choices & types of strategies

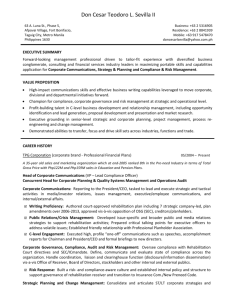

advertisement

31-Jan-12 STRATEGIES IN ACTION Session 5 Professor Hilda L. Teodoro Ateneo Graduate School of Business AGENDA: STRATEGIES Choices/Types of Strategies Analytical Tools for Strategic Direction-Setting SWOT, BCG, SPACE, IE and GRAND STRATEGY Setting of Strategic Objectives HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 2 CHOICES & TYPES OF STRATEGIES HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 3 TYPES OF STRATEGIES Integration •Forward Integration •Backward Integration •Horizontal Integration Diversification •Concentric Diversification •Horizontal Diversification •Conglomerate Diversification HILDA L. TEODORO Intensive •Market Penetration •Market Development •Product Development Defensive •Retrenchment •Divestiture •Liquidation ATENEO GRADUATE SCHOOL OF BUSINESS 4 Forward Integration Gaining ownership or increased control over distributors. FedEx completed a buyout of Tianjin Datian's domestic express delivery network as part of the $400 million deal, giving it 89 office locations across China to help it compete with UPS, DHL and TNT in the booming Chinese logistic market. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 5 Backward Integration Seeking ownership or increased control of firm’s suppliers. 2007 - Symrise acquires Paris/Madagascar-based Aromatics S.A.S. Symrise, one of the world's leading manufacturers of flavors and fragrances, is continuing to expand its international business activities in the sector of natural raw materials and extracts. “This backward integration in the field of vanilla has successfully proven that it translates into first-class raw materials and a secure supply chain, as well as reliability and traceability for our customers,” said Heinrich Schaper, President Flavor & Nutrition EAME (Europe, Africa, Middle East) at Symrise HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 6 Horizontal Integration Seeking ownership of competitors. 2000: Pfizer, the manufacturer of Viagra, boosted its market cap from $172 billion to $271 billion after acquiring rival Warner-Lambert Co. rising from global No. 20 to No. 4. 2007: Pfizer has entered into an agreement to acquire Coley Pharmaceutical Group, Inc. a publicly-held biopharmaceutical company specializing in vaccine adjuvant technology and a new class of immunomodulatory drug candidates designed to fight cancers, allergy and asthma disorders, and autoimmune diseases. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 7 Market Penetration Increasing market share for present products in present markets through greater marketing efforts. In the 1960s and early 1970s, PepsiCo was a much more aggressive and innovative company than Coca Cola. When Coke finally woke up-after losing its market leadership--it did a terrific job of advertising, too. And when Pepsi's managers responded by revving up their already aggressive advertising, the result made history. Industry growth has doubled, and both companies' market shares were the highest ever. http://www.thecoca-colacompany.com/presscenter/av_advertising.html HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 8 Market Development Introducing present products in new geographic area or finding new market segments for present products.. After years of speculation, last June 2007 the iPhone, perhaps the most hyped consumer electronics device ever created, started shipping in the US. Jobs said Apple plans to bring the iPhone to Europe in the fourth calendar quarter of 2007, and to Asia in 2008. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 9 Product Development increasing sales by improving present products or developing new ones. Nokia is constantly developing newer versions of their cell phones. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 10 Related (Concentric) Diversification adding new but related products. Telephone companies and cable firms offer Internet access. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 11 Unrelated Diversification adding new unrelated products or services Amazon.com originally offered books and CDs. Now its assortment is huge with kitchen sections, auction sections etc GE makes power plants, locomotives, lightbulbs, and refrigerators; GE manages more credit cards than American Express. