Source 1: Internal Records

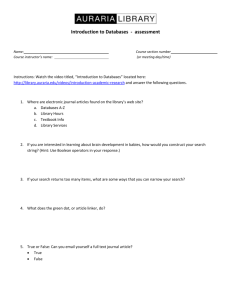

advertisement

E-Marketing, 3rd edition Judy Strauss, Adel I. El-Ansary, and Raymond Frost Chapter 6: Marketing Knowledge © Prentice Hall 2003 Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Data Drives Strategy Current problem for marketing decision makers = Information overload. Origin of data: Survey results, product sales information, secondary data about competitors, and much more, Automated data gathering at Web sites, brick-andmortar points of purchase, and all other customer touch points. Data Drives Strategy What to do with all the data? Purina marketers built a roadmap for their Internet advertising strategy: 1. Data are collected from a myriad of sources, 2. Filtered into databases, 3. Turned into marketing knowledge, 4. Used to create marketing strategy. S D Internal Data Secondary Data Primary Data Information: consumer behavior, competitive intelligence Product Database Customer/ Prospect Base Other Data/ Information *Marketing Knowledge* S Tier 1 Segmentation Targeting Differentiation Positioning Tier 2 Marketing Mix CRM From Sources to Databases to Strategy (SDS Model) Performance Metrics Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics The Learning Organization Uses internal and external data to: Quickly adapt to its changing environment, Creating organizational change to improve competitive position + employee satisfaction. Recognizes the importance of: Employee empowerment and development, Cross-functional teams for brainstorming, Risk-taking for breakthrough ideas. The Learning Organization Benefits from: Improved product quality and innovation, Better customer relations, Shared visioning, Process breakthrough improvements, Stronger competitiveness through team effort. Is a key concept in an organization because of information technology advances and the rapid growth of the Internet. The Learning Organization One of the most important areas in marketing learning = the learning relationship. The more marketers can learn about their customers, the better they can serve them with appropriate marketing mixes needs. Example: An American Airlines frequent flier can receive a short text message on her cell phone two hours before a flight with all flight information. A step further = Would you like us to notify you this way for each flight you book with us? American would be learning what the customer wants, confirming it, and then delivering it automatically. 1) Customer orders 10 new co mputers. 3) database trends Sales rep Where is the %@#& “on” switch? Hmmm, 21% of customers can’t find “on” switch. Customer Database 4) Redesign computer switch 2) Customer calls co mpany Customer service rep A hypothetical scenario for a computer company that is learning from its customers as a whole and using the information to improve products. E-Marketers Learn From Customers Source: Adaptation of ideas from Brian Caulfield (2001), “Facing up to CRM” at www.business2.com Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics From Data to Knowledge Data is the lubricant for a learning organization, and organizations are drowning in it. This is an information technology manager’s problem, and e-marketers must determine how to glean insights from these billions of bytes. Marketing insight occurs somewhere between information and knowledge: Knowledge is more than a collection of information, but resides in the user, People, not the Internet or computers, create knowledge; computers are simply learning enablers. Data growth rates = 80% a year = need an increasing amount of storage space 2,000,000 1,800,000 1,600,000 1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 1999 2000 2001 Terabytes of Corporate Data: Growth Rate from 1999 to 2003 Source: Data from International Data Corp (www.idc.com) 2002 2003 Decision Let’s put banner ads on about.com Knowledge Dog owners who see ads online are likely to buy Purina ONE. We know the sites they visit: about.com, www.petsmart.com. Information 1. Purina buyers are 20% more likely to visit about.com 2. 36% of dog owners who see Purina ads would buy the brand. Data 016030102 (Buyer 1 bought Purina puppy chow on March 1) From Data to Decision at Nestlé Purina PetCare Company Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Marketing Knowledge Management Knowledge management = Process of managing the creation, use, and dissemination of knowledge. Data, information, and knowledge are shared with internal marketing decision makers, partners, distribution channel members, and sometimes customers, When other stakeholders can access selected knowledge, The firm becomes a learning organization, The firm is better able to reach desired ROI and other performance goals. Marketing Knowledge Management Marketing knowledge = the digitized “group mind” = “collective memory” of the marketing personnel and sometimes of consultants, partners, and former employees. Sometimes the knowledge management technology even allows marketing staff to chat in real time for problem solving, which is why the system also includes contact information. Use