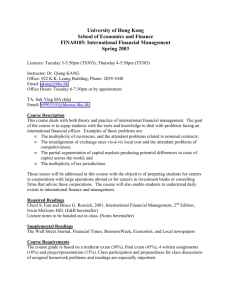

Course Description

advertisement

Course Syllabus FIN 436: International Finance Semester 1 2013 Instructor: Dr. Ishaq Bhatti, Professor of Finance Lecture Hours: 9 to 10 AM, Boys: Room 106, Girls TA Miss Batool: Room 905 Office Hours: Sunday, Tuesday & Thursday 12.30 - 14.30, and by appointment E-mail: IBKAAU@gmail.com Office Phone: (02) 6952000 - Ext. 65316 COURSE DESCRIPTION: This course will cover issues related to both international financial markets and the financial operations of a firm within the international environment. The course discusses theoretical basis on the various issues, it also mixes in empirical evidence and discussion of firms' actual behaviors with International portfolio of Ethical, behavioral, Islamic and microfinance and investment. It also discusses the structure of derivatives, the Bonds and hedging after global financial crises. COURSE OBJECTIVE: 1. Overview of market risks, international monetary systems and institutions. 2. Theoretical determinants of currency prices and equilibrium conditions, determination of currency prices. 3. Hedging currency and interest rate risks: instruments and strategies. 4. Raising capital in international markets: international Bond and equity markets 5. The international cost of capital. 6. Political risk and its impact on corporate financial decisions LEARNING OUTCOMES: By the end of this course, students should be able to: 1. Understand the market risk and monetary systems. 2. Explain the typical International Trade. 3. Be aware of Exchange Rate Determination, and Currency Derivatives. 4. Gain insight into the foreign exchange market. 5. Measure the foreign exchange exposure. COURSE MATERIAL: Required Text - Multinational Business Finance. Eiteman, k. Stonehill, A.Moffett,M. Published by prentiahall, 13th Edition 2012. Supplementary (but optional) Texts: International Financial Management, by Eun, C. and Resnick, B., Published by: McGraw-Hill, 6th edition, (2012). Additional readings and reference materials will be announced during the semester. 1 An important complement to class work is following the financial news. There are several sources of information: The Wall Street Journal and its European counterpart, The Financial Times. The business sections of the New York Times and Globe and Mail are very informative, as well as weekly magazines such as Business Week and the Economist. The Internet offers substantial information resources (Bloomberg, Reuters, NYSE.com, ft.com, and others). It will keep you informed on what is happening in the business world and help you connect the concepts developed during the lectures with the real world. Course Requirements and Expectations The course relies on basic concepts from calculus, algebra, and statistics. I will do a review when it is necessary. You will need to use a spreadsheet such as Excel for the class project. Students should prepare for class by completing all required readings in advance. This class requires a lot of work but I do think that everyone has the capacity to achieve an above average performance or better if they do the work harder. Course Grading and assessment Methods Your course grade will reflect your performance on midterm and final exams, class participation, one presentation, and one group project with weights determined as follows: Class Participation Assignments/cases Midterm Examination-1 Midterm Examination-2 Final Examination 10% 10% 20% 20% 40% Special Notes - - The final exam is comprehensive but it focuses mostly on issues covered after the midterm examination - 2. All exams are closed book tests. Assignments will not be accepted via email to Dr Ishaq Bhatti. Please hand in your assignments to Teaching Assistants (Girls – Ms. Batool) and (Boys – myself) and negotiate with them if they accept the assignment via e-mail. The student is responsible for missed classes and any assignments made during that time. The class Participation marks are handled by TA’s. HOW TO STUDY FOR THIS COURSE: Spend some time on the course every day, whether you have class or not Take good notes in class and review them frequently, comparing them to corresponding material in the text Read the chapter in the textbook (prior to it's being covered in class) Answer and study the questions in the text Do homework assignments as soon as possible after they have been assigned Pay attention to the solutions (i.e., the solution processes), not just the answers Get to know the software involved so that you feel comfortable using it to solve managerial problems with it without having to spend a great deal of time 2 Tentative Course Outline Weeks 1 2&3 Topic Course presentation, topics overview International Monetary System and Balance of Payments 4 Foreign exchange markets: participants, spot and forward markets 5 International Parity Conditions 6 Spot rate forecasting and Midterm 1 7 Currency futures and Currency Options 8 Currency and interest option pricing 9 & 10 Remarks Greeks, volatility and option strategies Interest rate swaps 11 Currency Swaps and Midterm 2 12 Raising capital in international markets and International Bond markets 13 International Equity markets and Financial management of the international firm 14 Calculate cost of capital and investments Note: The above syllabus and schedule are subject to change at the discretion of the instructor, as necessary. IMPORTANT NOTE If a midterm exam is not completed, the mark assigned to the missed component will be zero except in the case of a valid excuse (illness, death of a close family member, etc.). In the case of a valid excuse the marks associated with the missed component will be reassigned to the final exam. In every aspect of the course, students are required to adhere to the standards of conduct in the King Abdulaziz University Honor Code. IN ADDITION, ACTIVE CELL PHONES ARE NOT ALLOWED DURING CLASS TIME. 3