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 12 Retrenchment Regroup through cost and asset reduction to reverse declining profit. In 2002 Club Med kicked off a cost-cutting program expected to save up to $36 million a year by merging regional offices and closing 17 of 120 resorts. "We're shrinking temporarily to face lower demand," says Bourguignon, Club Med CEO HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 13 Divestiture Selling a division or part of an organization. In 1997 Sara Lee embarked on a major restructuring designed to boost both profits, which had been growing by just 6 percent a year since 1992. Sara Lee aimed to shift from a manufacturing and sales orientation to one focused foremost on marketing the firm's top brands. The company sold off more than 110 manufacturing and distribution facilities over the next two years. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 14 Liquidation Selling all of a company’s assets. GM liquidated its Canadian factory that made Camaros and Firebirds. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 15 Means For Achieving Strategies Joint venture/Partnering – two firms form another org for cooperative purposes. Movielink is a joint venture by five major movie studios aimed at creating an Internet video-on-demand service. Merger – when two organizations of about equal size unite to form one enterprise. Equitable and PCI Bank merge. Acquisition – when a large organization purchases a smaller firm. Pfizer acquired Pharmacia for $50 billion. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 16 Why Is It Not Advisable To Pursue Too Many Strategies At Once? Organizational resources are spread too thin. All organizations have limited resources. No organization can pursue all the strategies . No more than a few strategies can be financed, marketed, and managed effectively at the same time. Some practitioners say only a single strategy should be pursued at a given time by a single organization. HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 17 Michael Porter’s Generic Strategies HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 18 Cost Leadership Strategy Successful cost leaders develop competitive advantage by offering of comparable quality at lower prices than most industry competitors. Seeks efficient facilities, employs tight cost controls Probably most effective in those markets where price is the most important factor (over service, technology, or product characteristics). Seek to exploit economies of scale and experience by maximizing sales volume 01/14/96 HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 19 Differentiation Strategy Seeks to distinguish its products and services from competitors Features what is important & valuable to buyers Firms must develop strong marketing capabilities and a reputation for quality or uniqueness. 01/14/96 HILDA L. TEODORO • technical superiority • quality • support services • guarantees • image/prestige/r eliability • delivery • style • options ATENEO GRADUATE SCHOOL OF BUSINESS 20 Focus Strategy These firms seek overall cost leadership or perceived uniqueness, but they “focus” that advantage on a particular market segment. segment is big enough to be profitable segment has good growth potential Firm has superior ability to serve buyers in segment HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 21 ANALYTICAL TOOLS FOR STRATEGIC DIRECTION-SETTING HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 22 MATRIX STRENGTHS 1 2 List 3 strengths 4 5 WEAKNESSES 1 2 List 3 weaknesses 4 5 OPPORTUNITIES 1 2 List 3 opportunites 4 5 SO Strategies WO Strategies 1 2 3 4 5 1 2 3 4 5 THREATS 1 2 List 3 threats 4 5 ST Strategies WT Strategies 1 2 Use strengths 3 to avoid 4 threats 5 1 2 Minimize 3 weaknesses & 4 avoid threats 5 HILDA L. TEODORO Use strength to take advantage of opportunities ATENEO GRADUATE SCHOOL OF BUSINESS Overcome weakness by taking advantage of opportunities Fred David 23 SAMPLE SWOT STRENGTHS--S 1. Good editorial quality. 2. High readership ratings. 3. Market leadership. 4. Strong staff loyalty. 5. United Board of Directors WEAKNESSES—W 1. Profit margin squeeze. 2. No. 2 in classifieds. 3. Lack of a shared culture. 