Administrative and Academic Support Units Assessment Report

advertisement

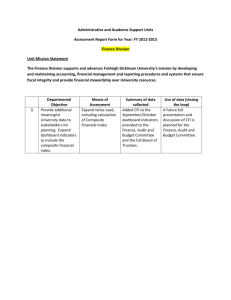

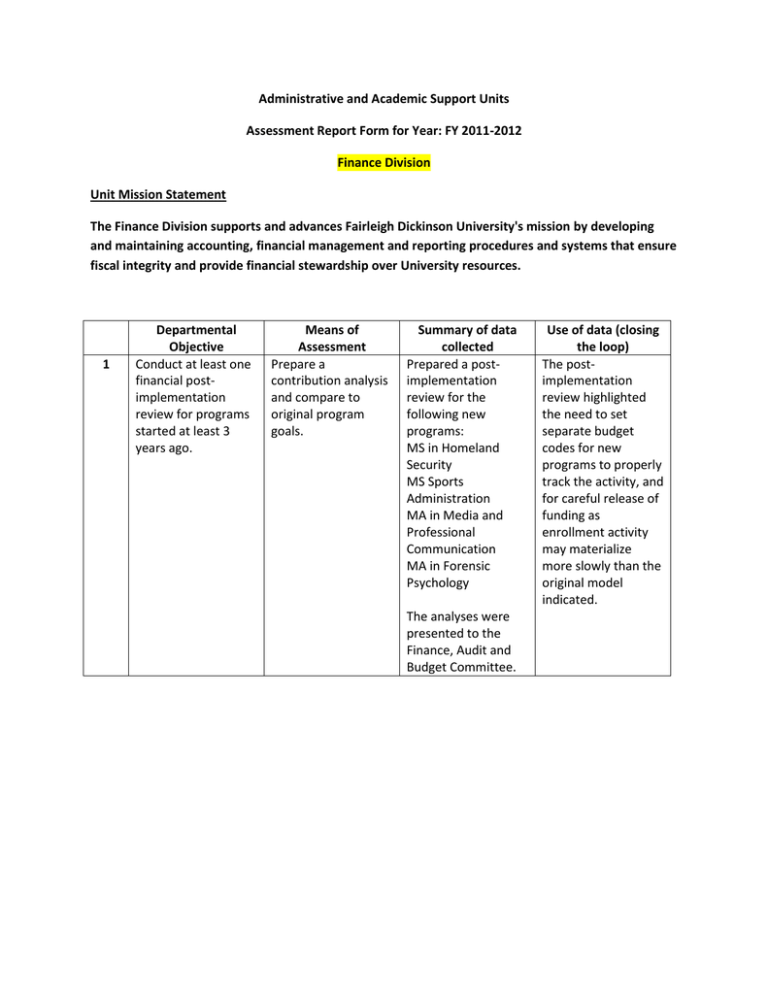

Administrative and Academic Support Units Assessment Report Form for Year: FY 2011-2012 Finance Division Unit Mission Statement The Finance Division supports and advances Fairleigh Dickinson University's mission by developing and maintaining accounting, financial management and reporting procedures and systems that ensure fiscal integrity and provide financial stewardship over University resources. 1 Departmental Objective Conduct at least one financial postimplementation review for programs started at least 3 years ago. Means of Assessment Prepare a contribution analysis and compare to original program goals. Summary of data collected Prepared a postimplementation review for the following new programs: MS in Homeland Security MS Sports Administration MA in Media and Professional Communication MA in Forensic Psychology The analyses were presented to the Finance, Audit and Budget Committee. Use of data (closing the loop) The postimplementation review highlighted the need to set separate budget codes for new programs to properly track the activity, and for careful release of funding as enrollment activity may materialize more slowly than the original model indicated. Administrative and Academic Support Units Assessment Report Form for Year: FY 2011-2012 Finance-Office of Resource Allocation & Planning Unit Mission Statement The Resource Allocation and Planning offices’ mission is providing, gathering and analyzing financial data as it pertains to the University’s Budget process, Cost Analysis and Fixed Asset/Inventory Management. This data is used by various constituencies throughout the University to make decisions that support the overall mission of the Institution in preparing students as global citizens. It is to this end that the Office of Resource Allocation and Planning strives to meet the needs of management in providing accurate and timely reports and analyses. 1 2. Departmental Objective To complete implementation of the network version of fixed assets with appropriate documentation. To begin using the upload features and exporting of files options available. Means of Assessment Time saved in running reports and measuring the benefits derived from the uploading and export features. Provide documentation to end users for running XLSA and XLB S reports. Arose from request of end users wanting to view Enables end users to review their own reports. Time and paper savings for Finance-ORAP. Summary of data collected This was the first time the network version was used for running depreciation and for reporting purposes. Depreciation and custom reports ran faster and saved approximately 6 hours from previous pc based version. The Export version of FAS was used for the first time to extract some reports in Excel and PDF format. The documentation was completed but time did not permit the use of the upload feature. This will be done in 2012-2013. Documentation completed and distributed to a few individuals for use. Saves this office time in running and printing reports. Use of data (closing the loop) Provided quicker turn-around of depreciation reports and enabled excel worksheets to be done on a more timely basis. Provided PDF file from Export feature to be used by Risk Manager for insurance purposes. Based on this outcome this will be rolled out Universitywide in fiscal year 2012-2013. This will eliminate the running and printing of three 3. previous fiscal years data. Web Advisor provides the current year and only a small window of the previous year (JulyOct) until the old year is closed in October. Update tables for the monthly financial package. With the opening of new identifiers this process is necessary every few years. Time savings and less chance of error in producing the reports since updated tables reflect the proper pointing of cell addresses in the formal report. Gives end users the ability to run these reports on an ongoing basis as needed. reports from this office and two reports from MIS. This will save a substantial amount of time and paper. The updating of these tables expedited the download process and decreased the chance of errors in the pointing s to the formal report. This will save about two hours each month. The August 2012 Financial Package was used to test the new download tables. Pointings were accurate and the time saved from the previous template was about 2 hours. This file will roll forward for future monthly financials and facilitate the turnaround time of the report. Administrative and Academic Support Units Assessment Report Form for Year: 2011-2012 Finance - Accounting Department Unit Mission Statement: The Accounting department supports the University mission of global education by providing University constituents with timely and accurate financial information and by ensuring that financial records are maintained in accordance with generally accepted accounting principles and the guidelines set forth by State and Federal government agencies. The Accounting department gathers, records, reports and analyzes financial data. This information is provided to and relied upon by various University constituencies. Decision makers consider this information when making determinations or to substantiate determinations made to support the University’s mission, strategic drivers and goals. 