TVM Sample Probs w/solns

advertisement

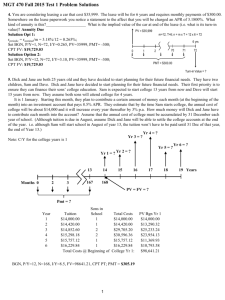

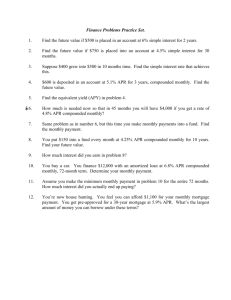

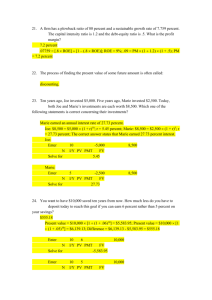

TVM Sample Problems (ver. 2.1 Fall 13) More Than One Future Cash Flow? Yes No Single FV (4 parameters) Even or Uneven Cash Flows Even Uneven Annuity (5 parameters) CF Worksheet More Than One Pmt per year? Use Periodic Rate More Than One Pmt per year? Yes No Compute n Draw Time Line Draw Time Line Add Cash Flows Add Cash Flows Ord. Annuity or An. Due? Inventory What You Know To Identify What You Don’t Know List Inputs Note: Usually (but not always), One of the Five Parameters Is Irrelevant Know What You Need to Find? No Yes Compute the Answer 1 2 1. To complete your business school education, you will need $10,000 a year for the next four years, starting next year (that is, you will need to pay for one year’s worth of schooling at the beginning of the year, one year from today). Your rich uncle offers to put you through school and he will deposit a lump sum into a saving account paying 7% p.a. sufficient to defray these expenses. The deposit will be made today. How large must the deposit be? (Assume your uncle is rich because he won the lottery and he doesn’t know much about finance stuff.) PMT = 10,000 nominal = 7% 0 1 2 3 4 PV = Soln. Opt 2: P/Y=1, N=4, I/Y=7, PMT=10000; CPT,PV: $33,872.11 2. You are considering financing a new car which cost $51,300 with an amortized loan. The nominal rate is 2.9% p.a., the term of the loan is 6 years and you will make monthly payments. How much will each payment be? PV = $51,300 0 nominal = 2.9% 1 2 m = 12 T=6 n = m x T = 12 x 6 = 72 70 71 72 PMT = ? rperiodic = nominal / m = 2.9/12 = 0.24167 P/Y=1, N=72, I/Y= 0.24167, PV=51300; CPT,PMT: PMT = $777.14 OR P/Y=12, N=72, I/Y=2.9, PV=51300’ CPT,PMT: PMT = $777.14 3 3. How many years will it take for your savings account to accumulate $1m if it pays 4% interest p.a. compounded semiannually and you deposit $10k every 6-months at the end of the 6-month period? FV = $1m r = 4% 0 1 2 3 4 5 n-2 n-1 n=? PMT = (-)10,000 a) Find number of periods rperiodic = nominal / m = 4%/2 = 2% P/Y=1, I/Y= 2, PMT=-10000, FV=1000000; CPT,N: N = 55.48 periods OR P/Y=2, I/Y= 4, PMT=-10000, FV=1000000; CPT,N: N = 55.48 periods b) Find number of years: Years = N/m = 55.48/2 = 27.74 years 4. Today you deposited $1,300 in a bank that pays 5% p.a., compounded quarterly. How much money would you have in this account 20 months from now? m = 4, T = 20/12 = 1.666667 FV = ? n = m x T = 6.666667 nominal = 5% 0 1 2 5 PV = $1,300 6 7 n = 6.666667 rperiodic = rnominal/m = 5%/4 = 1.25% P/Y=1, N=6.666667, I/Y=1.25, PV=1300; CPT,FV: FV = $1,412.25 OR P/Y=4, N=6.666667, I/Y=5, PV=1300; CPT,FV: FV = $1,412.25 4 5. What is the future value of an annuity due yielding 9.6400% p.a. that pays quarterly payments of $1,000 for 9 mos? (Do the math; do not use the financial functions on your calculator. Draw a cash flow diagram) nominal = 9.64% T = 9/12, m = 4, n = T x m = 9/12 x 4 = 3 PMT = 1,000 0 1 2 3 FV = ? FV = PV(1 + r/m)n + PV(1 + r/m)n-1 + ………….. = 1000(1 + 0.0964/4)3 + 1000(1 + 0.0964/4)2+ 1000(1 + 0.0964/4)1 = 1000(1.0241)3 + 1000(1.0241)2 + 1000(1.0241)1 = 1000(1.0741) + 1000(1.0488)+ 1000(1.0241) = 1,074.0564 + 1,048.8000 + 1,024.1000 = $3,146.96 5 6. On 1 January 2008 you deposited $700 in a mutual fund that has been yielding a constant 6% p.a. for the last several years. You plan to deposit $700 every 3 months thereafter for the next 4 years (i.e. the next deposit will be made 1 April, the subsequent deposit on 1 July, etc.) How much money will have accumulated after 4 years? FV = ? m = 4, T = 4 n = m x T = 16 nominal = 6% 0 1 2 14 15 16 PMT = 700 Note: There is no payment at t = 16 Set to “BGN” mode: 2nd, BGN, 2nd, SET, CE/C rperiodic = rnominal/m = 6%/4 = 1.5% P/Y=1, N=16, I/Y=1.5, PMT=700; CPT,FV: FV = $12,740.95 OR P/Y=4, N=16, I/Y=6, PMT=700; CPT,FV: FV = $12,740.95 7. On 1 January 2008 you deposited $700 in a mutual fund that has been yielding a constant 6% p.a. for the last several years. You plan to deposit $700 every 3 months thereafter for the next 4 years (i.e. the next deposit will be made 1 April, the subsequent deposit on 1 July, etc.) How much money will have accumulated after 4 years to include a payment to be made at the beginning of the first quarter of the fifth year. Option 1: (Treat as an Annuity Due) FV = ? nominal = 6% m = 4, T = 4 n = m x T = 16 0 1 2 PMT = 700 14 15 16 700 Set to “BGN” mode: 2nd, BGN, 2nd, SET, CE/C rperiodic = rnominal/m = 6%/4 = 1.5% [P/Y=1, N=16, I/Y=1.5, PMT=700; CPT,FV: FV = $12,740.95] + $700 = $13,440.95 OR P/Y=4, N=16, I/Y=6, PMT=700; CPT,FV: FV = $12,740.95] + $700 = 13,440.95 6 7. (continued) Option 2: (Treat as an Annuity in Arrears) FV = ? nominal = 6% m = 4, T = 4 n = m x T = 16 0 1 2 700 14 15 16 PMT = 700 rperiodic = rnominal/m = 6%/4 = 1.5% P/Y=1, N=16, I/Y=1.5, PV=700, PMT=700; CPT,FV: FV = $13,440.95 OR P/Y=4, N=16, I/Y=6, PV=700, PMT=700; CPT,FV: FV = 13,440.95 8. You are considering leasing a car that cost $46,000. The lease will be for 5 years and requires monthly payments. Somewhere on the lease paperwork you notice a statement to the affect that you will be charged a nominal rate of 6.2850% p.a. Assume the car will be worth $20,000 at the end of the lease. What kind of annuity is this?___________________ How much will your payments be? PV = $46,000 0 m=12, T=5; n = m x T = 60 nominal = 6.2850% 1 58 2 59 5 yrs 60 Turn-in = $20,000 PMT = ? rperiodic = rnominal/m = 6.2850%/12 = 0.5238% Set BGN, P/Y=1, N=60, I/Y=0.5238, PV=46000, FV= -20000; CPT PMT: PMT = $607.67 OR Set BGN, P/Y=12, N=60, I/Y=6.2850, PV=46000, FV= -20000; CPT PMT: PMT = $607.67 7 9. You are tasked with estimating the fair market value of a security that promises uneven future payments. The table below shows the monthly payment schedule (each cash flow occurs at the end of the month). You consider 6% p.a. to be the appropriate opportunity cost. What is the theoretical value of this security? 1st month 2nd month 3rd month 4th month 5th month 6th month $350 $390 $480 $660 $820 $940 $820 $350 0 1 $390 2 $480 3 $660 4 rperiodic = rnominal/m = 6%/12 = 0.5% CF, 2nd, CLR WORK (Clears Cash Flow Registers) 0, ENTER, ↓, 350, ENTER ↓, ↓, 390, ENTER ↓, ↓, 480, ENTER ↓, ↓, 660, ENTER ↓, ↓, 820, ENTER ↓, ↓, 940, ENTER NPV, 0.5, ENTER ↓, CPT = $3,566.31 8 $940 5 6 10. Today you open a new investment account for your company with a $30,000 deposit. The account has had an average yield of 7.5600% p.a. over the last three years and compounds every month. You plan to deposit $30,000 into this account every quarter, at the beginning of the quarter. Your next deposit will be three months from now. How much will you have in this account 3 years from now?. m=4, T=3; n = m x T = 4 x 3 = 12 nominal = 7.56% compounded monthly 0 1 2 FV = ? 