4. Complacency. 5. Lack of entrepreneurial spirit OPPORTUNITIES—O 1. Better relations with government. 2. The youth market 3. The lower income markets. 4. Better newspaper technology. 5. Digital advertising. SO STRATEGIES 1. Introduce a new product for the youth market (S1, S2, S3,O1,O2) 2. Introduce a new product for the lower income market (S1,S2,S3, O1,O3) 3. Offer digital advertising services (S3, O4, O5). WO STRATEGIES 1. Develop a readership program involving employees (W3,W4,O2,O3). 2. Convert non-revenue earning products into a youth publication (W1,W2, O2). THREATS--T 1. Television. 2. High newsprint costs. 3. Declining readership. 4. Slowdown in the economy. 5. Internet and on-line ST STRATEGIES 1. Introduce a free print medium. (S1,S2,S3, T1,T4) 2. Introduce a youth website. (S1,S3,T1,T5) WT STRATEGIES 1. Set up regional printing sites (W1, T2). 2. Merge non-revenue earning classifieds products into the main classifieds (W2,T2). publications. ATENEO GRADUATE SCHOOL OF BUSINESS HILDA L. TEODORO 24 Space Matrix Internal Strategic Position y-axis=fs + es IFE EFE HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 25 Space Matrix Example External Strategic Position x-axis=ca + is CPM 5 Forces HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 26 x-axis=ca(-1.0)+is(5.6)= +4.6 y-axis=es(-5.2)+fs(2.0)= -3.2 Financial Strength Conservative +6 Aggressive +5 +4 +3 +2 +1 -6 -5 -4 -3 -2 -1 -2 -3 -4 -5 -6 Defensive +1+2+3+4+5+6 (+4.6, -3.2) Competitive Environmental Stability HILDA L. TEODORO Industry Strength MATRIX Competitive Advantage External Strategic Position Internal Strategic Position ATENEO GRADUATE SCHOOL OF BUSINESS The Company is competing fairly well in an unstable environment 27 THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX CONSERVATIVE Stay close to core comp, No excessive risks > Market Penetration > Market Development > Product Development > Concentric Diversif CA -6 -5 -4 -3 -2 Rectify internal weaknesses Avoid external threats > Retrenchment > Divestiture > Liquidation DEFENSIVE HILDA L. TEODORO +6FS_ +5 _ +4 _ +3 _ +2 _ +1 _ 0 -1 -2 -3 -4 -5 -6 Fred David AGGRESSIVE > Market Penetration > Market Development > Product Development > Integration > Diversification _ +1 +2 +3 +4 +5 +6 _ > Integration _ > Market Penetration _ > Market Development _ > Product Development _ > Joint Venture ATENEO GRADUATE ES SCHOOL OF BUSINESS IS COMPETITIVE 28 Relative Market Share (Internal Strengths) H 1.0 (Industry Attractiveness) H M 0.50 STARS Intensive strategies Integration strategies Diversification strategies M Grow CASH COWS L QUESTION MARKS Intensive Strategies Divest Double or QuitBCG MATR DOGS Product Development Retrenchment Concentric Diversification Liquidation Hold/Harve Divestment st HILDA L. TEODORO L 0.0 Divest Fred David ATENEO GRADUATE SCHOOL OF BUSINESS 29 BCG MATRIX Used for Portfolio Management. Relative market share: ratio of a division’s own market share to the market share held by the largest rival firm. Dividing point is usually selected to have only the two-three largest competitors fall in the high market share region. Industry Growth Rate: Dividing point is typically the GNP’s growth rate. Draws attention to the cash flow, investment characteristics and needs of the organization’s various divisions. Pearce & Robinson HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 30 INTERNAL-EXTERNAL (IE) MATRIX Fred David TOTAL EFE WEIGHTED SCORES TOTAL IFE WEIGHTED SCORES Grow & Build HIGH 3.0-4.0 STRONG AVERAGE 3.0-4.0 2.0-2.99 I Intensive Integrative MEDIUM IVIntensive 2.0-2.99 Integrative LOW 1.0-1.99 HILDA L. TEODORO Market VIIpenetration Prod. devt WEAK 1.0-1.99 II Intensive Integrative III V Market penetration Prod. devt VI VIII Divestment ATENEO GRADUATE SCHOOL OF BUSINESS Hold & Maintain Market penetration Prod. devt Divestment IX Divestment Harvest & Divest 31 TOTAL EFE WEIGHTED SCORE = 3.0 SAMPLE INTERNAL-EXTERNAL (IE) MATRIX TOTAL IFE WEIGHTED SCORE= 3.2 Intensive Integrative HIGH 3.0-4.0 STRONG AVERAGE 3.0-4.0 2.0-2.99 I ABC MEDIUM IV 2.0-2.99 LOW 1.0-1.99 HILDA L. TEODORO VII WEAK 1.0-1.99 II III V VI VIII IX ATENEO GRADUATE SCHOOL OF BUSINESS 32 THE GRAND STRATEGY MATRIX RAPID MARKET GROWTH Quadrant I Quadrant II W E 1. market development A 2. market penetration K 3. product development C 4. horizon integration O 5. divestiture M 6. liquidation P E Quadrant III T 1. retrenchment I 2. concentric diversification T 3. horizontal diversification I V 4. conglomerate diversification E 5. divestiture 1. 