1 2. Departmental Objective Maintain financial systems in accordance with GAAP, State, Federal and industry standards. On an annual basis this will continue to be the number one administrative objective of the Accounting Department. Explore the possibilities, uses, and implementation of the Image Now software for the Accounting Department. Means of Assessment Unqualified opinion from external auditor. Accounting Department personnel will participate in continuing education events such as webinars, workshops, and seminars in as much as they are available. Central log of all CE activities will be maintained going forward. To be successful the objective will take place in several parts, or phases and depending on workloads and staffing, may take place over multiple fiscal years. Phase one will include identifying possible areas that would benefit from Summary of data collected Unqualified opinion issued by PwC on the FY 2012 financial statements. The University received a very good audit report from PwC. Use of data (closing the loop) Finance will continue to keep current on financial and industry standards. PwC recommendations will be implemented and monitored during the year. Phase one began but was not completed due to limited resources. This work will continue into FY 2013. 3. Update the existing University policy and procedures. Objective to take place in two phases. Phase one to include revising the highly visible policy and procedures such as the expense report. Phase two includes revising the procedures of reconciliation and interdepartmental procedures by the end of the fiscal year. Continuation from prior year. electronically storing information, and prioritizing which would be most beneficial and why. Phase two would involve exploring the hardware and software requirements, and costs needed to implement. Phase three would primarily involve implementation. Substantial percentage of procedures are updated and in place by fiscal year end. Phase one, specifically the “Request for Travel Advance”, and “Faculty and Staff Travel and Business Expense Report” have both been updated and uploaded onto the Finance office Website. The mileage reimbursement portion has been added to the Finance Calendar to be reviewed in June of every fiscal year. Part A of phase two (revising the interdepartmental procedures) has been completed, however, Part B of phase two reviewing the procedures is approximately 50% complete. Anticipate This phase has not been completed by the projected date due to unavailable resources. This is being addressed currently with anticipated completion date of January 2013. completing the review at or around 1/2013. Administrative and Academic Support Units Assessment Report Form for Year: 2011-2012 Finance - Accounts Payable Unit Mission Statement The office of Accounts Payable supports the University’s mission by providing professional, courteous and reliable service to its students, faculty, staff and vendors while maintaining high standards of quality to promote the University’s goals and objectives. Through efficient, timely and accurate payment processing and reporting, the office of Accounts Payable assists in controlling the University’s expenditures and maximizing resources. 1 Departmental Objective To explore the option of changing the 1099-MISC form to a laser print format. Means of Assessment Identify steps needed to change the software and the form layout. Create a timeline for the project in order to have the forms ready for the January 31, 2012 mailing deadline. Summary of data collected Standard Register was identified as the vendor that would change the software and the form layout. Standard Register set up the integration of the data stream and the document setup from the old method (line printing) to the laser print format. Pre-printed 1099MISC forms and envelopes were ordered and received in December, 2011. These forms were successfully tested and printed in the Datatel development account. Use of data (closing the loop) On January 27th, 2012, 377 forms were successfully printed and mailed prior to the January 31st, 2012 deadline for 1099-MISC reporting for calendar year 2011. On February 11th, 2012, the IRS sent an e-mail to Gregory Sarajian in Accounts Payable as notification that the electronic transmission of the 1099-MISC file was successful and did not contain any errors. It should be noted that any 1099-MISC form that must be done manually (information that is not generated as a voucher in Datatel) will not be processed through the laser printing. 2. 