Financial Accounting

advertisement

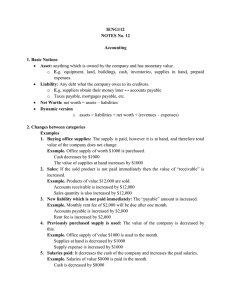

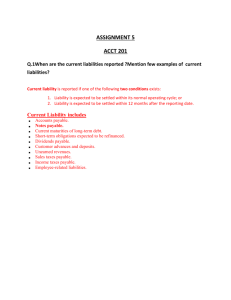

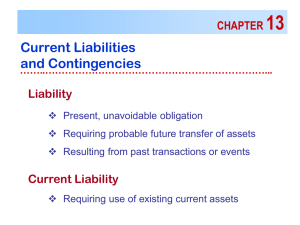

FINANCIAL ACCOUNTING A USER PERSPECTIVE Hoskin • Fizzell • Davidson Second Canadian Edition Liabilities Chapter Nine Recognition for Liabilities • Classify as liabilities if – Transfer of assets or the delivery of services or other benefits – Company has little or no discretion – Results from an event that has already occurred Contingent Liability • If there is a possibility of the future transfer of assets, and • If the future obligation is contingent on certain events occurring, then • Company should disclose in a note to the financial statements Valuation Methods • Gross amount of the obligation – May not measure obligation accurately – Ignores the time value of money Valuation Methods • Net present value of the obligation – Recognizes the time value of money – Future payments of principal and interest are discounted back to the current period using a discount rate Valuation Methods • Canadian practice – Record liabilities at the present value of the future payments – Exception: short-term liabilities Working Capital Loans and Lines of Credit • Short-term loan from a bank • Secured by accounts receivable or inventory balances • Results in negative cash balance Accounts Payable • Occur when goods or services are purchased on credit • Called trade accounts payable • Payment deferred for 30-60 days • Generally do not carry interest charges, unless payment is delayed Wages and Other Payroll Payables • Accrual of wages since the last pay period • Fringe benefits – Health care, pensions, vacation pay • Company acts as government agent in collecting taxes – Income taxes, CPP (QPP), EI, WCB Wages and Other Payroll Payables • Deductions from employees’ earned income SE-Wages expense 7,500.00 L-Employee income tax payable 990.00 L-CPP contribution payable 240.00 L-EI taxes payable 202.50 A-Cash 6,067.50 Wages and Other Payroll Payables • Additional amounts paid by employer SE-Wages expense L-CPP contribution payable L-EI taxes payable 7,500.00 240.00 283.50 Short-Term Notes and Interest Payable • Short-term notes – Borrowings that require repayment in the next year or operating cycle – Carry explicit interest rates, or represent implicit interest amounts • Interest expense and payable – Recognized over the life of the loans Short-Term Notes and Interest Payable • Example: – Borrowing of $10,000 at 9%. – Six monthly payments of $1,710.70 – Monthly instalments included reductions of the principal, plus interest – Interest is calculated on the decreasing amount of principal Short-Term Notes and Interest Payable Month Payment Interest Principal Principal Reduction Balance 10,000.00 1 1,710.70 75.00 1,635.70 8,364.30 2 1,710.70 62.73 1,647.97 6,716.33 3 1,710.70 50.37 1,660.33 5,056.00 4 1,710.70 37.92 1,672.78 3,383.22 5 1,710.70 25.37 1,685.33 1,697.89 6 1,710.70 12.81 1,697.89 -0- Short-Term Notes and Interest Payable • Entry at the end of the first month SE-Interest expense 75.00 L-Short-term note payable 1,635.70 A-Cash 1,710.70 Income Taxes Payable • Companies are subject to taxes – Federal corporate income taxes – Provincial corporate taxes • Payment of taxes does not always coincide with the incurrence of the tax • Results in taxes payable Warranty Payable • Goods or services sold may result in guarantees to the buyer • May result in warranty service • Estimate the amount of warranty expense to match to the revenue from the sale – Estimate % based on past history Warranty Payable • Record the estimated warranty obligation (in the period of the sale) SE-Warranty expense 460 L-Estimated warranty obligation 460 Warranty Payable • Record the repair work (in the period when the work is done) L-Estimated warranty obligation A-Cash 126 126 Unearned Revenues • If customers are required to make downpayments prior to the receipt of goods or services • Defer the recognition of revenue • Liabilities – Unearned revenues, or – Deferred revenues Current Portion of Long-Term Debt • When long-term debt comes within a year of being due • Must be reclassified as a current liability Commitments • Purchase commitment – An agreement to purchase items in the future for a negotiated price – Discuss in a note to the financial statements if material to future operations Contingencies • Contingent liabilities (losses) – When the incurrence of the liability is contingent upon some future event – Examples • Settlement of a lawsuit • Guarantee of another company’s loan Contingencies • In Canada, recognize a contingent loss if: – The use of assets or performance of services are required – The amount of the loss can be reasonably estimated Deferred Taxes • Differing calculations: – Income tax expense from the income statement – Income tax payable according to Revenue Canada • Two methods: Liability method and Deferral method Liability Method • Focuses on the balance sheet • Attempts to measure the liability to pay taxes in the future based on a set of assumptions about future revenues and expenses Liability Method • Calculate (pro forma) future income taxes payable based on temporary differences existing in the current period • A liability in the current period will become a tax deduction as actual costs are incurred Liability Method • Assumptions Income before tax and warranties $10,000 Warranty expense (accounting purposes): Year 1: $200 Actual warranty costs incurred: Year 1: $ 50 Year 2: $ 70 Year 3: $ 80 Tax rate: 40% Liability Method Year 1 Year 2 Year 3 Beginning warranty obligation $ 200 $ 150 $ Actual warranty costs incurred 50 70 Ending warranty obligation $ 150 $ 80 $ Tax rate Future tax asset Reduction of future tax asset 80 80 -0- 40% 40% 40% $ 60 $ 32 $ -0( $28) ( $32) Liability Method Income tax payable: Year 1 Year 2 Year 3 Income $10,000 $10,000 $10,000 Actual warranty costs Taxes payable Taxes payable Future tax asset Tax expense 50 70 80 9,950 9,930 9,920 3,980 3,972 3,968 $ 5,970 $ 5,958 $ 5,952 $ 3,980 $ 3,972 $ 3,968 (60) 28 32 $ 3,920 $ 4,000 $ 4,000 Deferral Method • Focuses on the income statement • Tax expense is based on the recognized revenues and expenses on the income statement • Uses the tax rates in effect in the current year Deferral Method Tax expense: Income Warranty expense Tax expense Net income Year 1 Year 2 Year 3 $10,000 $10,000 $10,000 200 -0-09,800 10,000 10,000 3,920 4,000 4,000 $ 5,880 $ 6,000 $ 6,000 Taxes payable $ 3,980 $ 3,972 $ 3,968 Deferred taxes 60 (28) (32) Differences Liability Method Deferral Method • Balance sheet • Income focus statement focus • Future tax rate • Current tax rate • Future reviews • Deferred taxes of tax assets and drawn down; no liabilities periodic reviews