HW Chap 13 Day 2.f13

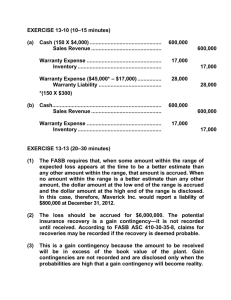

advertisement

ANSWERS TO QUESTIONS 17. (a) A contingency is defined as an existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss (loss contingency) to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur. (b) A contingent liability is a liability incurred as a result of a loss contingency. 18. A contingent liability should be recorded and a charge accrued to expense only if: (a) information available prior to the issuance of the financial statements indicates that it is probable that a liability has been incurred at the date of the financial statements, and (b) the amount of the loss can be reasonably estimated. 20. The terms probable, reasonably possible, and remote are used in GAAP to denote the chances of a future event occurring, the result of which is a gain or loss to the enterprise. If it is probable that a loss has been incurred at the date of the financial statements, then the liability (if reasonably estimable) should be recorded. If it is reasonably possible that a loss has been incurred at the date of the financial statements, then the liability should be disclosed via a footnote. The footnote should disclose (1) the nature of the contingency and (2) an estimate of the possible loss or range of loss or a statement that an estimate cannot be made. If the incurrence of a loss is remote, then no liability need be recorded or disclosed (except for guarantees of indebtedness of others, which are disclosed even when the loss is remote). 23. The expense warranty approach and the sales-warranty approach are both variations of the accrual method of accounting for warranty costs. The expense warranty approach charges the estimated future warranty costs to operating expense in the year of sale or manufacture. The sales-warranty approach defers a certain percentage of the original sales price until some future time when actual costs are incurred or the warranty expires. 25. Although the accounting for this transaction has been studied, no authoritative guideline has been developed to record this transaction. In the case of a free ticket award, AcSEC proposed that a portion of the ticket fares contributing to the accumulation of the 50,000 miles (the free ticket award level) be deferred as unearned transportation revenue and recognized as revenue when free transportation is provided. The total amount deferred for the free ticket should be based on the revenue value to the airline and the deferral should occur and accumulate as mileage is accumulated. SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 13-13 2012 Warranty Expense ........................................................... 70,000 Inventory ..................................................................... 70,000 12/31/12 Warranty Expense ........................................................... 400,000 Warranty Liability ........................................................... 400,000 BRIEF EXERCISE 13-14 (a) (b) (c) Cash.................................................................................. 1,980,000 Unearned Warranty Revenue (20,000 X $99) ....................................................... 1,980,000 Warranty Expense ........................................................... 180,000 Inventory ................................................................. 180,000 Unearned Warranty Revenue .......................................... 330,000 Warranty Revenue ($1,980,000 X 180/1,080*) ..................................... 330,000 *180,000 + 900,000 SOLUTIONS TO EXERCISES EXERCISE 13-11 (15–20 minutes) (a) (b) Cash.................................................................................. 3,000,000 Sales Revenue (500 X $6,000) ................................ 3,000,000 Warranty Expense ........................................................... 30,000 Inventory ................................................................. 30,000 Warranty Expense ........................................................... 90,000 Warranty Liability ($120,000 – $30,000) ............................................ 90,000 Cash.................................................................................. 3,000,000 Sales Revenue ........................................................ Unearned Warranty Revenue ................................. 2,840,000 160,000 Warranty Expense ........................................................... 30,000 Inventory ................................................................. 30,000 Unearned Warranty Revenue .......................................... 40,000 Warranty Revenue [$160,000 X ($30,000/$120,000)] .......................... 40,000 EXERCISE 13-13 (20–30 minutes) (1) The FASB requires that, when some amount within the range of expected loss appears at the time to be a better estimate than any other amount within the range, that amount is accrued. When no amount within the range is a better estimate than any other amount, the dollar amount at the low end of the range is accrued and the dollar amount at the high end of the range is disclosed. In this case, therefore, Maverick Inc. would report a liability of $800,000 at December 31, 2012. (2) The loss should be accrued for $6,000,000. The potential insurance recovery is a gain contingency—it is not recorded until received. According to FASB ASC 410-30-35-8, claims for recoveries may be recorded if the recovery is deemed probable. (3) This is a gain contingency because the amount to be received will be in excess of the book value of the plant. Gain contingencies are not recorded and are disclosed only when the probabilities are high that a gain contingency will become reality.