2006-07 California Cash for College FAFSA Presentation: Applying

advertisement

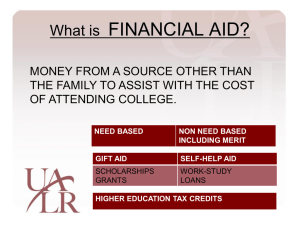

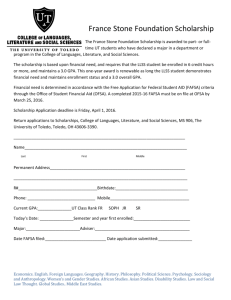

Applying for Financial Aid 2013-2014 Mt. San Antonio College Financial Aid Office Financial Aid Myths • GPA too low… • Sibling did not qualify… • Family income is too high… • The paperwork is too complicated… Etc… SCAM Alert: “Billions of Dollars Unclaimed” • Scholarship Search Companies • Warning signs of a possible scam CAUTION: As a general rule, if you must pay money to get money, it might be a scam. Who Wants A Million Dollars? 4 Copyright 2005 CAD What Financial Aid Offers? • Access to funds to help pay for – 4 year public and independent colleges – Community colleges – Private career colleges • Choice among schools – choose the best academic, cultural, and social fit rather than the least expensive program 5 Copyright 2005 CAD Cost of Attendance • • • • • • Tuition/Enrollment fees Room and board Books and supplies Transportation Miscellaneous personal expenses Loan fees, study abroad costs, dependent or elder care expenses, expenses associated with a disability, or expenses for cooperative education program, computer (if required for program). Determining the Expected Family Contribution (EFC) • Income • Asset Equity (excluding home equity) • Family Size • Number of Family Members in College • Age of Parents (for dependent students) How Much am I Eligible for? Basic Equation of Need Cost of Attendance (COA) Expected Family Contribution (EFC) _________________________________ Student’s Financial Need (eligibility) How The Formula Works CC Cost $ 18,200 EFC - 500 Need $ 17,700 CSU $24,958 - 500 $24,458 UC Private $47,464 - 500 $46,964 $45,700 - 500 $45,200 In the best of all possible worlds, full “need” will be met with a financial aid package made up of grants and scholarships along with reasonable amounts of work and loan. Some schools are not able to meet full need. 9 Copyright 2005 CAD Sources of Financial Aid Federal government State government Colleges and universities Private agencies, companies, foundations, your parents’ employers, etc… Types of Aid Gift Aid - Grants or scholarships that do not need to be repaid Work - Money earned by the student as payment for a job on or off campus Loans - Borrowed money to be paid back, usually with interest Cal Grants Cal Grant A Entitlement Awards – for students with a Grade Point Average (GPA) of at least 3.0, family income and assets below the state ceilings, and who demonstrate financial need and are attending a 4 year University. Cal Grant B Entitlement Awards – for students from disadvantaged or low income families with a GPA of at least 2.0, family income and assets below the state ceilings, and who demonstrate financial need Cal Grant C Awards - for students from low income families pursuing vocational programs of study Eligibility for Cal Grants To be eligible for a Cal Grant, the student must also: – be a U.S. citizen or eligible non-citizen – be a California resident – Be a High school Grad and pass the CAHSEE (if graduated 2006 and after and required to take by High School.) – attend a California college or university in 2013-2014 2013-2014 Cal Grant Application Requirements By March 2, 2013: Complete and Submit the Free Application for Federal Student Aid The Cal Grant GPA Verification Form Check with your high school or college counselor for more details on how to file the Cal Grant GPA Verification form California Dream Act Allows students who meet AB 540 criteria to apply for & receive non state-funded scholarships at the public colleges and universities, including scholarships funded through private donors, alumni contributions, or individual departmental efforts • Allows students who meet AB 540 criteria to Apply for & receive institutional grants Apply for & receive Board of Governors fee waivers at the California Community Colleges Apply for & receive state financial aid, including Cal Grants and Chafee Foster Youth Grants 15 Copyright 2005 CAD California Chafee Grant The California Chafee Grant program provides up to $5,000 annually to current and former foster youth for college or vocational training at any accredited college in the U.S. To be eligible, the foster youth must have been in California foster care on their 16th birthday and not have reached their 22nd birthday before July 1, 2012 To apply, the foster youth must complete: - 2013-2014 FAFSA - California Chaffee Grant Program Application To learn more about the Chafee Grant, go to www.chafee.csac.ca.gov Federal Eligibility Criteria FEDERAL • U.S. citizen or eligible noncitizen with valid Social Security # • High School diploma, GED, or ability to benefit test • Enroll in an eligible program • Register for Selective Service (males – ages 18-25) • Drug Conviction – required resolution completed. Federal Need-Based Grants Federal Grants Pell Grants ($5,550 Max per year) Supplemental Educational Opportunity Grant (SEOG) ($4,000 MAX PER YEAR depending on the College) Federal Work Study Other Need-Based Grants College Grants Community College Board of Governors’ (BOG) Fee Waiver - Waives the California Community Colleges’ enrollment fee for financially needy California residents - To learn more about this BOG Fee Waiver, go to: www.icanaffordcollege.com CSU State University Grant (SUG) – amounts vary UC Grant – amounts vary Independent College Grants - amounts vary OTHER FINANCIAL AID RESOURCES FOR STUDENTS • BOARD OF GOVERNORS FEE WAIVER (BOGW) – Fee Waiver • PRIVATE SCHOLARSHIPS – Mt. SAC – Private Donors • EDUCATIONAL OPPORTUNITY PROGRAM (EOP&S) – Book Grants • BRIDGE Program – Summer Academy – Freshmen Experience What are scholarships? Scholarship: A financial award that does not have to be