Internal Rate of Return (IRR) and Net Present Value (NPV)

advertisement

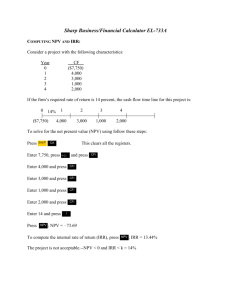

Internal Rate of Return (IRR) and Net Present Value (NPV) Net present value (NPV): the sum of the present values of all cash inflows minus the sum of the present values of all cash outflows. The internal rate of return (IRR): (1) the discount rate that equates the sum of the present values of all cash inflows to the sum of the present values of all cash outflows; (2) the discount rate that sets the net present value equal to zero. The internal rate of return measures the investment yield. IRR and NPV Example: Yield on a single receipt. An investor can purchase a vacant lot for $28,371 and expects to sell it for $50,000 in 5 years. What is the expected IRR for this investment? 1 PV FV (1 d )n 1 $28,371 $50,000 (1 d ) 5 d = 12% IRR and NPV HP 10B Keystrokes CLEAR ALL 1 P/YR 28371 +/- 50000 5 N I/YR FV PV Clears registers One payment per year PV = -$ 28,371 FV = $ 50,000 FV in 5 years Solve for IRR IRR and NPV Example: NPV for a single receipt. An investor can purchase a vacant lot for $28,371 and expects to sell it for $50,000 in 5 years. What is the expected NPV for this investment if the investor discounts future cash flows at 15%? 1 NPV PV FV (1 d )n 1 NPV $28,371 $50,000 5 (1 0.15) NPV = -$28,371 + $24,858.84 = - $3,512.16 IRR and NPV HP 10B Keystrokes CLEAR ALL 1 P/YR 50,000 FV 15 I/YR 5 N PV - +/28,371 = Clears registers One payment per year $50,000 future value Discount rate = 15% FV in 5 years Compute present value Subtract $28,371 IRR and NPV Example: Yield on an Ordinary Annuity An investor has the opportunity to invest in real estate costing $28,371 today. The investment will provide $445.66 at the end of each month for the next 8 years. What is the (annual) IRR (compounded monthly) for this investment? nk 1 PV PMT d t t 1 (1 ) k 96 1 $28,371 445.66 d t t 1 (1 ) 12 d 0.9167%; d 110% . 12 IRR and NPV HP 10B Keystrokes +/- Clears registers Monthly compounding PV = - $28,371 Monthly pmt = $445.66 96 months Compute IRR IRR and NPV Example: NPV for an Ordinary Annuity An investor has the opportunity to invest in real estate costing $28,371 today. The investment will provide $445.66 at the end of each month for the next 8 years. What is the NPV for this investment if the investor discounts future cash flows monthly at a 10% annual rate? 96 1 NPV $28,371 445.66 010 . t t 1 (1 ) 12 NPV = - $28,371 + $29,369.66 = $998.66 IRR and NPV HP 10B Keystrokes x P/YR +/- - = Clears registers Monthly payments Monthly pmt = $445.66 Annual discount rate = 10% 96 monthly payments Compute PV Subtract $28,371 IRR and NPV Example: What is the IRR for an investment that costs $96,000 today and pays $1028.61 at the end of the month for the next 60 months and then pays an additional $97,662.97 at the end of the 60th month? nk 1 FV PV PMT d d nk t 1 (1 ) t (1 ) k k 60 1 $97,662.97 $96,000 $1,028.61 d t d 60 t 1 (1 ) (1 ) 12 12 d/12 = 1.0921% ; d = 13.10% IRR and NPV HP 10B Keystrokes +/- Clears registers Monthly payments PV = -$96,000 Monthly pmt = $1,028.61 FV = $97,662.97 60 months Compute yield (IRR) IRR and NPV Example: NPV for an ordinary annuity with an addition lump sum receipt at the end of the investment term. What is the NPV for an investment that costs $96,000 today and pays $1028.61 at the end of the month for the next 60 months and then pays an additional $97,662.97 at the end of the 60th month if the investor discounts expected future cash flows monthly at the annual rate of 13.1047%? nk 1 FV d t d t 1 (1 ) (1 )nk k k 60 1 $97,662.97 NPV $96,000 $1,028.61 0131047 . 0131047 . t t 1 (1 ) (1 )60 12 12 NPV PV PMT NPV = - $ 96,000 + $ 96,000 = $ 0 IRR and NPV HP 10B Keystrokes Clears registers Monthly payments Monthly pmt = $1,028.61 FV = $97,662.97 60 months of payments Discount rate = 13.1047% Compute PV Subtract $96,000 +/- = IRR and NPV Example: IRR for uneven cash flows. What is the IRR for an investment that costs $100,000 today and pays $20,000 one year from today; $35,000 two years from today; and $75,000 three years from today? $20,000 $35,000 $75,000 $100,000 2 (1 d ) (1 d ) (1 d )3 d 1159% . IRR and NPV HP 10B Keystokes +/- Clears registers One payment per year Initial CF = - $100,000 1st CF = $ 20,000 2nd CF = $ 35,000 3rd CF = $ 75,000 Compute yield (IRR) IRR and NPV Example: NPV for uneven cash flows. What is the NPV for an investment that costs $10,000 today, $8,000 one year from today, $5,000 two years from today and pays $15,000 three years from today and $25,000 four years from today if future cash flows are discounted at 10%? $8,000 $5,000 $15,000 $25,000 NPV $10,000 2 3 11 . 11 . 11 . 11 .4 NPV = -$10,000 - $7,272.73 - $4,132.23 + $11,269.72 + $17,075.34 = $ 6,940.10 IRR and NPV HP 10B Keystrokes +/+/+/- Clear registers One payment per year Initial CF = - $ 10,000 1st CF = - $ 8,000 2nd CF = - $ 5,000 3rd CF = $ 15,000 4th CF = $ 25,000 Discount rate = 10% Compute net present value IRR and NPV Example: IRR for grouped cash flows. Compute the IRR for an investment that costs $92,725.60 today and is expected to pay $10,000 at the end of the year for the next three years; $15,000 at the end of years 4 and 5; and $100,000 at the end of year 6. 3 $10,000 5 $15,000 $100,000 $92,725.60 t t 6 ( 1 d ) ( 1 d ) ( 1 d ) t 1 t 4 d = 12% IRR and NPV HP 10B Keystrokes +/- Clears registers One payment per year Initial CF = - $ 92,725.60 1st grouped CF = $ 10,000 Occurs three times 2nd grouped CF = $ 15,000 Occurs twice 3rd CF = $ 100,000 (once) Compute the yield (IRR) IRR and NPV Example: NPV for grouped cash flows. Compute the NPV for an investment that costs $98,000 today and is expected to pay $791.38 at the end of each month for 12 months; $850.73 at the end of each month for the following 12 months; $914.54 at the end of each month for the following 11 months and a balloon payment of $107,491.18 at the end of month 36 if the investor discounts future cash flows monthly at a 13% annual rate. NPV = - $554.17 = - $98,000 + 12 24 35 1 1 1 $107,49118 . $791.38 $850.73 $914.54 013 . 013 . 013 . 013 . 36 t 1 (1 t 13 (1 t 25 (1 )t )t )t (1 ) 12 12 12 12 IRR and NPV HP 10B Keystrokes +/- Clear registers Monthly payments Initial CF = - $98,000 1st grouped CF = $791.38 Occurs 12 times 2nd grouped CF = $850.73 Occurs 12 times 3rd grouped CF = $914.54 Occurs 11 times 4th CF = $107,491.18 (once) Discount rate = 13% Compute net present value