10 11 12 qtrs PMT = $30,000 Set BGN, P/Y=4, C/Y=12, N=12, I/Y=7.56, PMT=30000; CPT,FV: FV = $407,761.65 OR Convert the monthly rate into a quarterly rate then solve for FV 2nd , ICONV, 7.56, ENTER, ↓, 12, ENTER, ↓, ↓, CPT: EFF% = 7.8275% ↓, 4, ENTER. ↓, CPT: NOM% = 7.6077% Set BGN, P/Y=4, N=12, I/Y=7.6077, PMT=30000; CPT,FV: FV = $407,761.65 9 11. You are considering buying one of the two securities described below. What is the fair market value of each security and which one is priced closer to its fair market value? Security A: A 2-year investment period yielding 6.35% p.a.; monthly payments of $75; priced at $1950. Security B: A 2-year investment period yielding 6.25% p.a.; 3 payments of $62.50 at the end of each of each successive 6-month period and a final lump sum payment of $1,062.50; priced at $1300. PMT = 75 Security A: nominal = 6.35% m = 12, T = 2; n = m x T = 24 0 1 2 22 23 24 PV = ? rperiodic = rnominal/m = 6.35%/12 = 0.529% P/Y=1, N=24, I/Y=0.529, PMT=75; CPT,PV: PV = $1,686.21 OR P/Y=12, N=24, I/Y=6.35, PMT=75; CPT,PV: PV = $1,686.21 Percent Above FMV: (1,950 - 1,686.21) / 1,686.21 = 15.6440% Security B: m = 2, T = 2; n = m x T = 4 Soln Opt 1 PMT = 1062.50 PMT = 62.50 nominal = 6.25% 0 1 2 3 4 PV = ? Soln. Opt 1: rperiodic = rnominal/m = 6.25%/2 = 3.125% CF0=0, CF1=62.5, CF2=62.5, CF3=62.5, CF4=1062.5, I/Y=3.125; NPV = $1,115.82 10 PMT = 1000 Soln Opt 2 PMT = 62.50 nominal = 6.25% 0 1 2 3 4 PV = ? Soln. Opt 2a: PVA(4, 3.125, 62.50) + PV(4, 3.125, 1000) [N=4, I/Y=3.125, PMT=62.5] + [N=4, I/Y=3.125, FV=1000] $231.63 + $884.19 = $1,115.82 Soln. Opt 2b: P/Y=1, N=4, I/Y=3.125, PMT=62.5, FV=1000; CPT,PV: PV = $1,115.82 Percent Above FMV: (1,300 – 1,115.82) / 1,115.82 = 16.5062% Security A is more fairly priced 11 12. Retirement Plan You plan to retire on your 65th birthday. You want to withdraw $100,000.00 each year at the beginning of each year. You plan to live until your 88th birthday and you want your account balance to be $0 on that day (this is for planning purposes only). How much money you must deposit annually into a retirement account starting on your 25th birthday to fund the above described retirement plan. You estimate the average rate of return over the rest of your life will be 7% p.a. Step 1: Find the amount of money the account needs to have on your 65th birthday. PMT = $100k 65 PV = ? 66 67 86 87 88 nominal = 7% Set calculator to “Begin” mode P/Y=1, N=23, I/Y=7, PMT= 100000; CPT, PV: $1,206,124.05 Step 2: Find the amount of the annual deposit. nominal = 7% 25 FV = $1,206,124.05 26 27 63 64 65 PMT = ? You make your deposit at the beginning of each year: Set calculator to “Begin” mode P/Y=1,N=40, I/Y=7, FV=1,206,124.05; Compute PMT: $5,646.395 12 13. Martha Mills, manager of the Plaza Gold Emporium, wants to allow her customers to buy on credit, giving them 3 months in which to pay. However, Martha will have to borrow from her bank to establish the credit reserve. The bank will charge 7% p.a. interest compounded monthly. Martha wants to quote a simple rate to her customers that will exactly cover her financing cost. What simple (quoted, nominal) should Martha quote to her customers. Assume that all customers will take the full 3 months to pay. (Hint: the credit account compounds quarterly.) Approach: In order to break even, Martha wants credit sales to yield exactly equal to her cost of debt. Thus both arrangements must have the same EAR. For the bank loan, m = 12. For credit sales, m = 4. 1) Find EAR on the bank loan: Solution Opt 1: EAR = (1 + 0.07/12)12 – 1 = 7.229% Solution Opt 2: 2nd, ICONV 7, ENTER ↓, ↓, 12, ENTER ↓, ↓, CPT : EFF% = 7.229% 2) Find the quoted (simple) rate to apply to credit sales Solution Opt 1: EFF%bank = (1 + rnominal/m)m - 1 0.07229 = (1 + rnominal/4)4 - 1 1.07229 = (1 + rnominal/4)4 1.01760 = 1 + rnominal/4 0.01760 = rnominal/4 nominal = 7.041% Solution Opt 2: 2nd, ICONV ↓, 7.229, ENTER ↓, 4, ENTER ↓, CPT: NOM = 7.041% 13 14. A friend of yours is working as an unpaid intern at a local brokerage firm and her boss is selling some securities which pay $50 at the end of each of the next 3 years and a final payment of $1050 at the end of the 4 th year. Your friend says she can get you some of these securities at a cost of $900 each. Your money is currently invested in a bank that pays 8% p.a. with quarterly compounding. You consider the securities as being just as safe and as liquid as your bank. What is the fair market value (the theoretical value) of these securities? 