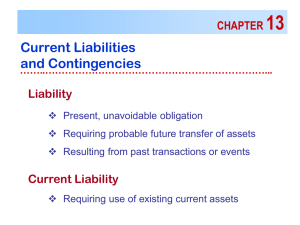

Chapter 13 Current Liabilities

advertisement

Intermediate Accounting II, ACCT-2164 Chapter 13 Practice Problem Solutions Brief Exercise 13–1 Cash ............................................................... Notes payable.............................................. 60,000,000 Interest expense ($60,000,000 x 12% x 3/12) ....... Interest payable .......................................... 1,800,000 60,000,000 1,800,000 Brief Exercise 13–4 Cash (difference) .......................................................... Discount on notes payable ($12,000,000 x 9% x 9/12) .... Notes payable (face amount) .................................... 11,190,000 810,000 Interest expense ........................................................ Discount on notes payable ........................................... 810,000 Notes payable (face amount) ........................................ Cash ....................................................................... 12,000,000 12,000,000 810,000 12,000,000 Exercise 13–8 Requirement 1 Cash ....................................................................... Liability—customer advance ........................... 7,500 7,500 Requirement 2 Cash ....................................................................... Liability—refundable deposits ......................... 25,500 25,500 Requirement 3 Accounts receivable .............................................. Sales revenue .................................................... Sales taxes payable ([5% + 2%] x $800,000) ......... Solutions Manual, Vol.2, Chapter 13 856,000 800,000 56,000 © The McGraw-Hill Companies, Inc., 2013 13–1 Exercise 13–13 1. Current liability: $10 million The requirement to classify currently maturing debt as a current liability includes debt that is callable by the creditor in the upcoming year—even if the debt is not expected to be called. 2. Noncurrent liability: $14 million The current liability classification includes (a) situations in which the creditor has the right to demand payment because an existing violation of a provision of the debt agreement makes it callable and (b) situations in which debt is not yet callable, but will be callable within the year if an existing violation is not corrected within a specified grace period—unless it's probable the violation will be corrected within the grace period. In this case, the existing violation is expected to be corrected within six months. 3. Current liability: $7 million The debt should be reported as a current liability because it is payable in the upcoming year, will not be refinanced with long-term obligations, and will not be paid with a bond sinking fund. © The McGraw-Hill Companies, Inc., 2013 13–2 Intermediate Accounting, 7e Exercise 13–18 Requirement 1 This is a loss contingency. Some loss contingencies don’t involve liabilities at all. Some contingencies when resolved cause a noncash asset to be impaired, so accruing it means reducing the related asset rather than recording a liability. The most common loss contingency of this type is an uncollectible receivable, as described in this situation. Requirement 2 Bad debt expense: 3% x $2,400,000 = $72,000 Requirement 3 Bad debt expense (3% x $2,400,000) ................................. Allowance for uncollectible accounts .................. 72,000 72,000 Requirement 4 Allowance for uncollectible accounts: Beginning of 2013 Write off of bad debts* Credit balance before accrual Year-end accrual (Req. 3) End of 2013 $75,000 73,000 2,000 72,000 $74,000 * Allowance for uncollectible accounts ........................ Accounts receivable ......................................... Net realizable value: Accounts receivable Less: Allowance for uncollectible accounts Net realizable value Solutions Manual, Vol.2, Chapter 13 73,000 73,000 $490,000 (74,000) $416,000 © The McGraw-Hill Companies, Inc., 2013 13–3