in the Telecom Industry Representative Firm Scanner Check-Out Data Analysis Call Volume Analysis Equipment Sales Analysis Customer Profitability Analysis Cost and Inventory Analysis Purchasing Leverage with Suppliers Frequent-Buyer Program Management AT&T Ameritech Belgacom British Telecom Telestra Australia Telecom Ireland Telecom Italia Use in the Retail Industry Representative Firm Scanner Check-Out Data Analysis Sales Promotion Tracking Inventory Analysis and Deployment Price Reduction Modeling Negotiating Leverage with Suppliers Frequent-Buyer Program Management. Profitability Analysis Product Selection for Markets Wal-Mart Kmart Sears Osco/Savon Drugs Casino Supermarkets W. H. Smith Books Otto Versand Mail Order Amazon.com Uses of Knowledge Management in Two Industries Source: Adapted from Kalakota and Robinson (1999) Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics The Electronic Marketing Information System A marketing information system (MIS) The process by which marketers manage knowledge, A system of assessing information needs, gathering information, analyzing it, and disseminating it to marketing decision makers. The process: Marketing managers have a problem that requires data to solve, Gather the data from internal sources, from secondary sources, or by conducting primary marketing research, These managers receive the needed information in a timely and usable form. The Electronic Marketing Information System 1. Electronic marketing data are stored in databases and data warehouses. Marketers can obtain valuable, appropriate, and tailored information anytime day or night. Marketers can receive database information in Web pages and e-mail on a number of appliances in addition to the desktop computer: pagers, FAX machines, and even cellular phones. The Electronic Marketing Information System 2. 3. Customers also have access to portions of the database = Consumers can query the product databases. Firms recognize that data and information are useless unless turned into knowledge to increase profits. Firms make project reports, proposals, and data analyses available to other stakeholders in the MIS network. The Electronic Marketing Information System The Internet and other technologies have greatly facilitated marketing data collection. Internal records give marketing planners excellent insights about sales and inventory movement. Secondary data help marketers understand: Competitors, Consumers, The economic environment, Political and legal factors, Technological forces, Other factors in the macro-environment affecting an organization. The Electronic Marketing Information System Marketing planners use the Net, the telephone, product bar code scanners, and other technologies to collect primary data about consumers. Through: Online e-mail and Web surveys, Online experiments, Focus groups, Observation of Net user discussions, Marketers learn about both current and prospective customers. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Source 1: Internal Records One important source of marketing knowledge is internal records. Accounting, finance, and production personnel collect and analyze data that provide valuable information for marketing planning. The marketing department itself collects and maintains much relevant information about customer characteristics and activities. Source 1: Internal Records Non-marketing Data: The accounting department generates data about sales, cash flow, marketing expenses, and profitability that emarketers can use to evaluate marketing effectiveness, A firm introducing a new product on its Web site wants immediate feedback on its sales. Source 1: Internal Records Sales Force Data: Sales information systems, using sales force automation software, allow representatives to input results of sales calls to both prospects and current customers into the MIS, Sales reps access the product and customer databases both for input and review of customer records while on the road from their laptop computers. Customer Characteristics and Behavior Most important internal marketing data = individual customer activity. New storage + retrieval technologies + the availability of large amounts of electronic information = growth of database entries: Addresses, phone numbers, and purchase behavior. E-mail addresses, customer characteristics, and surfing and purchase behavior. Customer Characteristics and Behavior A record of calls made to customer service reps, product service records, specific problems or questions related to various products. Data on in-store behavior is gathered through scanning universal product codes (bar code) on products. Data in customer databases improve sales rep effectiveness, refine the product mix, identify optimum pricing for individual products, assess promotion effectiveness, and signal distribution opportunities. Customer Characteristics and Behavior Firms with Web sites track user movement through the pages and use these data to improve site effectiveness. http://stats.nd.edu:1099/remote_login.pl? By knowing: How long users spend on each page, How long they are at the site, What path they take through the site. Web developers can reorganize pages and content frequently and in a timely manner. Customer Characteristics and Behavior Firms can identify the Web site users visited immediately before and after the firm’s site. Provides competitive insights, especially if a user is reviewing particular products. These data are all generated automatically in the Web site logs and can be part of a firm’s marketing databases. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Source 2: Secondary Data When are they used? But: Need specific information not available in company or partner databases, Need information that can be collected more quickly and less expensively than primary data. They may not meet the e-marketer’s information needs, because they were gathered for a different purpose, The quality of secondary data need to be checked, They are often out of date. Internet easy access to secondary data about environmental factors and trends. Source 2: Secondary Data Marketing intelligence = Marketers continually scan the firm’s macro-environment for threats and opportunities. What type of information do marketing managers need? Demographic trends, Competitors, Technological forces, Natural resources, Social and cultural trends, World and local economies, Legal and political environments. Publicly Generated Data Most U.S. agencies provide online information in their respective areas. Many global organizations, such as the International Monetary Fund (www.imf.org) are also good sources of data. Most universities provide extensive information through their libraries, and many faculty post their research results online. Industry- or profession-specific information is available at the sites of professional associations such as the American Marketing Association (www.ama.org). Most of this information is free and available to all Internet users. Web site Information Stat-USA www.stat-usa.gov U.S. Department of Commerce source of international trade data. U.S. Patent Office www.uspto.gov Provides Trademark and Patent Data for Businesses. World Trade Organization www.wto.org World Trade Data. International Monetary Fund www.imf.org Provides information on many social issues and projects. Securities and Exchange Commission www.sec.gov Edgar database provides financial data on U.S. public corporations. Small Business Administration www.sbaonline.gov Features information and links for small business owners. University of Texas at Austin advweb.cocomm.utexas.edu/world Ad World with lots of links in the ad industry. Federal Trade Commission www.ftc.gov Shows regulations and decisions related to consumer protection and anti-trust laws. U.S. Census www.census.gov Provides statistics and trends about the U.S. population. Public Sources of Data in the U.S. Privately Generated Data Many firms and individuals put timely information on Web sites. Company Web sites provide a great overview of the firm’s mission, products, partners, and current events. Individuals often maintain sites with useful information about companies as well. Large research firms put sample statistics and press releases on their sites or offer e-mail newsletters. Infomediaries: News aggregators are firms that monitor a number of media sources, presenting selected stories to users either by “pushing” stories to the user’s desktop via e-mail, or by allowing users to “pull” it from a specially tailored Web site. Web site Information AC Nielsen Corporation www.acnielsen.com Television audience, supermarket scanner data and more. The Gartner Group www.gartnergroup.com Specializes in e-business and usually presents highlights of its latest findings on the Web site. Information Resources, Inc. www.infores.com Supermarket scanner data and new product purchasing data. Arbitron www.arbitron.com Local-market and Internet radio audience data. The Commerce Business Daily www.cbd.savvy.com Lists of government requests for proposals online. Simmons Market Research Bureau www.smrb.com Media and ad spending data. Dun & Bradstreet www.dnb.com Database on more than 50 million companies worldwide. Dialog library.dialog.com Access to ABI/INFORM, a database of articles from 800+ publications. Hoovers Online www.hoovers.com Business descriptions, financial overviews, and news about major companies worldwide. Sampling of Sources of Privately Generated Data in the U.S. Online Databases Commercial online databases contain publicly available information that can be accessed via the Internet. Thousands of databases are available online: News, Industry data, Encyclopedias, Airline routes and fares, Yellow Page directories, etc. Instead of going to the library, marketers can simply download the electronic versions of articles. Competitive Intelligence Competitive intelligence (CI) = analyzing the industries in which a firm operates as input to the firm’s strategic positioning and to understand competitor vulnerabilities. 40% of all firms regularly conduct CI activities Intelligence cycle: 1. 2. 3. 4. 