1st Step: Find the EAR on the bank account Why? Answer: This is the Opportunity Cost of Capital and it must be converted to the same compounding frequency as the securities Solution Opt. 1: EAR = (1 + r/m)m - 1 = (1 + 0.08/4)4 – 1 = 8.24% Solution Opt. 2: 2nd, ICONV 8, ENTER ↓, ↓, 4, ENTER ↓, ↓, CPT: EFF% = 8.24% 2nd Step: Find PV of the securities PMT = 50 PMT = 1050 nominal = 8.24% 0 1 2 3 4 PV = ? Why use 8.24% for nominal? Find PV using uneven CF approach CF, 2nd, CLR WORK (clears CF registers) 0, ENTER ↓, 50, ENTER ↓, ↓, 50, ENTER ↓, ↓, 50, ENTER ↓, ↓, 1050, ENTER NPV, 8.24, ENTER ↓, CPT: PV = $893.26 14 Another way: Recognize the cash flows as such (this looks like a bond or a PMT = 1000 non-amortized loan) PMT = 50 nominal = 8.24% 0 1 2 3 4 PV = ? Solution Opt 1: PV = PVA(4, 8.24, 50) + PV(4, 8.24, 1000) = [N=4, I/Y=8.24, PMT=50] + [N=4, I/Y=8.24, FV=1000] = $164.73 + $728.53 = $893.26 Solution Opt 2: N=4, I/Y=8.24, PMT=50, FV=1000; CPT,PV: PV = $893.26 Compare quoted price to fair market value $900 - $893.26 = $6.74 Your friend is trying to make a profit of $6.74 15 15. On 1 January you deposited $500 in a savings account that pays 3% p.a.. You plan to deposit $500 every three months thereafter (i.e. the next deposit will be on 1 April, the subsequent deposit on 1 July, etc.) How much money will have accumulated after 14 months? Wrong Ans: $2,383.37 PMT = $500 0 1 2 n = 4.666667 m = 4 T = 14/12 =1.1666667 n = m x T = 4.666667 3 5 4 FV = ? Solution Option 1: Compound each CF forward and sum them: Cash Flow 0 1 2 3 4 PV $500.00 $500.00 $500.00 $500.00 $500.00 n 4.6667 3.6667 2.6667 1.6667 0.6667 rperiodic 0.7500% 0.7500% 0.7500% 0.7500% 0.7500% FV $517.74 $513.89 $510.06 $506.27 $502.50 Sum of FVs: $2,550.46 Solution Option 2: 1) Find the FV at t=4: PMT = $500 PV = $500 0 1 2 3 5 4 FV = ? Set “END”, P/Y=4, N=4, I/Y=3, PV=500, PMT=500; CPT, FV: $2,537.78 2) Compound $2,537.78 forward 0.666667 periods n = 0.666667 PV = $2,537.78 3 4 P/Y=4, N=0.666667, I/Y=3, PV= 2537.78; CPT, FV: $2,550.46 16 5 FV = ? 16. If you save $500 each year for 2 years and then $1,000 each for two years, how much must you save in the 5th and 6th years to have $10,000 at the end of 10 years if the interest rate is 5% p. a.? FV = $10,000 0 1 2 3 $500 4 $1,000 5 6 7 8 9 10 PMT = ? $500[(1.05)9 +(1.05)8] + $1,000[(1.05)7 + (1.05)6] + x[(1.05)5 + (1.05)4] = $10,000 $500(3.0288) + $1,000(2.7472) + x(2.4918) = $10,000 $1,514.3918 + $2,747.2000 + x(2.4918) = $10,000 x(2.4918) = $10,000 - $1,514.3918 - $2,747.2000 x = $5,738.4082 / 2.4918 x = $2,302.92 17. A football coach is leaving his current school. In doing so, he is giving up an annuity of $100,000 per year for 10 years that would begin when he turns 60. The coach is 45. His new school has offered to make up the loss of the annuity with a lump sum payment when he moves. How much should the new school pay if the interest rate is 7% p.a.? Step 1: Compute the value of the annuity at age 60 P/Y=1, SET BGN, N=10, I/Y=7, PMT=100000; CPT, PV: PV = $751,523.22 PV = ? 0 PV = ? 1 2 8 9 10 45 46 47 58 59 60 FV = $751,523.22 PMT = $100,000 Step 2: Discount the value computed in Step 1 to age 45 P/Y=1, N=15, I/Y=7, FV=751523.22; CPT, PV: PV = $272,386.60 17