2. 3. 4. 5. 6. 7. market development market penetration product development forward integration backward integration horizontal integration concentric diversification Quadrant IV 1. 2. 3. 4. concentric diversification horizontal diversification conglomerate diversification joint venture 6. liquidation HILDA L. TEODORO SLOW MARKET GROWTH ATENEO GRADUATE SCHOOL OF BUSINESS Fred David S T R O N G C O M P E T I T I V E 33 STRATEGIES SUMMARY STRATEGY OPTIONS TOWS SPACE IEM GSM TOTAL INTEGRATION STRATEGIES 1 2 Forward Integration Backward Integration 1 1 1 1 2 2 3 Horizontal Integration INTENSIVE STRATEGIES 4 Market Penetration 5 Market Development 1 1 2 0 4 3 1 1 1 1 1 6 Product Development DIVERSIFICATION STRATEGIES 1 1 1 3 0 7 8 1 1 1 2 1 Concentric Diversification Conglomerate Diversification 9 Horizontal Diversification DEFENSIVE STRATEGIES 1 1 1 1 0 10 Joint Venture 0 11 Retrenchment 0 12 Divestiture 0 13 Liquidation 0 HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 34 THE QSP MATRIX (QSPM) STEPS 1. List key external opportunites/threats and internal strenths and weaknesses (identical to EFE & IFE) 2. Assign weights(identical to EFE & IFE) 3. Examine stage 2 matrices/identify alternatives – choose top 3 or 4 alternatives (see Matching Strategies Summary) HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 35 THE QSP MATRIX(QSPM) 4. determine attractiveness score (AS) - be sure not to assign the same AS in a given row. Recall that dashes should be inserted all the way across a given row when used. 1. Not attractive 2. Somewhat attractive 3. Reasonably attractive 4. Highly attractive AS: Does this factor affect the choice of strategies being made? If the answer to the above question is no then use a dash across set. If you assign an AS score to one strategy, you must assign an AS to the other strategies in the set HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 36 SAMPLE QSP MATRIX (QSPM) HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 37 SETTING OF STRATEGIC OBJECTIVES HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 38 SETTING OF STRATEGIC OBJECTIVES Arriving at a clearer definition of where we want to go and what we want to achieve in a given planning horizon. An Objective must be: • • • • • Specific Measurable Achievable Realistic Time-bound It must also be: • Challenging • Hierarchical • Understandable HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 39 OBJECTIVE-SETTING TYPES OF OBJECTIVES: STRATEGIC & FINANCIAL EXAMPLES STRATEGIC OBJECTIVES FINANCIAL OBJECTIVES • A bigger market share • Quicker design-to-market times than rivals • Higher product quality • Lower costs relative to competitors • Broader or more attractive product line • Superior customer service • Wider geographic coverage • Growth in revenues • Growth in earnings • Wider profit margins • Higher returns on invested capital • Attractive economic value added (EVA) performance • Bigger cash flows • A rising stock price • Earnings per Share • Strong bond and credit ratings HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 40 EXAMPLE STRATEGIC OBJECTIVE: TO DOUBLE REVENUES IN FIVE YEARS STRATEGIES: Improve product quality through the acquisition of new production facilities with advance/better technology Build a strong brand image through greater advertising efforts Strengthen sales and distribution system, and focus on the institutional outlets Enter the low-end market through the acquisition of XYZ Company HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 41 EXAMPLE STRATEGIC OBJECTIVE: To improve profitability from 6% to 12% by 2008 STRATEGIES: To rationalize product line by eliminating low-margin and slowmoving products To move from in-house selling, warehousing and distribution to third-party distributorship system To change packaging materials from imported to locally-sourced ones To reduce manpower complement by 20% by integrating the Finance and HR functions, and the Marketing and Sales Units HILDA L. TEODORO ATENEO GRADUATE SCHOOL OF BUSINESS 42