Office of Finance Departments - Fairleigh Dickinson University

advertisement

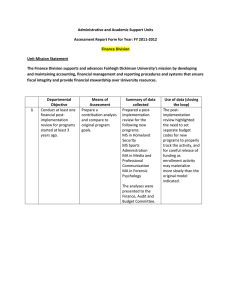

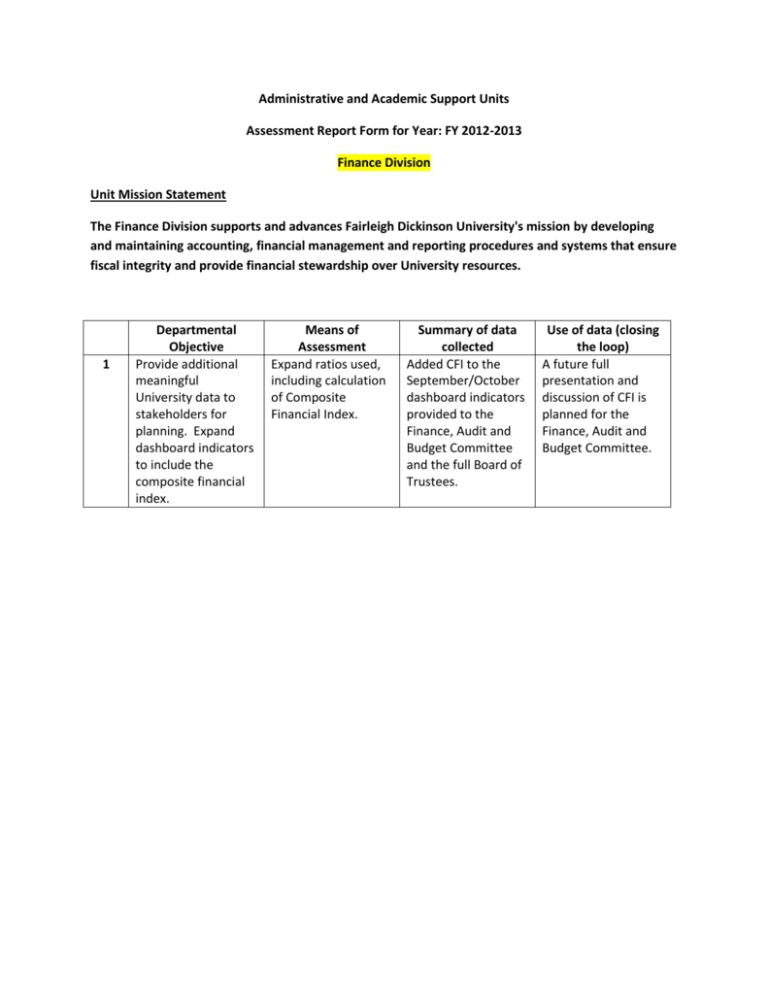

Administrative and Academic Support Units Assessment Report Form for Year: FY 2012-2013 Finance Division Unit Mission Statement The Finance Division supports and advances Fairleigh Dickinson University's mission by developing and maintaining accounting, financial management and reporting procedures and systems that ensure fiscal integrity and provide financial stewardship over University resources. 1 Departmental Objective Provide additional meaningful University data to stakeholders for planning. Expand dashboard indicators to include the composite financial index. Means of Assessment Expand ratios used, including calculation of Composite Financial Index. Summary of data collected Added CFI to the September/October dashboard indicators provided to the Finance, Audit and Budget Committee and the full Board of Trustees. Use of data (closing the loop) A future full presentation and discussion of CFI is planned for the Finance, Audit and Budget Committee. Administrative and Academic Support Units Assessment Report Form for Year: 2012-2013 Finance-Office of Resource Allocation & Planning Unit Mission Statement The Resource Allocation and Planning offices’ mission is providing, gathering and analyzing financial data as it pertains to the University’s Budget Process, Cost Analysis and Fixed Asset/Inventory Management. This data is used by various constituencies throughout the University to make decisions that support the overall mission of the Institution in preparing students as global citizens. It is to this end that the Office of Resource Allocation and Planning strives to meet the needs of management in providing accurate and timely reports and analyses. Departmental Objective Eiminate hard copy report distribution (XLSA/XLBS) at year end. Move responsibility of running and printing reports to the end users. Means of Assessment To provide training and assistance so that all end users can run and print their own reports, not only at year end but also on an as needed basis. 2. To redesign Fixed Assets Excel worksheet to facilitate the use of the upload feature of the network version of FAS. To begin using the upload feature of the software as well as using more of the exporting component. To measure the time saved and the increase in accuracy due to data not having to be re-keyed. 3. To redesign Budget Summary Report to have sub-totals break on type of expense. Elimination of the need to run summary report three times to get 1. Summary of data collected Considerable time was taken to put together a very detailed procedure booklet. In addition to distributing booklets to over 200+ end users , one on one training was provided on an as needed basis throughout the university community. Initial steps were taken to look at how the worksheet would be changed and time was spent speaking with a representative at Sage. Due to other high priority work within the department this goal was not completed this year. With each end user now doing their own reporting and less need for hard copies Use of data (closing the loop) Approximately 18,000 sheets of green bar paper were saved. To further save on paper Users were also given instructions on how to save their files to the hard drive or other electronic medium. This Goal will be moved to Fiscal Year 2013-2014 for further implementation. Will monitor how the end users are doing over the next year with running and the required subtotal breaks needed. This would all be accomplished by running one report. the need for this change seems to be less important. printing their own reports. If there is a need for this change in the reports it will be pursued at that time. Administrative and Academic Support Units Assessment Report Form for Year: 2012-2013 Finance - Accounting Department Unit Mission Statement: The Accounting Department supports the University mission of global education by providing University constituents with timely and accurate financial information by ensuring the financial records are maintained in accordance with generally accepted accounting principles and the guidelines set forth by State and Federal government agencies. The Accounting department gathers, records, reports and analyzes financial data. This information is provided to and relied upon vy various University constituencies. Decision makers consider this information when making determinations or to substantiate determinations made to support the University’s mission, strategic drivers and goals. 1 2. Departmental Objective Maintain financial systems in accordance with GAAP, Federal, State and Industry standards. On an annual basis this will be the number one administrative objective of the Accounting department. Means of Assessment Unqualified Audit opinion from external auditors. Accounting Department personnel will participate in continuing education events such as webinars, workshops and seminars in as much as they are available. Summary of data collected In September of 2013 Fairleigh Dickinson University received an unqualified opinion from Price WaterhouseCoopers on the fiscal year ended June 30, 2013 financial statements. See log on continuing education activities that members of the Finance department participated in . In can be found on the N-drive. Use of data (closing the loop) Results of current and past year audits have established a benchmark of what is expected going forward. The Accounting department