5. Define intelligence requirements. Collect and organize information. Analyze by applying information to the specific purpose and recommending action. Report and inform others of the findings. Evaluate the impact of intelligence use and suggest process improvements. Competitive Intelligence Sources of CI: Competitor press releases, New products, Alliances and co-brands, Trade show activity, Advertising strategies. Competitive Intelligence The Internet simplified CI: Competitive marketing strategies: observed on competitors’ Web sites Web sites linked to competitors’ pages: type companyname.com in search tools. And then wonder why are these sites linking to the competitor? Analyze a firm’s Web site log to see what Web page users visited immediately prior to and after the site. Third-party, industry-specific sites can also provide information about competitive activities. Company profiles for public firms are available in the SEC’s online EDGAR database + investment firm sites. User conversation: e-mail lists on every imaginable topic. Most of the list members are professionals in their industries and combing through the many e-mail queries and responses can yield insights. Information Quality Caution: Secondary and primary data are subject to many limitations. Be objective + skeptical when reviewing and using Internet-based information. Why? Because anyone can easily publish on the Web without being reviewed or screened for accuracy or appropriateness. Don’t be seduced by good design: The best-designed sites may not be the most accurate or credible, and vice versa. Fake Web page created to show just how easy it is to get fooled. A Real Web Page? Source: Laura B. Cohen and Trudi E. Jacobson, http://library.albany.edu/briggs/addiction.html Evaluate the quality of secondary data collected online: Author. A site published by a government agency or well-known corporation has more credibility than one by an unknown author. Is the site author is an authority on the Web site topic? When the site was last updated? How comprehensive is the site? Does it cover only one aspect of a topic, or does it consider the broader context? Validate the research data by finding similar information at other sources on the Internet or in hard copy at the library. If the same statistics are not available elsewhere, look for other ways to validate the data. Compare sites that cover the same topic. Check the site content for accuracy. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Source 3: Primary Data Primary data = information gathered for the first time to solve a particular problem. When secondary data are not available managers may decide to collect their own information. They are more expensive and time-consuming to gather than secondary data. They are current and more relevant to the marketer’s specific problem. They are proprietary = unavailable to competitors. Each primary data collection method can provide important information, as long as e-marketers understand the limitations. Remember that Internet research can only collect information from people who use the Internet, which leaves out a huge portion of the population. Source 3: Primary Data Electronic sources of primary data collection: The Internet: Focus groups, observation, in-depth interviews (IDI), and survey research. Online panels: popular survey research method _ single-source research. Real-time profiling at Web sites and computer client-side or server-side automated data collection. The real-space Refers to technology-enabled approaches to gather information offline that is subsequently stored and used in marketing databases. Techniques = bar code scanners and credit card terminals at brickand-mortar retail stores, computer entry by customer service reps while talking on the telephone with customers. Primary Research Steps 1. Research problem. Specificity is vital. 2. Research plan. Research approach. Choose from experiments, focus groups, observation techniques, in-depth interviews, and survey research, or nontraditional real-time and real-space techniques. Sample design. Select the sample source and number of desired respondents. Contact method. Telephone, mail, in person, via the Internet. Instrument design. For survey = a questionnaire. For other methods = a protocol to guide the data collection. Primary Research Steps 3. Data collection. Gather the information according to plan. 4. Data analysis: Analyze the results in light of the original problem. 5. Distribute finding / add to the MIS. Research data might be Use statistical software packages for traditional survey data analysis or data mining to find patterns and other information in databases. placed in the MIS database and be presented in written or oral form to marketing managers. 