2014 Business Plan Executive Summary The Board continues to

advertisement

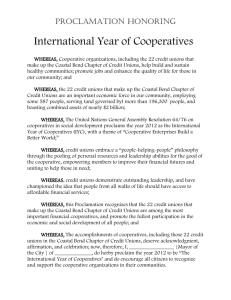

2014 Business Plan River Valley Credit Union – 2014 Business Plan Page 1 Executive Summary The Board continues to focus on being a cooperative. Credit unions continue to look out for their members’ interests and provide a level of service that is not generally available at other financial institutions. A cooperative is significantly more open, democratic, transparent, and inclusive than that of a for-profit business. Credit unions are consumer-owned cooperatives. Cooperatives are about meeting the needs of its owners. Cooperatives build a better world by putting people at the center of their business and not capital. Cooperatives around the world generally operate according to the same core principles and values. In an era when many average working Americans are increasingly fed up with Wall Street, the cooperative principles of credit unions strike a chord with many people looking for increased accountability in banking. The Board continues to adopt the seven cooperative principles into our strategic plan. Mission Statement: Exceeding expectations. Vision Statement: To be the trusted choice for superior service within our community. Values Statement: Building a community of trust and integrity with friendly, quality service. River Valley Credit Union – 2014 Business Plan Page 2 SEVEN COOPERATIVE PRINCIPLES 1. Voluntary Membership All qualifying members are welcomed, embraced, and valued. You own, by simply participating. 2. Democratic Member Control Credit union members enjoy equal voting rights, and the members who serve as the elected board of directors are accountable to the membership. 3. Customer-owner (Member) Participation Through the elected board of directors, members have control over how the credit union’s capital is used – for paying dividends or new products and services. Members recognize benefits of ownership in proportion to general usage. 4. Autonomy and Independence We value the rights of our members to be individuals and the diversity of the communities we serve. We are stronger when we work together. 5. Education, Training, and Information We educate our members, elected officials, managers, and employees so that everyone can contribute to making the credit union stronger. We recognize the importance of ensuring the general public and law makers are informed about the nature, structure, and benefits of the cooperative. 6. Cooperation Among Cooperatives We strengthen the cooperative movement by working together through local, state, regional, national, and international structures. We are involved with other credit unions through our local chapter of our state trade association. We offer operation assistance, especially to smaller credit unions, so that all can thrive. 7. Concern for the Community We take pride in participating in the communities we serve. River Valley Credit Union – 2014 Business Plan Page 3 STRATEGIES TO DRIVE OUR COOPERATIVE PRINCIPLES Member-Owner Strategies: Get back to the core values of a credit union and what makes our structure unique. Members need to understand and value the power of ownership. The following will reinforce cooperative principles 1-4: voluntary membership, democratic member control, member participation, and autonomy and independence. 1. Continue to allow for electronic ballots during Board elections per Bylaw Article V. 2. Continue a virtual Annual Meeting to increase member/owner awareness and participation. a. Post annual reports on our website for members to review. b. Post scholarship winners’ essays to promote this program. c. Utilize online ballots in home banking for board elections. d. Have virtual meeting material available two weeks prior to live annual meeting to encourage attendance and participation. 3. Investigate the possibility of paying a patronage dividend. a. Members should be rewarded based on their usage of the credit union. b. The board and management will need to discuss feasibility and design at least quarterly. c. The credit union needs to determine a portion of earnings to retain in order to build capital. Education, Training, and Information Strategies: 1. Members. a. We educate, advise, and provide suitable products and services for our members. b. We communicate the importance of financial responsibility. c. We look for opportunities to host financial education seminars. River Valley Credit Union – 2014 Business Plan Page 4 2. Elected Officials. a. Continue board education and training. b. Encourage participation in MCUL events. 3. Employees. a. Continue online training tools. b. Encourage participation in MCUL and vendor events. 