will continue to participate in continuing education opportunities as they present themselves to stay abreast of changes in financial reporting and other related areas. Explore the possibilities, uses and implementation of the Image Now software for the Accounting department. To be successful the objective will take place in several parts, or phases and depending on workloads and staffing may take place over multiple fiscal years. Phase one will include identifying possible areas that would Finance department has successfully identified hardware and software requirements needed to implement and several areas that would benefit from electronically storing information. Hardware setup and software set up were Implementing the electronic storage of and access to journal entries has proven to be very beneficial to the accounting department. It saves time in several ways. 1) by not having to access the binders and make copies of the je and backup. 3. Update the existing University policy and procedures. Objective to take place in two phases. Phase one to include revising the highly visible policy and procedures such as the expense report. Phase two includes revisiting the procedures of reconciliation and interdepartmental procedures by the end of the fiscal year. Continuation from prior year. benefit from electronically storing information, which would be most beneficial and why. Phase two would involve exploring hardware and software requirements and costs needed to implement. Phase three would primarily involve implementation. Substantial percentage are updated and in place by fiscal year end. Phase one, specifically the “Request for Travel Advance” , and “Faculty and Staff Travel and business Expense Report” have both been updated and uploaded onto the Finance office Website. The mileage reimbursement portion has been added to the Finance calendar to be reviewed in June of every fiscal year. Part A of phase two (Revising the interdepartmental procedures) has been completed. Part B of phase two is approximately 50% complete. Anticipate completing the review at or around 12/2012-1/2013. completed. One of the areas identified to potentially benefit from the Image Now implementation is the electronic storage and access of journal entries. Over the course of this past year, all fiscal year 2013 journal entries have been stored electronically. Infor can be screen shot directly to the network printer. 2) being able to view the journal entries and backup support. Accounting will continue to identify and implement additional areas to electronically store information as time allows to streamline processes. Mileage reimbursement rate has been reviewed, and it was decided that FDU will maintain the same rate for the current fiscal year, 2014. The highly visible policies and procedures will need to be reviewed, and if necessary, updated on a regular basis should there be changes in other policies and procedures. For example any change in the mileage reimbursement rate would affect the travel and business expense report. Policies and procedures are located on the network drives in the Accounting Office. Policies and procedures will continue to be reviewed on a regular basis, to document changes in the way we currently complete specific tasks. Accounting will pursue electronically storing these procedures on Image Now, a storage area separate from the departments network drive. Administrative and Academic Support Units Assessment Report Form for Year: 2012-2013 Finance – Office of Treasury Unit Mission Statement The Office of Treasury manages the University’s cash, investments, and long term debt. In support of the University’s mission, the Office of Treasury establishes secure pathways that facilitate global payments and receipts in connection with the protection of University financial resources. This office also reports investment results to various university constituencies. 1 Departmental Objective Ensure FDU compliance with Payment Card Industry-Data Security Standards (PCI-DSS) regulations. (Annual Review) Means of Assessment FDU currently has seven payment card merchant accounts operating under its corporate domain which are serviced by four merchant providers. We will assess each account individually to determine if its operating processes are in compliance with current regulations. And, we will file self assessment questionnaires with service providers that require such documentation. Summary of data collected It has been determined that the existing merchant accounts are in compliance with PCIDSS regulations. We will continue to monitor the merchant accounts as future changes are expected. Use of data (closing the loop) After final review, it has been determined that FDU currently has sixteen payment card merchant accounts operating under its corporate domain. They are serviced by five merchant providers. All accounts are in compliance with PCIDSS regulations. We will continue to monitor the merchant account activity as future changes are expected. Administrative and Academic Support Units Assessment Report Form for Year: 2012-2013 Finance - Purchasing Department Unit Mission Statement: The Mission of the Purchasing Department of Fairleigh Dickinson University is to obtain all goods and services necessary for students, faculty, and staff in a cost effective and efficient manner. We strive to provide value added service to the academic and administrative community in support of the University’s global mission. The Purchasing Department maintains a commitment to excellence through professional ethics and practices. We abide by the Universities Purchasing Policies and Procedures while aiming to develop and implement operational procedures that provide the highest level of service. 