5 Steps for Primary Research Research Problem Primary Research Steps Research Plan Data Collection Data Analysis Distribute Results Some typical e-marketing research problems that electronic data can help solve. Online Retailers Web Sites Improve online merchandising Forecast product demand Test new products Test various price points Test co-brand and partnership effectiveness Measure affiliate program effectiveness Pages viewed most often Increase site “stickiness” (stay longer) Test site icons and organization Path users take through the site—is it efficient? Site visit overall satisfaction Customers and Prospects Promotions Identify new market segments Test shopping satisfaction Profile current customers Test site customization techniques Test advertising copy Test new promotions Check coupon effectiveness Measure banner ad click-through Typical Research Problems for E-Marketers Internet-Based Research Approaches The Internet is fertile ground for primary data collection. Why? Declining cooperation from consumers using traditional research approaches. Telephone survey refusal rates = 40- 60%. Increasing number of consumers online: Appropriate to conduce research using this inexpensive and quick method makes sense. In North America, 71% of all research firms use various online methodologies. Proportion Using 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Online surveys E-mail surveys Online focus groups Bulletin Web site board focus use groups measures Proportion of 200 Firms Using Online Primary Research Source: “Big Bytes” (2001) Internet-Based Research Approaches Marketers are learning how to combine online and offline data effectively and efficiently. This involves merging data from: Older legacy systems, Incoming call centers, Retailer bar code scanners, Government statistics, and many other places. Internet-Based Research Approaches Web data = exposure to ads, sites visited, and surfing and purchasing frequency and patterns. TO COMBINE WITH: Offline panel data = Actual packaged goods purchased at brick-and-mortar grocery stores, as well as volume purchased, timing of purchases, promotional effectiveness, and brand loyalty. Primary data are collected online using experiments, focus groups, observations, in-depth interviews, and survey research, as discussed in the following sections. Online Experiments Experimental research attempts to test cause-and-effect relationships: A researcher will select subjects, Randomly put them into two or more groups, Expose each group to different stimuli. Measures responses to the stimuli = a questionnaire, to determine if differences exist among the groups. If the experiment has been carefully controlled, group differences can be attributed to the stimuli. These effects must be tested in other situations and with other subjects to determine their degree of generalizability. Marketers can easily test alternative Web pages, banner ads, and promotional offers online. Online Focus Groups Focus group research: A qualitative methodology that attempts to collect indepth information from a small number of participants. Used to help marketers understand important feelings and behaviors prior to designing survey research. 1530% of advertising agencies and market research firms use the Internet to conduct online focus groups. Online Focus Groups Advantages over traditional focus groups: The Internet can bring together people who do not live in the same geographic area. Because participants type their answers at the same time, they are not influenced as much by what others say. Researchers can show participants animated ads, demonstrate software, or use other multimedia stimuli to prompt group discussion. Quicker and less expensive to operate than offline versions. Online Focus Groups Disadvantages: Can accommodate only four to eight participants at a time (traditional groups 10 – 12). Nonverbal communication is lost online. The authenticity problem = Without seeing people in person, it is difficult to be sure they are who they say they are (need to verify respondent authenticity). Technical problems can also stall an online group. Subjects use stronger positive and negative words online than in other modalities. Online Focus Groups Procedure for online focus groups: 1. 2. 3. 4. Contact potential participants via e-mail, asking them to go to a Web site and answer screening questions. Send e-mail messages to qualified users, offering them money to participate in the group. Have clients and four to eight participants appear at an online site at the appointed time and day, and have all greeted electronically by the moderator. Split the screen into two vertical portions: On the right, the moderator types questions and the participants type responses. Multimedia can also be presented on the right side. The left side is a “back room” where clients can communicate with each other and the moderator through their keyboards as the group progresses. Online Observation Observation research monitors people’s behavior by watching them in relevant situations. BUT observations of a small number of people cannot be used to describe how all people might act. Important form of observational research = monitoring consumer chatting and e-mail posting through chat rooms, bulletin boards, or mailing lists. The Usenet = 35,000 newsgroups, each a forum for public discussion on a specific topic. People post articles to newsgroups for others to read. Discussions range from the meaningful to the absurd, but marketing planners can learn about products and industries by monitoring discussions. To monitor