repaid. • Scholarships are generally made based on an applicant meeting certain eligibility criteria. • Scholarships usually require competition for the award. Copyright 2005 CAD How to Win a Scholarship • Know how to research scholarship opportunities • Be prepared and organized in the application process • Write a unique and compelling personal statement/essay Copyright 2005 CAD Register On-line www.fastweb.com www.collegeboard.com www.financialaid.com www.collegenet.com www.nextstudent.com Copyright 2005 CAD Scholarship List-serve To request bi-monthly email updates, send an email to: scholarships@mtsac.edu Advantages: • Application release priority • Workshop schedules Copyright 2005 CAD Recent Changes to the Student Aid Programs • Eligibility of Students Without a High School Diploma • – You will no longer have the option of becoming eligible for federal student aid by passing an approved test or completing at least six credit hours Federal Pell Grant Program — Duration of Eligibility – Once you have received a Pell Grant for 12 semesters, or the equivalent, you will no longer be eligible for additional Pell Grants. www.studentaid.ed.gov Copyright 2005 CAD Types of Applications FAFSA Cal Grant GPA Verification Form Other applications or forms as required by the college such as – CSS Financial Aid PROFILE – Institutional Scholarship and/or Financial Aid Application – 2012 federal tax returns (along with schedules and W-2s) or other income documentation GPA Form Apply for a Federal PIN Want to process your application quicker? – Obtain a PIN – Check on FAFSA status – Correct FAFSA data – Use as the electronic signature on all ED documents Apply for TODAY at: www.pin.ed.gov 27 Copyright 2005 CAD File Your Free Application For Federal Student Aid “FAFSA” File your FAFSA as soon as you can after January 1, 2013. AT: www.FAFSA.ED.GOV Check with the College you will be attending for All applicable deadlines. What you will need….. To complete your FAFSA, you need to gather: – Student driver’s license – Student Alien Registration Card (if applicable) – Student and Parent Social Security cards 2012 W-2 Forms and other records of money earned 2012 federal income tax form (even if not completed) Records of untaxed income Current bank statements Business, farm and other real estate records Records of stocks, bonds and other investments Create a file for copies of all financial aid documents submitted Students Dependency Determination Student’s dependency status: • To determine if a student is Dependent or Independent for purposes of Financial Aid • If Dependent, a student must provide Parent information on the FAFSA application 30 Copyright 2005 CAD 30 With the IRS tool you can transfer your tax information directly into your FAFSA! Copyright 2005 CAD Copyright 2005 CAD Step 2 Determination of Student Dependency Status The answers to these questions will determine if you need to include your parent’s information and signature on your FAFSA. 33 Copyright 2005 CAD 33 Step 3 Parent Information See Page 3 of FAFSA on the Web Worksheet about who is considered a parent – Biological or adoptive parent(s) – In case of divorce or separation, provide information about the parent and/or stepparent the student lived with more in the last 12 months Copyright 2005 CAD – Stepparent (regardless of any prenuptial 34 34 agreements) • Step 3 Who is Not a Parent Do not provide information on: – Foster parents or legal guardians • If the student is in foster care or has a legal guardian (and can provide documentation regarding this), he/she is automatically considered an independent student – Grandparents or other relatives are not considered parents unless they have adopted the student – Colleges may use Professional Judgment to allow the student to file as independent Copyright 2005 CAD 35 35 36 Copyright 2005 CAD 37 Copyright 2005 CAD Special Circumstances Contact the Financial Aid Office if there is: – Loss or reduction in parent or student income or assets – Death or serious illness – Unusual medical or dental expenses not covered by insurance – Reduction in child support, social security benefits or other untaxed benefit – Financial responsibility for elderly grandparents – Any other unusual circumstances that affect a family’s ability to contribute to higher education How much aid will I get? Priority Student Deadline: 4/15/13 Budget $18,147 PELL = $ 5,550 BOGW = $ 1,104 EOP&S = $ 200 SEOG = $ 500 FWS = $ 4,000 TOTAL= $11,354 Short Fall Copyright 2005 CAD $ 6,793 All Students who file after deadline Budget Pell = BOGW = $18,147 $ 5,550 $ 1,104 TOTAL= $ 6,654 Short fall $ 11,493 Summary of the Financial Aid Process Submit all required forms, including FAFSA, by each college’s published deadlines (but no later than March 2) By March 2 submit a Cal Grant GPA Verification Form Keep a copy of all forms submitted Review the electronic Student Aid Report (SAR) Acknowledgement or the paper SAR sent to the student Review the California Aid Report (CAR) Watch for financial aid award notifications from colleges to which the student has been admitted Be sure to apply for financial aid this year and every year as soon as possible after January 1 to receive the best financial aid award possible ASK QUESTIONS! The Financial Aid Information www.finaid.org or www.studentaid.ed.gov Accurate, Comprehensive and Objective Information • Links to Free Scholarship Searches – www.fastweb.com and www.SCHOLARSHIPS.com • Scholarship Scam Alerts • Financial Aid Consultant Guide • Loan Calculators • Strategies--Maximizing Aid Eligibility • Answers to Frequently Asked Questions Mt. SAC: Financial Aid Office (909) 594-5611 ext. 4450 Web: www.mtsac.edu/students/finaid/ - Federal Processor (800) 4-FED-AID (319) 337-5665 - Cal Grant (888) CA-GRANT (888) 224-7268