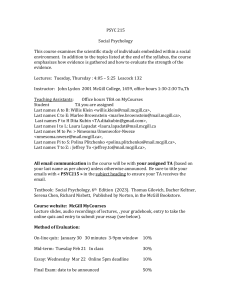

McGill Management

advertisement

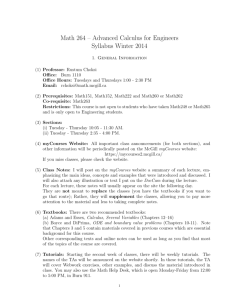

McGill University Faculty of Management International Finance I BCom FINE 482-001. Winter 2003 Section 001 – Monday-Wednesday 16:05-17:25 – BRONF: 599 ________________________________________________________________________ Prof. Stefano Mazzotta Office: BRONF: 551B; Phone: 398-4000 ext 00856; E-mail smazzo@po-box.mcgill.ca Office Hours: Monday, 2:30-16:00, or by appointment Administrative Assistant: Che Doran, 514-398-4000 Ext. 09264 ________________________________________________________________________ Course Description International finance is the discipline that studies cross-country, cross-currency money management, and the structure and processes of institutions that use global capital. The objective of this course is to give a comprehensive introduction to the foundations of global finance including but not limited to spot and forward exchange markets, future markets, options, swaps, international monetary system, and currency risk management. The student will learn how firms and individuals make decisions in a global environment and manage their capital flows. The ultimate goal is that the student becomes able to recommend ways to make this system more efficient. In addition, the student should be able to evaluate and know how to control the risks embedded in the international markets. Learning Objectives The first area of learning is related to the environment. International refers to the fact the economies and markets that we consider are thought of as nations that interact in the international markets. There are also two different approaches to the discipline we follow in this course. The first, is related to broader concepts that take into consideration the complexity of the economic relation in international markets and requires that the student make the best possible use of the material covered in the course along with all her/his previous cultural background. The second one is very technical in nature. In this second area clear-cut answers can be given to precise managerial questions. These two approaches eventually must converge with one another when it is time to make business decisions related to international finance problems. The paramount goal of the course is becoming able to formulate recommendations that are based on sensible evaluation of the risks and return implied by business decisions and that harmonize the relevant concepts from the two approaches. Prerequisite for this class are basic finance, calculus classes and computer proficiency. Good quantitative skills and knowledge of personal computers and major business application, such as excel software are also important. Career Focus To cover the International Finance exhaustively, the Faculty offers three courses. This one is the necessary first step. The next two steps are International Finance II and Global Investments. International Finance II covers in detail the problems faced by corporations in the global environment. If you plan to work instead in the investment area, Global Investments provides a presentation of international capital markets. Course Material Choice of required textbooks: David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett, Multinational Business Finance, Ninth edition, Addison Wesley Longman. Bruno Solnik, International Investments, Fourth edition, Addison Wesley Longman. Both texts are available at the McGill Bookstore. The first one (ESM) is the standard reference for global corporate finance and will be useful for you if you plan to register for International Finance II. The second one (S) is written by a leading academic figure of international finance and is the required textbook for Global Investments. It is also on the recommended reading list for the CFA examination. We will only cover about half of these two books in this course, so you should base your choice on what you want to specialize in later. Course Grade Class Participation – Short Quiz Problem Sets and Case Studies Essay and Presentation First Midterm Second Midterm 15% 20% 15% 25% 25% The even repartition of percentages in the overall grade aims at favoring a continuous acquisition of the course materials rather than an end of semester race. Peer’s assessment will also contribute to the final grade. Class participation grade is based on both your attendance and your constructive interventions in class. A series problem set and case studies will be assigned. The work must be done in predetermined groups of 5. No late assignment will be accepted. Assignments must be typed. The choice of the essay or case study is to be chosen by the end of the term. It will be a group work due at the end of the term and presented in class. The midterms will be in-class, closed-book exams. They will be partly numerical and partly non-numerical, asking you to explain concepts and results. Only written requests (not e-mails) for re-grades carefully explaining the reason may be accepted. A re-grade might result in a lower grade. Quality Circle. To insure that the course will be a constructive and enjoyable experience for all the participants we will use a QC. The purpose of the QC is to acquire continuous feedback for improving the course. The QC is formed by for three volunteers and myself. We will meet every other week throughout the term for 20-30 minutes after class. Integrity. Cheating and plagiarism by any student hurts all students, because anything that undermines the evaluation process undermines the integrity of our degrees. More information about how to maintain integrity can be found at www.mcgill.ca/integrity/students/ Course Outline Week Theme Topics International Monetary Environment Readings 1 The Balance of Payments 2 Foreign Exchange Markets ESM4 or S1 and S12 3 Parity Conditions ESM3 or S2 4 ESM3 or S3 5 The Determination of Exchange Rates First Midterm 6 Financial crises and the Euro ESM2 Foreign Exchange Exposure 7 Currency Options ESM5 or S13 8 Currency Risk Management 9 10 Interest Rate Exposure and Swaps Review before the midterm ESM6 and ESM7 or S14 ESM9 or S11 11 Second Midterm 12 Presentation of Work Group 13 Presentation of Work Group The slides for the course and other relevant information will be available on WebCT. Student Profile FINE 482. Winter 2003 Your picture here Name ______________________________________________________________ Telephone __________________________________________________________ Email ______________________________________________________________ Previous Finance Courses ______________________________________________ ___________________________________________________________________ Educational Background _______________________________________________ Professional Experience _______________________________________________ What is an option? ________________________________________ As a personal investor, do you trade financial assets? _______________________ Professional Objective ________________________________________________ Any special interests or other background info you'd like me to know ___________ ___________________________________________________________________