customer chat are to provide space on the firm’s Web site or to subscribe to e-mail lists on product-related topics. Consumers Discussing Product in the Usenet Source: www.deja.com Online In-Depth Interviews (IDIs) Semi-structured conversation with a small number of subjects: The interviewer develops a set of questions Encourages the subject to speak at length on particular issues through careful probing techniques. Web site usability studies to watch users as they click through the firm’s Web site: The subject and interviewer are in the same room while the subject performs specified tasks on the computer. IDIs are better conducted in person; BUT e-mail can facilitate communication when subjects live far from the researcher. Online Survey Research E-marketers conduct surveys by: Sending questionnaires to individuals via e-mail, Posting a survey form on the Web or an electronic bulletin board. E-Mail Surveys To prepare an e-mail survey, an organization can: Draw a sample of e-mail addresses from its database, Purchase a list, Gather e-mail addresses from the Web or Usenet newsgroups. Select a specialized + representative group to research to control who gets the questionnaire. After sending a questionnaire, the researcher can send e-mail reminders to participants who have not yet responded: response rates are just as high for e-mail surveys as for traditional contact methods. Online Survey Research Problem with e-mail survey: = Consumers do not type their answers in the appropriate places = Increase the chance of error E-mail survey research: Is diminishing in use as a contact method in favor of Webbased surveys, Is still preferable in countries where users pay by the hour for Internet connection because e-mail may be answered offline whereas a user must be online to complete a multipage Web form survey. Online Survey Research Web Surveys Many companies post questionnaires on their Web pages. Purpose: Gather statistics about a site’s visitors (e.g., Web site registration); More formal survey research. When not sampling Web site users, researchers: Post a Web survey Send e-mail and use other forms of publicity to direct respondents to the Web site. Online Survey Research Web Surveys The best response rates come from: Members of e-mail lists = have a special interest in the topic. Customers and prospects on e-mail lists. Advertising on electronic bulletin boards or via banner ads and links from other Web sites will drive a very small amount of traffic to a Web survey. Response rates to online surveys are as good as or better than surveys using traditional approaches, sometimes reaching as much as 40%. An example of Web Survey Open ended Radio buttons: Choose one Mitchell and Strauss Web Survey Radio buttons: Choose all that apply Mitchell and Strauss Web Survey Online Survey Research Advantages Fast and inexpensive: Instantaneously worldwide delivery of questionnaires, No cost for postage or an interviewer, No printing, collating, and mailing time, Those who complete the questionnaires = in the first three days, Easy to send multiple reminders if using e-mail invitations. Web surveys reduce errors: Technique reduces the complexity and time involved for respondents, Respondents enter their answers= eliminates data entry errors found in traditional methods when converting answers from paper questionnaires. Respondents answer questions more honestly and openly on a computer than when an interviewer is present. Online Survey Research Disadvantages Sample representativeness and measurement validity = No ability to draw a random sample = Researchers cannot generalize results to the entire population being studied. Online research entails several measurement issues: Different browsers, computer screen sizes, and resolution settings = researchers worry that colors will look different and measurement scales will not display properly online. A comparison study between telephone and online surveys found that online users were less likely to use the two extreme scale points on a five-point scale. Online Survey Research Disadvantages Researchers have not yet found proof to support the explanation of differences among the various survey methodologies (demographic and other differences between online and offline populations). The firm has no control over who responds (for Web surveys and questionnaires posted on bulletin boards). Respondent authenticity: 20-50% of Web users have posed as the opposite sex on the Internet, and children often pose as adults online. Duplicate responses to online surveys. Survey forms are not nearly as easy to create as most other types of Web pages Advantages Disadvantages Fast and inexpensive Sample selection / generalizability Diverse, large group of Net users worldwide to small specialized niche Measurement validity Self-selection bias Computer entry reduces researcher data entry errors Respondent authenticity uncertain Honest responses to sensitive questions Frivolous or dishonest responses Anyone-can-answer, invitation-only, or password protected Duplicate submissions Electronic data are easy to tabulate Steep learning curve