4. General public and lawmakers. a. Continue participation with the Michigan Credit Union League (MCUL). b. Contribute to MCUL Cooperative Advertising fund. c. Participate in MCUL legislative events. Concern for the Community Strategies: 1. Ada Community Events Supported: a. Ada in August (kids event) b. Expo c. Treats, Trolleys, and Holiday d. Run 4 A Cause 2. Lowell a. Expo b. River Walk c. Flat River Outreach Ministries (FROM) d. Relay for Life e. Christmas Through Lowell – including Santa pictures f. Hunt for a Cure Golf Outing River Valley Credit Union – 2014 Business Plan Page 5 g. Harvest Celebration h. Little League i. Summer Concert Series 3. Edmore a. Potato Festival b. Women’s Expo c. Santa pictures d. Firemen’s Parade e. Letters to Soldiers f. School visits for financial education River Valley Credit Union – 2014 Business Plan Page 6 STRATEGIES THAT DRIVE OUR BUSINESS LINES Loan Strategies: This follows Cooperative Principle number 6, cooperation among cooperatives. 1. Participation loans a. Lendkey Private Student Loan Participations. We participate in a CUSO participation pool where we hold 10% in private student loans. This allows us to offer a consolidation loan to our members that we could not hold on our own. We mitigate our risk on this type of loan by only holding 10% of the loan. We will continue our due diligence of this program, monitor for desired performance, and be ready to act on our exit strategy if necessary. b. Progressive CU Taxi Medallion Participation Loans. Progressive CU has been offering these loans to its members for over 20 years without a loss. They participate with credit unions nationwide offering a higher yield than what we can get on any other type of investment. Recent regulations limit us to a $5M maximum. We will continue our due diligence of this program, monitor for desired performance, and be ready to act on our exit strategy if necessary. 2. Evaluate eDoc’s packages with DocuSign. We are looking toward technology to offer online loan closing for our members. This project is dependent on the successful installation of a VPN. 3. Continue to push for organic loan growth within our own membership. Deposit Strategies: We will keep aware of emerging technologies that provide desired convenience to our members. New technologies can be costly. We strive to introduce new products and services that are affordable for our members. 1. Promote P2P or A2A transfers within home banking (person-to-person, account-toaccount). River Valley Credit Union – 2014 Business Plan Page 7 2. Evaluate remote deposit capture. Marketing Strategies: 1. Utilize our website to communicate our seven cooperative principles. This will also be a focal point for our annual meeting. 2. Continue with onboarding program to build deeper relationships with new members. River Valley Credit Union – 2014 Business Plan Page 8 River Valley Credit Union FINANCIAL GOALS 2013 Results 2014 9.49% > 9.50% 0.53% < 1.00% 0.10% < 0.80% 0.55% > 0.55% 56.77% > 60.00% $71.7M > $73.5M Benchmark Capital Delinquency Charge Offs ROA Loans to Shares Assets (5% growth) 2015 > 9.75% < 1.00% < 0.80% > 0.55% > 65.00% > $77.2M Michigan Credit Union Trends Net Worth Ratios by Asset Size Category (Percent of Assets) 18 16 14 12 10 8 6 4 2 0 102 100.0 97.6 97.8 100 98 96 91.9 94 92 90 16.5 11.2 11.0 10.7 < $5Mil $5-$20 $20-$100 > $100 Mil 88 86 NW Ratio (left) Percent of CUs > 7% (right) Asset Quality by Asset Size Category 3.00 1.83 2.50 2.00 1.50 0.50 0.68 0.55 1.00 Net Worth (Capital) Ratio is equity divided by assets. Credit unions must maintain a minimum of 7%. RVCU’s current ratio is at 9.49% with a 2014 goal of > 9.50%. Asset size has a huge impact on this figure. Each spring when Amway pays our members bonuses, our Capital Ratio drops. ROA is critical in achieving our Net Worth (Capital) Ratio goal. 2.52 1.54 < $5Mil $5-$20 1.21 0.82 1.12 0.00 2.00 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Asset Quality is achieved through the Delinquency and Charge-offs Ratios. Our goal is to be < 1.00% in Delinquency and < 0.80% in Chargeoffs. Our performance in these categories during the past couple years has been well below our peers. There is room for some controlled risk. $20-$100 > $100 Mil 60+ Day Dollar Delinquency (left) Net Chargeoffs (right) River Valley Credit Union – 2014 Business Plan Page 9 ROA in Basis Points by Asset Size Category 120 120 95.5 100 100 84.8 80 80 58.1 60 48.5 60 Return on Assets (ROA) or earnings have been a challenge for small credit unions. ROA is essential in building capital. ROA for 2014 is budgeted at 0.56%. 40 40 20 20 -4 41 105 < $5Mil $5-$20 $20-$100 > $100 Mil 20 0 -20 0 ROA (left) Percent with positive ROA (right) Ratio of Total Loans-to-Total Savings (%) By Asset Size Category 63.9 54.6 45.0 < $5Mil 49.1 $5-$20 $20-$100 The Loans-to-Shares Ratio indicates how well we are utilizing deposits towards earnings. Ideally, we want to make loans to our members. Yields on investments have been low since the economic turndown. > $100 Mil Growth Rates By Asset Size Categogy (%) 8.3 5.5 We would like to see a 5% growth in assets per year. Keeping asset growth in control will help us to reach our goals for building capital. -0.5 -2.2 -5.0 -7.8 -8.2 -11.1 < $5Mil $5-$20 Loan Growth $20-$100 > $100 Mil Savings Growth *Source: NCUA and CUNA E&S, June 2013. River Valley Credit Union – 2014 Business Plan Page 10