3. To explore the option of changing the check process from the current line print to a laser print format. Identify steps needed to change the software, printer and forms and create a timeline from inception to completion of the project. Coordinate with the MIS department, the print vendor and TD Bank to determine support, security/risks, enhancements and costs. Standard Register was identified as the vendor who will setup the software and maintain the hardware for the laser check writing process. MIS has submitted the Datatel software information to Standard Register in order to setup the program to print laser checks. AP is working with Standard Register on document specification needed to print laser checks. TD Bank has been contacted to determine what they need from Accounts Payable in order to setup the change to lasMr checks. Testing will take place once all software information has been setup and forms have been received. Testing samples will be given to TD Bank who will determine if the laser check meets their requirements and specifications. Administrative and Academic Support Units Assessment Report Form for Year: 2011-2012 Finance - Purchasing Department Unit Mission Statement: The Mission of the Purchasing Department of Fairleigh Dickinson University is to obtain all goods and services necessary for students, faculty, and staff in a cost effective and efficient manner. We strive to provide value added service to the academic and administrative community in support of the University’s global mission. The Purchasing Department maintains a commitment to excellence through professional ethics and practices. We abide by the Universities Purchasing Policies and Procedures while aiming to develop and implement operational procedures that provide the highest level of service. 1 Departmental Objective Enforcement of University Purchasing Policies and Procedures. Identify departments in violation. Means of Assessment Develop means to track violations by category, department and individual. Analyze collected data. Send notification to the individual placing the requisition alerting them of the infraction and send notification to department heads when consistent violations occur. Summary of data collected The Purchasing Department analyzed the collected data and defined which departments and/or individuals were in consistent violation of University Purchasing Policies and Procedures. This complete assessment provided us with the information needed to alert department heads of how many and what types of violations were occurring in their areas. Further monitoring will continue in order to determine if this method of notification is effective in minimizing/eliminating violations. Use of data (closing the loop) After evaluating the number of violations, the purchasing department has determined that this exercise has proven helpful in reducing the occurrences of violations. Community members are more aware of the policies and procedures and the amount of repeated violations has been reduced. Purchasing has adopted this method into daily operating procedures. Administrative and Academic Support Units Assessment Report Form for Year: 2011-2012 Finance - Treasury Unit Mission Statement: The Office of Treasury manages the University’s cash, investments, and long term debt. In support of the University’s mission, the Office of Treasury establishes secure pathways that facilitate global payments and receipts in connection with the protection of University financial resources. This office also reports investment results to various university constituencies. 1 Departmental Objective Ensure FDU compliance with Payment Card Industry-Data Security Standards (PCI-DSS) regulations. (Annual Review) Means of Assessment FDU currently has seven credit card merchant accounts operating under its corporate domain which are serviced by four merchant providers. We will assess each account individually to determine if its operating processes are in compliance with current regulations. And, we will file self assessment questionnaires with service providers that require such documentation. Summary of data collected After further review, it has been determined that the existing merchant accounts are in compliance with PCIDSS regulations. Use of data (closing the loop) We will continue to monitor the merchant accounts as future changes are expected. Administrative and Academic Support Units Assessment Report Form for Year: 2011-2012 Finance – Student Loan Repayment/Credit & Collection Unit Mission Statement: The Office of Student Loan Repayment mission is to assist students to be responsible world citizens and ensure compliance with applicable federal regulations. The office provides students with an ethical understanding of their student loans and tuition obligations. We enhance students’ success by developing strategies to ensure that students do not default on their financial responsibilities and to provide, with accurate and timely manner, services that help students better manage their obligations. 1 Departmental Objective Continue the scanning of credit and collection office’s files. Means of Assessment Determine completion rate and accuracy of the scanned files. Summary of data collected Recommend continued scanning of documents while keeping files on site. Use of data (closing the loop) Files will be kept in house until it is determined to be moved off site.