Less interviewer bias Advantages and Disadvantages of Online Survey Research Online Panels Used to combat sampling and response problems. Called opt-in communities = a panel of people who have agreed to be the subject of marketing research (paid +receive free products). Panel participants complete extensive questionnaires to have information about their characteristics and behavior. When panel members are asked to test product, or are given questionnaires to complete, researchers can correlate results with already collected demographic data. Online Panels An advantage to large panels = smaller groups of members can be targeted based on behavior or demographics. Disadvantage: Panel is usually more expensive than traditional methods of sample generation. Sometime the generalizability of survey results is questionable. Ethics of Online Research A “gift culture” = give something to respondents as appreciation for participating to increase the response rate: Offer free products or cash. Donate money to charities selected by respondents Ethics of Online Research Ethical concerns regarding survey research on the Internet: Respondents are increasingly upset with unsolicited e-mail requesting survey participation, Some researchers “harvest” e-mail addresses from newsgroups without permission, Some companies conduct “surveys” for the purpose of building a database for later solicitation (marketing research is different from marketing promotion), Privacy of user data is a huge issue in this medium, because it is relatively easy and profitable to send electronic data to others via the Internet. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Other Technology-Enabled Approaches The Internet is an excellent place to observe user behavior The technology automatically records actions in a format that can be easily, quickly, and mathematically manipulated for analysis. Nontraditional technology-enabled approaches: Client-side data collection Server-side data collection: Real-time profiling at Web sites These techniques = interesting + unusual They did not exist prior to the Internet. They allow marketers to make quick and responsive changes in Web pages, promotions, and pricing. Client-Side Data Collection = Collecting information about consumer surfing right at the user’s PC. Use cookies when a user visits a Web site. They track user surfing. They help marketers present appropriate promotions and Web pages to individual users. Measuring user surfing patterns by installing a PC Meter on the computers of a panel of users and tracking the user clickstream. Server-Side Data Collection Web site log software generates reports on: Numbers of users who view each page, Location of site visited prior to the firm’s site, What users buy at a site. Use = to make frequent changes in Web pages and promotional offers. Real-time profiling = when special software: Tracks a user’s movements through a Web site, Compiles and reports on the data at a moment’s notice. Allows marketers to analyze consumer online behavior and make instantaneous adjustments to site promotional offers and Web pages. Real-time profiling is not cheap—one estimate puts the software at $150,000 to start and $10,000 a month thereafter. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Real-Space Approaches Real-space primary data collection occurs at offline points of purchase with: Smart card and credit card readers, interactive point of sale machines (iPOS), and bar code scanners are mechanisms for collecting real-space consumer data. Offline data, when combined with online data, paint a complete picture of consumer behavior for individual retail firms. UPC used primarily for inventory management to: Reduce accounting inventory levels automatically Send communication to suppliers for replenishment of physical goods. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Marketing Databases and Data Warehouses Regardless of whether data are collected online or offline, they are moved to various marketing databases. Product databases = product features, prices, and inventory levels. Customer databases = customer characteristics and behavior. Transaction processing databases are important for moving data from other databases into a data warehouse. Data warehouses: Store entire organization’s historical data. Designed specifically to support analyses necessary for decision making. The data in a warehouse are separated into more specific subject areas (called data marts) and indexed for easy use. Marketing Databases and Data Warehouses Web sites content management is a hot new area: Web sites are complex, including tens of thousands of pages from or for many different corporate departments. Software vendors are attempting to solve the Web site maintenance problem. These programs have features such as press release databases that automatically put the newest stories on a designated page and archive older stories, deleting them on a specified date. UPC Scanner Product Database Transaction Database Data Warehouse Customer Database Real-Space Data Collection and Storage Example Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Data