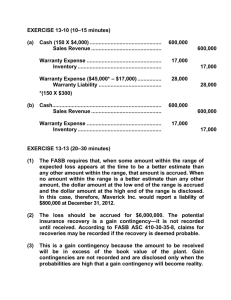

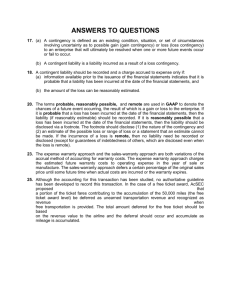

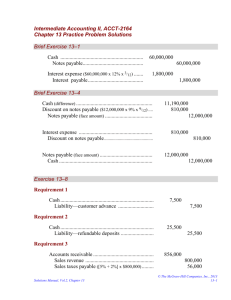

CHAPTER 13 Current Liabilities and Contingencies ……..…………………………………………………………... Liability Present, unavoidable obligation Requiring probable future transfer of assets Resulting from past transactions or events Current Liability Requiring use of existing current assets Present, unavoidable obligation 12/31 Liability 11/1 Borrowed $100,000, 12%, 6 months. 11/1 Issued $100,000 non-interest 6month note; rec’d $94,340. $500,000 of 8% cumulative preferred is outstanding for the entire year. 12/1 Declared 8% cash dividend on $500,000 preferred, payable 1/15. Future transfer of assets 12/31 Liability 12/1 Declared a 5% stock dividend on 100,000 shares of common stock ($1 par, $11 market value). 12/1 Restaurant received $2,200 from sale of gift certificates. From past transactions or events 12/31 Liability 11/1 Signed contract to purchase inventory next year for $600,000 (inventory worth $570,000 12/31). 12/31 Ordered $32,000 of inventory to be shipped FOB destination. Deferred income tax liability = $8,000 (on current income, paid in the future). $8,600 sick pay earned but not taken during past year. Current Liability = use of existing current assets Current Liability 12/28 Purchased on account and received $3,000 on inventory, $500,000 of 8% serial bonds are outstanding. Interest plus $100,000 principal payable each July 1. $60,000, 10% note payable due March of next year is outstanding. Firm plans to refinance with a 2-year note. Payroll Deductions To record payroll: Salary Expense Withholding Taxes Payable FICA Taxes Payable Union Dues Payable Cash Based on federal & state schedules 10,000 7.65% on first $102,000 1.45% on excess 1,320 765 88 7,827 To record employer payroll tax: Payroll Tax Expense FICA Taxes Payable Fed Unemploy Tax Payable State Unemploy Tax Payable 1,245 765 80 400 6.2%* on first $7000. * 0.8% if state unemployment taxes have been paid Compensated Absences Liability Obligation from services already rendered Vested or accumulated Probable and reasonably estimated If future compensation exceeds the liability, the difference is charged to wage expense. Sick pay that accumulates need not be accrued CONTINGENCIES Gain Contingencies Possible donations, lawsuit awards, etc. Not recorded Loss Contingencies Expense and liability recognized Required conditions: probable at financial statement date reasonably estimated Litigation, Claims, & Assessments Cause of litigation on or before financial statement date “Probability of unfavorable outcome” based on experience, legal opinion, etc. For lawsuits not yet filed probable that suit will be filed, and probable that outcome will be unfavorable Guarantee and Warranty Costs Cash Basis Warranty Expense Cash, Inventory, etc. (Warranty costs incurred.) 20,000 20,000 Not acceptable if warranty liability is probable and reasonably estimated. Accrual Basis – Expense Warranty Approach Cash 3,000,000 Sales (To record sales for the year.) 3,000,000 (Warranty costs incurred.) (To accrue warranty costs.) (Warranty costs incurred on prior year sales.) Accrual Basis – Sales Warranty Approach Cash 3,000,000 Sales Unearned Warranty Rev (To record sales for the year.) (Warranty costs incurred.) (To recognize revenue related to warranty costs incurred.) 2,850,000 150,000 Premiums and Coupons Expense recorded w/ actual redemption Additional expense accrued at year end a reasonable estimate of the cost of future redemptions matched with current-year revenues Self-Insurance Not insurance No liability recorded for events that have not happened PRESENTATION AND ANALYSIS Current liabilities reported at full maturity value (i.e. not discounted) Bond sinking fund exception Supplemental information on secured liabilities and refinancing arrangements Loss contingencies that are reasonably possible should be disclosed in the notes Exercise 13-1 Balance Sheet Class Accrued vacation pay Estimated taxes payable Service warranties Bank overdraft Injury claim pending Unpaid bonus Customer deposits Sales tax payable Exercise 13-1 (cont.) Balance Sheet Class Unredeemed gift certif. Premium offers outstand Discount on notes pay Unpaid payroll deduct. Current matur: LT debt Unpaid cash dividend Dividends in arrears Loans from officers