1 2. Departmental Objective Compile data to determine the business status of current vendors. Means of Assessment Create a form letter to send to University vendors requesting they complete or update their business status information. This will allow the Purchasing Department to categorize various data. Responses will be recorded into a master spread sheet for evaluation. Summary of data collected The collected data provided the Purchasing Department the ability to categorize the different business statuses of our vendors. Use of data (closing the loop) The compilation of this data can provide the University a quantified percentage of the types of business statues. This objective supports the University’s commitment to the principals of affirmative action, and assists in the process when applying for grants, etc. The business form is a living document that will be maintained and routinely updated by the Purchasing Department. Revisit previous assessment goal of the feasibility of on- Through the University’s IT Department, contact The Purchasing Department reviewed the After reviewing the information obtained in the session, the line requisitioning through the Datatel module. Datatel to see if any updates have been made the module. Review obstacles that prevented us from moving forward with implementation previously. updated Datatel manual and presented an overview of pertinent questions and concerns to the Datatel representative. This question and answer session provided valuable information for the Finance dept to evaluate the feasibility of a move forward plan to implement the online system. Purchasing and Finance Departments determined that there were too many obstacles to overcome in order to utilize the on line process. Requirements of using the module are not conducive in the manner in which we do business, therefore it has been decided at his time that the University cannot implement this system. Administrative and Academic Support Units Assessment Report Form for Year: 2012-2013 Finance - Accounts Payable Unit Mission Statement The office of Accounts Payable supports the University’s mission by providing professional, courteous and reliable service to its students, faculty, staff and vendors while maintaining high standards of quality to promote the University’s goals and objectives. Through efficient, timely and accurate payment processing and reporting, the office of Accounts Payable assists in controlling the University’s expenditures and maximizing resources. 1 Departmental Objective To change the check writing process for U.S. vendors/student refunds from the current method (line printing) to laser printing. Means of Assessment 1. Identify steps needed to change the print software, printer and forms and create a timeline in order to allow sample testing. 2. Coordinate with the MIS department, the print vendor and TD Bank to determine support, security/risks, enhancements and costs. Summary of data collected Standard Register was identified as the vendor who will setup the software and maintain the hardware for the laser check writing process. MIS has submitted the Datatel software information to Standard Register in order to setup the program to print laser checks. Standard Register has been contacted by Accounts Payable in order to determine document specification needed to print laser checks. Items needed include blank check stock with security background that must meet bank specifications, a new or enhanced laser printer with added trays, toner, window Use of data (closing the loop) Standard Register has been sent a Purchase Order to convert the hardware and software data from the current PC application to the FDU server. In addition, the print linkup is in the process of an upgrade to a new version. Once this is completed, Accounts Payable will order check stock, supplies and added printer trays so that testing can take place. 2. To record the time (in days) it takes for a student refund request to be vouchered to the actual check mailing date. Maintain a spreadsheet log of a sample of vouchers received from Enrollment Services listed by Student Name, Student ID#, Voucher Date, Refund Received Date, and Check Mail Date. The refund received date will be the actual date received by Accounts Payable after the voucher has been received, verified and checked for accuracy by Finance. envelopes and colored paper for non-negotiable check copies. It should be noted that Standard Register already has the signature template of President Sheldon Drucker on file to incorporate into the software laser check print program. A sample of ten vouchers were chosen each week and recorded on a spreadsheet. The sample dates ranged from the period 7/1/12 to 6/30/13. The average time for a student refund request to be vouchered by Enrollment Services to the actual time received by Accounts Payable was 3.8 days. Accounts Payable then mailed the check within 1 day of receiving the approved voucher resulting in a average total between 4-5 days from the voucher entry date to the check mailing date. The time it takes a student refund voucher to be entered in Datatel to the time it takes the check to be mailed is necessary information because student refunds must be issued and disbursed on a timely basis in order to meet strict Federal government and Financial Aid regulations and audit compliance.