Analysis and Distribution Data collected from all customer touch points are: Stored in the data warehouse, Available for analysis and distribution to marketing decision makers. Analysis for marketing decision making: Data mining = extraction of hidden predictive information in large databases through statistical analysis. Here, marketers don’t need to approach the database with any hypotheses other than an interest in finding patterns among the data. Patterns uncovered by marketers help them to: Refine marketing mix strategies, Identify new product opportunities, Predict consumer behavior. Data Analysis and Distribution Customer profiling = uses data warehouse information to help marketers understand the characteristics and behavior of specific target groups. Understand who buys particular products, How customers react to promotional offers and pricing changes, Select target groups for promotional appeals, Find and keep customers with a higher lifetime value to the firm, Understand the important characteristics of heavy product users, Direct cross-selling activities to appropriate customers; Reduce direct mailing costs by targeting high-response customers. Data Analysis and Distribution RFM analysis (recency, frequency, monetary) = scans the database for three criteria. When did the customer last purchase (recency)? How often has the customer purchased products (frequency)? How much has the customer spent on product purchases (monetary value)? => Allows firms to target offers to the customers who are most responsive, saving promotional costs and increasing sales. Report generators: = automatically create easy-to-read, high-quality reports from data warehouse information on a regular basis. Possible to specify information that should appear in these automatic reports and the time intervals for distribution. Overview Data Drives Strategy The Learning Organization From Data to Knowledge Marketing Knowledge Management The Electronic Marketing Information System Source 1: Internal Records Source 2: Secondary Data Source 3: Primary Data Other Technology-Enabled Approaches Real-Space Approaches Marketing Databases and Data Warehouses Data Analysis and Distribution Knowledge Management Metrics Knowledge Management Metrics Marketing research is not cheap: Need to weigh the cost of gaining additional information against the value of potential opportunities or the risk of possible errors from decisions made with incomplete information. Storage cost of all those terabytes of data coming from the Web. Two metrics are currently in widespread use: ROI. Companies want to know: Why they should save all those data. How will they be used, and will the benefits in additional revenues or lowered costs return an acceptable rate on the storage space investment? Total Cost of Ownership (TCO). Includes: Cost of hardware, software, and labor for data storage. Cost savings by reducing Web server downtime and reduced labor requirements. Key Terms •Knowledge Management (KM) •Marketing Information System (MIS) •Data warehouse •Product database •Secondary data •Bar code scanner •Primary data •Focus groups •Universal Product Codes (UPC) •Marketing intelligence •Real-space •In-depth interviews •Online panels •Real-time profiling •Client-side data collection •Server-side data collection •Respondent authenticity •Usenet •Opt-in •Clickstream •Transaction processing databases •Data mining •Customer profiling •RFM analysis •Total Cost of Ownership (TCO) Review Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. What are the three main sources of data for solving marketing research problems? Contrast primary with secondary data and explain the advantages and disadvantages of each. What is competitive intelligence and what are some sources of online CI data? Why and how do e-marketers evaluate the quality of information on a Web site? What are the strengths and weaknesses of the Internet for primary and secondary data collection? How do marketers turn marketing data into marketing knowledge? What is a learning organization? What is real-space data collection? Why is it important? Is data mining possible without a data warehouse? Why or why not? Give an example of how data mining uncovers new knowledge. Identify the steps in a primary marketing research project. Discussion Questions 1. 2. 3. 4. 5. 6. What online research method(s) would you use to test a new product concept? Why? What online research method(s) would you use to test the brand image of an existing product? Why? Of the ethical issues mentioned in the chapter, which are you most concerned about as a consumer? Why? Can you think of a marketing research technique that could not be supported online? Explain your answer. What are the current limitations for undertaking market research on the general population on the Net? How might these be overcome now and in the future? Given that the cost of sending an e-mail questionnaire to 10,000 people is no higher than the cost of sending it to 10 people, why would market researchers bother devising samples if they were planning to undertake some research online?